Ezz Steel

Ezz Steel

Ezz Steel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

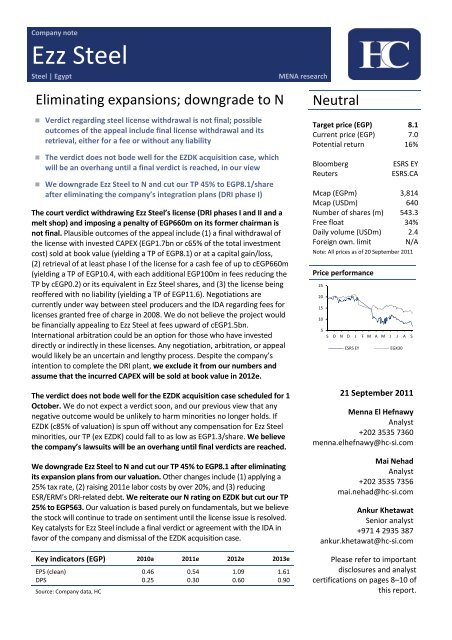

Company note<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | EgyptMENA researchEliminating expansions; downgrade to N• Verdict regarding steel license withdrawal is not final; possibleoutcomes of the appeal include final license withdrawal and itsretrieval, either for a fee or without any liability• The verdict does not bode well for the EZDK acquisition case, whichwill be an overhang until a final verdict is reached, in our view• We downgrade <strong>Ezz</strong> <strong>Steel</strong> to N and cut our TP 45% to EGP8.1/shareafter eliminating the company’s integration plans (DRI phase I)The court verdict withdrawing <strong>Ezz</strong> <strong>Steel</strong>’s license (DRI phases I and II and amelt shop) and imposing a penalty of EGP660m on its former chairman isnot final. Plausible outcomes of the appeal include (1) a final withdrawal ofthe license with invested CAPEX (EGP1.7bn or c65% of the total investmentcost) sold at book value (yielding a TP of EGP8.1) or at a capital gain/loss,(2) retrieval of at least phase I of the license for a cash fee of up to cEGP660m(yielding a TP of EGP10.4, with each additional EGP100m in fees reducing theTP by cEGP0.2) or its equivalent in <strong>Ezz</strong> <strong>Steel</strong> shares, and (3) the license beingreoffered with no liability (yielding a TP of EGP11.6). Negotiations arecurrently under way between steel producers and the IDA regarding fees forlicenses granted free of charge in 2008. We do not believe the project wouldbe financially appealing to <strong>Ezz</strong> <strong>Steel</strong> at fees upward of cEGP1.5bn.International arbitration could be an option for those who have investeddirectly or indirectly in these licenses. Any negotiation, arbitration, or appealwould likely be an uncertain and lengthy process. Despite the company’sintention to complete the DRI plant, we exclude it from our numbers andassume that the incurred CAPEX will be sold at book value in 2012e.The verdict does not bode well for the EZDK acquisition case scheduled for 1October. We do not expect a verdict soon, and our previous view that anynegative outcome would be unlikely to harm minorities no longer holds. IfEZDK (c85% of valuation) is spun off without any compensation for <strong>Ezz</strong> <strong>Steel</strong>minorities, our TP (ex EZDK) could fall to as low as EGP1.3/share. We believethe company’s lawsuits will be an overhang until final verdicts are reached.We downgrade <strong>Ezz</strong> <strong>Steel</strong> to N and cut our TP 45% to EGP8.1 after eliminatingits expansion plans from our valuation. Other changes include (1) applying a25% tax rate, (2) raising 2011e labor costs by over 20%, and (3) reducingESR/ERM’s DRI‐related debt. We reiterate our N rating on EZDK but cut our TP25% to EGP563. Our valuation is based purely on fundamentals, but we believethe stock will continue to trade on sentiment until the license issue is resolved.Key catalysts for <strong>Ezz</strong> <strong>Steel</strong> include a final verdict or agreement with the IDA infavor of the company and dismissal of the EZDK acquisition case.Key indicators (EGP) 2010a 2011e 2012e 2013eEPS (clean) 0.46 0.54 1.09 1.61DPS 0.25 0.30 0.60 0.90Source: Company data, HCNeutralTarget price (EGP) 8.1Current price (EGP) 7.0Potential return 16%BloombergReutersESRS EYESRS.CAMcap (EGPm) 3,814Mcap (USDm) 640Number of shares (m) 543.3Free float 34%Daily volume (USDm) 2.4Foreign own. limit N/ANote: All prices as of 20 September 2011Price performance252015105S O N D J F M A M J J A SESRS EYEGX3021 September 2011Menna El HefnawyAnalyst+202 3535 7360menna.elhefnawy@hc‐si.comMai NehadAnalyst+202 3535 7356mai.nehad@hc‐si.comAnkur KhetawatSenior analyst+971 4 2935 387ankur.khetawat@hc‐si.comPlease refer to importantdisclosures and analystcertifications on pages 8–10 ofthis report.

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011Plausible scenarios regarding current lawsuitsIn our base case scenario, we assume that the company’s licenses will be withdrawn, itsplans for integration and margin expansion suspended, and the incurred CAPEX sold off atbook value in 2012e when the debt related to the project would be paid off. Should <strong>Ezz</strong><strong>Steel</strong> retain the license in return for a EGP660m fee, we would raise our TP to EGP10.4.Each additional EGP100m in fees would reduce our TP EGP0.2. At fees upward ofEGP1.5bn, the project would cease to be financially appealing, in our view.Possible scenarios and corresponding valuationsScenario descriptionScenario 1 (base case) Scenario 2 Scenario 3 Scenario 4 Scenario 5Final withdrawal ofthe license, with theincurred CAPEX soldat book value and theproceeds used to payoff the project’soutstanding debtFinal withdrawalof the license,with the incurredCAPEX sold at80% of bookvalueRetention of atleast phase I ofthe license (DRIcapacity of c1.9mtpa) in return fora fee of up toEGP660mRetention oflicense withoutany liability afterwinning theappealFinal withdrawal ofthe license and spinoffof EZDK from <strong>Ezz</strong><strong>Steel</strong> with nocompensation, incash or EZDK shares,for <strong>Ezz</strong> <strong>Steel</strong>minoritiesRebar prices (2011–15e)USD713–USD773HRC prices (2011–15e)USD713–USD771Scrap prices (2011–15e)USD450–USD490Iron ore prices (2011–15e) USD194–USD170 N/A (1)EBITDA margin (2011–15e) 12.2%–14.7% 12.2%–14.7% 12.2%–23.7% 12.2%–23.7% 5.0%–6.5%Value/share EGP8.1 EGP7.5 EGP10. 4 EGP11.6 EGP1.3EZDK value/total value (2) 85% 92% 66% 60% ‐Source: HCNote: (1) ESR/ERM and EFS are scrap‐based (2) EZDK stand‐aloneUncertain outcome for Al <strong>Ezz</strong> Dekheila acquisition caseThe outcome of the Al <strong>Ezz</strong> Dekheila <strong>Steel</strong> (EZDK) acquisition case is uncertain at this stage.Possible scenarios include (1) the spin‐off of EZDK from <strong>Ezz</strong> <strong>Steel</strong> with/withoutcompensation, in cash and/or EZDK shares, for <strong>Ezz</strong> <strong>Steel</strong> minorities, (2) partial or fullnationalization of the former chairman’s stake in <strong>Ezz</strong> <strong>Steel</strong> in the case that the acquisitionis proven to have been illegitimate, and (3) dismissal of the case.EZDK acquisition historyYearEvent1999 Acquisition of 9.9% of EZDK by <strong>Ezz</strong> <strong>Steel</strong> from the Employees Shareholders Union (ESU)2000 Acquisition of c11% of EZDK by <strong>Ezz</strong> <strong>Steel</strong> through a rights issue in which all other EZDK shareholders declined their preemptiverights; the subscription price was c2.1x the market price2001–03 Acquisition of the ESU’s 11.8% stake in EZDK by <strong>Ezz</strong> Industries (which currently owns a 66% stake in <strong>Ezz</strong> <strong>Steel</strong> and is fullyowned by Ahmed <strong>Ezz</strong>, <strong>Ezz</strong> <strong>Steel</strong>’s former chairman)2004–05 Acquisition of 17.6% of EZDK by <strong>Ezz</strong> Industries from the International Finance Corporation, JFE <strong>Steel</strong> Corporation, Kobe <strong>Steel</strong>,the African Development Bank, and Tomen Corporation2006 Acquisition of 29.4% of EZDK by <strong>Ezz</strong> <strong>Steel</strong> through a share swap with <strong>Ezz</strong> Industries at a swap ratio of 21.9 <strong>Ezz</strong> <strong>Steel</strong> shares to 1EZDK share based on the historical market prices of both stocks, bringing <strong>Ezz</strong> <strong>Steel</strong>’s share in EZDK to 50.3% and increasing <strong>Ezz</strong>Industries’ stake in <strong>Ezz</strong> <strong>Steel</strong> c21% to c79%2008–10 Acquisition of 3.2% of EZDK by <strong>Ezz</strong> <strong>Steel</strong> from the marketSource: <strong>Ezz</strong> <strong>Steel</strong>, HC2

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011<strong>Ezz</strong> <strong>Steel</strong> estimate revisions (EGPm)2011e 2012e 2013e 2014e 2015eNew rebar prices (USD) 713 729 743 758 773Old rebar prices (USD) 660 673 711 725 739% change 8% 8% 5% 5% 5%New revenue 19,689 22,632 23,747 24,853 25,996Old revenue 16,725 18,313 19,878 21,012 22,182% change 18% 24% 19% 18% 17%New EBITDA 2,404 2,883 3,493 3,661 3,833Old EBITDA 1,838 3,294 4,372 5,035 5,153% change 31% ‐12% ‐20% ‐27% ‐26%New EBITDA margin 12.2% 12.7% 14.7% 14.7% 14.7%Old EBITDA margin 11.0% 18.0% 22.0% 24.0% 23.2%New net income 328 656 974 1,116 1,247Old net income 227 972 1,649 2,109 2,218% change 45% ‐33% ‐41% ‐47% ‐44%New net margin 1.7% 2.9% 4.1% 4.5% 4.8%Old net margin 1.4% 5.3% 8.3% 10.0% 10.0%New CAPEX 421 435 453 471 490Old CAPEX 1,434 713 419 443 467% change ‐71% ‐39% 8% 6% 5%Source: HC3

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011ValuationWe downgrade <strong>Ezz</strong> <strong>Steel</strong> to Neutral and cut our TP 45%. In our SOTP DCF valuation, weassume that the DRI and melt shop licenses will be withdrawn, with the incurred CAPEXsold at book value in 2012e when the debt related to the project is expected to be paidoff.<strong>Ezz</strong> <strong>Steel</strong> valuation summarySubsidiaryWACCEnterprise value(EGPm)Equity value(EGPm)<strong>Ezz</strong> <strong>Steel</strong>’sstakeValue of stake(EGPm)Value/share(EGP)ContributionAl <strong>Ezz</strong> Dekheila (stand‐alone) 13.8% 11,142 6,897 55% 3,765 6.9 85%<strong>Ezz</strong> <strong>Steel</strong> Rebars/<strong>Ezz</strong> Rolling Mills14.1% 1,482 314 100% 314 0.6 7%Al <strong>Ezz</strong> Flat <strong>Steel</strong> 14.3% 1,768 542 63% (1) 342 0.6 8%Total 4,421 8.1 100%Source: HCNote: (1) Combination of direct and indirect stakesRisksKey risks include (1) a final verdict in the license case that withdraws the company’s DRIlicense or imposes a hefty fee, (2) a verdict in the EZDK acquisition case that harmsminorities, such as one requiring that EZDK be spun off from <strong>Ezz</strong> <strong>Steel</strong>, and (3) lower thanexpected volumes and/or selling prices due to lower local and/or global consumption.EZDK valuationWe reiterate our Neutral rating on EZDK but cut our TP 25% to EGP563/share, implying4% upside to the current market price. We exclude Al <strong>Ezz</strong> Flat <strong>Steel</strong>’s expansion plans andapply a tax rate of 25%.EZDK valuation summarySubsidiary WACC (1) Enterprise value(EGPm)Equity value(EGPm)EZDK’sstakeValue of stake(EGPm)Value/share(EGP)ContributionAl <strong>Ezz</strong> Dekheila (stand‐alone) 14.3% 11,509 7,264 100% 7,264 544 97%Al <strong>Ezz</strong> Flat <strong>Steel</strong> 14.8% 1,691 465 55% 256 19 3%Total 7,520 563 100%Source: HCNote: (1) Incorporates a 0.5% illiquidity premiumRisksWe believe that EZDK’s shareholders are immune to the current acquisition case. Ifnationalization were to take place, it would be specific to <strong>Ezz</strong> <strong>Steel</strong>’s stake in the companyor the former chairman’s stake in <strong>Ezz</strong> <strong>Steel</strong>, in our view. Risks include a lower thanexpected utilization rate and/or selling prices due to lower global and/or localconsumption, higher raw material costs without corresponding selling price increases,difficulties raising debt given the negative sentiment toward Egypt’s steel sector,employee strikes, and production halts.4

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011<strong>Ezz</strong> <strong>Steel</strong> base case valuation (EGPm)2011e 2012e 2013e 2014e 2015eAl <strong>Ezz</strong> Dekheila <strong>Steel</strong>Sales 11,503 12,552 12,848 13,105 13,368EBTDA 1,989 2,350 2,877 2,955 3,024EBITDA margin 17.3% 18.7% 22.4% 22.5% 22.6%Taxes (303) (395) (532) (557) (580)Appropriations (137) (178) (160) (167) (174)Change in working capital (287) (314) (321) (328) (334)CAPEX (265) (326) (334) (341) (348)Free cash flow 998 1,137 1,530 1,562 1,589Terminal value 13,717PV of FCF 896 897 1,060 951 850PV of terminal value 7,338Enterprise value 11,142Gross debt 5,131Cash 886Equity value 6,897<strong>Ezz</strong> <strong>Steel</strong>’s stake 55%Value/<strong>Ezz</strong> <strong>Steel</strong> share (EGP) 6.9<strong>Ezz</strong> <strong>Steel</strong> Rebars/<strong>Ezz</strong> Rolling MillsSales 5,855 6,504 6,634 6,766 6,902EBITDA 304 334 349 361 373EBITDA margin 5.2% 5.1% 5.3% 5.3% 5.4%Taxes 45 7 (8) (23) (35)Appropriations (59) (65) (66) (68) (69)Change in working capital (23) (26) (27) (27) (28)CAPEX (117) (59) (60) (61) (62)Free cash flow 151 192 188 182 179Terminal value 1,511PV of FCF 141 157 135 115 99PV of terminal value 835Enterprise value 1,482Gross debt (1) 1,654Cash 487Equity value 314<strong>Ezz</strong> <strong>Steel</strong>’s stake 100%Value/<strong>Ezz</strong> <strong>Steel</strong> share (EGP) 0.6Al <strong>Ezz</strong> Flat <strong>Steel</strong>Sales 2,331 3,577 4,264 4,981 5,727EBITDA 111 199 267 346 435EBITDA margin 4.8% 5.6% 6.3% 6.9% 7.6%Taxes 6 (13) (27) (44) (65)Change in working capital (9) (14) (17) (20) (23)CAPEX (40) (50) (60) (70) (80)Free cash flow 68 122 164 212 267Terminal value 2,209PV of FCF 63 100 117 132 146PV of terminal value 1,209Equity value 1,768Gross debt 1,326Cash 101Equity value 542<strong>Ezz</strong> <strong>Steel</strong>’s stake (2) 63%Value/<strong>Ezz</strong> <strong>Steel</strong> share (EGP) 0.6Source: HCNote: (1)Excludes DRI‐related debt (2) Combination of direct and indirect stakes5

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011<strong>Ezz</strong> <strong>Steel</strong> financial statements and ratios (1)EGPm 2010a 2011e 2012e 2013e 2014e 2015eIncome statementRevenue 16,621 19,689 22,632 23,747 24,853 25,996Revenue growth 32.0% 18.5% 14.9% 4.9% 4.7% 4.6%COGS (14,129) (16,843) (19,215) (19,693) (20,602) (21,543)Gross profit 2,493 2,846 3,417 4,053 4,251 4,453Gross margin 15.0% 14.5% 15.1% 17.1% 17.1% 17.1%SG&A expenses (382) (442) (534) (561) (590) (620)EBITDA 2,111 2,404 2,883 3,493 3,661 3,833EBITDA growth 28.7% 13.9% 19.9% 21.1% 4.8% 4.7%EBITDA margin 12.7% 12.2% 12.7% 14.7% 14.7% 14.7%Depreciation (577) (595) (609) (622) (631) (639)Provisions (1) ‐ ‐ ‐ ‐ ‐Net interest expense (754) (774) (607) (527) (445) (378)Other income (expense) 23 ‐ ‐ ‐ ‐ ‐Pretax income 772 979 1,607 2,292 2,546 2,788Income tax (208) (252) (400) (568) (625) (680)Pre‐minority net income 565 727 1,207 1,725 1,921 2,107Minority interest (313) (398) (551) (751) (805) (860)Net income 252 328 656 974 1,116 1,247Growth (2) 362% 18% 100% 48% 14.6% 11.7%Net margin (2) 1.5% 1.5% 2.6% 3.7% 4.0% 4.3%Balance sheetCash and equivalents 1,473 1,710 2,000 2,407 2,707 3,290Receivables 185 303 431 562 697 833Inventory 3,734 4,054 4,407 4,771 5,144 5,528Other current assets 665 780 905 1,034 1,165 1,299Total current assets 6,057 6,847 7,743 8,774 9,713 10,950Intangible assets 315 315 315 315 315 315Other long‐term assets 199 199 199 199 199 199Net fixed assets 12,886 12,712 11,538 11,369 11,209 11,060Total long‐term assets 13,400 13,226 12,052 11,883 11,723 11,574Total assets 19,457 20,072 19,795 20,657 21,437 22,525Short‐term debt 4,649 4,110 3,781 3,561 3,024 2,686Payables 1,145 1,206 1,269 1,334 1,401 1,468Other current liabilities 1,195 1,639 2,150 2,663 3,077 3,491Total current liabilities 6,989 6,955 7,201 7,558 7,502 7,646Long‐term debt 5,117 5,174 3,821 3,169 2,736 2,304Other long‐term liabilities 862 925 941 958 975 992Total long‐term liabilities 5,980 6,099 4,763 4,127 3,711 3,296Total liabilities 12,968 13,054 11,963 11,685 11,213 10,942Shareholder equity 6,489 7,018 7,831 8,972 10,223 11,583Source: <strong>Ezz</strong> <strong>Steel</strong>, HCNote: (1) Numbers exclude DRI plant (2) Ex nonrecurring items6

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011<strong>Ezz</strong> <strong>Steel</strong> financial statements and ratios (continued)EGPm 2010a 2011e 2012e 2013e 2014e 2015eCash flow statementOCF before change in working capital 1,994 2,211 2,549 3,003 3,130 3,259Change in working capital (559) (318) (355) (366) (376) (386)Operating cash flows 1,436 1,893 2,193 2,637 2,754 2,873CAPEX (2,241) (421) (435) (453) (471) (490)Other investments (182) 63 1,016 17 17 17Investing cash flows (2,422) (359) 581 (437) (454) (473)Financing cash flows 820 (1,297) (2,486) (1,792) (1,999) (1,818)Change in cash (166) 237 289 407 300 583Key financial ratiosNet debt/equity 1.3x 1.1x 0.7x 0.5x 0.3x 0.1xNet debt/EBITDA 3.9x 3.1x 1.9x 1.2x 0.8x 0.4xROAA (1) 1.6% 1.7% 3.4% 5.2% 5.9% 6.6%ROAE (1) 5.8% 6.5% 12.5% 17.4% 18.4% 18.9%ROIC (1) 2.6% 3.0% 6.8% 10.4% 11.9% 13.2%Key price ratiosEV/EBITDA (2) 8.1x 6.5x 4.4x 3.1x 2.4x 1.8xClean P/E 15.2x 12.9x 6.5x 4.4x 3.8x 3.4xP/B 0.8x 0.8x 0.7x 0.7x 0.6x 0.6xDividend yield 3.6% 4.3% 8.6% 12.8% 14.6% 16.3%FCF yield ‐22.5% 19.4% 23.3% 29.5% 30.6% 31.9%Source: <strong>Ezz</strong> <strong>Steel</strong>, HCNote: (1) Ex nonrecurring items (2) Proportionate7

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011DisclaimerHC Brokerage, which is an affiliate of HC Securities & Investment (referred to herein as “HC”) – a full‐fledged investment bank providing investment banking,asset management, securities brokerage, research, and custody services – is exclusively responsible for the content of this report. JonesTrading InstitutionalServices LLC (“JonesTrading”), a member of SIPC/FINRA, has not had any input informing or determining the content of this report. The information used toproduce this document is based on sources that HC believes to be reliable and accurate. This information has not been independently verified and may becondensed or incomplete. HC does not make any guarantee, representation, or warranty and accepts no responsibility or liability for the accuracy andcompleteness of such information. Expression of opinion contained herein is based on certain assumptions and the use of specific financial techniques thatreflect the personal opinion of the authors of the commentary and is subject to change without notice.The information in these materials reflects HC’s equity rating on a particular stock. HC, its affiliates, and/or their employees may publish or otherwise expressother viewpoints or trading strategies that may conflict with the views included in this report. Please be aware that HC and/or its affiliates, and the investmenfunds and managed accounts they manage, may take positions contrary to the included equity rating.This material is for informational purposes only and is not an offer to sell or the solicitation of an offer to buy. Ratings and general guidance are not personalrecommendations for any particular investor or client and do not take into account the financial, investment, or other objectives or needs of, and may not besuitable for, any particular investor or client. Investors and clients should consider this only a single factor in making their investment decision, while takinginto account the current market environment. Foreign currency‐denominated securities are subject to fluctuations in exchange rates, which could have anadverse effect on the value or price of, or income derived from, the investment. Investors in securities such as ADRs, the values of which are influenced byforeign currencies, effectively assume currency risk. Neither HC nor any officer or employee of HC accepts liability for any direct, indirect, or consequentialdamages or losses arising from any use of this report or its contents.CopyrightNo part or excerpt of this research report’s content may be redistributed, reproduced, or conveyed in any form, written or oral, to any third party withoutprior written consent of the firms. The information within this research report must not be disclosed to any other person until HC has made its informationpublicly available.Issuer of report:HC BrokerageBuilding F15‐B224, Smart VillageKM28 Cairo‐Alexandria Desert Road6 October 12577, EgyptTelephone: +202 3535 7666Fax: +202 3535 7665Website: www.hc‐si.comPursuant to Rule 15a‐6, this report is only available in the United States to Major US Institutional Investors and is being distributed pursuant to anagreement between JonesTrading and HC. The Alembic Global Advisors trade name is licensed by JonesTrading. Brokerage services in the United States aremade available through JonesTrading.JonesTrading Institutional Services LLC32133 Lindero Canyon Road, Suite 208Westlake Village, CA 91361Telephone: +1 800 423 5933Website: www.jonestrading.comAlembic Global Advisors780 Third Avenue, 8th FloorNew York City, NY 10017Telephone: +1 212 359 8292Website: www.alembicglobal.com8

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011IMPORTANT DISCLOSURESAnalyst certification:The analysts preparing and contributing to this report are not associated persons of JonesTrading, are not registered/qualified as research analysts withFINRA, and are not subject to the NASD Rule 2711 and incorporated NYSE Rule 472 restrictions on communications with a subject company, publicappearances, and trading securities held by a research analyst account.We, Menna El Hefnawy and Ankur Khetawat, certify that the views expressed in this document accurately reflect our personal views about the subjectsecurities and companies. We also certify that we do not hold a beneficial interest in the securities traded.Analyst disclosures:The analyst or a member of the analyst’s household does not have a financial interest in the securities of the subject company (including, withoutlimitation, any option, right, warrant, future, long or short position).The analysts or a member of the analysts’ household do not serve as an officer, director, or advisory board member of the subject company.The analysts’ compensation is not based upon HC’s investment banking revenues and is also not from the subject company in the past 12 months.HC disclosures:Company name: <strong>Ezz</strong> <strong>Steel</strong>Company name: Al <strong>Ezz</strong> Dekheila <strong>Steel</strong> Company AlexandriaDisclosure: NoneDisclosure: None1. HC or its affiliates beneficially own 1% or more of any class of common equity securities of the subject company.2. HC or its affiliates have managed or co‐managed a public offering of securities for the subject company in the past 12 months.3. HC or its affiliates have received compensation for investment banking services from the subject company in the past 12 months.4. HC or its affiliates expect to receive or intend to seek compensation for investment banking services from the subject company in the next 3months.5. HC has received compensation for products or services other than investment banking services from the subject company in the past 12 months.6. The subject company currently is, or during the 12 month period preceding the date of distribution of this research report was, a client of HC.7. HC makes a market in the subject company’s securities at the time this report was published.The HC Rating System consists of 3 separate ratings: Overweight, Neutral, and Underweight.The appropriate rating is determined based on the estimated total return of the stock over a forward 12 month period, including both share appreciationand anticipated dividends.Overweight rated stocks include a published 12 month target price. The target price represents the analysts’ best estimate of the market price in a 12month period. HC cautions that target prices are based on assumptions related to the company, industry, and investor climate. As such, target pricesremain highly subjective.The definition of each rating is as follows:Overweight (OW): Estimated total potential return greater than or equal to 20%Neutral (N): Estimated total potential return greater than or equal to 0% and less than 20%Underweight (UW): Estimated total potential return less than 0%NR: Not RatedSP: SuspendedStocks rated Overweight are required to have a published 12 month target price, while it is not required on stocks rated Neutral and Underweight.Distribution of HC ratingsRating Count Percent Percent provided investment banking services in past 12 monthsOverweight (OW) 34 50.00 0.00Neutral (N) 26 38.24 0.00Underweight (UW) 8 11.76 0.009

<strong>Ezz</strong> <strong>Steel</strong><strong>Steel</strong> | Egypt21 September 2011<strong>Ezz</strong> <strong>Steel</strong> as of 19 September 2011 Al <strong>Ezz</strong> Dekheila <strong>Steel</strong> Company Alexandria as of 19 September 201122201816141210864900850800750700650600550500Date Recommendation Target price Date Recommendation Target price30 Jun 2009 Overweight EGP17.2 30 Jun 2009 Overweight EGP9706 Aug 2009 Overweight EGP19.0 6 Aug 2009 Overweight EGP1,09017 Nov 2009 Neutral EGP17.0 22 Mar 2010 Overweight EGP1,28422 Mar 2010 Overweight EGP23.4 6 Apr 2010 Overweight EGP1,5376 Apr 2010 Overweight EGP30.1 9 Jun 2010 Overweight EGP1,4439 Jun 2010 Overweight EGP26.3 16 Sep 2010 Overweight EGP1,15116 Sep 2010 Overweight EGP23.5 28 Feb 2011 Neutral EGP74728 Feb 2011 Underweight EGP14.8 21 Sep 2011 Neutral EGP56310 Apr 2011 Overweight EGP14.821 Sep 2011 Neutral EGP8.1All HC employees and its associate persons, including the analyst(s) responsible for preparing this research report, may be eligible to receive non‐product orservice specific monetary bonus compensation that is based upon various factors, including total revenues of HC and its affiliates, as well as a portion of theproceeds from a broad pool of investment vehicles consisting of components of the compensation generated by directors, analysts, or employees and mayaffect transactions in and have long or short positions in the securities (options or warrants with respect thereto) mentioned herein.Although the statements of fact in this report have been obtained from and are based upon recognized statistical services, issuer reports orcommunications, or other sources that HC believes to be reliable, we cannot guarantee their accuracy.All opinions and estimates included constitute the analysts’ judgment as of the date of this report and are subject to change without notice. HC may affecttransactions as agent in the securities mentioned herein.This report is offered for information purposes only, and does not constitute an offer or solicitation to buy or sell any securities discussed herein in anyjurisdiction where such would be prohibited.Additional information available upon request.10