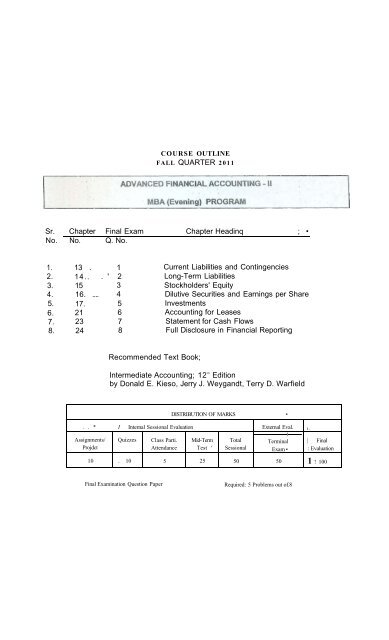

Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ISU Company adopted a stock option plan on November 30, 2005, that provided that 70,000 shares of $. .Tarvalue stock be designated as available for the granting of options to officers of the corporation at a price of $S ashare. The market value was $ 12 a share on November 30,2005.On January 2,2006. options to purchase 28,000 shares were granted to president Don Pedro - 15,000 forservices to be rendered in 2006 and 13,000 for services to be rendered in 2007. Also on that date, options topurchase 14,000 shares were granted to vice president Beatrice Leonato - 7,000 for services to be rendered in2006 and 7,000 for services be rendered in 2007. The market value of the stock was $14 a share on January 2,2006. The options were exercisable for a period of one year following the year in which the services wererendered. The fair value of the options on the grant date was $3 per option.In 2007 neither the president nor the vice president exercised their options because the market price of the stockwas below the exercise price. The market value of the stock was $7 a share on December 31, 2007, when theoptions for 2006 services lapsed.On December, 31, 2008. both president Pedro and vice president Leonato exercised their options for 13,000 and7,000 shares, respectively, when the market price was $16 a share.INSTRUCTIONS:Prepare the necessary journal entries in 2005 when the stock option plan was adopted, in 2006 when optionswere granted, in 2007 when options lapsed, and in 2008 when options were exercised.On January 1,2007, Rob Wilco Company purchased $200,000, 8% bonds of Mercury Co. for $ 184,557. Thebonds were purchased to yield 10% interest. Interest is payable semiannually on July 1 and January 1. The bondsmature on January 1, 2012. Rob Wilco Company uses the effective-interest method to amortize discount orpremium. On January 1,2009, Rob Wilco Company sold the bonds for $185,363 after receiving interest to meetits liquidity needs. . . .ISNTRUCTIONS:i. Prepare the journal entry to record the purchase of bonds on January 1. Assume that the bonds are classifiedas available-for-sale.ii. Prepare the amortization schedule for the bonds.iii. Prepare the journal entries to record the semiannual interest on July I, 2007, and December 31,2007.iv. If the fair value of Mercury bonds is $ 186,363 on December 31, 2008, prepare the necessary adjusting .entry.(Assume the securities fair value adjustment balance on January 1, 2008, is a debit of $3,375.)v. Prepare the journal entry to record the sale of the bonds of January 1, 2009.Cascade Industries and Hardy Inc. enter into an agreement that requires Hardy Inc. to build three diesel-electricengines to Cascade's specifications. Upon completion of the engines, Cascade has agreed to lease them for aperiod of 10 years and to assume all costs and risks of ownership. The lease is noncancelable, becomes effective. on January 1, 2008, and requires annual rental payments of $620,956 each January 1, starting January 1,2008.Cascade's incremental borrowing rate is 10%. The implicit interest rate used by Hardy Inc. and known toCascade is 8%. The total cost of building the three engines is $3,900,000. The economic life of the engines isestimated to be 10 years, with residual value set at zero. Cascade depreciates similar equipment on a straight-linebasis. At the end of the lease. Cascade assumes title to the engines. Collectibility of the lease payments isreasonably certain; no uncertainties exist relative to unreimbursable lessor costs.INSTRUCTIONS:(Round all numbers to the nearest dollar.)i. Discuss the nature of this lease transaction from the viewpoints of both lessee and lessor.ii. Prepare the journal entry or entries to record the transaction on January 1, 2008, on .the books of CascadeIndustries.iii. Prepare the journal entry or entries to record thetransaction on January 1 2008, on the books of Hardy Inc.iv. Prepare the journal entries for both the lessee and lessor to record the first rental payment on January 1, 2008.v. Prepare the journal entries for both the lessee and lessor to record interest expense (revenue) at December 31,2008. (Prepare a lease amortization schedule for 2 years).vi. Show the items and amounts that would be reported on the balance sheet (not notes) at December 31, 2008,for both the lessee and the lessor.Page 2 of3

The comparative balance sheets for Shenandoah Corporation show the following information.December3l2008 2007Cash $ 38,500 $13,000Accounts receivable 12,250 10,000Inventory 12,000 9,000Investments • -0- 3,000Building -0- 29,750Equipment 40,000 20,000Patent 5,000 6,250$107,750 $91,000Allowances for doubtful accounts 3,000 4,500Accumulated depreciation on equipment 2,000 4,500Accumulated depreciation on building -0- 6,000Accounts payable 5,000 3,000Dividends payable : • -Or 5,000Notes payable, short-term (nontrade) 3,000 4,000Long-term notes payable 31,000 25,000Common stock 43,000 33,000Retained earnings20,750 6,000$107,750 $91,000Additional data related to 2008 are as follows:i. Equipment that had cost $ 11,000 and was 30% depreciated at lime of disposal was sold for $2,500.ii. $10,000 of the long-term note payable was paid by issuing common stock.iii. Cash dividends paid were $5,000.iv. On January 1, 2008, the building was completely destroyed by a flood. Insurance proceeds on the buildingwere $30,000 (net of $2,000) taxes).v. Investments (available-for-sale) were sold at $3,700 above their cost. The company has made similar salesand investments in the past.vi. Cash of $15,000 was paid for the acquisition of equipment.vii. A long-term note for $16,000 was issued for the acquisition of equipment.viii. hiterest of $2,000 and income taxes of $6,500 were paid in cash.INSTRUCTIONS:Prepare a statement of cash Hows using the indirect method. Flood damage is unusual and infrequent in that partof the country.Friendly Corporation is a diversified company that operates in live different industries: A, B, C, D, and E. Thefollowing information relating to each segment is available for 2007:A B c D P.Sales $40,000 $80,000 $580,000 ' $35,000 $55,000Cost of goods sold 19,000 50,000 270,000 19,000 30,000Operating expenses 10,000 40,000 235,000 12,000 18,000Total expenses 29,000 90,000 505,000 31,000 4S.000Operating profit(loss) $11,000 $(10,000) $ 75,000 $ 4,000 $ 7,000Identifiable assets $35,000 $60,000 $500,000 $65,000 $50,000Sales of segments B and C included intersegment sales of $20,000 and $100,000, respectively.INSTRUCTIONS:a. Determine which of the segments are reportable based on the:i. Revenue test. ii. Operating profit (loss) test. Iii. Identifiable assets test.b. Prepare the necessary disclosures required by FASB No. 131. •Page 3 ol'3

|lf toluo ilnlwr.il.PRESTONUNIVERSITYStudent Name:Islamabad - Kohat - Peshawar - LahoreTERMINALCourse Code:Course Title:Program:Quarter:Executive MBA/MBA (Evening)This is a three-hour examination and consists of problems only.You may attempt not moreQ.lQ.2Q-3Star Wars Company pays its office employee payroll weekly. Below is a partial list of employees and their payrolldata for August. Because August is their vacation period, vacation pay is also listed.EmployeeEarnings toJuly 31Weekly• PayVacation Pay to be- Received in AugustMark Hamill $4,200 $180Carrie Fisher 3,500 150 $300Harrison Ford 2,700 110 . . 200Alec Guinness 7,400 250Peter dishing 8,000 290 580Assume that the federal income tax withheld is 10% of wages. Union dues withheld are 2% of wages. Vacationsare taken the second and third weeks of August by Fisher, Ford, and Cushing. The state unemployment tax rate is2.5% and the federal is 0.8%, both on a $7,000 maximum. The F.I.C.A rate is 7.65% on employee and employeron a maximum of $90,000 per employee. In addition, a 1.45% rate is charged both employer and employee for anemployee's wage in excess of $90,000.INSTRUCTIONS:Make the journal entries necessary for each of the four August payrolls. The entries for the payroll and for thecompany's liability are made separately. Also make the entry to record the monthly payment of accrued payrollliabilities.Palmiero Co. is building a new hockey arena at a cost of $2,000,000. It received a down payment of $500,000from local businesses to support the project and now needs to borrow $ 1,500,000 to complete the project. Ittherefore, decides to issue $1,500,000 of 10.5%, 10-year bonds. These bonds were issued on January 1,2005, andpay interest annually on each January 1. The bonds yield 10%. Palmiero paid $50,000 in bond issue costs relatedto the bond sale.INSTRUCTIONS:i. Prepare the journal entry to record the issuance of the bonds and the related bond issue costs incurred onJanuary 1,2005.u.iii.Prepare a bond amortization schedule up to and including January 1, 2009, using the effective interest method.Assume that on July 1,2008, Palmiero Co. retires half of the bonds at a cost of $800,000 plus accrued interest.Prepare the journal entry to record this retirement.Matsui Corporation's charter authorized issuance of 100,000 shares of $100 par value common stock and 50,000shares of $50 preferred stock. The following transactions involving the issuance of shares of stock werecompleted. Each transaction is independent of the others.i. Issued a $10,000, 9% bond payable at par and gave as a bonus one share of preferred stock, which at that timewas a selling for $ 106 a share.u. Issued 500 shares of common stock for machineiy. The machinery had been appraised at $7,100; the seller'sbook value was $6,200. The most recent market price of the common stock is $15 a share.in. Issued 375 shares of common and 100 shares of preferred for a lump sum amounting to $1.1,300. The commorhad been selling at $14 and the preferred at $65.IV.Issued 200 shares of common and 50 shares of preferred for furniture and fixtures. The common had a fairmarket value of $16 per share; the furniture and fixtures have a fair value of $6,200.INSTRUCTIONS: Record the transactions listed above in journal entry form.Page 1 of

Counter Inc. issued $1,500,000 of convertible 10-year bonds on July 1, 2007. The bonds provide for 12% interestpayable semiannually on January 1 and July 1. The discount in connection with the issue was $34,000 which isbeing amortized monthly on. a straight-line basis.The bonds are convertible after one year into 8 shares of Counter In.c.'s $100 par value common stock for each$1,000 of bonds.On August 1,2008, $150,000 of bonds were turned in for conversion into common. Interest has been accruedmonthly and paid as due. At the time of conversion any accrued interest on bonds being converted is paid in cash.INSTRUCTIONS:(Round to nearest dollar)Prepare the journal entries to record the conversion amortization and interest in connection with the bonds as ofthe following dates:i. August 1, 2008, (Assume the book value method is used).ii. August 31, 2008,iii. December 31, 2008, including closing entries for end-of-year.Presented below is information taken from a bond investment amortization schedule with related fair valuesprovided. These bonds are classified as available-for-sale.12/31/06 " 12/31/07 12/31/08Amortized cost $491,150 $519,442 $550,000Fair value $499,000. $506,000 $550,000INSTRUCTIONS:iv Indicate whether the bonds were purchased at a discount or at a premium.ii. Prepare the adjusting entry to record the bonds at fair value at December 31, 2006. The Securities Fair ValueAdjustment account has a debit balance of $ 1,000 prior to adjustment. ,iii. Prepare the adjusting entry to record the bonds at fair value at December 31, 2007. 'Stine Leasing Company agrees to lease machinery to Potter Corporation on January I, 2007. The followinginformation relates to the lease agreement:a. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of9 years.b. The cost of the machinery is $420,000 and the fair value of the assets on January 1,2007, is $560,000.c. At the end of the lease term the asset reverts to the lessor. At the end of the lease term the asset has aguaranteed residual value of $80,000. Potter depreciates all of its requirement on a straight-line basis.d. The lease agreement requires equal annual rental payments, beginning on January 1, 2007.e. The collectability of the lease payments is reasonably predictable, and there are no important uncertaintiessurrounding the amount of costs yet to be incurred by the lessor. ,f. Stine desires a 10% rate of return on its investments. Potter's incremental borrowing rate is 11%, and thelessor's implicit rate is unknown.INSTRUCTIONS:(Assume the accounting period ends on December 31)i. Discuss the nature of this lease for the both the lessee and the lessor.ii. Calculate the amount of the annual rental payment required.iii. Compute the present value of the minimum lease payments.iv. Prepare the journal entries Potter would make in 2007 and 2008 related to the lease arrangement.v. Prepare the journal entries Stine would make in 2007 and 2008.Page 2 of3

The comparative balance sheets for Shenandoah Corporation show the following information.December 312008 2007Cash $ 38,500 $13,000Accounts receivable 12,250 10,000Inventory 12,000 9,000Investments -0- 3,000Building -0- 29,750Equipment 40,000 20,000Patent 5,000 6,250$107,750 $91,000Allowances for doubtful accounts 3,000 4,500Accumulated depreciation on equipment 2,000 4,500Accumulated depreciation on building -0- 6,000Accounts payable 5,000 3,000Dividends payable -0- 5,000Notes payable, short-term (nontrade) 3,000 4,000Long-term notes payable 31,000 25,000Common stock 43,000 33,000Retained earnings20,750 6^00$107,750 $91,000Additional data related to 2008 are as follows:i. Equipment that had cost $11,000 and was 30% depreciated at time of disposal was sold for $2,500.ii. $10,000 of the long-term note payable was paid by issuing common stock. .iii. Cash dividends paid were $5,000.iv. On January 1, 2008, the building was completely destroyed by a flood. Insurance proceeds on the buildingwere $30,000 (net of $2,000) taxes).v. Investments (available-for-sale) were sold at $3,700 above their cost. The company has made similar salesand investments in the past.vi. Cash of $15,000 was paid for the acquisition of equipment.vii. A long-term note for $16,000 was issued for the acquisition of equipment.viii. Interest of $2,000 and income taxes of $6,500 were paid in cash.INSTRUCTIONS:Prepare a statement of cash flows using the indirect method. Flood damage is unusual and infrequent in that part ofthe country.Friendly Corporation is a diversified company that operates in five different industries: A, B, C, D, and E. Thefollowing information relating to each segment is available for 2007:A R c D F.Sales $40,000 $80,000 $580,000 $35,000 $55,000Cost of goods sold 19,000 50,000 270,000 19,000 30,000Operating expenses 10,000 . 40,000 235,000 12,000 18,000Total expenses 29,000 90,000 505,000 31,000 48,000Operating profit(loss) $11,000 $(10,000) $ 75.000 $ 4,000 $ 7,000Identifiable assets $35,000 $60,000 $500,000 $65,000 $50,000Sales of segments B and C included intersegment sales of $20,000 and $100,000, respectively"INSTRUCTIONS:a. Determine which of the segments are reportable based on the:i. Revenue test. ii. Operating profit (loss) test. Iii. Identifiable assets test.b. Prepare the necessary disclosures required by FASB No. 131. .Page 3 o

tJrulan ll.ilutr«llg^^=£^ Kohat - Islamabad Lahore - 'Peshawar- - FaisaJaba'dCourse Code:Course Title:Program:Quarter:<strong>Advanced</strong> <strong>Financial</strong> <strong>Accounting</strong>-<strong>II</strong>Executive MBA/MBA (Evening)Summer 2010This is a three-hour examination and consists of problems only.You may attempt not more than live problems.Q. 1 Below is a payroll sheet for Jedi Import Company for the month of September 2007. The company is allowed a1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximumfor both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% F.I.C.A. tax onemployee and employer on a maximum of $90,000. In addition, 1.45% is charged both employer and employeefor an employee's wage in excess of $90,000 per employee.Earnings September Income TaxName to Aug. 31 Earnings Withholding F.I.C.AB.D Williams $ 6,800 $ 800D. Prowse 6,300 700 - iK.Baker 7,600 1,100F.OZ 13,600 1,900 }A.Daniels 105,000 15,000B.Mayhew 112,000 16,000StateFederalU.CINSTRUCTIONS: .i. Complete the payroll sheet and make the necessary entry to record the payment of the payroll.ii. Make the entry to record the payroll tax expenses of Jedi Import Company.iii. Make the entry to record the payment of the payroll liabilities created. Assume that the company pays allpayroll liabilities at the end of each month.Q-2The following amortization and interest schedule reflects the insurance of 10-years bonds by Terrel BrandonCorporation on January 1,2000, and the subsequent interest payments and charges. The company's year-end isDecember 31, and financial statements are prepared once yearly.INSTRUCTIONS:Amortization ScheduleAmountBookYear Cash Interest Unamortized Value1/1/2000 $5,651 $ 94,3492000 $11,000 $11,322 5,329 94,6712001 11,000 11,361 4,968 95,0322002 11,000 11,404 4,564 95,4362003 11,000 11,452 4,112 95,8882004 11,000 11,507. 3,605 96,3952005 11,000 11,567 3,038 96,9622006 11,000 11,635 2,403 97,5972007 11,000 11,712 1,691 98,3092008 11,000 11,797 894 99,1062009 11,000 11,894 100,000i. Indicate whether the bonds were issued at a premium or a discount and how you can determine this factfrom the schedule.it. Indicate whether the amortization schedule is based on the straight-lint! method or the effective interestmethod and how you can determine which method is used.in. Determine the stated interest rate and the effective interest rate.Page I of 5

iv. On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January j 11,2000.v. On the basis of the schedule above, prepare the journal entry or entries to reflect the bond transactions and ,.accruals for 2000. (Interest is paid January 1.).vi. On the basis of the schedule above, prepare the journal entry or entries to reflect the bond transactions andaccruals for 2007. Brandon Corporation does not use reversing entries.Andrew Jones Company had the following stockholders' equity as of January 1,2007:Common stock, $5par value, 20,000 shares issued $ 100,000Paid-in- capital in excess of par 300,000Retained earnings | 320,000Total stockholders' equity 1 ' $720,000During 2007, the following transactions occurred:Feb. 1 Jones repurchased 2,000 shares of treasury stock at a price of $ 18 per share.Mar. 1 800 shares of treasury stock repurchased above were reissued at $17 per share.Mar. 18 500 shares of treasury stock repurchased above were reissued at $14 per share. \Apr. 22 600 shares of treasury stock repurchased above were reissued at $20 per share..INSTRUCTIONS:i. Prepare the journal entries to record the treasury stock transactions in 2007, assuming Jones uses the costmethod.ii. Prepare the stockholders' equity section as of April 30, 2007. Net income for the first 4 months of 2007 was$110,000.Diane Leto, controller at Dewey Yaeger Pharmaceutical Industries, a public company, is cunenfiy preparing the.calculation for basic and diluted earnings per share and the related disclosure for Yaeger's external financialstatements. Below is selected financial information for the fiscal year ended June 30, 2008.DEWEY YAEGER PHARMACEUTICAL 1NDUSTIRESSELECTED STATEMNT OFFINANCIAL POSITION 1NFORAMTIONJUNE 30,2008Long-term debt ;Notes payable, 10% $ 1,000,0007% converting bonds payable 5,000,00010% bonds payable . 6,000,000Total long-term debt $12,000,000Shareholders' equityPreferred stock, 8.5% cumulative, $50 par value,100,000 shares authorized, 25,000 shares issuedand outstanding $ 1,250,000Common stock, $1 par, 10,000,000 shares authorized,1,000,000 shares issued and outstanding 1,000,000Additional paid-in capital 4,000,000Retained earnings 6,000,000Total shareholder's equity $12,250,000The following transactions have also occurred at Yaeger.i. Options were granted in 2006 to purchase 100,000 shares at $15 per share. Although no options wereexercised during 2008, the average price per common share during fiscal year 2008 was $20 per share.ii. Each bond was issued at face value. The 7% convertible debenture will convent into common stock at 50shares per $1,000 bond..It is exercisable after 5 years and was issued in 2007.iii. The 8.5 % preferred slock was issued in 2006.IV. There are no preferred dividends in arrears; however, preferred dividends were not declared in fiscal year2008.Page 2 of 5

v. The 1,000,000, shares of common stock were outstanding for the entire 2008 fiscal year.vi. Net income for fiscal year 2008 was $1,500,000, and the average income tax rate is 40%.ISNTRUCTIONS: .For the fiscal year ended June 30, 2008, calculate the following for Dewey Yaeger Pharmaceutical Industries:i. Basic earnings per share.ii. Diluted earnings per share.Octavio Paz Corp. Carries an account in its general ledger called investments, which contained debits forinvestment purchases, and no credits.Feb. 1,2008 Chiang Kai-Shek Company common stock, $100 par, 200 sh'ares $ 37,400April 1, U.S. government bonds, 11%, due April 1,2016, Interest payableApril 1 and October 1, lOObonds of $1,000 par each. 100,000July 1 Claude Monet Company 12% bonds, par $50,000, dated March 1, 2006purchased at 104 plus accrued interest, interest payableINSTRUCTIONS:annually on March 1, due March 1,2026. 54,000(Round all computations to the nearest dollar)i. Prepare entries necessary to classify the amounts into proper accounts, assuming that all the securities areclassified as available-for-sale.ii. Prepare the entry to record the accrued interest and the amortization of premium on December 31,2006,using the straight-line method. • jiii. The fair values of the securities on December 31,2006, were;Chiang Kai-shek Company common stock $ 3j,800U.S. government bonds 124,700Claude Monet Company bonds . 58,600What entry or entries, if any, would you recommend be made?iv. The U.S. government bonds were sold on July 1, 2007, for $119,200 plus accrued interest. Give the proper,entry.Cascade Industries and Hardy Inc. enter into an agreement that requires Hardy Inc. to build three diesel-eleclricengines to Cascade's specifications. Upon completion of the engines, Cascade has agreed to lease them for aperiod of 10 years and to assume all casts and risks of ownership. The lease is noncancelable, becomes effectiveon January 1,2008, and requires annual rental payments of $620,956 each January 1, starting January 1,2008.Cascade's incremental borrowing rate is 10%. The implicit interest rate used by Hardy Inc. and known toCascade is 8%. The total cost of building the three engines is $3,900,000. The economic life of the engines isestimated to be 10 years, with residual value set at zero. Cascade depreciates similar equipment on a straight-linebasis. At the end of the lease, Cascade assumes title to the engines. Collectibility of the lease payments isreasonably certain; no uncertainties exist relative to unreimbursable lessor costs.INSTRUCTIONS:(Round all numbers to the nearest dollar.)i. Discuss the nature of this lease transaction from the viewpoints of both lessee and lessor.ii. Prepare the journal entry or entries to record the transaction on January 1, 2008, on the books of CascadeIndustries.iii. Prepare the journal entry or entries to record the transaction on January; 1 2008, on the books of Hardy Inc.iv. Prepare the journal entries for both the lessee and lessor to record the first rental payment on January 1, 2008.V. Prepare the journal entries for both the lessee and lessor to record interest expense (revenue) at December 31,2008. (Prepare a lease amortization schedule for 2 years),vi. Show the items and amounts that would be reported on the balance sheet (not notes) at December 31,2008,for both the lessee and the lessor.iPage 3 of

Cleveland Company had available at the end of 2007 the information as follows:CLEVELAND COMPANYComparative Balance SheetAs of December 31,2007 and 20082007 2008Cash $ 15,000 $ 4,000Accounts receivable 17,500 12,950Short-term investments 20,000 30,000Inventory 42,000 35,000Prepaid rent 3,000 12,000Prepaid Insurance 2,100 900Office supplies 1,000 750Land 125,000 175,000Building 350,000 350,000Accumulated depreciation (105,000) (87,500)Equipment 525,000 400,000Accumulated depreciation (130,000) (112,000)Patent ; 45,000 50,000Total Assets ! . $910,600 $ 871,100Accounts payable $ 27,000 $ 32,000Taxes payable i 5,000 4,000Wages payable 5,000 3,000Short-term notes payable ( 10,000 10,000Long-term notes payable f 60,000 70,000Bonds payable 400,000 400,000Premium on bonds payable 20,303 25,853Common stock 240,000 220,000Paid-in-capital in excess of par 20,000 17,500Retained earnings 123,297 88,747Total liabilities and stockholders' equity $910,600 $871,100CLEVELAND COMPANY•• Income StatementFor the Year ended December 31, 2007Sales revenue $1,160,0.00Cost of goods sold (748,000)412,000Gross margin ' (|Operating expensesSelling expenses $ 79,200Administrative expense? 156,700Depreciation / Amortization expense 40,500Total operating expenses (276,400)Income from operations ' 135,600Other revenues/expenses >Gain on sale of land ! 8,000Gain on sale of short-term investment 4,000Dividend revenue 2,400Interest expense (51,750) (37,350)Income before taxes 98,250Income tax expense (39,400)Net Income 58,850Dividends to common stockholders . ' (24,300)To retained earnings $ 34,550

INSTRUCTIONS:Prepare a statement of cash flows for Cleveland Company using the direct method accompanied a reconciliationschedule. Assume the short-term investments are available-for-sale securities.Sandburg Corporation was formed 5 years ago through a public subscription of common stock. Robert Frost,who owns 15% of the common stock, was one of the organizers of Sandburg and is its current president. Thecompany has been successful, but it currently is experiencing a shortage of funds. On June 10, Robert Frostapproached the Spokane National Bank, asking for a 24-month extension on two $35000 notes, which are due onJune 30, 2007, and September 30,2007. Another note of $6,000 is due on March 31,2008, but he expects nodifficulty in paying this note on its due date. Frost explained that Sandburg's cash flow problems are dueprimarily to the company's desire to finance a $300,000 plant expansion over the next 2 fiscal years throughinternally generated funds.The Commercial Loan Officer of Spokane National Bank requested financial reports for the last 2 fiscal years.These reports are reproduced below:SANDBURG COPORATIONSTATEMENT OF FINANCIAL POSITIONAS OF MARCH 31Assets 2007 2006Cash $ 18,200 $ 12,500Notes receivable 148,000 132,000Accounts receivable (net) 131,800 125,500Inventories (at cost) 95,000 50,000Plant & equipment (net of depreciation) 1,449,000 1,420,500Total assets $1,842,000 $1,740,500Liabilities and Owners' EquityAccounts payable $ 69,000 $ 91,000Notes payable 76,000 61,500Accrued liabilities 9,000 6,000Common stock (130,000 shares, $10 par) 1,300,000 1,300,000Retained earnings 388,000 282,000Total liabilities and owners' equity $1,842,000 $1,740,500•Cash dividends were paid at the rate of $1 per share in fiscal year! 2006 and $2 per share in fiscal year'2007.SANDBURG COPORATIONINCOM STATEMENTFOR THE FISCAL YEARS ENDED MARCH 312007 2006Sales $3,000,000 $2,700,000Cost of goods sold" 1,530,000 1,425,000Gross margin $1,470,000 $1,275,000Operating expenses 860,000 780,000Income before income taxes $ 610,000 $ 495,000Income taxes (40%) 244,000 198,000 .Net income $ 366,000 $ 297,000•Depreciation charges on the plant and equipment of $100,000 and $102,500 for fiscal years ended •March 31,2006 and 2007 respectively, are included in cost of goods sold.1NSGTRUCTIONS:1a. Compute the following items for Sandburg Corporation:i. Current ratio for fiscal years 2006 and 2007.ii. Acid-test (quick) ratio for fiscal years 2006 and 2007.iii. Inventory turnover for fiscal year 2007.jiv. Return on assets for fiscal years 2006 and 2007. (Assume total assejts were $1,688,500 at 31-03-2005)v. Percentage change in sales, cost of good sold gross margin and net income after taxes from fiscal year2006 to 2007.b. Assume that the percentage changes experienced in. fiscal year 2007 as compared with fiscal year 2006 forsales and cost of goods sold will be repeated in each of the next 2 yearsi Is Sandburg's desire to finance theplant expansion from internally generated funds realistic? Discuss.Pnge5 of3

This is a three-hour examination and consists of problems only.You may attempt not more than five problems.Q. 1 Below is a payroll sheet for Jedi Import Company for the month of September 2007. The company is allowed a1% unemployment compensation rate by the state; the federal unemployment lax rate is 0.8% and the maximumfor both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% F.l.C.A. tax onemployee and employer on a maximum of $90,000. In addition, 1.45% is charged both employer and employeefor an employee's wage in excess of $90,000 per employee.Earnings September Income Tax State FederalName to Aug. 31 Earnings Withholding F.l.OA U.C U.CB.D Williams $ 6,800 $ 800D. Prowse 6,300 700K.Baker 7,600 1,100F.OZ 13,600 1,900A.Daniels 105,000 15,000B.Mayhew 112,000 16,000INSTRUCTIONS:i. Complete the payroll sheet and make the necessary entry to record the payment of the payroll.ii. Make the entry to record the payroll tax expenses of Jedi Import Company.iii. Make the entry to record the payment of the payroll liabilities created. Assume that the company pays allpayroll liabilities at the end of each month.Q.2 Palmiero Co. is building a new hockey arena at a cost of $2,000,000. it received a down payment of $500,000from local businesses to support the project and now needs to borrow $1,500,000 to complete the project. Ittherefore, decides to issue $1,500,000 of 10.5%, 10-year bonds. These bonds were issued on January I, 2005,and pay interest annually on each January I. The bonds yield 10%. Palmiero paid $50,000 in bond issue costsrelated to the bond sale.INSTRUCTIONS:i. Prepare the journal entry to record the issuance of the bonds and the related bond issue costs incurred onJanuary 1,2005.ii. Prepare a bond amortization schedule up to and including January 1, 2009, using the. effective interestmethod.iii. Assume that on July 1, 2008, Palmiero Co. retires half of the bonds at a cost of $800,000 plus accruedinterest. Prepare the journal entry to record this retirement.Q.3 Before Polska Corporation engages in the treasury stock transactions listed below, its general ledger reflects,among others, the following account balances (par value of its sock is $30 per share).Paid-in Capital in Excess of Par Common Stock ' Retained Earnings$99,000 $270,000 $80,000INSTRUCTIONS:Record the treasury stock transactions (given below) under the cost method of handling treasury stock; use theFIFO method for purchase-sale purposes.i. Bought 380 shares of treasury stock at $39 per share.ii. Bought 300 shares of treasury stock at $43 per share.iii. Sold 350 shares of treasury stock at $42 per share.iv. Sold 120 shares of treasury stock at $38 per share.Page I of5

Counter Inc. issued $1,500,000 of convertible 10-year bonds on July 1, 2007. The bonds provide for 12%interest payable semiannually on January I and July 1. The discount in connection with the issue was $34,000which is being amortized monthly on a straight-line basis.The bonds are convertible after one year into 8 shares of Counter lnc.'s $100 par value common stock for each$1,000 of bonds.On August 1, 2008, $ 150,000 of bonds were turned in for conversion into common. Interest has been accruedmonthly and paid as due. At the time of conversion any accrued interest on bonds being converted is paid incash.•.INSTRUCTIONS:(Round to nearest dollar)Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as ofthe following dates:i. August 1, 2008, (Assume the book value method is used).ii. August 31, 2008,iii. December 31, 2008, including closing entries for end-of-ycar.Presented below is information taken from a bond investment amortization schedule with related fair valuesprovided. These bonds are classified as available-for-sale.12/31/06 12/31/07 12/31/08Amortized cost $491,150 $519,442 $550,000Fair value $499,000 $506,000 $550,000INSTRUCTIONS:i. Indicate whether the bonds were purchased at a discount or at a premium.ii. Prepare the adjusting entry to record the bonds at fair value at December 31, 2006. The Securities Fair ValueAdjustment account has a debit balance of $1,000 prior to adjustment.iii. Prepare the adjusting entry to record the bonds at fair value at December 31, 2007.The following facts pertain to a noncancelable lease agreement between Alschuler Leasing Company andMcK.ee Electronics, a lessee, for a computer system.Inception date October 1, 2007Lease term6, yearsEconomic life of leased equipment6, yearsFair value of asset at October 1,2007 $200,255Residual value at end of lease term -0-Lessor's implicit rate 10%Lessee's incremental borrowing rate 10%Annual lease payment due at the beginning ofeach year, beginning with October 1, 2007 $41,800The collectibility of the lease payments is reasonably predictable, and there are no important uncertaintiessurrounding the costs yet to be incurred by the lessor. The lessee assumes responsibility for all executory costs,which amount to $5,500 per year and are to be paid each October 1, beginning October 1, 2007. (This $5,500 isnot included in the rental payment of$4I,800.) The asset will revert to the lessor at the end of the lease term. Thestraight-line depreciation method is used for all equipment.The following amortization schedule ha been prepared correctly for use by both the lessor and the lessee inaccounting for this lease. The lease is to be accounted for properly as a capital lease by the lessee and as a directfinancinglease by the lessor:Page 2

AnnualLease Interest 10%) Reduction Balance ofPayment/ on Unpaid of Lease LeaseDate Receipt Liability/Receivable Liability/Receivable Liability/Receivable10/01/07 • $200,25510/01/07 $ 41,800 $ 41,800 158,45510/01/08 41,800 $15,846 25,954 132,50110/01/09 41,800 13,250 28,550 103,95110/01/10 41,800 10,395 31,405 72,54610/01/11 41,800 7,255 34,545 38,00110/01/12 41,800 3,799* 38,001 -0-$250,800 $50,545 $200,255Rounding error is $1.INSTRUCTIONS:(Round all numbers to the nearest cent).(a) Assuming the lessee's accounting period ends on September 30, answer the following questions with respectto this lease agreement:(1) What items and amounts will appear on the lessee's income statement for the year ending September30,2008?(2) What items and amounts will appear on the lessee's balance sheet at September 30, 2008?(3) What items and amounts will appear on the lessee's income statement for the year ending September30,2009?(4) What items and amount will appear on the lessee's balance sheet at September 30, 2009?(b) Assuming the lessee's accounting period ends on December 31, answer the following questions with respectto this lease agreement:(1) What items and amounts will appear on the lessee's income statement for the year ending December 31,2007?(2) What items and amounts will appear on the lessee's balance sheet at December 31, 2007?(3) What items and amounts will appear on the lessee's income statement for the year ending December 31,2008?(4) What items and amount will appear on the lessee's balance sheet at December 31, 2008?Mardi Gras Company has not yet prepared a formal statement of cash flows for the 2008 fiscal year.Comparative balance sheets as of December 31, 2007 and 2008, and a statement of income and retained earningsfor the year ended December 31, 2008 are presented below:MARDI GRAS COMPANYStatement of Income and Retained EarningsFor the Year Ended December 31, 2008($000 Omitted)Sales $3,800ExpensesCost of goods sold $ 1,200Salaries and benefits 725Heat, light, and power 75Depreciation 80Property taxes 19Patent amortization 25Miscellaneous expenses 10Interest 30 2,164Income before income taxes 1,636Income taxes 818I'age 3 of S

Net income 818Retained earnings—Jan. 1, 2008 3101,128Stock dividend declared and issued 600Retained earnings—Dec. 31,2008 $ 528MARDI GRAS COMPANYComparative Balance SheetAs of December 31($000 Omitted)Assets 2008 2007Current assetsCash $ 383 $ 100U.S. Treasury notes (Available-for-sale) -0- 50Accounts receivable 740 500Inventory 720 560Total current assets 1,843 1,210Long-term assetsLand 150 70Buildings and equipment 910 600Accumulated depreciation (200) (120)Patents (less amortization) 105 130Total long-term assets 965 680Total assets $2,808 $1,890Liabilities and Stockholders' EquityCurrent liabilitiesAccounts payable $ 420 $ 340Income taxes payable ' 40 20Notes payable 320 320Total current liabilities 780 680Long-term notes payable-—due 2010 200 200Total liabilities 980 880Stockholders' equityCommon stock 1,300 700Retained earnings 528 310Total stockholders equity 1,828 1,010Total liabilities and stockholders' equity $2,808 $1,890INSTRUCTIONS:Prepare a statement of cash flows using the direct method. Changes in accounts receivable and accounts payabl"relate to sales and cost of goods sold. Do note prepare a reconciliation schedule.Sandburg Corporation was formed 5 years ago through a public subscription of common stock. Robert Frost,;who owns 15% of the common stock, was one of the organizers of Sandburg and is its current president. Thecompany has been successful, but it currently is experiencing a shortage of funds. On June 10, Robert Frostapproached the Spokane National Bank, asking for a 24-month extension on two $35000 notes, which are dueJune 30, 2007, and September 30, 2007. Another note of $6,000 is due on March 31, 2008, but he expects nodifficulty in paying this note on its due date. Frost explained that Sandburg's cash flow problems are dueprimarily to the company's desire to finance a $300,000 plant expansion over the next 2 fiscal years throughinternally generated funds.The Commercial Loan Officer of Spokane National Bank requested financial reports for the last 2 fiscal years.These reports are reproduced below:I'ase

SANDBURG COPORATIONSTATEMENT OP FINANCIAL POSITIONAS OF MARCH 31Assets 2007 2006Cash $ 18,200 $ 12,500Notes receivable 148,000 132,000Accounts receivable (net) 131,800 125,500Inventories (at cost) 95,000 50,000Plant & equipment (net of depreciation) 1,449,000 1,420,500Total assets $1,842,000 $1,740,500Liabilities and Owners' EquityAccounts payable $ 69,000 $ 91,000Notes payable 76,000 61,500Accrued liabilities 9,000 6,000Common stock (130,000 shares, $ 10 par) 1,300,000 1,300,000Retained earnings" 388,000 282,000Total liabilities and owners' equity i > $1,842,000 $ 1,740,500"Cash dividends were paid at the rate of $1 per share in fiscal year 2006 and $2 per share in fiscal year2007.SalesCost of goods sold"Gross marginOperating expensesIncome before income taxesIncome taxes (40%)Net incomeSANDBURG COPORATIONINCOM STATEMENTFOR THE FISCAL YEARS ENDED MARCH 312007 2006$3,000,0001,530,000$1,470,000860,000$ 610,000244,000$ 366,000$2,700,0001,425,000$1,275,000780,000$ 495,000198,000$ 297,000'Depreciation charges on the plant and equipment of $ 100,000 and $ 102,500 for fiscal years endedMarch 31, 2006 and 2007 respectively, are included in cost of goods sold.INSGTRUCTIONS:a. Compute the following items for Sandburg Corporation:Current ratio for fiscal years 2006 and 2007.i.ii.IV.v.Acid-test (quick) ratio for fiscal years 2006 and 2007.Inventory turnover for fiscal year 2007.Return on assets for fiscal years 2006 and 2007. (Assume total assets were $1,688,500 at 31-03-2005)Percentage change in sales, cost of good sold, gross margin, and net income after taxes from fiscal year2006 to 2007.b. Assume that the percentage changes experienced in fiscal year 2007 as compared with fiscal year 2006 forsales and cost of goods sold will be repeated in each of the next 2 years. Is Sandburg's desire to finance theplant expansion from internally generated funds realistic? Discuss.Page 5 of 5