Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

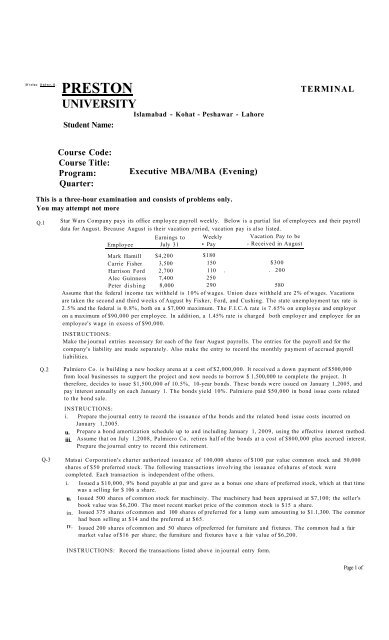

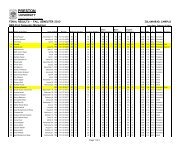

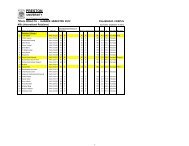

|lf toluo ilnlwr.il.PRESTONUNIVERSITYStudent Name:Islamabad - Kohat - Peshawar - LahoreTERMINALCourse Code:Course Title:Program:Quarter:Executive MBA/MBA (Evening)This is a three-hour examination and consists of problems only.You may attempt not moreQ.lQ.2Q-3Star Wars Company pays its office employee payroll weekly. Below is a partial list of employees and their payrolldata for August. Because August is their vacation period, vacation pay is also listed.EmployeeEarnings toJuly 31Weekly• PayVacation Pay to be- Received in AugustMark Hamill $4,200 $180Carrie Fisher 3,500 150 $300Harrison Ford 2,700 110 . . 200Alec Guinness 7,400 250Peter dishing 8,000 290 580Assume that the federal income tax withheld is 10% of wages. Union dues withheld are 2% of wages. Vacationsare taken the second and third weeks of August by Fisher, Ford, and Cushing. The state unemployment tax rate is2.5% and the federal is 0.8%, both on a $7,000 maximum. The F.I.C.A rate is 7.65% on employee and employeron a maximum of $90,000 per employee. In addition, a 1.45% rate is charged both employer and employee for anemployee's wage in excess of $90,000.INSTRUCTIONS:Make the journal entries necessary for each of the four August payrolls. The entries for the payroll and for thecompany's liability are made separately. Also make the entry to record the monthly payment of accrued payrollliabilities.Palmiero Co. is building a new hockey arena at a cost of $2,000,000. It received a down payment of $500,000from local businesses to support the project and now needs to borrow $ 1,500,000 to complete the project. Ittherefore, decides to issue $1,500,000 of 10.5%, 10-year bonds. These bonds were issued on January 1,2005, andpay interest annually on each January 1. The bonds yield 10%. Palmiero paid $50,000 in bond issue costs relatedto the bond sale.INSTRUCTIONS:i. Prepare the journal entry to record the issuance of the bonds and the related bond issue costs incurred onJanuary 1,2005.u.iii.Prepare a bond amortization schedule up to and including January 1, 2009, using the effective interest method.Assume that on July 1,2008, Palmiero Co. retires half of the bonds at a cost of $800,000 plus accrued interest.Prepare the journal entry to record this retirement.Matsui Corporation's charter authorized issuance of 100,000 shares of $100 par value common stock and 50,000shares of $50 preferred stock. The following transactions involving the issuance of shares of stock werecompleted. Each transaction is independent of the others.i. Issued a $10,000, 9% bond payable at par and gave as a bonus one share of preferred stock, which at that timewas a selling for $ 106 a share.u. Issued 500 shares of common stock for machineiy. The machinery had been appraised at $7,100; the seller'sbook value was $6,200. The most recent market price of the common stock is $15 a share.in. Issued 375 shares of common and 100 shares of preferred for a lump sum amounting to $1.1,300. The commorhad been selling at $14 and the preferred at $65.IV.Issued 200 shares of common and 50 shares of preferred for furniture and fixtures. The common had a fairmarket value of $16 per share; the furniture and fixtures have a fair value of $6,200.INSTRUCTIONS: Record the transactions listed above in journal entry form.Page 1 of