Understanding Shareholders' Use of Information and Advisers (pdf)

Understanding Shareholders' Use of Information and Advisers (pdf)

Understanding Shareholders' Use of Information and Advisers (pdf)

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

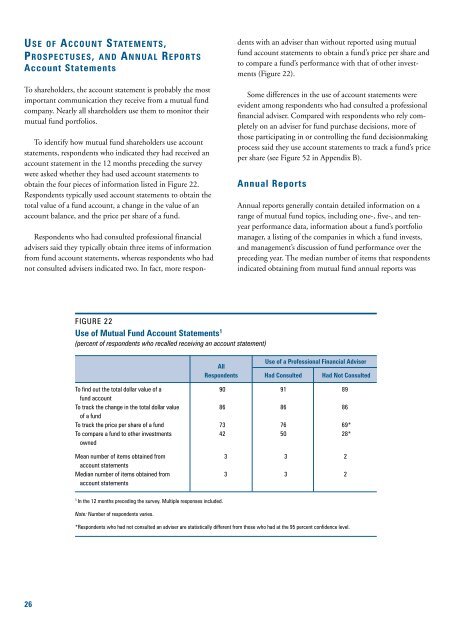

USE OF ACCOUNT STATEMENTS,PROSPECTUSES, AND ANNUAL REPORTSAccount StatementsTo shareholders, the account statement is probably the mostimportant communication they receive from a mutual fundcompany. Nearly all shareholders use them to monitor theirmutual fund portfolios.To identify how mutual fund shareholders use accountstatements, respondents who indicated they had received anaccount statement in the 12 months preceding the surveywere asked whether they had used account statements toobtain the four pieces <strong>of</strong> information listed in Figure 22.Respondents typically used account statements to obtain thetotal value <strong>of</strong> a fund account, a change in the value <strong>of</strong> anaccount balance, <strong>and</strong> the price per share <strong>of</strong> a fund.Respondents who had consulted pr<strong>of</strong>essional financialadvisers said they typically obtain three items <strong>of</strong> informationfrom fund account statements, whereas respondents who hadnot consulted advisers indicated two. In fact, more respondentswith an adviser than without reported using mutualfund account statements to obtain a fund’s price per share <strong>and</strong>to compare a fund’s performance with that <strong>of</strong> other investments(Figure 22).Some differences in the use <strong>of</strong> account statements wereevident among respondents who had consulted a pr<strong>of</strong>essionalfinancial adviser. Compared with respondents who rely completelyon an adviser for fund purchase decisions, more <strong>of</strong>those participating in or controlling the fund decisionmakingprocess said they use account statements to track a fund’s priceper share (see Figure 52 in Appendix B).Annual ReportsAnnual reports generally contain detailed information on arange <strong>of</strong> mutual fund topics, including one-, five-, <strong>and</strong> tenyearperformance data, information about a fund’s portfoliomanager, a listing <strong>of</strong> the companies in which a fund invests,<strong>and</strong> management’s discussion <strong>of</strong> fund performance over thepreceding year. The median number <strong>of</strong> items that respondentsindicated obtaining from mutual fund annual reports wasFIGURE 22<strong>Use</strong> <strong>of</strong> Mutual Fund Account Statements 1(percent <strong>of</strong> respondents who recalled receiving an account statement)<strong>Use</strong> <strong>of</strong> a Pr<strong>of</strong>essional Financial AdviserAllRespondents Had Consulted Had Not ConsultedTo find out the total dollar value <strong>of</strong> a 90 91 89fund accountTo track the change in the total dollar value 86 86 86<strong>of</strong> a fundTo track the price per share <strong>of</strong> a fund 73 76 69*To compare a fund to other investments 42 50 28*ownedMean number <strong>of</strong> items obtained from 3 3 2account statementsMedian number <strong>of</strong> items obtained from 3 3 2account statements1In the 12 months preceding the survey. Multiple responses included.Note: Number <strong>of</strong> respondents varies.*Respondents who had not consulted an adviser are statistically different from those who had at the 95 percent confidence level.26