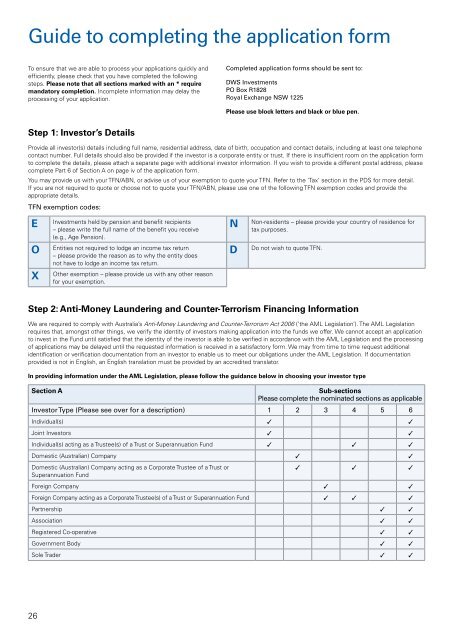

Guide to completing the application formTo ensure that we are able to process your applications quickly andefficiently, please check that you have completed the followingsteps. Please note that all sections marked with an * requiremandatory completion. Incomplete information may delay theprocessing of your application.Completed application forms should be sent to:<strong>DWS</strong> InvestmentsPO Box R1828Royal Exchange NSW 1225Please use block letters and black or blue pen.Step 1: Investor’s DetailsProvide all investor(s) details including full name, residential address, date of birth, occupation and contact details, including at least one telephonecontact number. Full details should also be provided if the investor is a corporate entity or trust. If there is insufficient room on the application formto complete the details, please attach a separate page with additional investor information. If you wish to provide a different postal address, pleasecomplete Part 6 of Section A on page iv of the application form.You may provide us with your TFN/ABN, or advise us of your exemption to quote your TFN. Refer to the ‘Tax’ section in the PDS for more detail.If you are not required to quote or choose not to quote your TFN/ABN, please use one of the following TFN exemption codes and provide theappropriate details.TFN exemption codes:EOXInvestments held by pension and benefit recipients– please write the full name of the benefit you receive(e.g., Age Pension).Entities not required to lodge an income tax return– please provide the reason as to why the entity doesnot have to lodge an income tax return.Other exemption – please provide us with any other reasonfor your exemption.NDNon-residents – please provide your country of residence fortax purposes.Do not wish to quote TFN.Step 2: Anti-Money Laundering and Counter-Terrorism Financing InformationWe are required to comply with Australia’s Anti-Money Laundering and Counter-Terrorism Act 2006 (‘the AML Legislation’). The AML Legislationrequires that, amongst other things, we verify the identity of investors making application into the funds we offer. We cannot accept an applicationto invest in the <strong>Fund</strong> until satisfied that the identity of the investor is able to be verified in accordance with the AML Legislation and the processingof applications may be delayed until the requested information is received in a satisfactory form. We may from time to time request additionalidentification or verification documentation from an investor to enable us to meet our obligations under the AML Legislation. If documentationprovided is not in English, an English translation must be provided by an accredited translator.In providing information under the AML Legislation, please follow the guidance below in choosing your investor typeSection ASub-sectionsPlease complete the nominated sections as applicableInvestor Type (Please see over for a description) 1 2 3 4 5 6Individual(s) 3 3Joint Investors 3 3Individual(s) acting as a Trustee(s) of a Trust or Superannuation <strong>Fund</strong> 3 3 3Domestic (Australian) Company 3 3Domestic (Australian) Company acting as a Corporate Trustee of a Trust orSuperannuation <strong>Fund</strong>3 3 3Foreign Company 3 3Foreign Company acting as a Corporate Trustee(s) of a Trust or Superannuation <strong>Fund</strong> 3 3 3Partnership 3 3Association 3 3Registered Co-operative 3 3Government Body 3 3Sole Trader 3 326

Type of Investor Description Information to be providedIndividual(s)Investing in your personal capacity – that is, not as a company, trust, Certified copy of:partnership, etc. This can include individuals investing on behalf of a Photo identification (e.g. current passport or driver’sperson under the age of 18.licence); orIndividual(s) acting asa trustee(s) of a trustor superannuationfundAustralian CompanyAustralian Companyacting as trusteeof a trust orsuperannuation fundPlease note that where individuals are investing as joint applicants,they must all sign the application form. However unless they expresslyindicated on the application form (Section A) any units will be held asjoint tenants and any of the investors are able to operate the accountand bind the other investor(s) for future transactions, including additionalapplications and withdrawals, and withdrawals by fax.An individual may also apply for units in their capacity as a power ofattorney for another person/entity. Note by signing the application formthe attorney warrants that the power of attorney has not been revokedat that time.Investing in your personal capacity as a trustee on behalf of another, i.e.where the trustee is not a company. A trust will in most circumstancesbe established pursuant to a trust deed with the intention of holdingincome or property on behalf of and for the benefit of another (who mayor may not include the trustee).Company incorporated in Australia including:Proprietary company (i.e. ending with Pty Ltd);Public company (i.e. ending with Ltd);Companies limited by guarantee (not for profit companies); andListed companies (e.g. listed on the ASX).An Australian domiciled company acting in the capacity of corporatetrustee on behalf of others (e.g. XYZ Pty Ltd as trustee of the XYZself-managed superannuation fund).A Birth certificate; orA Citizenship certificate; orA Pension/other Government issued card;and one of the following:A notice issued by a government or semi-governmentbody showing a current address (e.g. rate notice)that is less than 3 months old; orA utility bill that is less than 3 months old; orA certified copy of any Power of Attorney.As per Individual(s) above for each trustee.The registration number of the company(e.g. ABN, ARBN or ACN of the company);The registered office details of the company;The principal place of business of the company;The full name and date of birth of each director ofthe company; andCertified copy of photo identification for at least2 directors.As above for Australian Companies, together with:The full name of the Trust and the ABN or ACNof the Trust; andThe Superannuation <strong>Fund</strong> Number (if relevant).Foreign Company Company incorporated in a foreign jurisdiction. As per Australian Companies, together with any foreignregistration identification and beneficial ownership details.Foreign companyacting as a trusteeof a trust orsuperannuation fundTrustsPartnershipAssociationRegisteredCo-operativeGovernment BodySole TraderPower of AttorneyA foreign domiciled company acting in the capacity of corporate trusteeon behalf of others (e.g. PQR Pte as trustee of the PQR trust).Trusts are represented on a register either by individual trustees orcorporate trustees and can include:Superannuation funds (including self managed superannuation funds);Family trusts;Deceased estates;Managed Investment Schemes (registered or unregistered);Charitable trusts; andTestamentary trusts.Formally established pursuant to a partnership agreement/deed. If youare investing ‘jointly’ (and not pursuant to a partnership agreement/deed) then see Individual(s) section above.Incorporated Association is registered by the <strong>State</strong> or Territory in whichthe association is based. Features include:Not for profit;Appointment of a public officer and committee; andProfits, if any, can only be used to promote non-profit objectives.Unincorporated Association does not have a legal identity and cannothold assets in its own name. It must appoint individuals as trustees,who own the assets but hold them for the benefit of the association.A Registered Co-operative is a democratic structure owned andcontrolled by the people it serves, who join together for a commonbenefit. It is a separate legal entity (registered under the relevant <strong>State</strong>or Territory legislation) with the general aim of providing services for itsmembers rather than making profits.A Government Body is a legal entity that is owned or controlled by aFederal, <strong>State</strong> or Local Government (e.g. universities, local councils andstatutory agencies).Sole Trader describes a business that is owned and controlled by oneperson, although the business may employ people.Someone authorised under a formal document named a Power ofAttorney who is authorised to act on behalf of the a/c beneficiary(e.g. a person travelling may appoint an Attorney to conduct theirbusiness in their absence)As per Foreign Company above.Registration number (if any).Extract of Trust Deed (showing nature of Trust,purpose, identification of the Trustee, see above).Beneficiaries – these may be named individuals orclasses of beneficiaries (e.g. present and futuredescendents of John Smith).As per Individual(s) above.The registration number (if any) of the association;The registered office details of the association;The principal place of business of the association;The full name of the public officer and committeemembers of the association; andCertified copy of photo identification for at least2 of the public officers.As per Association above.Evidence of establishment (e.g. specific piece oflegislation).As per Individual(s) above or if investment is in thebusiness name, as per Australian Company above.A certified copy of the Power of Attorney; andIdentification of the named Attorneys per individualsabove.Copies of documents can be certified by a range of people including your financial adviser, a solicitor, a Justice of the Peace, AustraliaPost or a chartered accountant. If you have any questions about this, please contact client services on 1800 034 402.27