A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

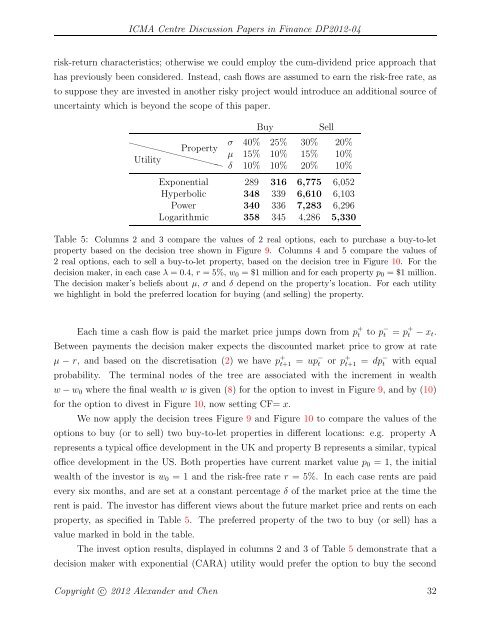

<strong>ICMA</strong> <strong>Centre</strong> Discussion Papers in Finance DP2012-04risk-return characteristics; otherwise we could employ the cum-dividend price approach thathas previously been considered. Instead, cash flows are assumed <strong>to</strong> earn the risk-free rate, as<strong>to</strong> suppose they are invested in another risky project would introduce an additional source ofuncertainty which is beyond the scope of this paper.❳ ❳❳❳ ❳❳❳ PropertyUtility ❳ ❳❳❳❳BuySellσ 40% 25% 30% 20%μ 15% 10% 15% 10%δ 10% 10% 20% 10%Exponential 289 316 6,775 6,052Hyperbolic 348 339 6,610 6,103Power 340 336 7,283 6,296Logarithmic 358 345 4,286 5,330Table 5: Columns 2 and 3 compare the values of 2 real options, each <strong>to</strong> purchase a buy-<strong>to</strong>-letproperty based on the decision tree shown in Figure 9. Columns 4 and 5 compare the values of2 real options, each <strong>to</strong> sell a buy-<strong>to</strong>-let property, based on the decision tree in Figure 10. For thedecision maker, in each case λ =0.4, r =5%,w 0 = $1 million and for each property p 0 = $1 million.The decision maker’s beliefs about μ, σ and δ depend on the property’s location. For each utilitywe highlight in bold the preferred location for buying (and selling) the property.Each time a cash flow is paid the market price jumps down from p + t <strong>to</strong> p − t = p + t − x t .Between payments the decision maker expects the discounted market price <strong>to</strong> grow at rateμ − r, and based on the discretisation (2) wehavep + t+1 = up− t or p + t+1 = dp− t <strong>with</strong> equalprobability. The terminal nodes of the tree are associated <strong>with</strong> the increment in wealthw − w 0 where the final wealth w is given (8) for the option <strong>to</strong> invest in Figure 9, andby(10)for the option <strong>to</strong> divest in Figure 10, now setting CF= x.We now apply the decision trees Figure 9 and Figure 10 <strong>to</strong> compare the values of theoptions <strong>to</strong> buy (or <strong>to</strong> sell) two buy-<strong>to</strong>-let properties in different locations: e.g. property Arepresents a typical office development in the UK and property B represents a similar, typicaloffice development in the US. Both properties have current market value p 0 = 1, the initialwealth of the inves<strong>to</strong>r is w 0 = 1 and the risk-free rate r = 5%. In each case rents are paidevery six months, and are set at a constant percentage δ of the market price at the time therent is paid. The inves<strong>to</strong>r has different views about the future market price and rents on eachproperty, as specified in Table 5. The preferred property of the two <strong>to</strong> buy (or sell) has avalue marked in bold in the table.The invest option results, displayed in columns 2 and 3 of Table 5 demonstrate that adecision maker <strong>with</strong> exponential (CARA) utility would prefer the option <strong>to</strong> buy the secondCopyright c○ 2012 Alexander and Chen 32