62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

62-5 SPD:62/5 SPD.qxd - NYCERS

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

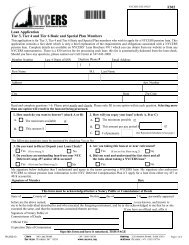

SUMMARY PLAN DESCRIPTION - <strong>62</strong>/5 TIER 4 MEMBERS VERSION APRIL 2012Tier 4 members with Tier 3 rights (those who joined <strong>NYCERS</strong> after July 26, 1976 and prior to September1, 1983) can collect a Vested Retirement Benefit before their Payability Date, but thebenefit is subject to a reduction and is offset by 50% of the Primary Social Security Benefit atage <strong>62</strong>. See section on Tier 4 members with Tier 3 rights for additional details on page 66.LR: Chapter 890 of the Laws of 1976, as amended by Chapter 389 of the Laws of 1998SR: RSSL §516 subdivision bFILING REQUIREMENTSIf you have at least five years of Credited Service, your pension vests automatically and filingpaperwork with <strong>NYCERS</strong> at the time of separation from City service is not required. However,<strong>NYCERS</strong> encourages members who separate from City service to file a Notice of Intention to Filefor a Tier 3 or Tier 4 Vested Retirement Benefit Form (Form # 254). By doing so, <strong>NYCERS</strong> cansend you important information regarding your vested membership. For example, in addition toreceiving an Annual Disclosure Statement, you will receive a Retirement Account Summarydetailing your account balances, deficit and/or outstanding loan amounts (where applicable)and your total years of service. Additionally, <strong>NYCERS</strong> will send you an Application for Paymentof a Vested Retirement Benefit (Form #266) approximately 90 days prior to your Payability Date.Filing Form #266 is required in order to begin collecting your Vested Retirement Benefit.PURCHASING SERVICE CREDITAs an active member (on active payroll) you are eligible to purchase service credit for previouspublic service rendered in New York City or New York State. Once you separate from City service,you may NOT initiate a new claim or submit an application to purchase previous servicecredit. However, if payroll deductions for the purchase of previous service were not completedat the time you separated from City service, you can pay off the balance in a lump sum andreceive credit for the service so long as you have completed the purchase prior to making a finaloption selection at retirement (which occurs after your Payability Date has passed). If youdecide to wait until you get closer to your Payability Date to complete the purchase, you shouldknow that the payoff amount continues to grow as interest continues to accrue on the unpaidbalance. So, the longer you wait the higher the payoff amount. If you choose not to pay off thebalance, you will receive credit for the time you purchased up to your separation date.DEATH BENEFITS FOR VESTED MEMBERSIf you die prior to your Payability Date, and at a time and in a manner which did not result in paymentof an Ordinary Death Benefit to your beneficiary(ies), a lump-sum death benefit will be paidto the beneficiary(ies) you last designated if you have 10 or more years of Credited Service. Thedeath benefit amount is based on 50% of the death benefit that would have been payable if youhad died on your last day in active service plus the return of the contributions in your MCAF plusinterest. If you did not render 10 or more years of Credited Service, only the return of the contributionsin your MCAF plus interest will be payable to your beneficiary(ies).LR: Chapter 388 of the Laws of 1998SR: RSSL §606-aWWW.<strong>NYCERS</strong>.ORGLEAVING CITY SERVICE29