DWS Strategic Value Fund - Colonial First State

DWS Strategic Value Fund - Colonial First State

DWS Strategic Value Fund - Colonial First State

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

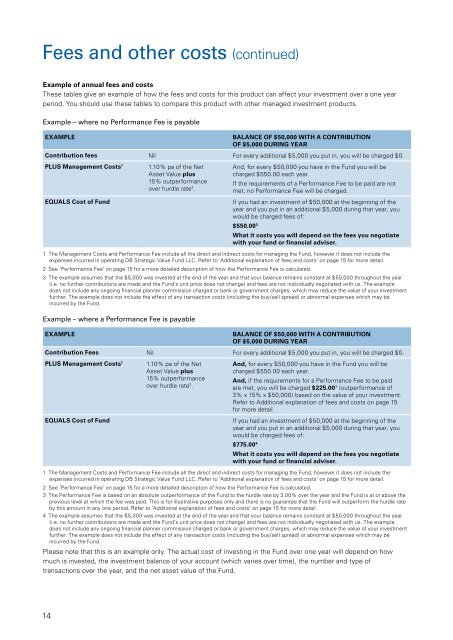

Fees and other costs (continued)Example of annual fees and costsThese tables give an example of how the fees and costs for this product can affect your investment over a one yearperiod. You should use these tables to compare this product with other managed investment products.Example – where no Performance Fee is payableEXAMPLEBALANCE OF $50,000 WITH A CONTRIBUTIONOF $5,000 DURING YEARContribution fees Nil For every additional $5,000 you put in, you will be charged $0.PLUS Management Costs 1EQUALS Cost of <strong>Fund</strong>1.10% pa of the NetAsset <strong>Value</strong> plus15% outperformanceover hurdle rate 2 .And, for every $50,000 you have in the <strong>Fund</strong> you will becharged $550.00 each year.If the requirements of a Performance Fee to be paid are notmet, no Performance Fee will be charged.If you had an investment of $50,000 at the beginning of theyear and you put in an additional $5,000 during that year, youwould be charged fees of:$550.00 3What it costs you will depend on the fees you negotiatewith your fund or financial adviser.1 The Management Costs and Performance Fee include all the direct and indirect costs for managing the <strong>Fund</strong>, however it does not include theexpenses incurred in operating DB <strong>Strategic</strong> <strong>Value</strong> <strong>Fund</strong> LLC. Refer to ‘Additional explanation of fees and costs’ on page 15 for more detail.2 See ‘Performance Fee’ on page 15 for a more detailed description of how the Performance Fee is calculated.3 The example assumes that the $5,000 was invested at the end of the year and that your balance remains constant at $50,000 throughout the year(i.e. no further contributions are made and the <strong>Fund</strong>’s unit price does not change) and fees are not individually negotiated with us. The exampledoes not include any ongoing financial planner commission charged or bank or government charges, which may reduce the value of your investmentfurther. The example does not include the effect of any transaction costs (including the buy/sell spread) or abnormal expenses which may beincurred by the <strong>Fund</strong>.Example – where a Performance Fee is payableEXAMPLEBALANCE OF $50,000 WITH A CONTRIBUTIONOF $5,000 DURING YEARContribution Fees Nil For every additional $5,000 you put in, you will be charged $0.PLUS Management Costs 1EQUALS Cost of <strong>Fund</strong>1.10% pa of the NetAsset <strong>Value</strong> plus15% outperformanceover hurdle rate 2 .And, for every $50,000 you have in the <strong>Fund</strong> you will becharged $550.00 each year.And, if the requirements for a Performance Fee to be paidare met, you will be charged $225.00 3 (outperformance of3% x 15% x $50,000) based on the value of your investment.Refer to Additional explanation of fees and costs on page 15for more detail.If you had an investment of $50,000 at the beginning of theyear and you put in an additional $5,000 during that year, youwould be charged fees of:$775.00 4What it costs you will depend on the fees you negotiatewith your fund or financial adviser.1 The Management Costs and Performance Fee include all the direct and indirect costs for managing the <strong>Fund</strong>, however it does not include theexpenses incurred in operating DB <strong>Strategic</strong> <strong>Value</strong> <strong>Fund</strong> LLC. Refer to ‘Additional explanation of fees and costs’ on page 15 for more detail.2 See ‘Performance Fee’ on page 15 for a more detailed description of how the Performance Fee is calculated.3 The Performance Fee is based on an absolute outperformance of the <strong>Fund</strong> to the hurdle rate by 3.00% over the year and the <strong>Fund</strong> is at or above theprevious level at which the fee was paid. This is for illustrative purposes only and there is no guarantee that the <strong>Fund</strong> will outperform the hurdle rateby this amount in any one period. Refer to ‘Additional explanation of fees and costs’ on page 15 for more detail.4 The example assumes that the $5,000 was invested at the end of the year and that your balance remains constant at $50,000 throughout the year(i.e. no further contributions are made and the <strong>Fund</strong>’s unit price does not change) and fees are not individually negotiated with us. The exampledoes not include any ongoing financial planner commission charged or bank or government charges, which may reduce the value of your investmentfurther. The example does not include the effect of any transaction costs (including the buy/sell spread) or abnormal expenses which may beincurred by the <strong>Fund</strong>.Please note that this is an example only. The actual cost of investing in the <strong>Fund</strong> over one year will depend on howmuch is invested, the investment balance of your account (which varies over time), the number and type oftransactions over the year, and the net asset value of the <strong>Fund</strong>.14