A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

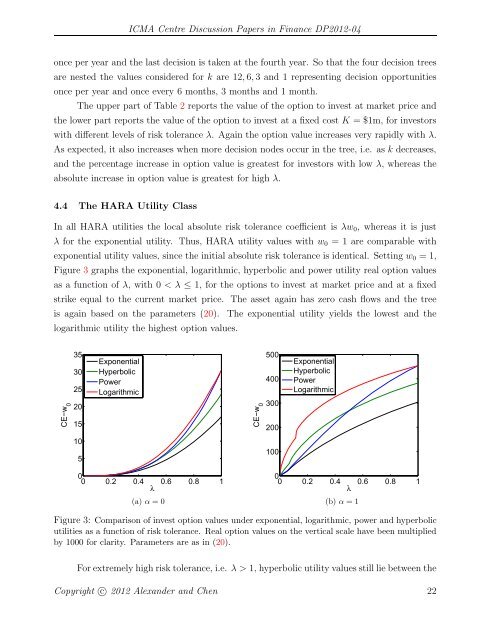

<strong>ICMA</strong> <strong>Centre</strong> Discussion Papers in Finance DP2012-04once per year and the last decision is taken at the fourth year. So that the four decision treesare nested the values considered for k are 12, 6, 3 and 1 representing decision opportunitiesonce per year and once every 6 months, 3 months and 1 month.The upper part of Table 2 reports the value of the option <strong>to</strong> invest at market price andthe lower part reports the value of the option <strong>to</strong> invest at a fixed cost K = $1m, for inves<strong>to</strong>rs<strong>with</strong> different levels of risk <strong>to</strong>lerance λ. Again the option value increases very rapidly <strong>with</strong> λ.As expected, it also increases when more decision nodes occur in the tree, i.e. as k decreases,and the percentage increase in option value is greatest for inves<strong>to</strong>rs <strong>with</strong> low λ, whereas theabsolute increase in option value is greatest for high λ.4.4 The HARA Utility ClassIn all HARA utilities the local absolute risk <strong>to</strong>lerance coefficient is λw 0 , whereas it is justλ for the exponential utility. Thus, HARA utility values <strong>with</strong> w 0 = 1 are comparable <strong>with</strong>exponential utility values, since the initial absolute risk <strong>to</strong>lerance is identical. Setting w 0 =1,Figure 3 graphs the exponential, logarithmic, hyperbolic and power utility real option valuesas a function of λ, <strong>with</strong>01, hyperbolic utility values still lie between theCopyright c○ 2012 Alexander and Chen 22