egypt telecom sector further tariff cuts are not welcome

egypt telecom sector further tariff cuts are not welcome

egypt telecom sector further tariff cuts are not welcome

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

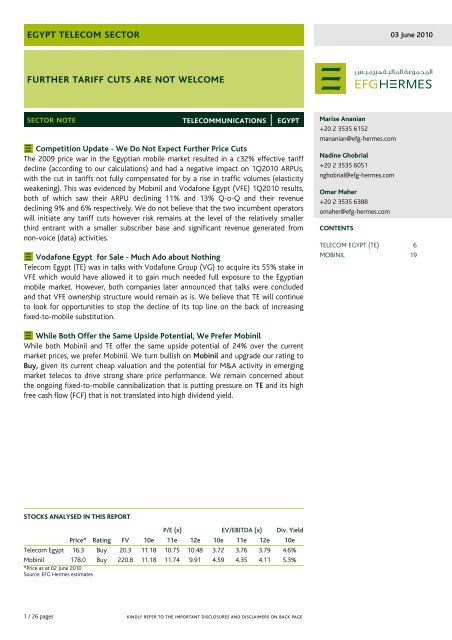

<strong>further</strong> <strong>tariff</strong> <strong>cuts</strong> <strong>are</strong> <strong>not</strong> <strong>welcome</strong> 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>MOBILE MARKET4Q2009 PRICE WAR - TARIFFS DOWN C32%As previously highlighted in our <strong>sector</strong> <strong>not</strong>e “More Growth Than We Thought There Was”published on 4 February 2010, competition in 2009 reached its peak before and during themonth of Ramadan, which started in late August. This was triggered by Etisalat Misr’s offer ofEGP0.19 per minute cross-net (to any mobile or landline) which was lower than the two otheroperators' on-net offerings at that time. This offer initiated an aggressive counter-offer frommarket leader Mobinil during Ramadan, with an on-net <strong>tariff</strong> of EGP0.05 per minute from thethird minute during the day (6:00 am - 4:00 pm). Less than three days later, Etisalat Misrlowered its minute rate to EGP0.15, while VFE matched Mobinil’s offer.After regulatory intervention, the market returned to normal for some time, before a newwave of offers and promotions were launched in 4Q2009. For example, all three operatorslaunched an “unlimited” <strong>tariff</strong> plan in the fourth quarter, whereby subscribers paid a fixedsubscription fee on a monthly basis to have an "unlimited" number of minutes (keeping inconsideration the fair usage policy).At the end of November, Mobinil launched its "Al Masry" <strong>tariff</strong> plan, whereby subscribers paidEGP0.08 per on-net minute and EGP0.19 per off-net minute with a call setup fee of EGP0.10.VFE also launched its "Kol El Masryeen" <strong>tariff</strong> plan, which charged EGP0.19 per minute to anymobile or landlineAccording to our estimates, effective mobile <strong>tariff</strong>s in the market dropped by a significantc32% in 2009.We do <strong>not</strong> believe that2009’s price war willcontinue into 2010BUT NOT FOR LONGWe remain of the view that operators will <strong>not</strong> continue with 2009’s <strong>tariff</strong> slashes in 2010being value destructive. This view was reinforced by Mobinil’s 1Q2010 results, which saw itsvoice revenue come under pressure as its <strong>tariff</strong> <strong>cuts</strong> were <strong>not</strong> fully compensated for by a rise intraffic. Mobinil’s minutes of usage (MOUs), which measure traffic volumes, increased only by6% Q-o-Q. As a result, Mobinil saw its ARPU decline by a significant 13% Q-o-Q to EGP32.We expect ARPUs to pickup from 2Q2010, providing of course that there <strong>are</strong> no <strong>further</strong> price<strong>cuts</strong>.Since the beginning of the year the mobile offers have been much less aggressive:International Minute Down to EGP1.99 - By all three operatorsIn early January 2010, Etisalat began offering a unified international minute rate of EGP1.99per minute, for a monthly subscription fee of EGP6.0. Shortly after this, VFE launched anidentical offer, but with a call initiation fee of EGP1.5 per call instead of a monthlysubscription fee. Less than a month later, Mobinil launched the same offer as VFE’s, but withan EGP1.0 call initiation fee.Some Temporary OffersVFE launched a temporary promotion in mid-January whereby for every three outgoingminutes per day, new prepaid subscribers received ten free on-net minutes per day to beconsumed within a month. Following this, Mobinil offered new “Al Masry” subscribers threefree minutes for every three outgoing minutes consumed, over a period of 90 days.2 / 26 pages

<strong>further</strong> <strong>tariff</strong> <strong>cuts</strong> <strong>are</strong> <strong>not</strong> <strong>welcome</strong> 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>VFE and Mobinil lowertheir roaming feesSome regional offersEtisalat: EGP0.01 on-netfrom 1am to 8amIn early February, VFE launched an offer whereby all postpaid subscribers could receive calls atEGP1.0 per minute when roaming outside of Egypt. Shortly afterwards Mobinil followed withthe same offer.At the end of February, Etisalat launched a dedicated Ahlan package (prepaid) for Alexandriaand other governorates ex-greater Cairo, whereby subscribers pay EGP0.15 per on-net minute.Two or three weeks later, VFE launched a similar offer whereby ex-greater Cairo subscriberscan make on-net calls for EGP0.14 per minute, in addition to getting one free outgoing on-nethour per day between midnight and 9 am. Mobinil finally followed with a similar promotion,charging ex-greater Cairo subscribers EGP0.14 per off-net minute and EGP0.08 per on-netminute.And finally, in April Etisalat launched the most aggressive offer of the year so far, with prepaidsubscribers paying EGP0.01 per on-net minute between 1 am and 8 am.3 / 26 pages

<strong>further</strong> <strong>tariff</strong> <strong>cuts</strong> <strong>are</strong> <strong>not</strong> <strong>welcome</strong> 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>MOBILE TARIFF STRUCTURE - ARE WE BACK INTO 2005?FIGURE 1: MOBILE TARIFF PLANS FOR THE THREE EGYPTIAN MOBILE OPERATORSTo MobilesTo FixedOn-Net Off-NetMobinilPostpaidStar 25 / 100 / 175 / 250 / 300 / 500 0.20 0.30 0.30Primo Monthly 0.20 0.30 0.35 / 0.45PrepaidALO Regions 0.20 0.35 / 0.45 0.50ALO Magic 0.20 0.40 0.50Alohat 0.20 0.20 / 0.40 0.60Al Masry 0.08 0.19 0.19Baladna 0.08 0.14 0.14Vodafone Egypt (VFE)PostpaidVodafone Line Bronze / Silver / Gold / Platinum / 0.19 0.19 0.19DiamondVodafone Easy 0.19 0.19 0.19PrepaidKol El Masryeen 0.19 0.19 0.19Kalam Extra 0.39 0.39Kalamna 0.20 0.40 0.60Yearly Control 0.30 0.30 0.35 / 0.45Ahla Kalam 0.10 0.35 0.60Etisalat MisrPostpaidOptions 100 / 200 0.25Green Line Unlimited Etisalat / Voice / All Free 0.19 / FreePrepaidAhlan Kol El Nas 0.19Ahlan Alex 0.15 0.15 0.15Ahlan Mohafazat 0.15 0.15 0.15Source: OperatorsFigure 1 above illustrates that, as happened in 2005, multiple <strong>tariff</strong> plans <strong>are</strong> now beingoffered. The mobile market currently offers 13 prepaid <strong>tariff</strong> plans (Mobinil has 5, VFE 5 andEtisalat Misr 3), and 6 postpaid <strong>tariff</strong> plans (Mobinil has 2 - with 6 different categories, VFE has2 - with 5 different categories, and Etisalat Misr has 2 - with 2 different categories).In 2005, prior to the entrance of Etisalat Misr, the Egyptian mobile market witnessed a similartrend, with a high number of different <strong>tariff</strong> plans, complicated structures and variety offeatures. In 2005, Mobinil was the first operator to simplify its structure and consolidate all itsdifferent plans into two simple prepaid and postpaid packages.4 / 26 pages

<strong>further</strong> <strong>tariff</strong> <strong>cuts</strong> <strong>are</strong> <strong>not</strong> <strong>welcome</strong> 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>Multiple <strong>tariff</strong> plans <strong>are</strong>here to staySIMPLIFYING TARIFF PLANS: NOT AN OPTIONWe do <strong>not</strong> believe, however, that operators now can do the same as in 2005 and merelysimplify their <strong>tariff</strong> plans, as the large size of the subscriber base prevents operators fromcompeting on headline <strong>tariff</strong>s. In 2005, Mobinil’s subscriber base was only 6.7 million whileVFE’s was 6.1 million. Today, however, Mobinil has 26 million subscribers and VFE 23 million.From conversations with industry experts, we believe that 2009’s severe <strong>tariff</strong> <strong>cuts</strong>demonstrated that operators can no longer afford to compete on headline <strong>tariff</strong>s. Instead, webelieve that operators will continue to offer multiple <strong>tariff</strong> plans to avoid having only one low<strong>tariff</strong>, which would harm profitability given the size of the subscriber base. Offering multipleplans enable the operators to adjust <strong>tariff</strong>s to ensure that higher <strong>tariff</strong>s compensate for lowerones, and thus protect their margins. For example, although decreasing on-net <strong>tariff</strong>s <strong>further</strong>would <strong>not</strong> impact margins, decreasing off-net <strong>tariff</strong>s would definitely have a negative impact.FIGURE 2: TELECOM MARKET INDICATORS IN EGYPTIn million, unless otherwise stated2009a 2010e 2011e 2012e 2013e 2014e 2015ePopulation 80.2 81.9 83.6 85.4 87.2 89.0 90.9Mobile Market IndicatorsMobile Addressable Market 62.3 64.1 66.0 67.9 69.8 71.8 73.9New Postpaid Additions (000's) 378 239 115 80 56 42 32New Prepaid Additions (000's) 13,305 9,338 5,632 3,942 2,760 2,070 1,552New Additions (000's) 13,683 9,578 5,747 4,023 2,816 2,112 1,584Total Subscribers 57.3 66.9 72.6 76.6 79.5 81.6 83.2Penetration to Addressable 91.9% 104.3% 110.0% 112.9% 113.8% 113.5% 112.5%Penetration Rate 71.4% 81.6% 86.8% 89.7% 91.1% 91.6% 91.5%Mobinil Subscribers 25.4 28.5 30.5 31.8 32.7 33.4 34.0Mobinil Sh<strong>are</strong> of Net Additions 38% 33% 33% 33% 33% 33% 33%Mobinil Market Sh<strong>are</strong> 44% 43% 42% 41% 41% 41% 41%VFE Subscribers 23.3 26.5 28.5 29.8 30.8 31.5 32.0Vodafone Sh<strong>are</strong> of Net Additions 42% 34% 34% 34% 34% 34% 34%Vodafone Market Sh<strong>are</strong> 41% 40% 39% 39% 39% 39% 38%Etisalat Misr Subscribers 8.6 11.8 13.7 15.0 16.0 16.7 17.2Etisalat Misr Sh<strong>are</strong> of Net Additions 20% 33% 33% 33% 33% 33% 33%Etisalat Misr Market Sh<strong>are</strong> 15% 18% 19% 20% 20% 20% 21%Fixed-Line Market IndicatorsFixed-Line Addressable Market 13.3 13.7 14.1 14.4 14.7 15.0 15.3New Additions (000's) (2,149) (100) 100 100 100 100 100Total Lines 9.6 9.5 9.6 9.7 9.8 9.9 10.0Penetration to Addressable 71.7% 69.1% 67.6% 67.0% 66.4% 65.7% 65.1%Penetration Rate 12.4% 12.0% 11.9% 11.8% 11.7% 11.5% 11.4%Source: Mobinil, Vodafone Group, Telecom Egypt and EFG Hermes estimates5 / 26 pages

[stock<strong>telecom</strong>name]<strong>egypt</strong> rating (te) [recommend.]Downgrading FV, Maintaining Buy<strong>telecom</strong>munications │ <strong>egypt</strong> 03 June 2010FV Cut by 18% to EGP20.3/sh<strong>are</strong>After slashing our forecasts for Telecom Egypt (TE), our sum of the parts DCF-basedmodel yields a value of EGP20.3/sh<strong>are</strong>, down 18% from our previous valuation. This ison the back of lower revenue and margin forecasts and higher FY2010-2011 capexforecasts. Our model still assumes that TE owns a 44.95% stake in VFE and consolidatesit under the equity method. Accordingly, VFE contributes 43% to the total valuation, TEData 6% and the fixed-line business the remaining 51%.Mobile OperationManagement seems to be keen on gaining exposure to the Egyptian mobile <strong>sector</strong> toallow TE to provide integrated services, which management believes will be a gamechanger for the company. Management is open to any proposition that wouldtransform TE into an integrated operator that could provide some growth andcompensate for the declining fixed-line revenues. This includes MVNO agreements,resellers, getting a 3G, increasing stake in Vodafone Egypt (VFE). Our view regardingthese initiatives ranges from neutral to negative but we believe that increasing its stakein VFE remains the most attractive option, depending on the transaction price. With a45% stake in VFE we believe initiatives to gain <strong>further</strong> exposure to the local market will<strong>not</strong> yield remarkably high returns and we remain of the view that TE should beincreasing its dividend.Maintaining Buy RatingWe maintain our Buy rating on the stock as our FV currently offers 24% upsidepotential over the current market price. We believe that a higher dividend distribution,which could be announced in the summer, or positive news on TE North, <strong>are</strong> positivecatalysts that could drive sh<strong>are</strong> price performance. The company is trading in line withregional peers at 2010e P/E of 11.2x (vs. average of 10.5x) and EV/EBITDA of 3.7x (vs.average of 5.2)KEY FINANCIAL HIGHLIGHTSDecember Year End (EGP mn) 2009a 2010e 2011e 2012eRevenue 9,960 9,889 9,973 10,102EBITDA 4,693 4,331 4,232 4,107EBITDA Margin 47.1% 43.8% 42.4% 40.7%Net Attrib. Income 2,912 2,485 2,583 2,651EPS (EGP) 1.71 1.46 1.51 1.55BUYPriceFair ValueEGP16.3*EGP20.3Last Div / Ex. Date EGP0.75 on 27 Apr 10Mkt. Cap / Sh<strong>are</strong>s (mn) EGP27,774 / 1,707Av. Mthly Liqdty (mn)EGP615.152-Week High / Low EGP20.5 / EGP15.3Bloomberg / Reuters TELE EY / ETEL.CAEst. Free Float 20%SHARE PRICE PERFORMANCE RELATIVETO HFI (REBASED)242322212019181716151402-Jun-0902-Sep-09QUARTERLY EARNINGSPrice (EGP)HFI (Rebased)02-Dec-0902-Mar-10(EGP mn) 2009a 2010a/eQ1 901 992**Q2 741 571Q3 716 534Q4 554 541**EAS while the rest of the figures <strong>are</strong> IFRS02-Jun-10Net Debt (Cash) (1,373) (2,770) (5,178) (7,036)P/E* (Attrib.) (x) 9.5 11.2 10.8 10.5EV/EBITDA (x)*** 3.5 3.7 3.8 3.8P/BV* (x) 1.0 1.0 1.0 1.0P/CF* (x) 5.3 8.6 7.0 7.4Div Yield 4.6% 4.6% 6.1% 9.2%*Prices as at 02 June 2010***ProportionateSource: EFG Hermes estimates6 / 26 pages kindly refer to the important disclosures and disclaimers on back pageMarise Ananian+20 2 3535 6152mananian@efg-hermes.comNadine Ghobrial+20 2 3535 6051nghobrial@efg-hermes.com

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>I. INTEGRATED OPERATOR?Management seems to be quite keen on gaining exposure to the Egyptian mobile <strong>sector</strong> toallow them to provide integrated services, which management sees as a game changer for thecompany and something that would transform the company’s dividend play profile into agrowth story. Management seems rather open to a number of propositions including MVNOagreements (naturally with VFE), reselling minutes, a 3G license only and roaming on one ofthe existing 2G networks, and of course increasing its exposure to VFE. By the end of May2010, both TE and Vodafone Group (VG) entered into discussions concerning the sale of VG’s55% stake in VFE to TE. The discussions were concluded with the agreement of both parties tokeep the current sh<strong>are</strong>holding structure of VFE unchanged (45% TE and 55% VG).We outline below our views with regards to the options that the company might choose toexplore, other than increasing its stake in VFE.Egypt’s Fourth Mobile Licence: Can it Add any Value?It is app<strong>are</strong>nt that management does <strong>not</strong> have the intention to pay anywhere near the USD2.9billion paid by Etisalat for Egypt’s third license. Given that the terms of the license <strong>are</strong> yetunknown, it will all depend on what kind of return on investment the company can achieve.We believe this implies that TE is looking to pay a significantly low price for such a license. Asper Etisalat Misr license terms, the government can only award a new license before May 2011if it has exactly the same terms of Etisalat’s license. After that date, however, a license can beprovided with different terms. We also understood from our meeting with the managementteam that having a mobile operation will <strong>not</strong> legally force the company to sell its stake in VFE,which they intend to keep.Despite management being very positive about having a mobile operation and while wegenerally agree on the concept, we <strong>are</strong> <strong>not</strong> that optimistic about the idea of a fourth license aswe remain concerned about the value that could be driven from a fourth operator at this pointof time. The Egyptian mobile market is approaching saturation with a mobile penetration ofc70% which we forecast to grow to 90% in 2015, in addition to very aggressive competitionduring 2009 which led to a price war and very low <strong>tariff</strong> levels. We believe incremental ARPUsin the market will <strong>not</strong> support the case for a 4 th operator unless the start up cost (capex +license) is significantly low and below USD1.0 billion.We, however, believe that the government may provide TE with attractive payment terms thatcould make the return on investment look positive.MVNOBased on experiences of MVNOs in different markets, we reached the conclusion that the besttime for the introduction of MVNOs to a market is usually when it is close to reachingmaturity and saturation, as they can be effective in grasping the last bits of growth out of themarket. The MVNO will <strong>not</strong> have to incur all infrastructure costs to build a new network, it canalso be able to operate under lower margin which could give it room for decreasing <strong>tariff</strong>s. Webelieve this scenario could be marginally positive for TE but would have a negative impact onthe other mobile operators: competition in the mobile market was very aggressive in 2009which had put strong pressure on mobile <strong>tariff</strong>s, we therefore believe that more pressure on<strong>tariff</strong>s would have a negative impact on margins and ARPUs. Mobile penetration rate in Egyptis now c70% and we expect it to reach c90% by 2015e.7 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>3G LicenseFrom our understanding of the Egyptian third mobile license terms, if TE decides to acquire a3G license before May 2011, it would have to pay the same amount that was paid by EtisalatMisr, which is 20% of the total USD2.9 billion, or USD580 million (EGP3.34 billion). In thatcase it would have to roam on an existing operator’s 2G network, which is in that case mostprobably VFE as it would be able to get special interconnection rates. This scenario could alsobe positive for TE but again it all depends on the price it would pay for the license and theroaming agreements it would have with VFE.Our ViewWhile the return on investments could look positive in some of these scenarios, we believethat from an investor standpoint, saving the cash and having a higher dividend payout ratiowould be a preferred option. In our view, entering the Egyptian mobile market at this point intime would only accelerate the intense competition that is already taking place and strip valueout of the market, which is already approaching saturation.8 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>II. NEW FORECASTSWILL REVENUE RETURN TO PRE-4Q2009 LEVELS?For revenue (ex-cable systems) to return back to its 2009 level, we need to see significantstability in the mobile market and strong uptake in broadband and wholesale revenue. Duringthe first quarter of 2010 in fact, we saw some stability returning to the mobile market. Webelieve this should continue for the remainder of the year, supported by the fact that: i) Thereis no market sh<strong>are</strong> benefits from <strong>further</strong> price <strong>cuts</strong> as penetration stabilizes, ii) Decline in theprofitability of the two incumbent operators at the event of <strong>further</strong> price <strong>cuts</strong> (with noincremental revenue benefit) means that the smaller operator, Etisalat Misr (price warinitiator), will be impacted more heavily.MANAGEMENT GUIDANCE FOR FY2010Following the 4Q2009 disappointing results, the company’s management updated theirguidance as follows:Revenue: Flat to -2% (includes the contribution from cable systems of cEGP700-800 million).EBITDA Margin before provisions: Mid-forties (EAS EBITDA)Capex: EGP1.5-2.0 billion, higher than FY2009 mainly on TE North. Maintenance capexcEGP700 - 800 million. TE North cEGP400 - 500 million. The remaining goes for broadbandspending.TE Data: Market sh<strong>are</strong> 62-63 % (850,000-900,000 subscribers). We <strong>are</strong> forecasting 760,000PSTN Subscriber Base: Flat or slightly declining by a couple of hundred K subs.NEW FORECASTSRevenue: For now, however, we prefer to remain on the conservative side since it appears thatwe have underestimated the impact of the mobile competition on TE. We now assumerevenue will soften 0.7% to EGP9,889 million in FY2010, with TE North and the other cablesystems significantly pushing wholesale revenue up and compensating for the loss in retailrevenue which we expect to drop by 9%.EBITDA Margin: We slash our margin forecasts to 45.1% (under EAS) in line with managementguidance from the previous 51.1%. Under IFRS, the margin forecast will be lower at 43.8% asemployee sh<strong>are</strong> in dividends is accounted for above the EBITDA line.Capex: We assume generally higher Capex levels in FY2010-2011 as the company investsaggressively in TE North. Afterwards, capex should return to normal levels of around 10-11%of revenue.VFE: We also lowered our equity value estimate for VFE by 2% reflecting the impact of theaggressive <strong>tariff</strong> <strong>cuts</strong> on the company's top line growth.9 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>FIGURE 3: TE OLD VERSUS NEW FORECASTS (IFRS)In EGP million unless otherwise stated2009 2010e 2011e 2012eOld New Chg. Old New Chg. Old New Chg.Total FL Subs. (mn) 9.6 9.7 9.5 -3% 9.9 9.6 -3% 10.0 9.7 -4%Total VFE Subs. (mn) 23.3 26.3 26.3 0% 28.1 28.1 0% 29.4 29.4 0%Retail Revenue 5,764 5,651 5,222 -8% 5,698 5,136 -10% 5,629 5,094 -10%Wholesale Revenue 4,197 4,931 4,668 -5% 5,088 4,837 -5% 5,341 5,007 -6%Total Revenue 9,960 10,582 9,889 -7% 10,787 9,973 -8% 10,970 10,102 -8%EBITDA 4,693 5,126 4,331 -16% 5,190 4,232 -18% 5,258 4,107 -22%EBITDA Margin 47.1% 48.4% 43.8% 48.1% 42.4% 47.9% 40.7%Deprec. & Amort. (2,642) (2,799) (2,795) 0% (2,794) (2,822) 1% (2,698) (2,714) 1%Associates 1,309 1,447 1,146 -21% 1,621 1,260 -22% 1,771 1,258 -29%Net Interest Inc (Exp) (10) 189 71 282 187 369 304Earnings before Taxes 3,371 3,963 2,752 -31% 4,299 2,857 -34% 4,700 2,954 -37%Taxes (453) (616) (260) (654) (265) (711) (293)NPBMI 2,917 3,347 2,492 -26% 3,645 2,592 -29% 3,989 2,661 -33%Minority Interest (5) (9) (7) (11) (9) (14) (11)Net Profit 2,912 3,338 2,485 -26% 3,634 2,583 -29% 3,975 2,651 -33%Capex (1,458) (1,403) (1,653) 18% (1,274) (1,411) 11% (1,229) (1,254) 2%Capex to Sales 15% 13% 17% 12% 14% 11% 12%FCF 3,265 3,347 1,664 -50% 3,516 2,729 -22% 3,651 2,816 -23%Source: Telecom Egypt (TE), EFG Hermes estimates10 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>III. VALUATIONOur sum of the parts DCF-based model yields a value of EGP20.3/sh<strong>are</strong>, down 18% from ourprevious valuation of EGP24.8/sh<strong>are</strong>. This is on the back of lower revenue and margin forecastsand higher FY2010-2011 capex forecasts. VFE contributes 43% of the total valuation from theprevious 37%.FIGURE 4: TE SOTP DCF VALUATIONIn EGP million, unless otherwise statedOperation Stake Total EquityValueProp. EquityValue% of TotalValueFixed Line 100.0% 17,187 17,187 51%VFE 45.0% 34,040 15,301 43%TE Data 100.0% 2,104 2,104 6%Total 34,593FV (EGP) 20.3Source: EFG Hermes estimatesTE DATAFollowing our meeting with TE Data management, we got a cle<strong>are</strong>r view on thedata/broadband business in Egypt in general and on TE Data’s significant potential value inspecific. We therefore decided to assign a separate equity value for TE Data based on a DCFmodel. Our assumptions <strong>are</strong>:i) Broadband penetration to household will reach 15% in 2015e from the current 6.0%ii) TE Data market sh<strong>are</strong> will <strong>not</strong> drop below 59% over the long run and its subscriber base willreach 1.5 million at the end of 2015e from 0.6 million at the end of 2009.iii) Revenue will grow at a 6-year CAGR of 15% to reach EGP1.4 billion in 2015eiv) EBITDA margin will remain between mid to high 30s, <strong>not</strong> exceeding 40% over the long run.v) We use a discount rate of 15% (risk free rate 10% + equity risk premium 5%), and aterminal growth rate of 5%We reach an estimated enterprise (EV) value of EGP2.1 billion which is 6.7x 2010e EBITDA.Below we ran a quick analysis comparing our value for TE Data with some ISP in differentcountries. With an average 3-years EBITDA CAGR of 17%, the average EV/EBITDA is 6.85x, inline with our implied EV/EBITDA multiple and our 3-years EBITDA CAGR of 22%.11 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>FIGURE 5: MULTIPLES COMPARISONISP Country EV/EBITDA (x) EBITDA CAGR2010 2011 2012 2009-12Fastweb Italy 4.5 4.3 4.1 5.2%Jaztel Spain 13.1 8.6 6.8 52.4%Illiad France 5.7 5.2 5.3 6.3%Tiscali Italy 4.2 3.7 3.2 6.0%Average 6.9 5.5 4.9 17.5%TE Data 6.7 5.7 4.8 22.5%Source: Reuters consensus estimates, EFG Hermes estimates12 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>IV. 1Q2010 RESULTSOUR TAKETelecom Egypt (TE) reported its 1Q2010 results under EAS on 13 May 2010. Results for1Q2010 showed a significant bottom line improvement over 4Q2009. Net profit came in atEGP992 million versus our estimate of EGP662 million and the consensus estimate of EGP658million. The positive surprises, which pushed earnings up included: 1) the recognition ofEGP160 million in revenue related to TE Transit Corridor that we had <strong>not</strong> been expecting, 2) <strong>are</strong>versal of an impairment loss on assets of EGP79 million, which management confirmed is aone-off item. Excluding both items, earnings for 1Q2010 would have been EGP756 million,roughly in line with our forecasted EGP762 million (adjusted for the reversal of theimpairment).FIGURE 6: TE'S ADJUSTED EARNINGS (ACTUAL VERSUS ESTIMATE)In EGP million, unless otherwise stated1Q10a 1Q10e Var.Earnings 992 662 49.8%Cable Revenue 160 -832 662 25.6%Provision (Reversal / Impairment Loss) 79 (100)Adjusted Earnings 753 762 -1.2%Source: Telecom Egypt (TE), EFG Hermes estimatesWhile the results were overall better than expected, we still do <strong>not</strong> believe that TE is out of thewoods just yet. Retail revenue remained under pressure and came in lower than forecasted,implying that aggressive competition in the mobile market still has an impact on TE. This isalso confirmed by the drop in revenue at the level of mobile incumbents Mobinil (-9%) andVodafone Egypt (VFE) (-6%). We again reiterate our view that <strong>tariff</strong> stability in the mobilemarket is the key to TE’s future performance. Although management remained cautious, thecompany has highlighted that it expects competition to slow down going forward from theaggressive levels seen in FY2009. We strongly agree with this view, particularly because thepromotions offered by the mobile incumbents during 2H2009 did <strong>not</strong> lead to a significantincrease in traffic.REVENUE - STRONG ON CABLE SYSTEMS CONTRIBUTIONTE's 1Q2010 total revenue increased 13% Q-o-Q, coming in at EGP2,503 million, 4.4% aboveour estimate. This is 8.6% above the consensus estimate. However, the most important trendto highlight, in our view, concerns retail revenue, which continued to disappoint, declining 2%Q-o-Q and coming in 8% below our forecast at EGP1,296 million (+4% Q-o-Q, -12% Y-o-Y).We now believe that the retail revenue level has reached a new low, and we do <strong>not</strong> believe itwill be able to reach the EGP1.5 billion level again going forward, a level that we saw until3Q2009.Both access and voice revenue streams were lower than forecasted, missing our estimates by5.3% and 17.3%, respectively. While TE did <strong>not</strong> launch any new offers/promotions during1Q2010, it has continued to offer fixed-to-mobile (F-to-M) calls at EGP0.15/minute andremove the administrative fees for new lines. The good news came at the level of internet anddata revenue, which exhibited healthy growth on both a yearly and quarterly basis after two13 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>quarters of stagnation and exceeded our forecasts by 7%. We remain of the view that thissegment is the only one that will continue growing in the retail revenue segment.Wholesale revenue surprised positively, mostly due to the EGP160 million contribution of TETransit Corridor (recorded in international wholesale), in addition to better-than-expecteddomestic wholesale revenue. Excluding the contribution of TE Transit Corridor, which we were<strong>not</strong> expecting, total revenue of EGP2.3 billion would have been roughly in line with ourestimate of EGP2.4 billion.FIGURE 7: TE QUARTERLY REVENUE BREAKDOWNIn EGP million, unless otherwise stated1Q09a 4Q09a 1Q10a Y-o-Y Q-o-Q 1Q10e Var.Access 536 463 455 -15.1% -1.9% 480 -5.3%Voice 680 486 538 -20.9% 10.6% 650 -17.3%Internet & Data 146 164 189 29.3% 15.6% 177 6.9%Others 106 126 115 8.1% -9.3% 100 14.6%Total Retail 1,468 1,239 1,296 -11.7% 4.6% 1,407 -7.9%Domestic 285 238 290 1.7% 21.8% 230 26.1%International 773 741 917 18.6% 23.8% 760 20.6%Total Wholesale 1,058 979 1,207 14.0% 23.3% 990 21.9%Total Revenue 2,526 2,218 2,503 -0.9% 12.8% 2,397 4.4%Source: Telecom Egypt (TE), EFG Hermes estimatesMore on TE Cable SystemsThe value of contracts signed up until now on TE’s cable system projects is USD219 million(EGP1.2 billion), distributed between TE Transit Corridor, the company’s physical terrestrialinfrastructure inside Egypt linking the Red Sea to the Mediterranean Sea and accounting forUSD126 million, and TE North, the wet part linking TE Transit Corridor to Europe andaccounting for USD93 million. The company expects to record EGP700-800 million duringFY2010.In terms of margins, TE Transit Corridor has very high margins of high 50-60%, while marginson the wet part <strong>are</strong> relatively low.EBITDA MARGIN – SURPRISES POSITIVELY, HELPED BY TRANSIT CORRIDORThe EBITDA margin for 1Q2010 came in at 57.5% versus our forecast of 44.2% and versus theconsensus estimate of 45.3%. This shows a significant improvement over the previousquarter’s margin, which dropped to the low 30% level. The main reasons behind the betterthan-expectedmargin <strong>are</strong>:i) TE Transit Corridor boosted revenue with low associated costs. (The company indicated thatthe margin stands at c60%.) We ran a quick exercise, removing the impact of TE TransitCorridor from the quarter’s revenue and costs to better estimate the recurring EBITDA margin.This gives us a margin of 51.9%, which we believe is a better indication of the company’smargins going forward.14 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>ii) A one-off reversal of an impairment loss on assets of EGP79 million was reported above theEBITDA figure. Management clarified during the conference call that this was due to thecollection of actual receivables.iii) Lower-than-expected administrative expenses came in at EGP264 million (vs. our estimateEGP315 million).Excluding the impact of the reversal of provisions and TE Transit Corridor, the EBITDA marginwould have been 54%, still higher than our expected margin. It is worth highlighting that thecompany’s first half margin is usually much higher than the second half margin, which usuallyincludes salary increases and bonuses. Management did <strong>not</strong> change, however, its previousguidance for the FY2010 margin of mid-40% (EAS EBITDA).VFE - EARNINGS DOWN ON AN ACCOUNTING ONE-OFF ITEMVodafone Egypt (VFE) contributed only EGP300 million to TE’s bottom line (versus ourestimate of EGP380 million and versus 4Q2009’s EGP388 million). This was due to a one-offaccounting adjustment by VFE related to the employee profit sh<strong>are</strong> that took place in1Q2010.Disregarding the one-off item, VFE had a solid quarter, particularly at the subscriber level. Netsubscriber additions for 1Q2010 came in at 1.28 million versus 1.26 million in 4Q2009 andmuch higher than Mobinil’s additions of 0.77 million, resulting in a total subscriber base of24.6 million. We were expecting VFE to add only 0.76 million subscribers, in line with Mobinil’sadditions due to the numbering capacity problem. Based on our estimate for Etisalat Misr’ssubscribers, VFE had the highest sh<strong>are</strong> of quarterly additions at 44.9%, which was confirmedby TE’s management during the results conference call.VFE’s voice traffic has also grown significantly in 1Q2010, with total voice minutes of 11,451million, implying a 12.3% Q-o-Q surge in quarterly traffic. Revenue declined 6.1% Q-o-Q (lessthan Mobinil’s revenue decline of 9%) to EGP2,878 million, on weakening ARPUs we suspect.We believe that, similar to Mobinil, VFE suffered from the aggressive price <strong>cuts</strong> that took placein 4Q2009 and that were <strong>not</strong> met by a proportionate increase in traffic.15 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>FIGURE 8: TE 1Q2010 KPIS AND INCOME STATEMENT HIGHLIGHTS (EAS)In EGP million, unless otherwise stated1Q09a 4Q09a 1Q10a Y-o-Y Q-o-Q 1Q10e Var.Additions (000's) (157) (77) (240) (25)Subscribers (000's) 11,546 9,554 9,314 -19.3% -2.5% 9,529 -2.3%Income StatementRetail Revenue 1,468 1,239 1,296 -11.7% 4.6% 1,407 -7.9%Wholesale Revenue 1,058 979 1,207 14.0% 23.3% 990 21.9%Total Revenue 2,526 2,218 2,503 -0.9% 12.8% 2,397 4.4%Operating Expenses (769) (914) (773) 0.4% -15.5% (808) -4.4%COGS / Revenue 30.5% 41.2% 30.9% 33.7%Gross Profit 1,757 1,304 1,730 -1.5% 32.7% 1,589 8.9%Admin. Expenses (304) (330) (264) (315)S&D (104) (101) (103) (115)Other Costs (Prov.& Impair. Loss) (33) (134) 76 (100)SG&A / Revenues 17.4% 25.4% 11.6% 22.1%EBITDA 1,316 739 1,439 9.3% 94.6% 1,059 35.9%EBITDA Margin 52.1% 33.3% 57.5% 44.2%Depreciation & Amortisation (668) (662) (661) (680)Net Operating Profit 648 77 778 20.1% 908.4% 379 105.3%NOP (EBIT) Margin 26% 3% 31% 16%Interest Expenses (65) (15) (5) (14)Income From Associates 354 388 300 -15.2% -22.5% 380 -21.0%Interest Income 82 0 39 15Other Income 43 81 20 20Other Expenses - - - -FX Gains (Losses) 51 (0) 11 -Earnings before Taxes 1,113 531 1,143 2.6% 115.3% 780 46.5%Tax Expense (180) (59) (179) (117)Deferred Tax Expense 29 4 28 -Effective Tax Rate 14% 10% 13% 15%Earnings before Minority Interest 962 476 992 663Minority Interest (2) (1) (1) (1)Net Profit 961 475 992 3.2% 108.7% 662 49.8%Source: Telecom Egypt (TE), EFG Hermes estimates16 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>V. FINANCIAL STATEMENTSBALANCE SHEET (DECEMBER YEAR END) IFRSIn EGP million, unless otherwise stated2009a 2010e 2011e 2012eCash & Liquid Assets 2,453 4,902 7,540 10,071Net Accounts Receivable 4,355 4,879 4,915 4,971Inventory 414 431 448 470Total Current Assets 7,222 10,211 12,903 15,512Net Plant 17,037 15,919 14,534 13,079Investment in Associates & Others 7,498 7,349 7,207 6,846Intangibles 128 163 136 130LT Receivables & Others 146 349 350 351Total Assets 32,031 33,990 35,129 35,918CPLTD & Bank Overdrafts 208 193 189 200Total Payables 3,395 3,519 3,554 3,556Taxes Payable 668 260 265 293Dividends Payable - 1,280 1,707 2,561Total Current Liabilities 4,271 5,253 5,715 6,610Loans 872 658 466 274Others 372 354 338 323Minority Interest 41 48 56 67Total Liabilities & Provisions 5,557 6,313 6,575 7,275Net Worth 26,473 27,677 28,553 28,644Source: Telecom Egypt (TE), EFG Hermes estimates17 / 26 pages

<strong>telecom</strong> <strong>egypt</strong> (te) 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>INCOME STATEMENT (DECEMBER YEAR END) IFRSIn EGP million, unless otherwise stated2009a 2010e 2011e 2012eRetail Revenue 5,764 5,222 5,136 5,094Wholesale Revenue 4,197 4,668 4,837 5,007Total Revenue 9,960 9,889 9,973 10,102Cost of Services (3,348) (3,437) (3,603) (3,824)SG&A (1,686) (1,726) (1,739) (1,790)Other Operating Inc. (Exp.) (233) (395) (398) (381)EBITDA 4,693 4,331 4,232 4,107EBITDA Margin 47.1% 43.8% 42.4% 40.7%Depreciation & Amortization (2,642) (2,795) (2,822) (2,714)Net Operating Profit 2,051 1,535 1,410 1,393NOP (EBIT) Margin 20.6% 15.5% 14.1% 13.8%Interest Expense (144) (76) (62) (48)Interest Income & Others 147 147 249 352Sh<strong>are</strong> of Profit (Loss) of Associates 1,320 1,146 1,260 1,258FX Gain (Loss) (4.2) - - -Net Profit before Taxes 3,371 2,752 2,857 2,954Income Tax (453) (260) (265) (293)Net Profit after Taxes 2,917 2,492 2,592 2,661Minority Interest (5) (7) (9) (11)Net Profit 2,912 2,485 2,583 2,651Source: Telecom Egypt (TE), EFG Hermes estimatesCASH FLOW STATEMENT (DECEMBER YEAR END) IFRSIn EGP million, unless otherwise stated2009a 2010e 2011e 2012eCash Operating Profit after Tax 5,213 3,662 3,972 3,842Change Working Investment 41 (416) (18) (76)Cash Flow after Change in WI 5,254 3,246 3,954 3,766Capital Expenditure (1,458) (1,653) (1,411) (1,254)Dividends received 917 1,295 1,402 1,618Free Cash Flow 4,712 2,888 3,945 4,130Non-operating Cash Flow (2,860) (281) (17) (16)Cash Flow before financing 1,852 2,607 3,928 4,114Net Financing (2,134) (158) (1,290) (1,584)Change in Cash (282) 2,449 2,638 2,531Source: Telecom Egypt (TE), EFG Hermes estimates18 / 26 pages

[stockmobinilname] rating [recommend.]Upgrade to Buy, Our Egypt Pick<strong>telecom</strong>munications │ <strong>egypt</strong> 03 June 2010We Cut our FV by 14% to EGP220.8, But Upgrade Rating to BuyWe cut our fair value (FV) for the stock by 14% to EGP220.8 per sh<strong>are</strong> on the back oflower forecasts. Still, our new FV offers 24% potential upside over Mobinil’s sh<strong>are</strong> priceand we therefore upgrade our recommendation to Buy from Neutral. We do <strong>not</strong>,however, see any immediate catalyst in sight as we believe operational results during2010 will remain under pressure. Starting 2011e, however, things should start to look upas FCF should move back into positive territory and therefore we expect dividenddistribution to increase to EGP15.0/sh<strong>are</strong> from EGP9.5/sh<strong>are</strong> in 2010. This translatesinto a 2011 dividend yield of 8%.We Trim our ForecastsFollowing the 1Q2010 results, we prefer to remain conservative and have trimmed ourforecasts to reflect lower revenue growth levels and lower margins. We now expectFY2010 revenue to grow by only 3.5% Y-o-Y, comp<strong>are</strong>d to our previous 7.5% andmanagement’s earlier guidance of 5%. We also lower our FY2010 EBITDA marginforecast to 42.6%, vs our previous 46.0% and management guidance of low to mid-40s.Tariff Cuts Not Fully Compensated by Rise in TrafficAs we had expected, the <strong>tariff</strong> <strong>cuts</strong> that took place at the end of 4Q2009 put downwardpressure on voice revenue and was <strong>not</strong> fully compensated for by a rise in traffic. This ledrevenue to drop 9% Q-o-Q to EGP2.5 billion, in line with our estimate.EBITDA Margin DisappointsAlthough revenue was broadly in line with our estimates, the EBITDA margindisappointed at 40%, versus our conservative estimate of 43%. While the gross profitmargin was exactly as expected there was a negative surprise at the level of SG&A,which was 5% higher than expected. This resulted in earnings coming in 14% lowerthan-expectedat EGP357 million, and 27% lower than consensus estimate.KEY FINANCIAL HIGHLIGHTSDecember Year End (EGP mn) 2009a 2010e 2011e 2012eRevenue 10,807 11,188 11,571 11,928EBITDA 5,121 4,761 5,024 5,310EBITDA Margin 47.4% 42.6% 43.4% 44.5%Net Attributable Income 1,942 1,592 1,516 1,795EPS (EGP) 19.42 15.92 15.16 17.95BUYPriceFair ValueEGP178.0*EGP220.8Last Div. / Ex. Date EGP7.5 on 29 Mar 10Mkt. Cap / Sh<strong>are</strong>s (mn) EGP17,800 / 100Av. Mthly Liqdty (mn)EGP420.352-Week High / Low EGP241.3 / 168.0Bloomberg / Reuters EMPN EY / EMOB.CAEst. Free Float 29%SHARE PRICE PERFORMANCE RELATIVETO HFI (REBASED)28026024022020018016002-Jun-09Price (EGP)02-Sep-09QUARTERLY EARNINGS02-Dec-09HFI (Rebased)02-Mar-1002-Jun-10(EGP mn) 2009a 2010a/eQ1 424 357Q2 536 427Q3 497 414Q4 581 488Net Debt (Cash) 4,166 5,623 5,063 4,546P/E* (Attrib.) (x) 9.2 11.2 11.7 9.9EV/EBITDA (x) 4.3 4.6 4.3 4.1P/BV* (x) 4.8 4.1 4.1 4.3P/CF* (x) 3.5 4.4 4.1 3.8Div Yield 5.3% 5.3% 8.4% 11.2%*Prices as at 02 June 2010Source: Mobinil, EFG Hermes estimates19 / 26 pages kindly refer to the important disclosures and disclaimers on back pageMarise Ananian+20 2 3535 6152mananian@efg-hermes.comOmar Maher+20 2 3535 6388omaher@efg-hermes.com

mobinil 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>II. 1Q2010 RESULTSIn a NutshellAs expected, the <strong>tariff</strong> <strong>cuts</strong> that took place at the end of 4Q2009 put downward pressure onvoice revenue and was <strong>not</strong> fully compensated for by a rise in traffic (measured in minutes ofusage, MOUs). Revenue declined 9% Q-o-Q to EGP2.5 billion, broadly in line with ourestimate. The EBITDA margin, however, was disappointing at 40% (vs our expected 43%),leading to a lower-than-expected bottom line of EGP357 million, 14% below our conservativeestimate of EGP414 million and a significant 27% below consensus estimates. Managementdeclined to provide guidance on future ARPU and margin performance. Our main thoughts onthe results <strong>are</strong>:i)It is <strong>not</strong> unusual to see weak ARPUs following a significant <strong>tariff</strong> decline - especially at thisend of the price elasticity curve - and we expect to see some stabilisation/increase in ARPUsfrom 2Q2010, provided there <strong>are</strong> no <strong>further</strong> price <strong>cuts</strong>;ii)there have been no <strong>tariff</strong> <strong>cuts</strong> since the beginning of the year, and we do <strong>not</strong> expect to seeone now. We remain of the view that any <strong>further</strong> cut in <strong>tariff</strong>s would <strong>not</strong> drive usage higher,and would thus result in <strong>further</strong> profitability erosion; andiii)management declining to provide guidance on ARPUs or margin development is anindication of higher uncertainty with respect to the competition’s behaviour.Subscriber Growth Impacted by Numbering CapacityMobinil added 768,000 new subscribers during 1Q2010 (+5% Q-o-Q, -28% Y-o-Y), and endedthe quarter with a subscriber base of 26.1 million. This was in line with our forecast 708,000additions. VFE added 1.28 million subscribers during the quarter to reach a total of 24.6million. Both Mobinil and VFE suffered during 1Q2010 from a lack of numbering capacity,which is why we had <strong>not</strong> forecast a strong growth in quarterly additions. We estimate EtisalatMisr added 800,000 new subscribers, to end March with 9.4 million subscribers.ARPUs Under PressureARPUs came under pressure in 1Q2010 as a result of 4Q2009’s aggressive offers, which webelieve pushed <strong>tariff</strong>s to very low levels but were <strong>not</strong> matched by sufficient increases in MOUsto offset the <strong>tariff</strong> <strong>cuts</strong>. Quarterly blended ARPU dropped 13% Q-o-Q to EGP32, exactly in linewith our estimate, while MOUs increased by only 6% Q-o-Q.Revenue Declines Q-o-Q as Expected, but EBITDA Margin DisappointsRevenue for the quarter declined 9% Q-o-Q to EGP2.6 billion, in line with our forecast. Thegross profit margin was also in line with our estimates at 78.3% (vs our estimate of 78.5%).However, the EBITDA margin disappointed at 40%, lower than our estimated 43% on higherthan-expectedSG&A expenses of EGP972 million (vs our estimate of EGP922 million). EBITDAwas EGP1.0 billion, 9% lower than our estimate.Earnings came at EGP357 million, 14% lower than our conservative estimate of EGP414million, and 27% lower than Bloomberg consensus estimates.20 / 26 pages

mobinil 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>FIGURE 9: MOBINIL QUARTERLY COMMERCIAL KPISCommercial KPIs 1Q09a 2Q09a 3Q09a 4Q09a 1Q10a Y-o-Y Q-o-Q 1Q10e Var.SubscribersPost-paid (000's) 659 667 694 686 704 6.8% 2.6% 736 -4.3%Pre-paid (000's) 20,520 22,187 23,931 24,668 25,418 23.9% 3.0% 25,326 0.4%Total Subscribers (000's) 21,179 22,854 24,625 25,354 26,122 23.3% 3.0% 26,062 0.2%Net Additions (000's) 1,063 1,675 1,771 729 768 -27.8% 5.3% 708 8.5%Churn Rate (Quarterly) 8.6% 7.7% 8.5% 10.3% 10.1%MOUs 9,055 11,001 10,465 10,284 10,903 20.4% 6.0%ARPUBlended Monthly ARPU 39.4 40.3 38.0 36.5 31.9 -19.0% -12.6% 32.1 -0.7%Excluding Visitor Roaming 37.8 39.2 37.0 34.8 30.7 -19.0% -12.0% 31.0 -1.1%Pre-paid Monthly ARPU 32.0 34.0 31.0 30.0 26.0 -18.8% -13.3%Post-paid Monthly ARPU 212 219.0 230.0 224.0 203.0 -4.2% -9.4%Source: Mobinil, EFG Hermes estimatesFIGURE 10: MOBINIL QUARTERLY INCOME STATEMENTIn EGP million, unless otherwise statedFinancial KPIs 1Q09a 2Q09a 3Q09a 4Q09a 1Q10a Y-o-Y Q-o-Q 1Q10e Var.Service Revenue 2,344 2,588 2,625 2,612 2,368 1.0% -9.3% 2,476 -4.3%Roaming Revenue 94 75 93 123 93 -1.1% -24.4% 85 9.4%Connection, Handset & Others 52 62 75 64 85 63.5% 32.8% 50 70.0%Revenue 2,490 2,725 2,793 2,799 2,546 2.2% -9.0% 2,611 -2.5%Cost of Sales (457) (473) (545) (564) (553) 21.1% -1.9% (561) -1.5%Gross Margin 81.7% 82.6% 80.5% 79.9% 78.3% 78.5%SG&A (819) (935) (980) (913) (972) 18.7% 6.4% (922) 5.4%SG&A/Sales 32.9% 34.3% 35.1% 32.6% 38.2% 35.3%EBITDA 1,215 1,317 1,268 1,322 1,021 -15.9% -22.7% 1,128 -9.4%EBITDA Margin 48.8% 48.3% 45.4% 47.2% 40.1% 43.2%Depreciation & Amortisation (495) (468) (466) (478) (482) -2.5% 0.8% (475) 1.6%EBIT 720 849 802 844 539 -25.1% -36.1% 653 -17.4%Interest Income (Expense) (175) (204) (167) (142) (130) (129)Other Non-Operating Income (Expense) 22 (7) 8 24 54 -Earnings before Taxes 567 638 643 725 463 -18.4% -36.2% 524 -11.6%Income Tax Provision (143) (103) (145) (144) (106) (110)Net Profit 424 536 498 581 357 -15.8% -38.5% 414 -13.7%Source: Mobinil, EFG Hermes estimates21 / 26 pages

mobinil 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>III. CHANGE IN FORECASTS AND VALUATIONFollowing 1Q2010 results we have decided to trim our forecasts, especially at the top line andEBITDA margin levels. We now expect FY2010 revenue to grow a conservative 3.5% Y-o-Y,based on the assumption that ARPUs will pickup from 2Q2010 and there <strong>are</strong> no <strong>further</strong> <strong>tariff</strong>s<strong>cuts</strong>. This comp<strong>are</strong>s to our old estimate of 7% Y-o-Y revenue growth. We have also remainedconservative regarding the EBITDA margin, which we have cut to 43.8% for the FY2010 versusour previous forecast of 46.0%.FIGURE 11: MOBINIL OLD VS NEW FORECASTSIn EGP million, otherwise stated2009a 2010e 2011e 2012eOld New Chg. Old New Chg. Old New Chg.Total Subscribers (mn) 25.4 28.9 28.5 -1% 30.6 30.5 -1% 31.9 31.8 0%Market Sh<strong>are</strong> 46.1% 43.2% 42.7% 42.4% 41.9% 41.9% 41.5%Revenue 10,807 11,757 11,188 -5% 12,408 11,571 -7% 13,149 11,928 -9%EBITDA 5,121 5,411 4,761 -12% 5,719 5,024 -12% 6,025 5,310 -12%EBITDA Margin 47.4% 46.0% 42.6% 46.1% 43.4% 45.8% 44.5%Depreciation & Amortisation (1,907) (2,183) (2,051) -6% (2,447) (2,347) -4% (2,447) (2,347) -4%Net Interest Income (Expense) (688) (598) (575) -4% (529) (568) 7% (474) (500) 5%Other Income (Expense) 47 - - - - - -Earnings before Taxes 2,573 2,630 2,135 -19% 2,743 2,109 -23% 3,104 2,463 -21%Taxes (536) (552) (448) (576) (443) (652) (517)Net Profit 2,037 2,078 1,687 -19% 2,167 1,666 -23% 2,453 1,945 -21%Capex 2,853 2,316 2,564 11% 2,097 2,081 -1% 2,168 2,072 -4%Capex-to-Sales 26% 20% 23% 17% 18% 16% 17%FCF (3,578) 206 (884) N/M 3,151 2,607 -17% 3,410 2,885 -15%Source: Mobinil, EFG Hermes estimatesOur change in forecasts results in a 14% cut to our fair value (FV) to EGP220.8, from ourprevious EGP257.6. However, despite this cut in our FV we upgrade our recommendation toBuy from Neutral, as our new FV offers 24% upside potential over the current market price.The stock has dropped 26% YTD. It has been trading mainly on news regarding FT’s tenderoffer during the OT/FT sh<strong>are</strong>holding dispute, which caused substantial volatility in the sh<strong>are</strong>price. Ever since we turned negative on Mobinil in April 2009 (ST Reduce / LT Neutral underour old rating system), the stock has lost 15%.We do <strong>not</strong> believe that the stock price will outperform on the short term due to the lack ofcatalyst: we believe that 2010 operational results will be weak in addition to the EGP2.6 billionthat the company has to pay in 3G license instalments putting the FCF under pressure. Webelieve that, even if in two years time the company becomes ex-growth, it will return to thedividend play theme and will start to once again follow its generous 100% dividend payoutstrategy. We believe that after 2010, once the company has paid the remaining EGP2.6 billionof instalments relating to the 3G licence, FCF will jump to EGP2.6 billion. This implies an FCFyield of 14.6%.22 / 26 pages

mobinil 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>IV. FINANCIAL STATEMENTSBALANCE SHEET (DECEMBER YEAR END)In EGP million unless otherwise stated2009a 2010e 2011e 2012eCash 814 1,210 950 750Net Accounts Receivables 753 786 821 857Other Debit Balances 178 178 178 178Inventory 125 130 135 140Total Current Assets 1,869 2,304 2,083 1,925Net Plant 9,800 10,989 11,017 10,892Intangible Assets 2,955 3,825 3,530 3,235Other Long Term Assets 13 14 14 14Total Assets 14,639 17,131 16,645 16,066Accrued Expenses 457 412 416 420Creditors 2,521 2,546 2,572 2,597Other Credit Balances 1,518 1,488 1,458 1,429CPLTD & Overdrafts 966 901 1,098 1,689Dividends Payable - 523 825 1,075Including Tax Provisions & Other Provisions 536 471 486 578Total Current Liabilities 5,999 6,340 6,854 7,788Bonds and LTD 4,013 5,932 4,915 3,607Payable to NTRA 409 - - -Other LT Liabilities 539 539 539 539Net Worth 3,679 4,321 4,337 4,132Source: Mobinil, EFG Hermes estimatesFIGURE 12: INCOME STATEMENT (DECEMBER YEAR END)In EGP million unless otherwise stated2009a 2010e 2011e 2012eRevenue 10,807 11,188 11,571 11,928Direct Costs (2,039) (2,381) (2,443) (2,530)SG&A & Provisions (3,647) (4,047) (4,104) (4,088)EBITDA 5,121 4,761 5,024 5,310EBITDA Margin 47.4% 42.6% 43.4% 44.5%Depreciation (1,677) (1,821) (2,052) (2,052)Amortisation (230) (230) (295) (295)Net Operating Profit 3,214 2,710 2,677 2,963Net Operating Margin 29.7% 24.2% 23.1% 24.8%Net Interest Income (Expense) (688) (575) (568) (500)Other Income (Expense) 47 - - -Earnings before Taxes 2,573 2,135 2,109 2,463Taxes (536) (448) (443) (517)Net Profit 2,037 1,687 1,666 1,945Source: Mobinil, EFG Hermes estimates23 / 26 pages

mobinil 03 June 2010<strong>telecom</strong>munications │ <strong>egypt</strong>CASH FLOW STATEMENT (DECEMBER YEAR END)In EGP million unless otherwise stated2009a 2010e 2011e 2012eCash Operating Profit after Tax 4,624 4,225 4,576 4,867Change in Working Invest. 537 (89) (40) (41)Cash Flow after Change in Working Capital 5,160 4,136 4,536 4,826Capital Expenditure (2,776) (5,020) (1,928) (1,941)Free Cash Flow 2,384 (884) 2,607 2,885Non-operating Cash Flow 329 668 21 163Cash Flow before Financing 2,714 (216) 2,628 3,048Net Financing (2,550) 613 (2,888) (3,248)Change in Cash 163 396 (260) (200)Source: Mobinil, EFG Hermes estimates24 / 26 pages

EGYPT SALES TEAMLocal call center 16900cc-hsb@efg-hermes.comUAE SALES TEAMcall center+971 4 306 9333uaerequests@efg-hermes.comKSA SALES TEAMcall center+800 123 4566RiyadhCallCenter@efg-hermes.comRiyadhTraders@efg-hermes.comRESEARCH MANAGEMENTCairo General + 20 2 35 35 6140UAE General + 971 4 363 4000efgresearch@efg-hermes.comHead of Western Institutional SalesMohamed Ebeid+20 2 35 35 6054mebeid@efg-hermes.comWestern Institutional SalesJulian Bruce+971 4 363 4092jbruce@efg-hermes.comDeputy Head of Gulf SalesAhmed Sharawy+9661 279 8677asharawy@efg-hermes.comHead of ResearchWael Ziada+20 2 35 35 6154wziada@efg-hermes.comLocal Institutional SalesAmr El Khamissy+20 2 35 35 6045amrk@efg-hermes.comHead of GCC Institutional SalesAmro Diab+971 4 363 4086adiab@efg-hermes.comHead of Publ. and DistributionRasha Samir+20 2 35 35 6142rsamir@efg-hermes.comGulf HNW SalesChahir Hosni+971 4 363 4090chosni@efg-hermes.comUAE Retail SalesReham Tawfik+971 4 306 9418rtawfik@efg-hermes.comDISCLOSURESWe, Marise Ananian, Nadine Ghobrial, and Omar Maher, hereby certify that the views expressed in this document accurately reflect our personal views about thesecurities and companies that <strong>are</strong> the subject of this report. We also certify that neither we nor our spouses or dependants (if relevant) hold a beneficial interest inthe securities that <strong>are</strong> traded in The Egyptian Exchange. EFG Hermes Holding owns 3,283 GDRs in Telecom Egypt as at 02 June 2010, one of the securities that isthe subject of this report.Funds managed by EFG Hermes Holding SAE and its subsidiaries (together and separately, "EFG Hermes") for third parties may own the securities that <strong>are</strong> thesubject of this report. EFG Hermes may own sh<strong>are</strong>s in one or more of the aforementioned funds or in funds managed by third parties. The authors of this reportmay own sh<strong>are</strong>s in funds open to the public that invest in the securities mentioned in this report as part of a diversified portfolio over which they have nodiscretion. The Investment Banking division of EFG Hermes may be in the process of soliciting or executing fee earning mandates for companies that <strong>are</strong> either thesubject of this report or <strong>are</strong> mentioned in this report.DISCLAIMERThis Research has been sent to you as a client of one of the entities in the EFG Hermes group. This Research must <strong>not</strong> be considered as advice nor be acted upon byyou unless you have considered it in conjunction with additional advice from an EFG Hermes entity with which you have a client agreement.Our investment recommendations take into account both risk and expected return. We base our long-term fair value estimate on a fundamental analysis of thecompany's future prospects, after having taken perceived risk into consideration. We have conducted extensive research to arrive at our investmentrecommendations and fair value estimates for the company or companies mentioned in this report. Although the information in this report has been obtained fromsources that EFG Hermes believes to be reliable, we have <strong>not</strong> independently verified such information and it may <strong>not</strong> be accurate or complete. EFG Hermes does<strong>not</strong> represent or warrant, either expressly or implied, the accuracy or completeness of the information or opinions contained within this report and no liabilitywhatsoever is accepted by EFG Hermes or any other person for any loss howsoever arising, directly or indirectly, from any use of such information or opinions orotherwise arising in connection therewith. Readers should understand that financial projections, fair value estimates and statements regarding future prospects may<strong>not</strong> be realized. All opinions and estimates included in this report constitute our judgment as of this date and <strong>are</strong> subject to change without <strong>not</strong>ice. This researchreport is prep<strong>are</strong>d for general circulation to the clients of EFG Hermes and is intended for general information purposes only. It is <strong>not</strong> intended as an offer orsolicitation or advice with respect to the purchase or sale of any security. It is <strong>not</strong> tailored to the specific investment objectives, financial situation or needs of anyspecific person that may receive this report. We strongly advise potential investors to seek financial guidance when determining whether an investment isappropriate to their needs.

GUIDE TO ANALYSISEFG Hermes investment research is based on fundamental analysis of companies and stocks, the <strong>sector</strong>s that they <strong>are</strong> exposed to, as well as the country andregional economic environment.Effective 16 December 2009, EFG Hermes changed its investment rating approach to a three-tier, long-term rating approach, taking total return potential togetherwith any applicable dividend yield into consideration.In special situations, EFG Hermes may assign a rating for a stock that is different from the one indicated by the 12-month expected return relative to thecorresponding fair value.For the 12-month long-term ratings for any investment covered in our research, the ratings <strong>are</strong> defined by the following ranges in percentage terms:Rating Potential Upside (Downside) %Buy Above 15%Neutral (10%) and 15%Sell Below (10%)EFG Hermes policy is to update research reports when appropriate based on material changes in a company’s financial performance, the <strong>sector</strong> outlook, the generaleconomic outlook, or any other changes which could impact the analyst’s outlook or rating for the company. Sh<strong>are</strong> price volatility may cause a stock to moveoutside of the longer-term rating range to which the original rating was applied. In such cases, the analyst will <strong>not</strong> necessarily need to adjust the rating for the stockimmediately. However, if a stock has been outside of its longer-term investment rating range consistently for 30 days or more, the analyst will be encouraged toreview the rating.COPYRIGHT AND CONFIDENTIALITYNo part of this document may be reproduced without the written permission of EFG Hermes. The information within this research report must <strong>not</strong> be disclosed toany other person if and until EFG Hermes has made the information publicly available.CONTACTS AND STATEMENTSBackground research prep<strong>are</strong>d by EFG Hermes Holding SAE. Report prep<strong>are</strong>d by EFG Hermes Holding SAE (main office), Building No. B129, Phase 3, Smart Village -km 28 Cairo Alexandria Desert Road, Egypt. Tel +2 (0)2 3535 6140 | Fax +2 (0)2 3537 0939 which has an issued capital of EGP 1,939,320,000.Reviewed and approved by EFG Hermes KSA (closed Joint Stock Company) which is commercially registered in Riyadh with Commercial Registration number1010226534, and EFG Hermes UAE Limited, which is regulated by the DFSA and has its address at Level 6, The Gate, DIFC, Dubai, UAE. The information in thisdocument is directed only at institutional investors. If you <strong>are</strong> <strong>not</strong> an institutional investor you must <strong>not</strong> act on it.bloomberg efgh reuters pages .efgs .hrms .efgi .hfismcap .hfidomefghermes.com