Downloading - Curriculum Development Centre, Kalamassery

Downloading - Curriculum Development Centre, Kalamassery

Downloading - Curriculum Development Centre, Kalamassery

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

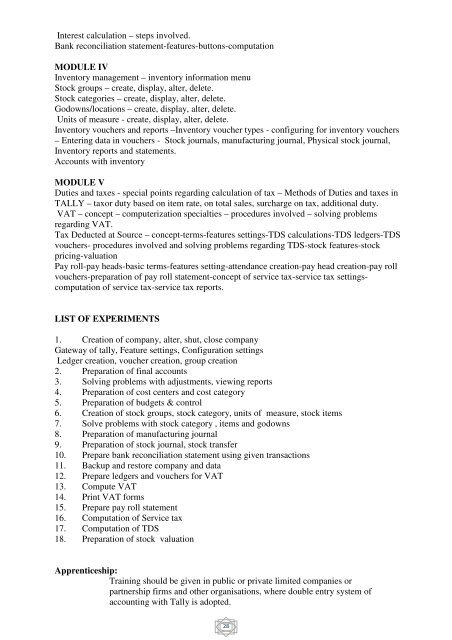

Interest calculation – steps involved.Bank reconciliation statement-features-buttons-computationMODULE IVInventory management – inventory information menuStock groups – create, display, alter, delete.Stock categories – create, display, alter, delete.Godowns/locations – create, display, alter, delete.Units of measure - create, display, alter, delete.Inventory vouchers and reports –Inventory voucher types - configuring for inventory vouchers– Entering data in vouchers - Stock journals, manufacturing journal, Physical stock journal,Inventory reports and statements.Accounts with inventoryMODULE VDuties and taxes - special points regarding calculation of tax – Methods of Duties and taxes inTALLY – taxor duty based on item rate, on total sales, surcharge on tax, additional duty.VAT – concept – computerization specialties – procedures involved – solving problemsregarding VAT.Tax Deducted at Source – concept-terms-features settings-TDS calculations-TDS ledgers-TDSvouchers- procedures involved and solving problems regarding TDS-stock features-stockpricing-valuationPay roll-pay heads-basic terms-features setting-attendance creation-pay head creation-pay rollvouchers-preparation of pay roll statement-concept of service tax-service tax settingscomputationof service tax-service tax reports.LIST OF EXPERIMENTS1. Creation of company, alter, shut, close companyGateway of tally, Feature settings, Configuration settingsLedger creation, voucher creation, group creation2. Preparation of final accounts3. Solving problems with adjustments, viewing reports4. Preparation of cost centers and cost category5. Preparation of budgets & control6. Creation of stock groups, stock category, units of measure, stock items7. Solve problems with stock category , items and godowns8. Preparation of manufacturing journal9. Preparation of stock journal, stock transfer10. Prepare bank reconciliation statement using given transactions11. Backup and restore company and data12. Prepare ledgers and vouchers for VAT13. Compute VAT14. Print VAT forms15. Prepare pay roll statement16. Computation of Service tax17. Computation of TDS18. Preparation of stock valuationApprenticeship:Training should be given in public or private limited companies orpartnership firms and other organisations, where double entry system ofaccounting with Tally is adopted.28