62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

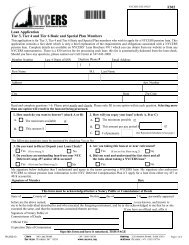

NEW YORK CITY EMPLOYEES’ RETIREMENT SYSTEMYou may elect to have your payments directly deposited into your bank account through EFT.Simply complete Form #380 and return it to <strong>NYCERS</strong>. EFT ensures that your payment won't getlost or stolen, and that you won't have to make a special trip to the bank for deposits. Also,you won't have to wait for checks to clear. Funds are available in your bank account on the lastday of each month. If the last day of the month is on a weekend or a holiday, the bank will normallycredit your payment on the next business day.HEALTH INSURANCE<strong>NYCERS</strong> does not administer health insurance benefits for its members. If you have any questionsin this regard you should contact your agency’s personnel office. For most City employees,the Office of Labor Relations administers health insurance for retirees. The Health BenefitsDivisions of the NYC Transit Authority or MTA Bridges and Tunnels administers health insurancefor their respective employees and retirees. Here is the contact information for each entity:NYC Office of Labor Relations - Health Benefits Division - (212) 513-0470NYC Transit Authority - Employee Benefits - (347) 643-8550MTA Bridges & Tunnels - Benefits Division - (646) 252-7935POST-RETIREMENT EARNINGS LIMITATIONS FOR SERVICE RETIREESSection 212 of the Retirement and Social Security Law (RSSL) sets the amount a retired personmay earn during a calendar year in public employment in New York State or New York City withoutloss, suspension or diminution of his or her retirement allowance. The maximum earningsin 2008 and thereafter is $30,000. This dollar limit is subject to change in any given yearthrough the enactment of legislation. If a change is made, the latest amount will be in the <strong>SPD</strong>Update.Post-retirement earnings limitations do not apply to those who are 65 or older or those underage 65 who work in the private sector, the Federal Government or enter public employment inanother state. In addition, these limitations do not apply to City retirees who are employed witha public benefit corporation in New York State. However, <strong>NYCERS</strong> retirees who retired from apublic benefit corporation (except NYC Transit) and accept employment with a City agency aresubject to the earnings limitations. You are strongly encouraged to consult with a <strong>NYCERS</strong> representativebefore you accept public employment as a retiree.LR: Chapter 729 of the Laws of 1996; Chapter 474 of the Laws of 2002; Chapter 74 of theLaws of 2006SR: RSSL §212WITHDRAWING AN APPLICATION FOR SERVICE RETIREMENTYou may withdraw your application for service retirement by filing Form #542 with <strong>NYCERS</strong> upto the day before your effective date of retirement.SERVICE RETIREMENTCHANGING YOUR RETIREMENT DATEIf you have filed for retirement and want to change your retirement date, you may extend yourretirement date up to 90 days from the original filing date. Any extension longer than 90days will require you to withdraw your original application.If you want to retire before the retirement date already on file with <strong>NYCERS</strong>, be sure to fileForm #543 before the new effective retirement date.36