A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

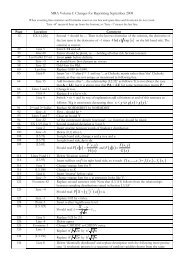

<strong>ICMA</strong> <strong>Centre</strong> Discussion Papers in Finance DP2012-04The displaced logarithmic utility may be written(U(w) =λw 0 log 1+ w − w )0, for w>(1 − λ)w 0 , (17)λw 0where w includes initial wealth w 0 ,sow − w 0 is the P&L from the investment. Note that(17) is a standardized from of logarithmic utility for which U(w 0 )=0,U ′ (w 0 )=1andtheasymp<strong>to</strong>te <strong>to</strong> −∞ is at (1 − λ)w 0 . Also, −U ′ (w)/U ′′ (w) =λw 0 + w − w 0 ,soatw = w 0 thelocal coefficient of absolute risk <strong>to</strong>lerance is λw 0 and λ is the local coefficient of relative risk<strong>to</strong>lerance. 11 When λ = 1, local relative risk aversion is 1, independent of wealth, so in thiscase the utility (17) is said <strong>to</strong> have the constant relative risk aversion (CRRA) property.The power utility is best written in terms of risk aversion γ = λ −1 ,asU(w) =−γ|1 − γ| −1 ( ww 0) 1−γ, for w/w 0 > 0ifγ>1. (18)Since −U ′ (w)/U ′′ (w) =λw, λ is the local coefficient of relative risk <strong>to</strong>lerance. It is a constant,so the power utility has the CRRA property. Absolute risk <strong>to</strong>lerance increases linearly w, butfor (18) the sensitivity of local risk <strong>to</strong>lerance <strong>to</strong> changes in w is λ, whereas it is 1 for (17).Thus, when λw 0 (w1.Exponential, logarithmic and power utilities are all special cases of the general HARAutility, which has two parameters determining the local coefficient of absolute risk <strong>to</strong>leranceand its sensitivity <strong>to</strong> wealth. That is, HARA utility functions have a risk <strong>to</strong>lerance λ thatincreases linearly <strong>with</strong> wealth at the rate η, and are defined as:U(w) =−[1 +ηλw 0(w − w 0 )] 1−η−1 (1 − η) −1 , for w>(1 − η −1 λ)w 0 . (19)When η = 0 we have the exponential utility, η = 1 corresponds <strong>to</strong> the displaced logarithmicutility, η =0.5 gives the hyperbolic utility and η = λ gives the power utility.4 Numerical ResultsRecall that RNV principal yields a unique price for an option, and this reference price impliesthat the option could be tradable on a secondary market. By contrast, the option value for a11 Relative risk <strong>to</strong>lerance is expressed as a percentage of wealth, not in dollar terms. So if, say, λ =0.4 thedecision maker is willing <strong>to</strong> take a gamble <strong>with</strong> approximately equal probability of winning 40% or losing 20%of his wealth, but he would not bet on a 50:50 chance (approximately) of winning x% or losing x%/2 for anyx>0.4.Copyright c○ 2012 Alexander and Chen 14