Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Advanced Financial Accounting - II - Preston University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

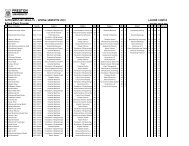

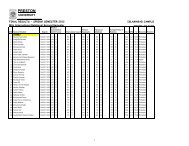

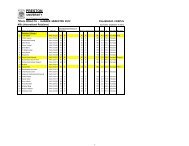

tJrulan ll.ilutr«llg^^=£^ Kohat - Islamabad Lahore - 'Peshawar- - FaisaJaba'dCourse Code:Course Title:Program:Quarter:<strong>Advanced</strong> <strong>Financial</strong> <strong>Accounting</strong>-<strong>II</strong>Executive MBA/MBA (Evening)Summer 2010This is a three-hour examination and consists of problems only.You may attempt not more than live problems.Q. 1 Below is a payroll sheet for Jedi Import Company for the month of September 2007. The company is allowed a1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximumfor both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% F.I.C.A. tax onemployee and employer on a maximum of $90,000. In addition, 1.45% is charged both employer and employeefor an employee's wage in excess of $90,000 per employee.Earnings September Income TaxName to Aug. 31 Earnings Withholding F.I.C.AB.D Williams $ 6,800 $ 800D. Prowse 6,300 700 - iK.Baker 7,600 1,100F.OZ 13,600 1,900 }A.Daniels 105,000 15,000B.Mayhew 112,000 16,000StateFederalU.CINSTRUCTIONS: .i. Complete the payroll sheet and make the necessary entry to record the payment of the payroll.ii. Make the entry to record the payroll tax expenses of Jedi Import Company.iii. Make the entry to record the payment of the payroll liabilities created. Assume that the company pays allpayroll liabilities at the end of each month.Q-2The following amortization and interest schedule reflects the insurance of 10-years bonds by Terrel BrandonCorporation on January 1,2000, and the subsequent interest payments and charges. The company's year-end isDecember 31, and financial statements are prepared once yearly.INSTRUCTIONS:Amortization ScheduleAmountBookYear Cash Interest Unamortized Value1/1/2000 $5,651 $ 94,3492000 $11,000 $11,322 5,329 94,6712001 11,000 11,361 4,968 95,0322002 11,000 11,404 4,564 95,4362003 11,000 11,452 4,112 95,8882004 11,000 11,507. 3,605 96,3952005 11,000 11,567 3,038 96,9622006 11,000 11,635 2,403 97,5972007 11,000 11,712 1,691 98,3092008 11,000 11,797 894 99,1062009 11,000 11,894 100,000i. Indicate whether the bonds were issued at a premium or a discount and how you can determine this factfrom the schedule.it. Indicate whether the amortization schedule is based on the straight-lint! method or the effective interestmethod and how you can determine which method is used.in. Determine the stated interest rate and the effective interest rate.Page I of 5