PROJECT: 2 x 660MW Coal Handling Plant Package for Meja ...

PROJECT: 2 x 660MW Coal Handling Plant Package for Meja ...

PROJECT: 2 x 660MW Coal Handling Plant Package for Meja ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

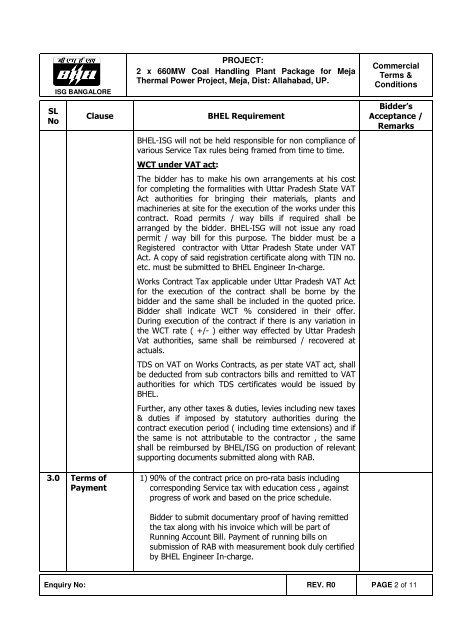

SLNoISG BANGALOREClause3.0 Terms ofPayment<strong>PROJECT</strong>:2 x <strong>660MW</strong> <strong>Coal</strong> <strong>Handling</strong> <strong>Plant</strong> <strong>Package</strong> <strong>for</strong> <strong>Meja</strong>Thermal Power Project, <strong>Meja</strong>, Dist: Allahabad, UP.BHEL RequirementBHEL-ISG will not be held responsible <strong>for</strong> non compliance ofvarious Service Tax rules being framed from time to time.WCT under VAT act:The bidder has to make his own arrangements at his cost<strong>for</strong> completing the <strong>for</strong>malities with Uttar Pradesh State VATAct authorities <strong>for</strong> bringing their materials, plants andmachineries at site <strong>for</strong> the execution of the works under thiscontract. Road permits / way bills if required shall bearranged by the bidder. BHEL-ISG will not issue any roadpermit / way bill <strong>for</strong> this purpose. The bidder must be aRegistered contractor with Uttar Pradesh State under VATAct. A copy of said registration certificate along with TIN no.etc. must be submitted to BHEL Engineer In-charge.Works Contract Tax applicable under Uttar Pradesh VAT Act<strong>for</strong> the execution of the contract shall be borne by thebidder and the same shall be included in the quoted price.Bidder shall indicate WCT % considered in their offer.During execution of the contract if there is any variation inthe WCT rate ( +/- ) either way effected by Uttar PradeshVat authorities, same shall be reimbursed / recovered atactuals.TDS on VAT on Works Contracts, as per state VAT act, shallbe deducted from sub contractors bills and remitted to VATauthorities <strong>for</strong> which TDS certificates would be issued byBHEL.Further, any other taxes & duties, levies including new taxes& duties if imposed by statutory authorities during thecontract execution period ( including time extensions) and ifthe same is not attributable to the contractor , the sameshall be reimbursed by BHEL/ISG on production of relevantsupporting documents submitted along with RAB.1) 90% of the contract price on pro-rata basis includingcorresponding Service tax with education cess , againstprogress of work and based on the price schedule.Bidder to submit documentary proof of having remittedthe tax along with his invoice which will be part ofRunning Account Bill. Payment of running bills onsubmission of RAB with measurement book duly certifiedby BHEL Engineer In-charge.CommercialTerms &ConditionsBidder’sAcceptance /RemarksEnquiry No: REV. R0 PAGE 2 of 11