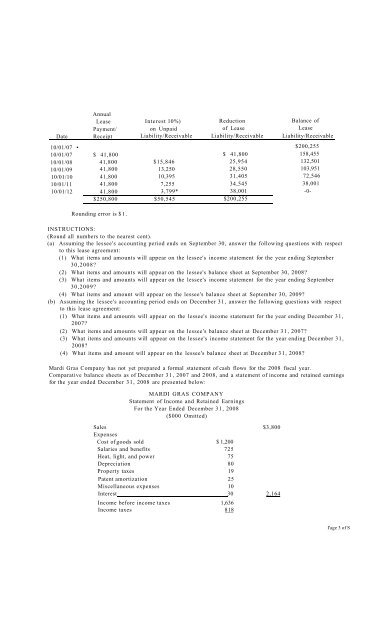

Counter Inc. issued $1,500,000 of convertible 10-year bonds on July 1, 2007. The bonds provide for 12%interest payable semiannually on January I and July 1. The discount in connection with the issue was $34,000which is being amortized monthly on a straight-line basis.The bonds are convertible after one year into 8 shares of Counter lnc.'s $100 par value common stock for each$1,000 of bonds.On August 1, 2008, $ 150,000 of bonds were turned in for conversion into common. Interest has been accruedmonthly and paid as due. At the time of conversion any accrued interest on bonds being converted is paid incash.•.INSTRUCTIONS:(Round to nearest dollar)Prepare the journal entries to record the conversion, amortization, and interest in connection with the bonds as ofthe following dates:i. August 1, 2008, (Assume the book value method is used).ii. August 31, 2008,iii. December 31, 2008, including closing entries for end-of-ycar.Presented below is information taken from a bond investment amortization schedule with related fair valuesprovided. These bonds are classified as available-for-sale.12/31/06 12/31/07 12/31/08Amortized cost $491,150 $519,442 $550,000Fair value $499,000 $506,000 $550,000INSTRUCTIONS:i. Indicate whether the bonds were purchased at a discount or at a premium.ii. Prepare the adjusting entry to record the bonds at fair value at December 31, 2006. The Securities Fair ValueAdjustment account has a debit balance of $1,000 prior to adjustment.iii. Prepare the adjusting entry to record the bonds at fair value at December 31, 2007.The following facts pertain to a noncancelable lease agreement between Alschuler Leasing Company andMcK.ee Electronics, a lessee, for a computer system.Inception date October 1, 2007Lease term6, yearsEconomic life of leased equipment6, yearsFair value of asset at October 1,2007 $200,255Residual value at end of lease term -0-Lessor's implicit rate 10%Lessee's incremental borrowing rate 10%Annual lease payment due at the beginning ofeach year, beginning with October 1, 2007 $41,800The collectibility of the lease payments is reasonably predictable, and there are no important uncertaintiessurrounding the costs yet to be incurred by the lessor. The lessee assumes responsibility for all executory costs,which amount to $5,500 per year and are to be paid each October 1, beginning October 1, 2007. (This $5,500 isnot included in the rental payment of$4I,800.) The asset will revert to the lessor at the end of the lease term. Thestraight-line depreciation method is used for all equipment.The following amortization schedule ha been prepared correctly for use by both the lessor and the lessee inaccounting for this lease. The lease is to be accounted for properly as a capital lease by the lessee and as a directfinancinglease by the lessor:Page 2

AnnualLease Interest 10%) Reduction Balance ofPayment/ on Unpaid of Lease LeaseDate Receipt Liability/Receivable Liability/Receivable Liability/Receivable10/01/07 • $200,25510/01/07 $ 41,800 $ 41,800 158,45510/01/08 41,800 $15,846 25,954 132,50110/01/09 41,800 13,250 28,550 103,95110/01/10 41,800 10,395 31,405 72,54610/01/11 41,800 7,255 34,545 38,00110/01/12 41,800 3,799* 38,001 -0-$250,800 $50,545 $200,255Rounding error is $1.INSTRUCTIONS:(Round all numbers to the nearest cent).(a) Assuming the lessee's accounting period ends on September 30, answer the following questions with respectto this lease agreement:(1) What items and amounts will appear on the lessee's income statement for the year ending September30,2008?(2) What items and amounts will appear on the lessee's balance sheet at September 30, 2008?(3) What items and amounts will appear on the lessee's income statement for the year ending September30,2009?(4) What items and amount will appear on the lessee's balance sheet at September 30, 2009?(b) Assuming the lessee's accounting period ends on December 31, answer the following questions with respectto this lease agreement:(1) What items and amounts will appear on the lessee's income statement for the year ending December 31,2007?(2) What items and amounts will appear on the lessee's balance sheet at December 31, 2007?(3) What items and amounts will appear on the lessee's income statement for the year ending December 31,2008?(4) What items and amount will appear on the lessee's balance sheet at December 31, 2008?Mardi Gras Company has not yet prepared a formal statement of cash flows for the 2008 fiscal year.Comparative balance sheets as of December 31, 2007 and 2008, and a statement of income and retained earningsfor the year ended December 31, 2008 are presented below:MARDI GRAS COMPANYStatement of Income and Retained EarningsFor the Year Ended December 31, 2008($000 Omitted)Sales $3,800ExpensesCost of goods sold $ 1,200Salaries and benefits 725Heat, light, and power 75Depreciation 80Property taxes 19Patent amortization 25Miscellaneous expenses 10Interest 30 2,164Income before income taxes 1,636Income taxes 818I'age 3 of S