A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

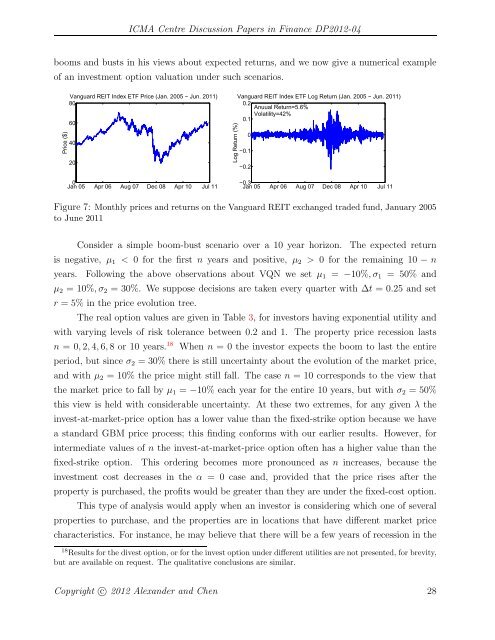

<strong>ICMA</strong> <strong>Centre</strong> Discussion Papers in Finance DP2012-04booms and busts in his views about expected returns, and we now give a numerical exampleof an investment option valuation under such scenarios.Price ($)Vanguard REIT Index ETF Price (Jan. 2005 − Jun. 2011)806040200Jan 05 Apr 06 Aug 07 Dec 08 Apr 10 Jul 11Log Return (%)Vanguard REIT Index ETF Log Return (Jan. 2005 − Jun. 2011)0.2Anuual Return=5.6%Volatility=42%0.10−0.1−0.2−0.3Jan 05 Apr 06 Aug 07 Dec 08 Apr 10 Jul 11Figure 7: Monthly prices and returns on the Vanguard REIT exchanged traded fund, January 2005<strong>to</strong> June 2011Consider a simple boom-bust scenario over a 10 year horizon. The expected returnis negative, μ 1 < 0 for the first n years and positive, μ 2 > 0 for the remaining 10 − nyears. Following the above observations about VQN we set μ 1 = −10%,σ 1 = 50% andμ 2 = 10%,σ 2 = 30%. We suppose decisions are taken every quarter <strong>with</strong> Δt =0.25 and setr = 5% in the price evolution tree.The real option values are given in Table 3, for inves<strong>to</strong>rs having exponential utility and<strong>with</strong> varying levels of risk <strong>to</strong>lerance between 0.2 and 1. The property price recession lastsn =0, 2, 4, 6, 8or10years. 18 When n = 0 the inves<strong>to</strong>r expects the boom <strong>to</strong> last the entireperiod, but since σ 2 = 30% there is still uncertainty about the evolution of the market price,and <strong>with</strong> μ 2 = 10% the price might still fall. The case n = 10 corresponds <strong>to</strong> the view thatthe market price <strong>to</strong> fall by μ 1 = −10% each year for the entire 10 years, but <strong>with</strong> σ 2 = 50%this view is held <strong>with</strong> considerable uncertainty. At these two extremes, for any given λ theinvest-at-market-price option has a lower value than the fixed-strike option because we havea standard GBM price process; this finding conforms <strong>with</strong> our earlier results. However, forintermediate values of n the invest-at-market-price option often has a higher value than thefixed-strike option. This ordering becomes more pronounced as n increases, because theinvestment cost decreases in the α = 0 case and, provided that the price rises after theproperty is purchased, the profits would be greater than they are under the fixed-cost option.This type of analysis would apply when an inves<strong>to</strong>r is considering which one of severalproperties <strong>to</strong> purchase, and the properties are in locations that have different market pricecharacteristics. For instance, he may believe that there will be a few years of recession in the18 Results for the divest option, or for the invest option under different utilities are not presented, for brevity,but are available on request. The qualitative conclusions are similar.Copyright c○ 2012 Alexander and Chen 28