Understanding Shareholders' Use of Information and Advisers (pdf)

Understanding Shareholders' Use of Information and Advisers (pdf)

Understanding Shareholders' Use of Information and Advisers (pdf)

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

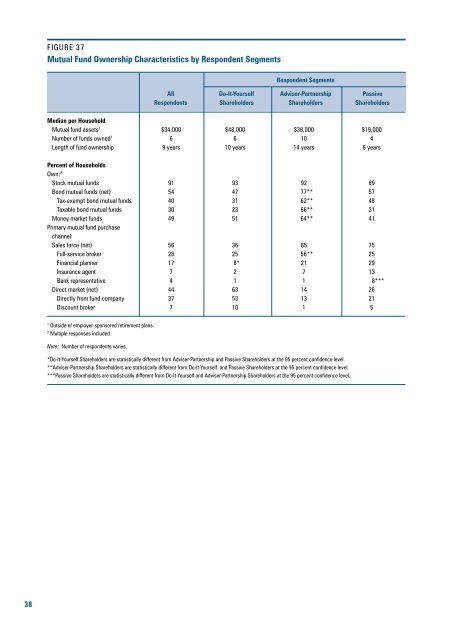

FIGURE 37Mutual Fund Ownership Characteristics by Respondent SegmentsRespondent SegmentsAll Do-It-Yourself Adviser-Partnership PassiveRespondents Shareholders Shareholders ShareholdersMedian per HouseholdMutual fund assets 1 $34,000 $48,000 $38,000 $19,000Number <strong>of</strong> funds owned 1 6 6 10 4Length <strong>of</strong> fund ownership 9 years 10 years 14 years 6 yearsPercent <strong>of</strong> HouseholdsOwn: 2Stock mutual funds 91 93 92 89Bond mutual funds (net) 54 47 77** 57Tax-exempt bond mutual funds 40 31 62** 48Taxable bond mutual funds 30 23 66** 31Money market funds 49 51 64** 41Primary mutual fund purchasechannel:Sales force (net) 56 36 85 75Full-service broker 28 25 56** 25Financial planner 17 8* 21 29Insurance agent 7 2 7 13Bank representative 4 1 1 8***Direct market (net) 44 63 14 26Directly from fund company 37 53 13 21Discount broker 7 10 1 51Outside <strong>of</strong> employer-sponsored retirement plans.2Multiple responses included.Note: Number <strong>of</strong> respondents varies.*Do-It-Yourself Shareholders are statistically different from Adviser-Partnership <strong>and</strong> Passive Shareholders at the 95 percent confidence level.**Adviser-Partnership Shareholders are statistically different from Do-It-Yourself <strong>and</strong> Passive Shareholders at the 95 percent confidence level.***Passive Shareholders are statistically different from Do-It-Yourself <strong>and</strong> Adviser-Partnership Shareholders at the 95 percent confidence level.38