Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

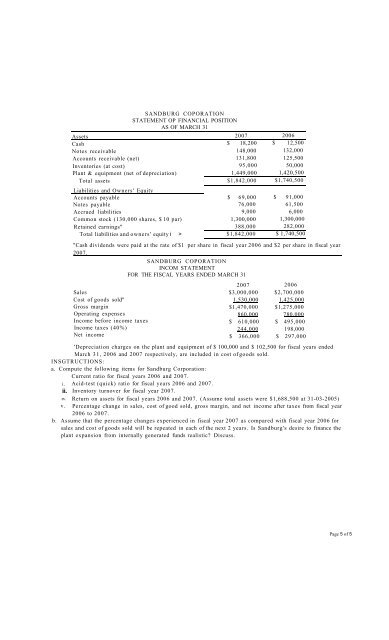

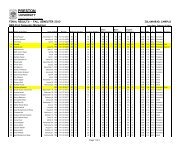

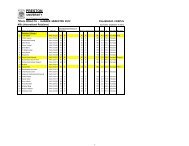

SANDBURG COPORATIONSTATEMENT OP FINANCIAL POSITIONAS OF MARCH 31Assets 2007 2006Cash $ 18,200 $ 12,500Notes receivable 148,000 132,000Accounts receivable (net) 131,800 125,500Inventories (at cost) 95,000 50,000Plant & equipment (net of depreciation) 1,449,000 1,420,500Total assets $1,842,000 $1,740,500Liabilities and Owners' EquityAccounts payable $ 69,000 $ 91,000Notes payable 76,000 61,500Accrued liabilities 9,000 6,000Common stock (130,000 shares, $ 10 par) 1,300,000 1,300,000Retained earnings" 388,000 282,000Total liabilities and owners' equity i > $1,842,000 $ 1,740,500"Cash dividends were paid at the rate of $1 per share in fiscal year 2006 and $2 per share in fiscal year2007.SalesCost of goods sold"Gross marginOperating expensesIncome before income taxesIncome taxes (40%)Net incomeSANDBURG COPORATIONINCOM STATEMENTFOR THE FISCAL YEARS ENDED MARCH 312007 2006$3,000,0001,530,000$1,470,000860,000$ 610,000244,000$ 366,000$2,700,0001,425,000$1,275,000780,000$ 495,000198,000$ 297,000'Depreciation charges on the plant and equipment of $ 100,000 and $ 102,500 for fiscal years endedMarch 31, 2006 and 2007 respectively, are included in cost of goods sold.INSGTRUCTIONS:a. Compute the following items for Sandburg Corporation:Current ratio for fiscal years 2006 and 2007.i.ii.IV.v.Acid-test (quick) ratio for fiscal years 2006 and 2007.Inventory turnover for fiscal year 2007.Return on assets for fiscal years 2006 and 2007. (Assume total assets were $1,688,500 at 31-03-2005)Percentage change in sales, cost of good sold, gross margin, and net income after taxes from fiscal year2006 to 2007.b. Assume that the percentage changes experienced in fiscal year 2007 as compared with fiscal year 2006 forsales and cost of goods sold will be repeated in each of the next 2 years. Is Sandburg's desire to finance theplant expansion from internally generated funds realistic? Discuss.Page 5 of 5