- Page 1 and 2: .1 i'•• . - l ."

- Page 3 and 4: y/li'''^J^Z£.\ 9'0THE,-5» ,^%v^l.

- Page 5: THE CYPRUS GAZETTE INDEX, 1923.APPO

- Page 8: MEDICAL—continued.HOSPITALS. Acco

- Page 11 and 12: The Cyprus Gazette.(EXTRAORDINARY.)

- Page 13: The Cyprus Gazette(Published by Aut

- Page 17 and 18: THE CYPRUS QAZETTE, 5th JANUARY, 19

- Page 20 and 21: 10 THE CYPRUS GAZETTE, 5th JANUARY,

- Page 22 and 23: Nf. 459A in Claas 45. in reapeci

- Page 24 and 25: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 26 and 27: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 28 and 29: Ig THE CYPRUS GAZETTE (EXTRAORDINAR

- Page 30 and 31: Short title.Amendmentof Law X. of19

- Page 32 and 33: Short title.Amendmentof LawXVIII. o

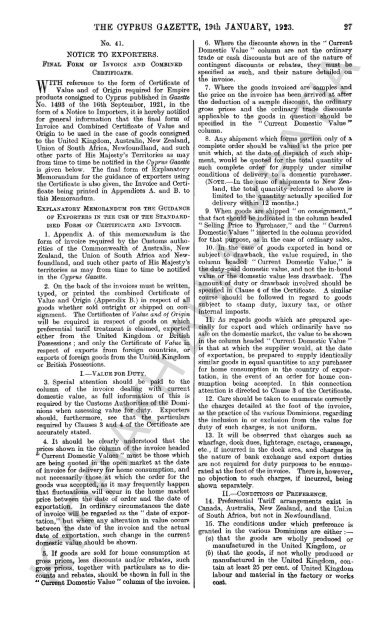

- Page 34 and 35: 24 rHE CYPRUS GAZETTE, 19th JANUARY

- Page 38 and 39: 28 THE CYPRUS GAZETTE, 19th JANUARY

- Page 40 and 41: 30 THK YPRUS GAZETTE, 19th JANUARY,

- Page 42 and 43: 32 THE CYPRUS GAZETTE, 19th JANUARY

- Page 44 and 45: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 46 and 47: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 48 and 49: 38 THE CYPRUS GAZETTE (EXTBAOSDINAR

- Page 50 and 51: 40 THE CYPRUS GAZETTE (EXTRAORDINAR

- Page 52 and 53: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 54 and 55: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 56 and 57: 46 THE CYPRUS GAZETTE, 2nd FEBRUARY

- Page 58 and 59: 48 THE GYPRUS GAZETTE, 2nd FEBRUARY

- Page 60 and 61: 50 THE CYPRUS GAZETTE, 2nd FEBRUARY

- Page 62 and 63: 52 THE CYPRUS GAZETTE, 2nd FEBRUARY

- Page 64 and 65: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 66 and 67: 56 THE CYPRUS GAZETTE, 16th FEBRUAR

- Page 68 and 69: 58 THE CYPRUS GAZETTE. 16th FEBRUAR

- Page 70 and 71: 60 THE CYPRUS GAZETTE, 16th FEBRUAR

- Page 72 and 73: 62 THE CYPRUS GAZETTE, 16th FEBRUAR

- Page 74 and 75: 61 THE CYPRUS GAZETTE, 16th FEBRUAR

- Page 76 and 77: 66 THE CYPRUS GAZETTE, 16th FEBRUAR

- Page 78 and 79: 68 THE CYPRUS GAZETTE, 16th FEBRUAR

- Page 80 and 81: 70 THE CYPRUS GAZETTE, 16th FEBRUAR

- Page 82 and 83: Short tiile.Amendmentof LawXVIII. o

- Page 84 and 85: ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 86 and 87:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 88 and 89:

78 THE CYPRUS GAZETTE, 2nd MARCH, 1

- Page 90 and 91:

SO THE CYPRUS GAZETTE, 2nd MARCH, 1

- Page 92 and 93:

82 THE CYPRUS GAZETTE, 2nd MARCH, 1

- Page 94 and 95:

84 THE CYPRUS GAZETTE, 2iid MARCH,

- Page 96 and 97:

86 THE CYPRUS GAZETTE, 2nd MARCH, 1

- Page 98 and 99:

88 THE CYPRUS GAZETTE, 2nd MARCH, 1

- Page 100 and 101:

90 THE CYPRUS GAZETTE, 2nd MARCH, 1

- Page 102 and 103:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 104 and 105:

Xo. 473A in Class 47, in respect of

- Page 106 and 107:

^6 THE CYPRUS GAZETTE, 16th MARCH,

- Page 108 and 109:

^8 THE CYPRUS GAZETTE, 16th MARCH,

- Page 110 and 111:

100 THE CYPRUS GAZETTE, 16th MARCH,

- Page 112 and 113:

102 THE CYPRUS GAZETTE, 16th MARCH,

- Page 114 and 115:

104 THE CYPRUS GAZETTE, 16th MARCH,

- Page 116 and 117:

106 THE CYPRUS GAZETTE, 16th MARCH,

- Page 118 and 119:

No. 473A in Class 47, in respect of

- Page 120 and 121:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 122 and 123:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 124 and 125:

114 THE CYPRUS GAZETTE, SOth MARCH,

- Page 126 and 127:

116 THE CYPRUS GAZETTE, SOth MARCH,

- Page 128 and 129:

118 THE CYPRUS GAZETTE, 30th MARCH,

- Page 130 and 131:

120 THE CYPRUS GAZETTE, 30tli MARCH

- Page 132 and 133:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 134 and 135:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 136 and 137:

126 THE CYPRUS GAZETTE, 13th APRIL,

- Page 138 and 139:

128 THE CYPRUS GAZETTE. 13th APRIL,

- Page 140 and 141:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 142 and 143:

PATENTS RULES CERTIFICATES.THE Regi

- Page 144 and 145:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 146 and 147:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 148 and 149:

138 THE CYPRUS GAZETTE, 27th APRIL,

- Page 150 and 151:

140 THE CYPRUS GAZETTE, 27th APRIL,

- Page 152 and 153:

142 THE CYPRUS GAZETTE, 27th APRIL,

- Page 154 and 155:

PATENTS RULES CERTIFICATES.THE Regi

- Page 156 and 157:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 158 and 159:

Oath.Unifonn orbadge.Protectionof R

- Page 160 and 161:

Report.(e) To impound any anima fee

- Page 162 and 163:

Penalty forunlawfullyremoving,anima

- Page 164 and 165:

Miscellaneous.^^aiPo'ice 42, There

- Page 166 and 167:

Fustappointment.Subsequentappomtmen

- Page 168 and 169:

To give information to the Commissi

- Page 170 and 171:

Short title.Hi-—^or every certifi

- Page 172 and 173:

Short title.Applicationof Law.Defin

- Page 174 and 175:

Member notto exercisehis rightstill

- Page 176 and 177:

LiabiUty ofmember(2) A society may

- Page 178 and 179:

R^very of 41, Any sum awarded by wa

- Page 180 and 181:

{h) prescribe the accounts and book

- Page 182 and 183:

Power forthe HighCommissionerinCoun

- Page 184 and 185:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 186 and 187:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 188 and 189:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 190 and 191:

Procedureuponweighing,measuringor t

- Page 192 and 193:

Short title.Amendmentof Law 6 of1S8

- Page 194 and 195:

(3) Where a person lands in Cyprus

- Page 196 and 197:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 198 and 199:

Duty onwarehousedgoods.Short title.

- Page 200 and 201:

190 THE CYPRUS GAZETTE, llth MAY, 1

- Page 202 and 203:

192 THE GYPRUS GAZETTE, llth MAY, 1

- Page 204 and 205:

194 THE CYPRUS GAZETTE, llth MAY, 1

- Page 206 and 207:

196 THE GYPRUS GAZETTE, llth MAY, 1

- Page 208 and 209:

198 THK CYPRUS GAZETTE, llth MAY, 1

- Page 210 and 211:

200 THE CYPRUS GAZETTE, llth MAY, 1

- Page 212 and 213:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 214 and 215:

No. 482A in Class 42, in respect of

- Page 216 and 217:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 218 and 219:

Advocateand hisclerk maytransactbus

- Page 220 and 221:

210 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 222 and 223:

212 THE GYPRUS GAZETTE (EXTRAORDINA

- Page 224 and 225:

iHlTHE CYPRUS GAZETTE (EXTRAORDINAR

- Page 226 and 227:

216 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 228 and 229:

218 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 230 and 231:

220 THE GYPRUS GAZETTE (EXTRAORDINA

- Page 232 and 233:

222 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 234 and 235:

224 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 236 and 237:

226 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 238 and 239:

228 THE CVPRUS GAZETTK (KXTRAORDINA

- Page 240 and 241:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 242 and 243:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 244 and 245:

Short title.Appropria*iion of£35,7

- Page 246 and 247:

AppointmentofRegistrar.Societieswhi

- Page 248 and 249:

Registrar to 21. The Registrar or a

- Page 250 and 251:

Borrowingpowers ofsociety.Restricti

- Page 252 and 253:

Appeal.Furtherpowers ofhqoidator.En

- Page 254 and 255:

Recovery efsums dueto Government.Pr

- Page 256 and 257:

Penaltv.(2) If any person aids or a

- Page 258 and 259:

Short title.Interpretation.Municipa

- Page 260 and 261:

Weighing of^tlncfofCustomsOfficers.

- Page 262 and 263:

Short title.^fTr^"*of 1878. 'Defini

- Page 264 and 265:

Rewards.Gratuitiesand pensions.Duti

- Page 266 and 267:

Animals notclaimed.Pasturage ofanim

- Page 268 and 269:

Proviso forattendanceof RuralConsta

- Page 270 and 271:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 272 and 273:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 274 and 275:

264 THE CYPRUS GAZETTE, 25th MAY, 1

- Page 276 and 277:

266 THE CYPRUS GAZETTE, 25th MAY, 1

- Page 278 and 279:

268 THE CYPRUS GAZETTE, 26lh MAY, 1

- Page 280 and 281:

270 THE CYPRUS GAZETTE. 2cth MAY, 1

- Page 282 and 283:

No. 487A in Class 43, in respect of

- Page 284 and 285:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 286 and 287:

Mukhtar andcomplainantto inqjectdam

- Page 288 and 289:

Appeal4igainstorder.Order of•Cour

- Page 290 and 291:

goats made by any such owner within

- Page 292 and 293:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 294 and 295:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 296 and 297:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 298 and 299:

Mukhtar and 2. Subject to the provi

- Page 300 and 301:

Swearing ofMukhtar.Penalty iorrefus

- Page 302 and 303:

High Commissionermay alterboundarie

- Page 304 and 305:

Short titleAppropnation of£8,500 f

- Page 306 and 307:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 308 and 309:

5^98 THE CYPRUS GAZETTE. Sth JUNE,

- Page 310 and 311:

300 THE CYPRUS GAZETTE, Sth JUNE, 1

- Page 312 and 313:

30-i THE CYPRUS GAZETTE, Sth JUNE,

- Page 314 and 315:

304 TliE CYPRUS CxAZETTE, Sth JUNE,

- Page 316 and 317:

Xo. 492A in Class 47, in respect of

- Page 318 and 319:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 320 and 321:

Mukhtar andcomplainantto inspectdam

- Page 322 and 323:

Appealagainstorder.Order ofCourt up

- Page 324 and 325:

Posting ofnotices.Penalty forneglec

- Page 326 and 327:

(6) There shaU be seven other membe

- Page 328 and 329:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 330 and 331:

AjiMndment 3^ rphg Principal Law, S

- Page 332 and 333:

322 THE CYPRUS GAZETTE, 22nd JUNE,

- Page 334 and 335:

324 THE CYPKUS GAZETTE, 22nd JUNE,

- Page 336 and 337:

326 THE CYPRUS GAZETTE, 22nd JUNE,

- Page 338 and 339:

328 THE CYPKUS GAZETTE, 22nd JUNE,

- Page 340 and 341:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 342 and 343:

No. 471A An Class 17, in respect of

- Page 344 and 345:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 346 and 347:

336 THE CYPRUS GAZETTE, 6th JULY, 1

- Page 348 and 349:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 350 and 351:

No. 500A in Class 45, in respect of

- Page 352 and 353:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 354 and 355:

344 THE CYPRUS GAZETTE, 20th JULY,

- Page 356 and 357:

346 THE CYPRUS GAZETTE, 20th JULY,

- Page 358 and 359:

No. 504A in Class 8, in respect of

- Page 360 and 361:

350 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 362 and 363:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 364 and 365:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 366 and 367:

Advocateand hisclerk maytransactbus

- Page 368 and 369:

A BILLTo AMEND THE CRIMINAL LAW.BE

- Page 370 and 371:

Power toenter landsor premisesforas

- Page 372 and 373:

stampingbills drawnin seta.stamping

- Page 374 and 375:

Saving olotherpowers.Saving as todu

- Page 376 and 377:

Short title.Definitions.Establishme

- Page 378 and 379:

Time ofmeetingQuorum ofBoards,Estab

- Page 380 and 381:

Summoningmeetings ofTownCommittee.Q

- Page 382 and 383:

Salaries.PeixnanentStaff.Continuanc

- Page 384 and 385:

Religion and 4^^—(1) ^Q pcrsou sh

- Page 386 and 387:

EstimateBand plans.New site ofschoo

- Page 388 and 389:

Advances.EducationFund.Existingscho

- Page 390 and 391:

Enquiry intoassessment.Alteration o

- Page 392 and 393:

Bbaids'hiEdutatiBn.The HighCommissi

- Page 394 and 395:

tiL^^u^* 6. The Principal Law, sect

- Page 396 and 397:

386 THE CYPRUS GAZETTE, 3rd AUGUST,

- Page 398 and 399:

388 THE CYPRUS GAZETTE, Srd AUGUST,

- Page 400 and 401:

3^THR i^??>mm (^A[»i: I;TK?3^ Auat

- Page 402 and 403:

392 THE CYPRUS GAZETTE, Srd AUGUST,

- Page 404 and 405:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 406 and 407:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 408 and 409:

3Sf8r THE CYPRUS GAZETTE (EXTKATOED

- Page 410 and 411:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 412 and 413:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 414 and 415:

404 THE CYPRUS GAZETTE. 17th AUGUST

- Page 416 and 417:

406HIS EXCELLENCY THE OFFICERthe fo

- Page 418 and 419:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 420 and 421:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 422 and 423:

Canceiiaticii^^registraPersons yt)m

- Page 424 and 425:

Short title.CYPRUS. NO. XXVIIL, 192

- Page 426 and 427:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 428 and 429:

Rapeal ofLaw I. of1923, sec. 4,and

- Page 430 and 431:

stampingbills drawnin sets.Stampmgb

- Page 432 and 433:

Saving ofotherpowers.Saving as todu

- Page 434 and 435:

Receipts given by any officer, sold

- Page 436 and 437:

Time ofmeeting.Quorum < 1Bo(u-ds,Es

- Page 438 and 439:

Siunmoningmeetings ofTownCommittee.

- Page 440 and 441:

Late 24. If for any reason it is no

- Page 442 and 443:

Teachers onold register.CandidatesD

- Page 444 and 445:

BenevolentgrantSchoolprem'sesto bep

- Page 446 and 447:

Tonm otEsiimatat,etc.Vesting ofprop

- Page 448 and 449:

equired under section 69, together

- Page 450 and 451:

Short title.Definitions.Boards ofEd

- Page 452 and 453:

Board ct 7^ ^]^Q Board of Education

- Page 454 and 455:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 456 and 457:

446 THE CYPRUS GAZETTE, Slst AUGUST

- Page 458 and 459:

448 THE CYPRUS GAZETTE, Slst AUGUST

- Page 460 and 461:

450 THE CYPRUS GAZETTE, Slst AUGUST

- Page 462 and 463:

452 THE CYPRUS GAZETTE, 31st AUGUST

- Page 464 and 465:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 466 and 467:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 468 and 469:

' ' • '458 THE CYPRUS GAZETTE, Ut

- Page 470 and 471:

460 THE CYPRUS GAZETTE, Uth SEPTEMB

- Page 472 and 473:

462 THE CYPRUS GAZETTE, Uth SEPTEMB

- Page 474 and 475:

464 TUE CYPRUS GAZETTE. 14th SEPTEM

- Page 476 and 477:

466 THE CYPRUS GAZETTE, Uth SEPTEMb

- Page 478 and 479:

4^8 THE CYPRUS GAZETTE, 14th SEPTEM

- Page 480 and 481:

470 THE CYPRUS GAZETTE, llth SEPTEM

- Page 482 and 483:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 484 and 485:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 486 and 487:

476 THE CYPRUS GAZETTE, 28th SEPTEM

- Page 488 and 489:

478 1 HE CYPRUS GAZETTE, 28th SEPTE

- Page 490 and 491:

480 THE CYPRUS GAZETTE, 28th SEPTEM

- Page 492 and 493:

482 THE CYPRUS GAZETTE, 28th SEPTEM

- Page 494 and 495:

484 HK CYPRUS GAZETTE, 28Lh SEPTEMB

- Page 496 and 497:

486 THE CYPRUS GAZETTE, 28th SEPTEM

- Page 498 and 499:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 500 and 501:

490 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 502 and 503:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 504 and 505:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 506 and 507:

496 THE CYPRUS GAZETTE, 12th OCTOBE

- Page 508 and 509:

498 THK CYPRUS GAZETTE. 12th OCTOBE

- Page 510 and 511:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 512 and 513:

ALTERATION OF REGISTERED TRADE MARK

- Page 514 and 515:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 516 and 517:

506 THE OYPRUS GAZETTE (EXTRAORDPNA

- Page 518 and 519:

,508 THE CYPRUS GAZETTE, 26th OCTOB

- Page 520 and 521:

510 THE CYPRUS GAZETTE, 26th OCTOBE

- Page 522 and 523:

512 THE CYPRUS GAZETTE. 26th OCTOBE

- Page 524 and 525:

;> 14 THE CYPRUS GAZETTE, 26th OCTO

- Page 526 and 527:

No. 410A in Class 47, in respecr of

- Page 528 and 529:

518 THE CYPKUS GAZETTE, 9tli NOVEMB

- Page 530 and 531:

520 THE CYPRUS GAZETTE, 9th NOVEMBE

- Page 532 and 533:

•>

- Page 534 and 535:

524 THE CYPRUS GAZETTE, 9th NOVEMBE

- Page 536 and 537:

526 THE CYPRUS GAZETTE, 9th NOVEMBE

- Page 538 and 539:

2S THE CYPRUS GAZETTE. 9th NOVEMBER

- Page 540 and 541:

530 THE CYPRUS GAZETTE, 9th NOVEMBE

- Page 542 and 543:

532 THE CYPRUS GAZETTE, 9th NOVEMBE

- Page 544 and 545:

534 THE CYPRUS GAZETTE, 9th NOVEMBE

- Page 546 and 547:

.536 THE CYPRUS GAZETTE. 9th NOVEMB

- Page 548 and 549:

538 THE CYPRUS GAZETTE, 9tli NOVEMB

- Page 550 and 551:

No. 410A in Class 47, in respect of

- Page 552 and 553:

542 THE CYPRUS GAZETTE, 23rd NOVEMB

- Page 554 and 555:

544 THE CYPRUS GAZETTE, 2Srd NOVEMB

- Page 556 and 557:

M6 THE CYPRUS GAZETTE, 23rd NOVEMBE

- Page 558 and 559:

548 THE CYPRUS GAZfiTTE, g3rd NOVEM

- Page 560 and 561:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 562 and 563:

No. 52HA in Class 45, in respect of

- Page 564 and 565:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 566 and 567:

Short title.btandard foriruga.iShor

- Page 568 and 569:

3TE2.3.4.5.6.7.8.9.10.11.12.13.14.1

- Page 570 and 571:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 572 and 573:

Short tiUeBA BILLTO AMEND THE LAW R

- Page 574 and 575:

A BILLShort title,ToAMEND THE LAW R

- Page 576 and 577:

566 THE CYPRUS GAZETTE, 7th DECEMBE

- Page 578 and 579:

568 THE CYPRUS GAZETTE, 7th DECEMBE

- Page 580 and 581:

57 d THE CYPRUS GAZETTE, 7th DECEMB

- Page 582 and 583:

572 THE CYPRUS GAZETTE, 7th DECEMBE

- Page 584 and 585:

574 THE CYPRUS GAZETTE,,7tbt>ECEMBE

- Page 586 and 587:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 588 and 589:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 590 and 591:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 592 and 593:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 594 and 595:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 596 and 597:

.36 THE CYPRUS GAZETTE, 21st DECEMB

- Page 598 and 599:

568 THE CYPRUS GAZETTE, 21st DECEMB

- Page 600 and 601:

.90 THE CYPRUS GAZETTE, 21st DECEMB

- Page 602 and 603:

592 THE CYPRUS GAZETTE, 21st. DECEM

- Page 604 and 605:

694 THE CYPRUS GAZETTE. 2ist DECEMB

- Page 606 and 607:

5t>6 THE CYPRUS GAZETTE, 21st DECEM

- Page 608 and 609:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 610 and 611:

Day12345678910111213141516171819202

- Page 612 and 613:

No. .")12A in Class 6, in respect o

- Page 614 and 615:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ

- Page 616 and 617:

Preamble.Short title.Appropriationo

- Page 618 and 619:

Shippingcharges.Penalty.Short title

- Page 620 and 621:

Short title.Amendifteii tof I^aw 11

- Page 622 and 623:

short title.King'sCoimsei.Date ofop

- Page 624 and 625:

€14 THE CYPRUS GAZETTE (EXTRAQB^N

- Page 626 and 627:

616 THE CYPRUS GAZETTE (EXTRAORDINA

- Page 628 and 629:

618 THE CYPRUS GAZETTE (ErmAORmUAHY

- Page 630:

ΚΥΠΡΙΑΚΗ ΔΗΜΟΚΡΑΤΙ