A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

A General Approach to Real Option Valuation with ... - ICMA Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

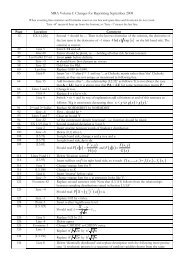

<strong>ICMA</strong> <strong>Centre</strong> Discussion Papers in Finance DP2012-04❍ ❍❍❍❍ λα ❍0.2 0.4 0.6 0.8 1 ∞0 0 5,853 45,305 70,656 86,976 161,3740.5 31,597 64,814 84,749 96,762 106,544 161,3741 59,825 116,939 145,009 161,573 172,462 224,333Table 1: Exponential utility <strong>with</strong> parameters T ′ =3years,Δt = k =1,K = p 0 = $1m,r =˜r =5%,μ = 10%, σ = 20%.applications – for instance, when a licence <strong>to</strong> drill for oil has been purchased and the decisionconcerns whether the market price of oil is sufficient <strong>to</strong> warrant exploration – the fixed-strikeassumption would be applicable. However, in many applications the investment cost is at themarket price prevailing at the time that the investment is made. The assumption about theinvestment cost – whether it is fixed (in time 0 terms) or s<strong>to</strong>chastic (and perfectly correlated<strong>with</strong> the market price) – has a significant influence on the real option value. A fixed cost(α = 1) may be regarded as the strike of an American call option, and the real option valueis derived from the expected utility of a call option pay-off for which the upper part of theterminal wealth distribution above the strike matters. In contrast, the opposite extreme(α = 0) focuses on the lower part of the terminal wealth distribution below the current pricep 0 . Although log returns are similar across the whole spectrum under the GBM assumption(1), P&L is in absolute terms and it is greater in the upper part of the distribution than inthe lower part. For this reason the at-the-money (K = $1m) fixed-strike assumption alwaysyields a greater real option value than the invest-at-market-price assumption. However, thisobservation only holds under GBM views for market prices, see Section 5.1 for further details.Our second conclusion is that the standard, RNV approach can produce very unreliableresults when the assumption of a complete market and a fixed strike option are unwarranted.The subjective price could be very much less than the RNV price (especially when risk <strong>to</strong>leranceis low and the investment cost is at market price) or very much greater than the RNVprice (especially when risk <strong>to</strong>lerance is high and the investment cost is fixed). Note that theRNV price is always zero when the opportunity <strong>to</strong> invest is at market price. This is becausethe linear utility function yields a CE equal <strong>to</strong> the expected value of terminal wealth, andthis is w 0 since the discounted price is always a martingale under the risk-neutral measure. Insuch a case the value of an investment opportunity is always zero. 16 The relationship betweenthe RNV option price and a real option’s more general utility valuation is further explored inSection 4.5.16 The RNV price is based on a hedging argument that also requires no frictions, i.e. a perfect market, sothat lending and borrowing costs are the same, i.e. r =˜r as we have assumed.Copyright c○ 2012 Alexander and Chen 20