Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

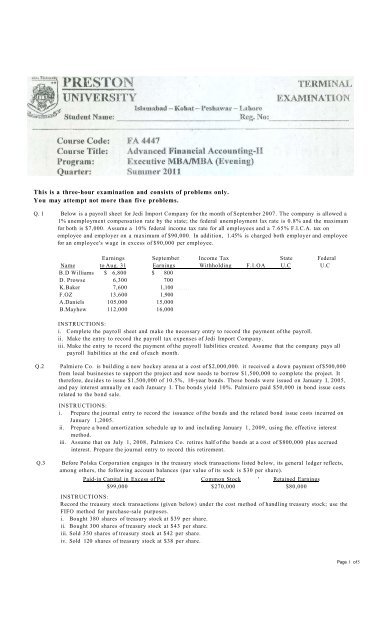

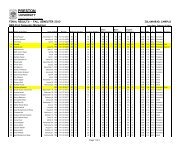

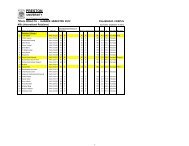

This is a three-hour examination and consists of problems only.You may attempt not more than five problems.Q. 1 Below is a payroll sheet for Jedi Import Company for the month of September 2007. The company is allowed a1% unemployment compensation rate by the state; the federal unemployment lax rate is 0.8% and the maximumfor both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% F.l.C.A. tax onemployee and employer on a maximum of $90,000. In addition, 1.45% is charged both employer and employeefor an employee's wage in excess of $90,000 per employee.Earnings September Income Tax State FederalName to Aug. 31 Earnings Withholding F.l.OA U.C U.CB.D Williams $ 6,800 $ 800D. Prowse 6,300 700K.Baker 7,600 1,100F.OZ 13,600 1,900A.Daniels 105,000 15,000B.Mayhew 112,000 16,000INSTRUCTIONS:i. Complete the payroll sheet and make the necessary entry to record the payment of the payroll.ii. Make the entry to record the payroll tax expenses of Jedi Import Company.iii. Make the entry to record the payment of the payroll liabilities created. Assume that the company pays allpayroll liabilities at the end of each month.Q.2 Palmiero Co. is building a new hockey arena at a cost of $2,000,000. it received a down payment of $500,000from local businesses to support the project and now needs to borrow $1,500,000 to complete the project. Ittherefore, decides to issue $1,500,000 of 10.5%, 10-year bonds. These bonds were issued on January I, 2005,and pay interest annually on each January I. The bonds yield 10%. Palmiero paid $50,000 in bond issue costsrelated to the bond sale.INSTRUCTIONS:i. Prepare the journal entry to record the issuance of the bonds and the related bond issue costs incurred onJanuary 1,2005.ii. Prepare a bond amortization schedule up to and including January 1, 2009, using the. effective interestmethod.iii. Assume that on July 1, 2008, Palmiero Co. retires half of the bonds at a cost of $800,000 plus accruedinterest. Prepare the journal entry to record this retirement.Q.3 Before Polska Corporation engages in the treasury stock transactions listed below, its general ledger reflects,among others, the following account balances (par value of its sock is $30 per share).Paid-in Capital in Excess of Par Common Stock ' Retained Earnings$99,000 $270,000 $80,000INSTRUCTIONS:Record the treasury stock transactions (given below) under the cost method of handling treasury stock; use theFIFO method for purchase-sale purposes.i. Bought 380 shares of treasury stock at $39 per share.ii. Bought 300 shares of treasury stock at $43 per share.iii. Sold 350 shares of treasury stock at $42 per share.iv. Sold 120 shares of treasury stock at $38 per share.Page I of5