Rabigh Refining & Petrochemical Co. (2380.SE)

Rabigh Refining & Petrochemical Co. (2380.SE)

Rabigh Refining & Petrochemical Co. (2380.SE)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Business ModelBoard of Directors• Chaired by Mr. AbdulazizFahad Al Khayyal• Mr. Hiromasa Yonekura –Vice Chairman• Mr. Motassim A Maashouq• Mr. Assamu Ishitobi• Mr. Ziad Al Labban• Mr. Noryaki Takichita• Mr. Ahmad Saleh AlHumaid• Mr. Saud Al Ashkar• Mr. Nabil Al AmoudiSource: ZawyaEngaged in production ofpetrochemical productssuch as polyethylene,polypropylene, monoethylene glycol andpropylene oxidePetro <strong>Rabigh</strong> is engaged inthe production of refinedpetroleum products likenaphtha, gasoline, jet fueland diesel fuel oilPetro <strong>Rabigh</strong>Benefits derived fromsecure feedstock supplyand well-establishedmarketing channels – thebases for long-term growthFocus on expandingproduction capacity throughprojects such as <strong>Rabigh</strong>Phase II to positively impactearnings in the long runInvestments of Petro <strong>Rabigh</strong>Petro <strong>Rabigh</strong> has no subsidiaries and associates. It has only one investment in the form of a 1%holding in <strong>Rabigh</strong> Arabian Water & Electricity <strong>Co</strong>. in Saudi Arabia.INDUSTRY SCENARIOGlobal economy expectedto witness negative growthof 1.4% in 2009According to estimates by the International Monetary Fund (IMF), the world economy will recede 1.4%during 2009 as a result of the continued economic slowdown. This is contrary to the growth rates of5.1% and 3.1% registered for 2007 and 2008, respectively. However, the trend is likely to reverse withgrowth rebounding to 2.5% in 2010. The Middle East region’s GDP, which registered a healthy realgrowth of 5.7% and 6.3% during 2006 and 2007, respectively, is anticipated to come down from 5.2%in 2008 to 2.0% for 2009 before expanding back to 3.7% in 2010. Within the region, the GCC countrieswitnessed GDP growth of 6.4% in 2008, but are likely to grow at a mere 1.3% during 2009 owing tomultiple factors that include weak oil prices, contraction of global demand and trade-related activity,squeezed liquidity, lower tourism and reduced remittances. However, the GCC’s growth is expected tonormalize to 4.2% in 2010 on improving market dynamics. Saudi Arabia’s real GDP grew at anaverage 4.4% over the period 2004-08, on the back of high oil prices and subsequent economicdevelopment. However, unlike the overall GCC region, Saudi Arabia’s real GDP is expected tocontract 0.9% during 2009 before bouncing back to a positive 2.9% in 2010.As per preliminary estimates, Saudi Arabia’s nominal GDP increased 22.0% YoY to reach SAR1,753.50 billion in 2008 from SAR 1,437.68 billion in 2007, driven by record oil prices during the firsthalf of the year. Average oil prices jumped to USD 95.0 per barrel (bbl) in 2008 from USD 67.6 per bblin 2007. The mining & quarrying sector (up 37.2% to SAR 1,005.20 billion) was the largest contributorto the GDP at 57.3%. Meanwhile, recording a YoY growth of 9.2%, the construction sector logged inrevenues worth SAR 71.03 billion during 2008 accounting for 4.1%. The finance, insurance, real estateand business services sectors together contributed 6.6%. In light of the financial turmoil and economicslowdown along with falling oil prices, the IMF forecasts a 22.3% decline in nominal GDP for 2009.However, a reversal is expected, as economic growth is likely to rebound to 13.3% in 2010. Thecountry is estimated to run a budget deficit of SAR 65 billion (USD 16 billion) in 2009 – the first in sixyears. However, massive fiscal surpluses registered during 2003-2008 have allowed Saudi Arabia toboost its foreign assets, which supported higher spending and offset the pressure due to the globalcrisis.

2,0001,6001,2008004000Saudi Arabia's NominalGDP2004 2005 2006 2007 2008E30.0%25.0%20.0%15.0%10.0%5.0%0.0%70.0%56.0%42.0%28.0%14.0%0.0%<strong>Co</strong>ntribution to GDP (%)2004 2005 2006 2007 2008ENominal GDP (SAR Billions) Nominal GDP Grow th (%)Source: SAMA, Central Department of Statistics & InformationOil to GDPNon-oil to GDPIn 2008, Saudi Arabia sawthe largest productionincrease, with output rising397,000 bpdAccording to BP Statistical Review of World Energy 2009, global oil production increased from 76.99million barrels per day (bpd) in 2003 to 81.82 million bpd in 2008. Despite production cuts institutedlate in the year, production from Organization of the Petroleum Exporting <strong>Co</strong>untries (OPEC) increased991,000 bpd led by a 4.0% increase in production from the Middle East. Among the OPEC members,Saudi Arabia saw the largest production increase of 397,000 bpd followed by Iraq, which witnessed a279,000 bpd rise. Oil production outside OPEC however fell 1.4% during the year. Organisation forEconomic <strong>Co</strong>-operation and Development (OECD) production fell by 748,000 bpd, with Mexicowitnessing the world’s largest decline (314,000 bpd). Russian oil production fell by 92,000 bpd - thefirst decline since 1998. As per data from the US Energy Information Administration (EIA), SaudiArabia (8.41 million bpd) was the largest oil exporter in 2008, followed by Russia (6.88 million bpd)and the UAE (2.58 million bpd).Oil Production (in thousand bpd)Top 5 Oil Producing <strong>Co</strong>untries in Middle East (in thousand bpd)30,00012,00024,0009,60018,00012,0006,000-North AmericaSouth &CentralAmericaEurope &EurasiaMiddle East Africa Asia Pacific7,2004,8002,400-Saudi Arabia Iran United ArabEmiratesKuw aitIraqSource: BP Statistical Review2007 2008Source: BP Statistical Review2007 2008Global oil consumptiondeclined in 2008 led byweak demand from the USGlobal oil consumption declined 0.6% (or 423,000 bpd) in 2008 - the first decline since 1993 and thelargest since 1982. <strong>Co</strong>nsumption in OECD countries dropped 3.2% (or 1.53 million bpd) for the thirdconsecutive year of decline. This was mainly led by a 6.4% or 1.26 million bpd drop in consumption inthe US. <strong>Co</strong>untries outside the OECD also witnessed a slowdown in consumption growth by 1.10million bpd. However, on a positive note, according to OPEC, the demand for oil is expected to rise by4.6 million bpd over 2008-15 and by 10 million bpd by 2020. At the same time, the increasingattractiveness of non-crude products is likely to negatively impact demand for refined products tosome extent.Oil <strong>Co</strong>nsumption (in thousand bpd)Top 5 Oil <strong>Co</strong>suming <strong>Co</strong>untries (in thousand bpd)30,00022,00024,00017,60018,00012,0006,000-North AmericaSouth &CentralAmericaEurope &EurasiaMiddle East Africa Asia Pacific13,2008,8004,400-US China Japan India RussianFederationSource: BP Statistical Review2007 2008Source: BP Statistical Review2007 2008

OPEC earnings expected todecline 42.7% in 2009 onweak oil pricesEIA reported that the sharp decline in crude prices coupled with heavy production cuts led to OPEC’soil export earnings plummeting 56% (or USD 363 billion) to USD 282 billion for the first seven monthsof 2009 compared to USD 645 billion for the same period last year. The price of OPEC’s basketaveraged USD 52.77 in the first seven months of 2009 compared with as high as USD 109.11 in thesame period last year. Going forward, the agency forecasts OPEC’s earnings at about USD 555 billionfor 2009, sharply lower than the record high income of USD 968 billion in 2008 because of high pricesand production. But it projects a strong recovery in income to about USD 667 billion in 2010 thanks torising prices amid a mild recovery in the global economy and resurgent oil demand.YoY Change in OPEC Crude Oil PriceOPEC Crude Oil Price (USD/bbl)84%10056%8028%600%40-28%20-56%1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 200901997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009Source: BloombergSource: BloombergThroughput declines onlower consumptionThe refining segment witnessed healthy growth over 2003-08 led by rising demand for refinedproducts supported by sound economic growth across the world. Moreover, rising demand led totighter refining capacity leading to high utilisation rates and record high refining margins. Globalrefining capacity expanded from 83.64 million bpd in 2003 to 88.63 million bpd in 2008. <strong>Refining</strong>capacity additions in 2008 totalled 833,000 bpd, most of which were concentrated in the Asia-Pacificregion, especially China where capacity grew by 2.9% (221,000 bpd). However, global crudethroughput fell by approximately 252,000 bpd to 75.18 million bpd in 2008 due to the dip inconsumption. The biggest throughput decline was reported in the US, where a 3.4% (or 511,000 bpd)fall was witnessed. However, this was partially offset by a 4.4% growth of 288,000 bpd reported byChina.Worldwide <strong>Refining</strong> capacity (million bpd)Total Global <strong>Refining</strong> Throughput (million bpd)90808876867284688264802003 2004 2005 2006 2007 2008602003 2004 2005 2006 2007 2008Source: BP Statistical ReviewSource: BP Statistical ReviewCapacity utilisation rates godown to 84.8% in 2008Capacity utilisation for refineries, which once stood high on healthy demand for refined products andrelatively lower available capacity, dipped as demand declined following the global economic crisis.Global refinery utilisation rates fell for a third year in succession to 84.8% in 2008 - the lowest levelsince 2003. <strong>Refining</strong> margins also exhibited a similar trend in 2008, with US Gulf <strong>Co</strong>ast West TexasSour <strong>Co</strong>king refining margin falling to its lowest level of USD 2.49 per bbl in 4Q08 compared to USD9.87 per bbl in 3Q08. The Singapore Dubai Hydrocracking refining margin also declined to USD 5.16per bbl in 4Q08 as against USD 5.90 per bbl in 3Q08.Capacity Utilisation Rates (%)Regional <strong>Refining</strong> Margins (in USD per bbl)88%3087%2486%85%1812684%083%1Q042Q043Q044Q041Q052Q053Q054Q051Q062Q063Q064Q061Q072Q073Q074Q071Q082Q083Q084Q0882%2003 2004 2005 2006 2007 2008Source: BP Statistical ReviewUSGC West Texas Sour <strong>Co</strong>king NWE Brent CrackingSingapore Dubai HydrocrackingSource: BP Statistical Review

The prices of key refined products have collapsed following weak demand. Naphtha, a majorfeedstock for the petrochemcals sector has reached levels even lower than the spot price of crude oil.Although the prices for refined products including gasoline, heat oil and diesel have started showingan uptrend starting 2009, but are still much lower than the levels attained in 2008. According to EIA,gasoline prices are expected to decline to USD 233.27 per gallon in 2009 from USD 325.17 per gallonin 2008 on continued weak demand. Similar trends are expected in the prices of heating oil and diesel,which are anticipated to go down 32.3% and 35.3% to USD 236.21 per gallon and USD 246.46 pergallon in 2009, respectively.Price of Key Refined Products (in cents per gallon)Monthly Naphtha Prices (USD/bbl)4001403401122808422056160281002003A 2004A 2005A 2006A 2007A 2008A 2009E 2010EGasoline Heating Oil Diesel-Aug-07Oct-07Dec-07Feb-08Apr-08Jun-08Aug-08Oct-08Dec-08Feb-09Apr-09Jun-09Aug-09Source: EIASource: BloombergHuge investments lined upfor the sector promiseshealthy outlookOvercapacity building upmight negatively impactmarginsGoing forward, the oil & gas sector will remain a very important economic driver for both the GCCcountries and the global economy. Despite recent economic challenges, the region is continuing withinvestments in the sector, particularly in exploration and development projects to replenish decliningreserves, replace and upgrade deteriorating assets and ensure long-term supply. According toProleads, the region recorded a 10.9% increase in upstream oil & gas investments with 265 projectsas of January 2009 from just 239 in June 2008. The UAE accounts for the highest increase inupstream oil & gas investments, pushing expenditure by 30% to USD 55 billion from USD 42 billion.Also, Qatar increased its oil & gas investments to USD 10 billion from USD 7 billion, including an 11%increase in upstream gas investments. Moreover, the GCC national oil companies (NOCs) hope tomake the best of the 30% drop in costs across both upstream and downstream. NOCs in SaudiArabia, Qatar and Kuwait announced going ahead with plans to establish major refineries. As of early2007, there were around 14 million bpd of refinery projects underway at various stages of completion.The figure rose to 20 million bpd at the beginning of 2008 and 35 mllion bpd by 1Q09. Furthermore,according to a recent report by Ernst & Young (E&Y), the world’s largest NOCs and international oilcompanies (IOCs) are planning investments worth more than USD 375 billion. Of these, nearly USD100 billion will be allocated towards investments in oil & gas activities this year.Favourable investments and healthy demand for oil indicate a healthy outlook for the refining sector inthe long run. However, at the same time, overcapacity building up may become a hurdle for overallmargins. In addition, the sector also faces issues of project cancellations/delays following the rise inconstruction costs and shortage of financing. Some of the US projects already under constructionhave been experiencing delays. This includes the Motiva expansion project of 325,000 bpd in PortArthur, Texas, which has been delayed from 2010 to 2012. In the Middle East, plans for the singlebiggest global project, the 625,000 bpd Al-Zour refinery, have also been deferred following issuesrelated to costs. Besides this, the industry also suffers from challenges in the form of mandates forbiofuel supply, transport fleet efficiency/emissions and carbon regimes in developed countries.

PETROCHEMICALSIncreased demand fromAsian economies drivesgrowth in the petrochemicalindustryAccess to cheap feedstockinstrumental to theemergence of Middle Eastas a petrochemical hubThe global petrochemical industry witnessed a healthy growth scenario in the years prior to the globaleconomic crisis on rising demand from emerging Asian economies. Rising population coupled withunparalleled growth witnessed by these economies over the last few years resulted in a rise indemand for petrochemicals from these regions. The demand for petrochemical products increased ata CAGR of 4% during the 2002-07 period. With demand being the key driver for any increase incapacity and utilisation rates, global petrochemical capacity increased at a CAGR of 3.3% to 128.4million tonnes over this period and capacity utilisation rates reached 91.7% in 2007 compared to 87%in 2002. <strong>Co</strong>nsequently, petrochemical production has increased at a CAGR of 3.9% to 117.7 milliontonnes over 2002-07. The year 2008 continued to benefit from soaring oil and gas prices, whichcontributed significantly to the top-line and bottom-line growth of the companies operating within theindustry. Further, on the cost front, the Middle East & North Africa (MENA) region holds the advantageof lower feedstock costs owing to its rich oil fields and gas reserves. According to a study by theAssociation of <strong>Petrochemical</strong>s Producers in Europe (APPE), Middle Eastern producers enjoy thehighest profit margins when compared to producers in Eastern European, American, and South EastAsian. The trend is likely to continue as the region holds approximately 65% of the world oil reservesand 49% of the world gas reserves. Additionally, the willingness of the region to diversify its economybeyond oil and gas is adding up to an increased interest in the petrochemicals sector. The MENAregion accounts for approximately 66% of the global petrochemical capacity of which the Gulf region(comprising the six GCC countries and Iran) contributes about 86%, while the rest is contributed byNorth African countries like Egypt, Libya, and Algeria. Saudi Arabia has the maximum share in thepetrochemical capacity amongst the Gulf countries, accounting for approximately 43% of the totalcapacity. Saudi Basic Industries <strong>Co</strong>rp. accounts for approximately 54% and 28% of the totalproduction capacity of Saudi Arabia and MENA respectively, and is the biggest petrochemicalcompany in the region.During the last few years, there has been a major shift in the petrochemical production base from theUS and Europe to MENA and China, which have emerged as the hub for new capacities andexpansions. The North American region, which once used to be the hub of petrochemical facilities, hasbeen on a downturn due to high feedstock costs that have hurt margins across the industry. Themarginal returns earned by companies in the US petrochemical industry coupled with stiff competitionfrom the Chinese and MENA regions on account of feedstock cost advantage have directly impactedcapacity expansion plans. Even the European petrochemicals industry has suffered on account ofhigher feedstock costs, which has stalled growth for the industry. Further, the European industry haswitnessed subdued growth due to various regulations including the Kyoto protocol - the EuropeanUnion’s directive on chemicals and environmental campaigns.Ethylene is the most important feedstock in the production of a number of derivatives apart from beingused as a raw material for a variety of inputs for plastics, fibres and elastomers. According to ChemicalMarket Associates Inc. (CMAI), the global ethylene industry operating rates are projected to fall from92% in early 2008 to below 90% throughout 2012 in the wake of current economic situation. Themassive build-up of ethylene capacity in the Middle East and Asia might be detrimental to the demandsupplydynamics of the sector. Historically, from 1995 to 2008, ethylene capacity increased by morethan 22 million metric tonnes (mmt) in the Asia-Pacific region and approximately 13 mmt in the MiddleEast. CMAI projects that these regions are projected to add another 41 mmt of capacity by 2015. Withinvestments to the tune of USD 80 billion planned over the next 5 years, Saudi Arabia is expected todouble its ethylene capacity from the levels achieved in 2008 to18.2 million tonnes per annum by theend of 2013.Major <strong>Petrochemical</strong> Projects in Middle East<strong>Co</strong>untry/<strong>Co</strong>mpanyProductTargetedcompletionStatusSaudi ArabiaArabian Industrial Fibers (IbnRushd)Propylene and derivatives 2012 PlannedSaudi KayanOlefins, aromatics andderivatives1Q11Under constructionNational Chevron Phillips Ethylene and derivatives 4Q11 Under constructionPetro <strong>Rabigh</strong> IIOlefins, aromatics andderivativesUnder studySaudi Aramco/Dow ChemicalEthylene, aromatics andderivatives2014 FEED stageSaudi Aramco/Total Propylene and aromatics Post 2012 NA* FEED – Front-End Engineering DesignSource: Chemical Industry News & Intelligence

Major <strong>Petrochemical</strong> Projects in Middle East<strong>Co</strong>untry/<strong>Co</strong>mpanyProductTargetedcompletionStatusAbu DhabiBorouge II Olefins and derivatives 2H10 Under constructionBorouge III Polyolefins 2014Feasibility studystageChemaWEyaatOlefins, aromatics andUnder preliminary2014derivativesengineeringQatarExxonMobil/Qatar Petroleum Ethylene Post 2012FEED awardHonam <strong>Petrochemical</strong>/QatarPetroleumOlefins and derivatives Post 2012OmanDuqm <strong>Refining</strong> &Refinery, olefins and<strong>Petrochemical</strong>derivativesPost 2012* FEED – Front-End Engineering DesignSource: Chemical Industry News & IntelligencedelayedDecision on projectdeferred to 2H12DelayedBenzene prices improve onincreased demand fromAsian producersIndia, China contribute tothe rise in demand forpolypropyleneBenzene is the basic raw material for a number of petrochemical intermediaries including styrene,phenol, acetone, cyclohexane and nitrobenzene. Demand for benzene as a raw material for theproduction of styrene constitutes 52%, while cumene used in the manufacturing of phenol andcyclohexane accounts for 19% and 13%, respectively. Nitrobenzene and other chemicalintermediaries account for the rest of the demand for benzene. Off late, the demand for benzene hasbeen increasing buoyed by higher gasoline consumption in Asia. According to the CMAI, the demandfor benzene is expected to witness an absolute growth of 1.3 million tonnes per year through 2011. Onthe other hand, the supply side dynamics remain tight mainly due to a shortage of investments in thesector. However, rising demand has necessitated additional capacities to be installed. According to theCMAI, approximately 9 million tonnes per year of benzene capacity is likely to be added over 2007-10.Further, according to the CMAI, around 3.1 million tonnes per year of new benzene capacity is likely tobe added across Northeast and Southeast Asia during the next five years. In the Middle East, 1.5million tonnes of new annual benzene capacity will be added over 2007-11. However, on the flip side,increased capacity is likely to strain utilisation rates, which are expected to fall to 80%. Benzeneprices, which follow crude oil and natural gas prices, have increased significantly since the start of2Q09 mainly due to higher demand for styrene from Asia. The price of benzene shot up sequentially66.9% during the first two months of the second quarter. Moreover, the Asian demand for benzene isincreasing fast and the trend may necessitate exports from the US and the Europe. However, in thelong run, with an increase in capacity, the price for benzene is expected to exhibit a better correlationto the cost of production.Polypropylene (PP) is the basic raw material for the production of a variety of products including fibers,yarns, and textiles. It is also used in food packaging, electronic films, photo and graphic artsapplications and automobiles, where its low weight serves as an inherent advantage. Historically, thedemand for PP has grown at around 7-8% mainly due to its versatility and relatively low costcompared to other polymers. According to the CMAI, the demand for PP is expected to increase atapproximately 6% per annum over the 2007-12 period buoyed by rising demand from India and China.However, the overcapacity build-up in Middle East and Asia is expected to become a key challenge forthe industry as 9 million tonnes of annual capacity gets added over 2008-10. The scenario is alsoexpected to intensify the competition for the export markets with North America likely to lose itsleadership position and Europe turning into a net importer. Meanwhile, China continues to remain thelargest consumer of PP. According to the China Petroleum & Chemical Industry Association (CPCIA),the PP production is likely to increase to 12 million tonnes by 2010 from an estimated 7.13 milliontonnes in 2007. Further, according to International <strong>Co</strong>nstruction Information Society (ICIS), a cost andspecification information provider for the construction industry expects at least 11 new PP plants withtotal capacity of 3.9 million tonnes per year under construction to come on-stream between 2008 and2011.

The ongoing global economic recession and credit crunch has dampened demand leading to pricecorrection across basic petrochemical products. The prices of ethylene, butadiene, polypropylene andbenzene have declined to at least three-year lows. However, on a positive note, the improving demandscenario has led to an improved trend in 2Q09. The prices for polypropylene, polyethylene andbenzene witnessed a sequential improvement during 2Q09. While polypropylene prices reported a24.4% sequential gain, polyethylene price improved 17.4% in 2Q09 compared to the previous quarter.The price of benzene however, gained the maximum rising 80.6% in 2Q09 on a sequential basis.Price Change in Crude Oil and Natural GasPrice Change of Key <strong>Petrochemical</strong>s72%56%54%36%28%18%0%0%-18%-28%-36%2004 2005 2006 2007 2008-56%2006 2007 2008 2009Crude OPEC basketNatural GasPolyethylene Ethylene Benzene PolypropyleneSource: Bloomberg*2009 includes prices till AugustSource: BloombergAsian economies, mainlyChina, remain the biggestexport market for theMiddle EastEconomic downturn leadsto negative demand forpetrochemicals in ChinaOn the demand side, Asian economies have emerged as the key markets for petrochemical productsbecause of their favourable demand growth. China remains the biggest export market withpetrochemical demand expected to rise around 9% each year till 2012 compared to a mere 1.8%projected for the US and Europe. At the same time, as a result of the feedstock cost advantage, theMiddle East region has emerged as a significant petrochemical producer, targeting its low costproducts towards the Asian markets. However, given the economic slump, the demand forpetrochemical products is likely to remain low with over-capacity further deteriorating the situation.Ethylene derivatives exports from North America are expected to decline as a result of weakeningglobal demand, appreciating dollar and overcapacity building up in the Middle East. The reduction inoperating rates in Asia particularly the Middle East is expected to exert pressure on US exports andcash margins. According to ICIS, exports from the Middle East are expected to increase from 4.3million tonnes in 2008 to 11.7 million tonnes in 2013 benefiting from capacity expansions.<strong>Co</strong>nsequently, net trade balance for US polyethylene is expected to fall from 3.4 million tonnes in 2008to 0.80 million tonnes by 2013.With access to low cost feedstock (coal), China has been developing the local industry to fulfil thesoaring domestic demand. However, the scenario is changing fast as a result of the sluggish demandfor petrochemicals. According to CPCIA, Chinese petrochemical industry is moving downwards for thefirst time after ten years of high growth. Further, according to the Centre for Business Intelligence, anindependent commodities information provider in China, demand for key petrochemical productsincluding ethylene, polyethylene, benzene and purified terephthalic acid (PTA) witnessed negativegrowth in demand for the first time in 2008. Amongst this, PTA’s demand was the most affecteddeclining 8% in 2008 compared to a rise of 26% in 2007. The slowdown in global demand for Chinesetextiles, toys, electronics, home appliances, machinery and other finished manufactured goods hascaused the dip in demand for petrochemical products. Further, industry experts believe that the sectorwould be challenged by overproduction, lack of innovation and competitiveness and price undercuttingfrom other parts of the world.Demand and Production in China in 2008 ('000 tonnes)16,00012,8009,6006,4003,2000EthylenePropylenePolyethylene(PE)PolypropylenePetrobenzenePurifiedterephthalicacid (PTA)Monoethyleneglycol (MEG)MethanolDemandProductionSources: CBI Research & <strong>Co</strong>nsulting, China National Bureau of Statistics

The Chinese government has undertaken certain initiatives to revive the industry. During January2009, China’s state council approved a stimulus package of approximately RMB 500 billion (USD 73billion) to ensure scheduled commission of planned capacity additions, in order to revive the localindustry. This initiative will likely reduce chemical imports to 17 mmt in 2011 from 20 mmt in 2007.<strong>Co</strong>mpanySinopec (includingjoint ventures)Fujian United<strong>Petrochemical</strong>Shanghai Secco<strong>Petrochemical</strong>China Cracker Expansion Plans, ’000 tonnes2009 2010Project locationexpansion expansion2011expansionStart-uptimeFujian, SouthChina800 - - 1H 2009Shanghai, EastChina300 - - Aug-09Tianjin <strong>Petrochemical</strong>Tianjin, NorthChina1,000 - - Sep-09Zhenhai Refinery and Zhejiang, East<strong>Petrochemical</strong> China1,000 - - Oct-09GuangzhouGuangdong, EastPlanning- - 1,000<strong>Petrochemical</strong> ChinaboardWuhanHubei, CentralPlanning- - 800<strong>Petrochemical</strong> ChinaboardPetroChinaDushanziXinjiang,<strong>Petrochemical</strong> Northwest China1,000 - - 1Q 2009Panjin <strong>Petrochemical</strong>Liaoning,Northeast China450 - - Oct-09FushunLiaoning,Planning- 800 -<strong>Petrochemical</strong> Northeast ChinaboardSichuanSichuan,Planning- - 800<strong>Petrochemical</strong> Southwest ChinaboardDaqingHeilongjiang,Planning- 600 -<strong>Petrochemical</strong> Northeast ChinaboardTotal New Capacity 4,550 1,400 2,600Source: CBI Research & <strong>Co</strong>nsultingGlobal turmoil leads toweak demand, overcapacity aggravatessituationThe demand for petrochemicals has remained weak given the ongoing financial turmoil. This in turnhas led to the closure of production facilities, delays in capacity addition plans and industry-widemerger and acquisition activity. Capacity additions have been facing delays or postponement mainly inthe financing and engineering stages with tightened credit availability. The liquidity crunch has alreadyforced Qatar Petroleum and Korea-based Honam <strong>Petrochemical</strong> to defer a joint cracker andderivatives project. Saudi Aramco and Dow Chemical-operated Ras Tanura project, estimated at USD26 billion and touted as the biggest petrochemical project in the sector is faced with apprehensionsregarding the scheduled completion in 2014. While decline in feedstock costs has improvedprofitability for producers, the weak demand scenario has kept a check on the volumes of businessgenerated. However, on a positive note, the demand situation is expected to improve in the mediumterm. <strong>Petrochemical</strong> prices, which have already seen multi-year lows, have been slowly, but definitely,recovering.On the other hand, with a decline in construction costs, petrochemical players are renegotiatingcontracts with their engineering partners. Saudi Aramco decided to renegotiate contracts for its giantManifa oilfield development project towards the end of 2008. Apart from this, the present situation isbelieved to be throwing up an array of consolidation and merger opportunities with the Middle Eastbeing considered a potential buyer for distressed assets across Asian and European petrochemicalcompanies. In February 2009, Abu Dhabi’s sovereign wealth fund IPIC agreed to acquire CanadabasedNOVA Chemicals for USD 2.3 billion, including the debt assumption. In another development,Sabic and Sipchem have signed an MoU to work together on new projects worth USD 4 billion usingSipchem’s government allocation of feedstock ethane. Further, the companies are also takingpreparatory steps towards streamlining operational efficiencies, enhancing vertical integration,reducing capacity and realigning portfolios to focus on core businesses and see through this globalturmoil.

Financial Performance - FY2008Petro <strong>Rabigh</strong> reports SAR6.54 billion as revenuesfrom its refineryRevenuesPetro <strong>Rabigh</strong> acquired the assets and inventories of Saudi Aramco on October 01, 2008. Accordingly,the company reported revenues of SAR 6,543.34 million for the three months ending December 2008.The company’s performance in 2008 was negatively impacted by the weak demand for refinedproducts, especially naphtha. The price of naphtha, which is a key constituent in petrochemicalproduction, declined significantly on weak demand and an unprecedented fall in petrochemical pricesdue to the global crisis.ExpensesThe company reported SAR 6,892.33 million as <strong>Co</strong>S pertaining to its refinery operations. Depreciationcharges for the year amounted to SAR 272.90 million, while general & administrative (G&A) expensesincreased from SAR 422.90 million in 2007 to SAR 679.66 million in 2008.Higher expenses results ina net loss of SAR 1,256million in 2008ProfitabilityPetro <strong>Rabigh</strong>’s refining segment experienced strong downward pressure on margins, which coupledwith the delay in the start of the new facilities, negatively impacted the operating margins. Thecompany reported a gross loss of SAR 348.99 million for 2008 on account of higher expenses thanrevenues earned. Furthermore, increased depreciation charges and G&A expenses resulted in anoperating loss of SAR 1,301.56 million for the year. However, interest income more than doubling toSAR 45.53 million and foreign exchange losses coming down to SAR 0.21 million from SAR 40.13million in 2007, helped the company restrict net losses at SAR 1,256.24 million, however, still highercompared to SAR 442.57 million in 2007. Accordingly, Petro <strong>Rabigh</strong>’s adjusted LPS stood at SAR 1.43in 2008, up from SAR 0.51 in 2007.

Chart GalleryTotal Revenues (SAR Millions)Net Profit (SAR Millions)012,0009,600-4007,200-8004,800-1,2002,400-1,60002008 1H09-2,0002007 2008 1H08 1H09EBIT and EBITDA MarginNet Profit Margin6%0%0%-6%-6%-12%-12%-18%-18%-24%-30%2008 1H09EBIT MarginEBITDA Margin-24%-30%2008 1H09Total Assets (SAR Millions)Return on Average Assets (RoAA)52,0000.0%41,600-1.2%31,200-2.4%20,800-3.6%10,400-4.8%-2007 2008 1H08 1H09-6.0%2008 1H08 1H09Shareholders' Equity (SAR Millions)Return on Average Equity (RoAE)12,0000%9,600-6%7,200-12%4,800-18%2,400-24%-2007 2008 1H08 1H09-30%2008 1H08 1H09

Size of the <strong>Co</strong>mpanyThe salient features of the balance sheet are: Petro <strong>Rabigh</strong> witnessed a 54.6% increase in assets to SAR 50.80 billion compared to SAR 32.86billion in 1H08 following the completion of the asset transfer from Saudi Aramco’s <strong>Rabigh</strong> refineryin October 2008. As a result, both current and non-current assets witnessed healthy YoY growthduring the first half of 2009.Non-current assets base increased 35.8% to SAR 43.69 billion compared to SAR 32.16 billion in1H08 mainly on account of additions to property, plant and equipment (PPE). Additions onaccount of the <strong>Rabigh</strong> refinery and petrochemicals complex led to PPE expanding to SAR 15.75billion compared to SAR 0.58 billion in 1H08. Leased assets, which include desalination & powerplants and marine terminal facilities were reported at SAR 6.38 billion compared to none in 1H08,leading to an increase in non-current assets. Despite this, the share of non-current assets in thetotal assets base declined from 97.9% in 1H08 to 86.0% in 1H09.Current assets also increased from SAR 0.69 billion in 1H08 to SAR 7.12 billion in 1H09 mainlyon account of transfers pertaining to the <strong>Rabigh</strong> refinery. While trade receivables were carried atSAR 3.18 billion, inventories were valued at SAR 2.84 billion for the first half of 2009. Accordingly,the share of current assets in the total assets base increased from 2.1% in 1H08 to 14.0%.Total liabilities increased 85.5% to SAR 41.81 billion from SAR 22.53 billion in 1H08 with theshare in the balance sheet going up from 68.6% to 82.3%. Non-current liabilities, accounting for64.9% of the total balance sheet increased 54.4% to SAR 32.96 billion led by a rise in long-termloans that increased 2.6% to SAR 21.90 billion. In addition to this, loan from foundingshareholders that stood at SAR 4.58 billion compared to none in 1H08 also contributed to theincrease.Current liabilities also rose from SAR 1.19 billion in 1H08 to SAR 8.84 billion in 1H09, mainly onaccount of the transfer in accounts payable pertaining to the <strong>Rabigh</strong> refinery, which stood at SAR7.42 billion during 1H09. Furthermore, the company also raised a short-term loan of SAR 0.63billion adding to the current liabilities.Shareholders’ equity reduced 12.8% to SAR 9 billion in 1H09 led by rise in accumulated losses forthe period. The company’s accumulated losses increased from SAR 0.81 billion in 1H08 to SAR2.14 billion in 1H09 as a result of rise in net losses for the period. Accordingly, the contribution ofshareholders’ equity to the total balance sheet decreased from 31.4% to 17.7%.Financial Performance Analysis – 1H09Higher expenses negativelyimpacts bottom-line in 1H09Petro <strong>Rabigh</strong> generated SAR 11,776.77 million in revenues from refining activities. However, higher<strong>Co</strong>S of SAR 11,408.85 million (96.9% of total revenues) impacted the company’s financialperformance. The company reported a gross profit of SAR 367.93 million for 1H09, up from the lossreported in 2008. However, depreciation charges of SAR 328.26 million and 35.1% higher G&Aexpenses of SAR 318.63 million led to an operating loss of SAR 278.96 million for 1H09 compared toSAR 236.31 million in 1H08.The company also reported a 54.3% decline in interest & other income to SAR 15.36 million, whileforeign exchange losses stood at SAR 1.04 million as against a gain of SAR 5.16 million in 1H08.Accordingly, net loss for the first half of 2009 increased to SAR 264.65 million compared to a net lossof SAR 197.56 million in 1H08. Adjusted annualised LPS stood at SAR 0.60 compared to SAR 0.45 in1H08. The annualised negative return on average equity stood at 5.8% in 1H09 as against 4.9% in1H08. Similarly, annualised negative return on average assets was reported at 1.1% for 1H09compared to 1.3% in 1H08.

Working Capital Snapshot(in SAR Million) 2007A 2008A 1H08A 1H09ACurrent assetsCash and cash equivalents 185.95 1,534.09 377.37 878.04Trade receivables 0 2,348.49 0 3,175.76Average collection period (Days) NA NA NA 42.80Inventories 0 974.11 0 2,840.71Inventory conversion period (Days) NA NA NA 29.56Advances to suppliers 420.88 90.25 212.94 53.28Average advances to suppliers period(Days) NA 14.26 NA 1.11Prepayments and other current assets 90.26 109.00 100.82 168.11Average prepayment period (Days) NA 5.56 NA 2.15Total current assets 697.09 5,055.94 691.13 7,115.88Current liabilitiesAccounts payable 1,118.83 6,647.42 779.62 7,418.74Average payment period (Days) NA 205.64 NA 112.50Short term loans 0 0 0 633.72Accrued expenses and other currentliabilities 445.45 421.13 410.42 658.17Current portion of finance lease obligation 0 130.53 0.00 134.25Total current liabilities 1,564.27 7,199.07 1,190.03 8,844.88Net <strong>Co</strong>re Working Capital -607.69 -3,125.57 -465.86 -1,180.90Average <strong>Co</strong>re Working Capital Cycle (Days) NA -186 NA -37Net Current Assets -867.18 -2,143.14 -498.91 -1,729.00Average Working Capital Cycle (Days) -434 -1,505 -683 -1,936Source: Petro <strong>Rabigh</strong>

Peer <strong>Co</strong>mparisonIn order to do a peer comparison, we have taken comparable companies involved in oil & gas business across GCC that includes SaudiIndustrial Investment Group (SIIG), Saudi Basic Industries <strong>Co</strong>rporation (SABIC), National Industrialization <strong>Co</strong>mpany (NIC) and Petro<strong>Rabigh</strong>.Financial Performance of <strong>Co</strong>mparable <strong>Co</strong>mpaniesSIIG SABIC NIC Petro <strong>Rabigh</strong>2008 1H09 2008 1H09 2008 1H09 2008 1H09Ratios:Total Assets TurnoverRatio (x) 0.31 0.27 0.57 0.32 0.36 0.25 0.17 0.48Operating Profit Margin(%) -0.5 5.4 24.3 10.2 9.7 5.2 -19.9 -2.4EBITDA Margin (%) 2.2 5.4 24.3 12.9 16.7 5.2 -15.7 0.4Net Profit Margin (%) 2.3 1.8 14.6 1.9 6.0 1.7 -19.2 -2.2Debt Equity Ratio 0.53 0.82 0.90 1.04 2.20 2.32 3.41 3.75RoAA (%) 0.7 0.5* 8.4 0.6* 2.2 0.4* -3.4 -1.1*RoAE (%) 1.2 0.9* 22.7 1.6* 9.1 1.8* -16.5 -5.8*Market Indicators:Adj. EPS (SAR) 0.11 0.10* 7.34 0.55* 1.30 0.29* -1.43 -0.60*P/E (x) 206.76 215.07 10.45 138.58 15.68 71.17 -22.66 -53.79Adj. BVPS (SAR) 11.55 11.60 34.31 33.34 15.88 15.74 10.58 10.27P/BV (x) 1.94 1.93 2.24 2.30 1.29 1.30 3.07 3.16Current MarketCapitalisation (SARMillions) 10,080 10,080 230,250 230,250 9,421 9,421 28,908 28,908(SAR Million)Revenues 2,138.96 1,317.56 150,809.60 43,567.15 10,037.14 3,796.42 6,543.34 11,776.77% YoY change 46.6 14.3 19.5 -47.7 38.9 -26.5 NA NAOperating Profit -10.32 71.60 36,591.29 4,460.68 974.43 198.57 -1,301.56 -278.96% YoY change NA -73.2 -10.9 -80.6 -12.9 -66.5 207.8 18.0EBITDA 46.26 71.60 36,709.93 5,641.93 1,671.81 198.57 -1,028.65 49.30% YoY change -90.2 -73.2 -10.8 -75.5 12.4 -66.5 143.2 NANet Profit 48.75 23.43 22,029.84 830.75 600.85 66.19 -1,256.24 -264.65% YoY change -88.9 -92.1 -18.5 -94.3 -9.1 -82.1 183.9 34.0Total Assets 8,649.03 10,534.40 271,759.99 279,185.90 30,422.66 31,050.35 47,910.94 50,804.66% YoY change 74.2 34.5 7.1 -0.2 23.4 8.7 77.7 54.6Shareholders’ Equity 5,197.23 5,219.95 102,932.47 100,011.83 7,317.76 7,249.45 9,263.84 8,999.21% YoY change 66.3 -4.1 12.9 -0.6 23.2 -9.5 55.6 -12.8Source: Zawya, Petro <strong>Rabigh</strong>’s financial statements

New Projects and StrategiesPetro <strong>Rabigh</strong> holds the advantage of having Saudi Aramco and Sumitomo Chemical as its foundingshareholders. As a result, the company is not only guaranteed access to inexpensive anduninterrupted feedstock, but also the established marketing channels and the technical knowhow ofrunning the business. This virtually eliminates the initial hiccups typically faced by capital intensivepetroleum and petrochemical units. The company has been progressing well with its expansion plans,evident from the transfer of <strong>Rabigh</strong> refinery completed in October 2008. In addition, the petrochemicalcomplex has been commissioned as well. The company’s petrochemical plant, which is well integratedwith its refinery, is likely to benefit from economies of scale. The company had supplied 340,000 bblsof diesel and 320,000 bbls of gasoline as of August 2009. The company also commenced exports tointernational markets with the first shipment of 19,200 metric tonnes of pure mono-ethylene glycol toChina in May 2009.<strong>Rabigh</strong> II expansion to scaleup company’s operationsGoing forward, the company’s plans to expand the <strong>Rabigh</strong> complex by adding more specialisedchemical units such as paraxylene and vinyl acetate monomer, along with the increase of gasolineproduction bodes well for long-term growth sustainability. The feasibility study for the <strong>Rabigh</strong> IIexpansion is being undertaken by JGC <strong>Co</strong>rporation. The second phase of expansion will includescaling up of ethane cracker capacity by 30 million scf/d along with the construction of a newaromatics complex using 3 million tonnes of naphtha. In addition, the complex will also includepetrochemical units for production of higher value and speciality products like EPR, TPO, MMA,PMMA, LDPE/EVA, caprolactam, polyols, cumene, phenol/acetone, acrylic acid, SAP and Nylon-6.The feasibility study is expected to be complete by 3Q10 following which, based on the outcome,Petro <strong>Rabigh</strong> will decide on the implementation plan.SWOT AnalysisSTRENGTHS Strong back-up from foundingshareholders - Saudi Aramco andSumitomo Chemical Secure access to feedstock at ahighly discounted rate from Aramco Access to well-established marketingchannels of its founding shareholdersWEAKNESS Huge debt on its balance sheet withdebt-equity ratio of 3.75 as of 1H09THREATS Increasing competition owing toregion-wide capacity expansions Delays in start of production facilitiescould lead to higher associated costs Overcapacity in the industry coulderode margins of petrochemicalcompaniesOPPORTUNITIES Rising demand for refined petroleumand petrochemical products fromexpanding economies to supportfuture growth <strong>Petrochemical</strong>s sector to benefit fromthe impressive domestic investmentprogram of governments across GCCto diversify from oil

Risks and <strong>Co</strong>ncerns:The current economic downturn has squeezed liquidity across most economies in the GCC.<strong>Co</strong>nsequently, mobilisation of funds towards infrastructure projects has been adverselyimpacted, leading to further slowdown in overall economic activity. In addition, the weakgrowth has negatively impacted demand across sectors, thereby restricting consumerspending. Going forward, the region’s economies are likely to witness slower/negative growthin 2009 despite some improvement during the second half of the year. Furthermore, asdemand for refined products and petrochemicals remains heavily dependent on economicfundamentals, companies may witness restrained revenue growth.The price realisations for refined petroleum products are directly correlated to movement inoil and gas prices. As oil and gas prices have remained volatile in the recent past, anysignificant dip in prices can negatively impact revenues for the company.The prices of petrochemical products are mainly determined by the demand/supply scenarioand movement in crude oil and natural gas prices, which form the basic raw materials.Therefore, any significant dip in crude oil and natural gas prices may lead to lower pricerealisations for petrochemical products, whereas at the same time, lower input costs mayhelp improve operating margins and vice versa.Valuation Methodology:We have used DCF valuation method to arrive at the fair value of Petro <strong>Rabigh</strong>, as discussed below:<strong>Co</strong>st of Equity: 11.61%WACC: 7.21%Assumptions:(i) Risk free Rate (Rf) of 3.21%, equivalent to one year average yield on 10 year US T-bill.(ii) Levered Beta of 1.18(iii) A terminal growth rate of 2%Based on the inputs and the Capital Asset Pricing Model (CAPM), we have arrived at a <strong>Co</strong>st of Equityof 11.61% and a WACC of 7.21%.DCF CalculationsDCF Valuation (FCFF Model)(in SAR Million) 2009E* 2010E 2011E 2012E 2013ENOPAT 1,331.56 2,433.77 4,044.92 5,303.44 6,159.74Add: Depreciation and Amortisation 95.03 486.89 533.75 579.95 623.42Less: Capex 2,299.18 1,924.07 2,695.75 2,386.09 2,557.98Less: Change in Net Working Capital 2,187.98 1,110.06 1,123.07 642.45 -133.62Operating Free Cash Flows to Firm (OFCFF) -3,060.58 -113.47 759.85 2,854.85 4,358.80Add: Non-Opearting Cash Flows (After TaxNon-Operating Income) 17.07 35.81 57.07 63.69 68.65Free Cash Flow to Firm (FCFF) -3,043.50 -77.66 816.92 2,918.54 4,427.44WACC (Ko) (%) 7.21 7.21 7.21 7.21 7.21Present Value / Discount Factor 0.9658 0.9009 0.8403 0.7838 0.7311Long-Term Growth Rate (g) (%) 2.00%Terminal Multiple [(1 + g) / (WACC - g)] 19.59Nominal Terminal Value[(FCFF * (1 + g)) / (WACC - g)] 86,738.86Present Value of Free Cash Flows -2,939.43 -69.96 686.48 2,287.67 3,237.12*2009E excludes 1H09A

Calculation of Equity Value and Fair Value Per ShareNPV of Free Cash Flows (during Explicit Forecast Period) 3,201.87Terminal Value:Residual Cash Flow (FCFF of 2013E) 4,427.44WACC 7.21%Long-Term Growth Rate (g) 2.00%Divided by Capitalisation Rate (WACC - g) 0.05Equals Nominal Terminal Value 86,738.86Implied Multiple of 2013E EBITDA 12.79Times PV/ Discount Factor 0.73Present Value of Terminal/Residual Value 63,419.10Enterprise Value 66,620.97Implied Multiple of 2013E EBITDA 9.82Less: Long-term Debts 33,715.50Less: Market Value of Preferred Shares 0.00Add: Surplus Cash and Investments 0.00Equity Value 32,905.47No. of Outstanding Shares (Million) 876.00Fair Value Per Share (SAR) 37.56* figures in SAR Million unless specifiedSensitivity AnalysisWe have prepared a sensitivity analysis table, showing the probable nominal terminal value, discounted terminal value andenterprise value, given different growth rate assumptions and the WACC. The shaded area represents the most probableoutcomes.DiscountFactorSensitivity Analysis of Nominal Terminal Value (SAR Million)Long-Term Growth Rate1.00% 1.50% 2.00% 2.50% 3.00%5.21% 106,307 121,245 140,842 167,680 206,6816.21% 85,888 95,483 107,359 122,440 142,2237.21% 72,050 78,751 86,739 96,424 108,4128.21% 62,052 67,008 72,763 79,527 87,5899.21% 54,490 58,313 58,313 67,668 73,477DiscountFactorSensitivity Analysis of Discounted Terminal Value (SAR Million)Long-Term Growth Rate1.00% 1.50% 2.00% 2.50% 3.00%5.21% 84,600 96,488 112,084 133,442 164,4796.21% 65,502 72,820 81,877 93,378 108,4657.21% 52,679 57,579 63,419 70,501 79,2658.21% 43,513 46,988 51,024 55,767 61,4209.21% 36,661 39,233 42,162 45,527 49,435DiscountFactorSensitivity Analysis of Enterprise Value (SAR Million)Long-Term Growth Rate1.00% 1.50% 2.00% 2.50% 3.00%5.21% 88,247 100,135 115,731 137,089 168,1276.21% 68,921 76,239 85,296 96,797 111,8847.21% 55,881 60,781 66,621 73,702 82,4678.21% 46,508 49,983 54,019 58,762 64,4159.21% 39,459 42,031 44,960 48,325 52,233

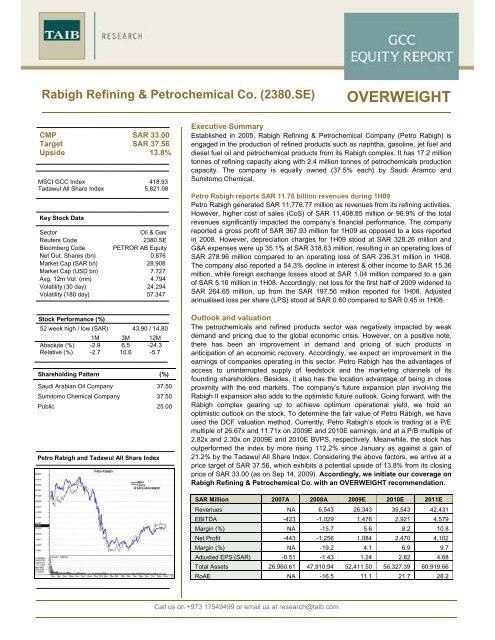

Investment OpinionThe performance of the refining and petrochemicals segments is directly dependent on the demandfor products, which is in turn strongly correlated to the overall macroeconomic health. According to BPStatistical Review of World Energy 2009, global oil production increased from 76.99 million bpd in2003 to 81.82 million bpd in 2008. The refining segment also witnessed healthy growth over 2003-08led by the rising demand for refined products and sound economic growth across the world. Globalrefining capacity expanded from 83.64 million bpd in 2003 to 88.63 million bpd in 2008. However,global crude throughput fell by approximately 252,000 bpd to 75.18 million bpd in 2008 mainly onaccount of a decline in consumption. Accordingly, global refinery utilisation rates fell for the third timein succession to 84.8% in 2008 - the lowest since 2003. The prices of key refined products collapsedfollowing weak demand due to the economic crisis. Naphtha, a major feedstock for the petrochemcalssector reached levels even lower than the spot price of crude oil following weak demand forpetrochemicals. However, on a positive note, the prices of refined products are beginning to movepositively with consolidating demand and improving macroeconomic environment. In addition, despitethe recent economic challenges, the region is on track with its investments in oil & gas, particularly inexploration and development projects to replenish declining reserves, replace and upgradedeteriorating assets and ensure long-term supply. According to Proleads, the region witnessed a10.9% increase in upstream oil & gas investments with 265 projects as of January 2009 from just 239in June 2008. As of 1Q09, there were 35 million bpd of refinery projects under construction at variousstages. Going forward, a favourable investent scenario along with consolidating demand and pricespresent a healthy outlook for the sector.Fair Value: SAR 37.56Investment Opinion:OVERWEIGHTThe petrochemicals sector witnessed healthy growth during 2008, as sound economic growthregistered by economies worldwide kept the demand for petrochemical products high. At the sametime, price realisations followed an upward trajectory leading to record top- and bottom-line growth forcompanies operating in the sector. However, towards the later part of 2008, the sector witnessedslower growth as demand for petrochemicals plunged due to the economic slump. The slowdownacross the world driven by multiple factors including the subprime mortgage crisis and declining oilprices was instrumental in pulling down demand for petrochemical products. The prices of basicpetrochemicals such as ethylene, butadiene, propylene, styrene and benzene slumped to at leastthree-year lows. Even China, which continues to be one of the largest consumers of petrochemicals,was no exception and witnessed negative demand growth for the first time in 10 years. As the impactof the economic crisis deepened, the petrochemicals sector witnessed shut-downs of productionfacilities and delays in capacity addition plans. In addition, the sector has been abuzz with talks ofvarious mergers and acquisitions. However, recently there has been a revival of sorts in the prices ofcrude oil and natural gas. The OPEC crude increased from USD 35.58 per bbl at the start of the yearto USD 66.47 per bbl as of September 14, 2009. The prices for polypropylene, polyethylene andbenzene witnessed sequential improvements in 2Q09. While polypropylene prices reported a 24.4%sequential gain, polyethylene price improved 17.4% in 2Q09 compared to the previous quarter. Theprice of benzene gained the maximum rising 80.6% on a sequential basis. Based on these factors, weexpect a gradual improvement in the earnings of companies operating in the sector.Petro <strong>Rabigh</strong> is well-placed in the downstream business given its ownership of one of the world’slargest refining & petrochemical complex with an annual production capacity of 17.2 million tonnes ofrefined petroleum products and 2.4 million tonnes of ethylene and propylene-based petrochemicals.Besides this, the company has strong backing from its founding shareholders - Saudi Aramco andSumitomo Chemical. The company not only has a feedstock cost advantage with uninterruptedaccess to raw materials from Saudi Aramco, but also has the location advantage of being in closeproximity with the end markets. Furthermore, access to established marketing channels of its foundingshareholders gives it a definite edge. Going forward, with demand improving and prices consolidatingfor refined products and petrochemicals, the company will benefit as its projects become fullyoperational. Future expansion plans including the <strong>Rabigh</strong> II project will further strengthen thecompany’s foothold in the industry. Based on these solid fundamentals, we hold an optimistic view onthis stock.Currently, Petro <strong>Rabigh</strong>’s stock is trading at a P/E multiple of 26.67x and 11.71x on 2009E and 2010Eearnings, and at a P/B multiple of 2.82x and 2.30x on 2009E and 2010E BVPS, respectively.Meanwhile, the stock has outperformed the index by more than doubling (up 112.2%) since Januaryas against a gain of 21.2% by the Tadawul All Share Index. <strong>Co</strong>nsidering the above factors, we arriveat a price target of SAR 37.56, which exhibits a potential upside of 13.8% from its closing price of SAR33.00 (as on Sep 14, 2009). Accordingly, we initiate our coverage on <strong>Rabigh</strong> <strong>Refining</strong> &<strong>Petrochemical</strong> <strong>Co</strong>. with an OVERWEIGHT recommendation.

Financial Statements<strong>Co</strong>nsolidated Balance Sheet(in SAR Million) 2007A 2008A 1H08A 1H09A 2009E 2010E 2011EASSETSNon-current assetsProperty, plant and equipment 0 1,541.27 578.76 15,750.30 18,148.97 22,879.54 26,239.74Leased assets 0 6,547.61 0 6,379.33 6,357.93 6,168.25 5,978.57<strong>Co</strong>nstruction in progress 23,812.68 31,428.49 28,461.02 18,299.24 16,886.37 13,782.65 12,774.14Long term investment 2,450.84 3,337.63 3,124.10 3,259.91 3,363.01 3,670.60 4,030.78Total non-current assets 26,263.52 42,855.00 32,163.89 43,688.78 44,756.28 46,501.05 49,023.22Current assetsCash and cash equivalents 185.95 1,534.09 377.37 878.04 927.10 995.43 1,543.25Trade receivables 0 2,348.49 0 3,175.76 3,587.89 4,860.49 5,860.55Inventories 0 974.11 0 2,840.71 2,913.54 3,725.14 4,225.61Advances to suppliers 420.88 90.25 212.94 53.28 53.28 53.28 53.28Prepayments and other current assets 90.26 109.00 100.82 168.11 173.42 192.01 213.76Total current assets 697.09 5,055.94 691.13 7,115.88 7,655.22 9,826.35 11,896.44Total Assets 26,960.61 47,910.94 32,855.01 50,804.66 52,411.50 56,327.39 60,919.66LIABILITIES AND EQUITYLiabilitiesNon-current liabilitiesLong-term loans 19,443.75 21,900.00 21,337.50 21,900.00 21,900.00 21,900.00 21,900.00Loan from founding shareholders 0 3,000.00 0 4,575.00 4,575.00 4,575.00 4,575.00Finance lease obligations 0 6,538.63 0 6,472.52 6,567.17 7,012.77 7,145.89Provision for deferred employee serviceawards 0 5.78 2.63 8.92 9.76 15.06 21.76Employees’ termination benefits 0 3.62 2.33 4.12 4.25 4.57 4.94Total non-current liabilities 19,443.75 31,448.02 21,342.45 32,960.57 33,056.18 33,507.40 33,647.59Current liabilitiesAccounts payable 1,118.83 6,647.42 779.62 7,418.74 7,665.70 8,658.44 9,057.64Short term loans 0 0 0 633.72 633.72 702.61 729.43Accrued expenses and other currentliabilities 445.45 421.13 410.42 658.17 678.98 735.34 801.39Current portion of finance lease obligation 0 130.53 0 134.25 137.46 153.13 174.40Total current liabilities 1,564.27 7,199.07 1,190.03 8,844.88 9,115.87 10,249.52 10,762.86Total liabilities 21,008.02 38,647.10 22,532.49 41,805.45 42,172.05 43,756.93 44,410.45EquityShare capital 6,570.00 8,760.00 8,760.00 8,760.00 8,760.00 8,760.00 8,760.00Statutory reserve 0 2,409.00 2,409.00 2,409.00 2,409.00 2,517.40 2,764.36Employee Share Ownership Plan 0 -31.50 -31.50 -31.48 -31.48 -31.48 -31.48Accumulated losses -617.42 -1,873.66 -814.98 -2,138.31 -898.07 1,324.55 5,016.34Equity attributable to equity holders ofthe <strong>Co</strong>mpany 5,952.58 9,263.84 10,322.53 8,999.21 10,239.44 12,570.46 16,509.21Total liabilities & equity 26,960.61 47,910.94 32,855.01 50,804.66 52,411.50 56,327.39 60,919.66

<strong>Co</strong>nsolidated Income Statement(in SAR Million) 2007A 2008A 1H08A 1H09A 2009E 2010E 2011ETotal Revenues 0 6,543.34 0 11,776.77 26,342.54 35,543.14 42,431.15<strong>Co</strong>st of Sales 0 -6,892.33 0 -11,408.85 -24,153.93 -31,305.40 -36,068.00Gross loss from sales 0 -348.99 0 367.93 2,188.60 4,237.74 6,363.15Depreciation 0 -272.90 -0.42 -328.26 -423.29 -486.89 -533.75General and administrative expenses -422.90 -679.66 -235.89 -318.63 -712.72 -1,317.08 -1,784.48Operating loss -422.90 -1,301.56 -236.31 -278.96 1,052.60 2,433.77 4,044.92EBITDA -422.90 -1,028.65 -235.89 49.30 1,475.88 2,920.66 4,578.67Interest and other income 20.46 45.53 33.59 15.36 32.43 35.81 57.07Foreign currency loss -40.13 -0.21 5.16 -1.04 -1.04 0 0Net profit/ (loss) for the year -442.57 -1,256.24 -197.56 -264.65 1,083.98 2,469.58 4,101.99Adjusted EPS -0.51 -1.43 -0.45* -0.60* 1.24 2.82 4.68

<strong>Co</strong>nsolidated Cash Flow Statement(in SAR Million) 2007A 2008A 1H08A 1H09A 2009E 2010E 2011ECash Flows from Operating ActivitiesNet loss for the year -442.57 -1,256.24 -197.56 -264.65 1,083.98 2,469.58 4,101.99Adjustments for:Depreciation 0 272.90 0.42 328.26 423.29 486.89 533.75Property, plant & equipment 0 0 0 0.26 0.26 0 0Provision for deferred employee serviceawards 0 5.78 2.63 3.16 4.03 5.34 6.74Provision for employees’ terminationbenefits 0 3.66 2.33 0.55 0.64 0.32 0.37Operating profit before changes inworking capital -442.57 -973.91 -192.19 67.57 1,512.19 2,962.14 4,642.85Changes in operating assets andliabilities(Increase) in trade receivables 0 -2,348.49 0 -827.26 -1,239.39 -1,272.61 -1,000.05(Increase) in inventories 0 -974.11 0 -1,866.60 -1,939.43 -811.60 -500.47Decrease in advances to suppliers 482.03 330.63 207.94 36.97 36.97 0 0(Increase) in prepayments and othercurrent assets -74.47 -18.75 -10.56 -59.11 -64.42 -18.59 -21.75Increase/(decrease) in accounts payable -698.09 5,528.59 -339.21 771.33 1,018.29 992.74 399.20(Decrease)/increase in accrued expensesand other liabilities 323.41 -24.31 -35.03 237.03 257.85 56.36 66.04Cash generated from operations -409.68 1,519.65 -369.05 -1,640.06 -417.94 1,908.44 3,585.82Zakat paid -13.09 0 0 0 0 0 0Employee termination benefits – paid 0.00 -0.04 0 -0.04 -0.04 -0.04 -0.04Net cash provided/(used in) by operatingactivities -422.77 1,519.61 -369.05 -1,640.10 -417.99 1,908.39 3,585.78Cash Flows from Investing ActivitiesProperty, plant & equipment 0 0 -579.18 -14,369.59 -16,841.30 -5,027.79 -3,704.26Additions to construction in progress -15,971.90 -8,237.80 -4,648.35 13,129.24 14,433.15 2,965.16 845.27Other purchases of property, plant andequipment 0 -1,002.51 0 0.33 0.33 0 0Additions to long term investment -2,119.65 -886.79 -673.26 77.72 -25.38 -307.59 -360.18Net cash used in investing activities -18,091.55 -10,127.09 -5,900.79 -1,162.29 -2,433.20 -2,370.22 -3,219.17Cash Flows from Financing ActivitiesShort term loans 0 0 0 633.72 633.72 68.89 26.82Proceeds from issue of share capital (net) 3,945.00 4,567.50 4,567.50 0 0 0 0Net movement in long-term loans 12,675.00 2,456.25 1,893.75 0 0 0 0Loans received from founding shareholders 0 3,000.00 0 1,575.00 1,575.00 0 0Repayment of finance lease obligations 0 -68.14 0 -62.38 35.48 461.27 154.39Net cash from financing activities 16,620.00 9,955.61 6,461.25 2,146.34 2,244.20 530.15 181.21Net increase/(decrease) in cash andcash equivalents -1,894.31 1,348.14 191.42 -656.05 -606.99 68.33 547.83Cash and cash equivalents at the beginningof the year 2,080.27 185.95 185.95 1,534.09 1,534.09 927.10 995.43Cash and cash equivalents at the end ofthe year 185.95 1,534.09 377.37 878.04 927.10 995.43 1,543.25

<strong>Co</strong>mmon – Size Statements<strong>Co</strong>mmon-Size <strong>Co</strong>nsolidated Balance Sheet2007A 2008A 1H08A 1H09A 2009E 2010E 2011EASSETSNon-current assetsProperty, plant and equipment 0.0% 3.2% 1.8% 31.0% 34.6% 40.6% 43.1%Leased assets 0.0% 13.7% 0.0% 12.6% 12.1% 11.0% 9.8%<strong>Co</strong>nstruction in progress 88.3% 65.6% 86.6% 36.0% 32.2% 24.5% 21.0%Long term investment 9.1% 7.0% 9.5% 6.4% 6.4% 6.5% 6.6%Total non-current assets 97.4% 89.4% 97.9% 86.0% 85.4% 82.6% 80.5%Current assetsCash and cash equivalents 0.7% 3.2% 1.1% 1.7% 1.8% 1.8% 2.5%Trade receivables 0.0% 4.9% 0.0% 6.3% 6.8% 8.6% 9.6%Inventories 0.0% 2.0% 0.0% 5.6% 5.6% 6.6% 6.9%Advances to suppliers 1.6% 0.2% 0.6% 0.1% 0.1% 0.1% 0.1%Prepayments and other currentassets 0.3% 0.2% 0.3% 0.3% 0.3% 0.3% 0.4%Total current assets 2.6% 10.6% 2.1% 14.0% 14.6% 17.4% 19.5%Total Assets 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%LIABILITIES AND EQUITYLiabilitiesNon-current liabilitiesLong-term loans 72.1% 45.7% 64.9% 43.1% 41.8% 38.9% 35.9%Loan from founding shareholders 0.0% 6.3% 0.0% 9.0% 8.7% 8.1% 7.5%Finance lease obligations 0.0% 13.6% 0.0% 12.7% 12.5% 12.5% 11.7%Provision for deferred employeeservice awards 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%Employees’ termination benefits 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%Total non-current liabilities 72.1% 65.6% 65.0% 64.9% 63.1% 59.5% 55.2%Current liabilitiesAccounts payable 4.1% 13.9% 2.4% 14.6% 14.6% 15.4% 14.9%Short term loans 0.0% 0.0% 0.0% 1.2% 1.2% 1.2% 1.2%Accrued expenses and other currentliabilities 1.7% 0.9% 1.2% 1.3% 1.3% 1.3% 1.3%Current portion of finance leaseobligation 0.0% 0.3% 0.0% 0.3% 0.3% 0.3% 0.3%Total current liabilities 5.8% 15.0% 3.6% 17.4% 17.4% 18.2% 17.7%Total liabilities 77.9% 80.7% 68.6% 82.3% 80.5% 77.7% 72.9%EquityShare capital 24.4% 18.3% 26.7% 17.2% 16.7% 15.6% 14.4%Statutory reserve 0.0% 5.0% 7.3% 4.7% 4.6% 4.5% 4.5%Employee Share Ownership Plan 0.0% -0.1% -0.1% -0.1% -0.1% -0.1% -0.1%Accumulated losses -2.3% -3.9% -2.5% -4.2% -1.7% 2.4% 8.2%Equity attributable to equityholders of the <strong>Co</strong>mpany 22.1% 19.3% 31.4% 17.7% 19.5% 22.3% 27.1%Total liabilities & equity 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

<strong>Co</strong>mmon-Size Income Statement2007A 2008A 1H08A 1H09A 2009E 2010E 2011ETotal Revenues NA 100.0% NA 100.0% 100.0% 100.0% 100.0%<strong>Co</strong>st of Sales NA -105.3% NA -96.9% -91.7% -88.1% -85.0%Gross loss from sales NA -5.3% NA 3.1% 8.3% 11.9% 15.0%Depreciation NA -4.2% NA -2.8% -1.6% -1.4% -1.3%General and administrative expenses NA -10.4% NA -2.7% -2.7% -3.7% -4.2%Operating loss NA -19.9% NA -2.4% 4.0% 6.8% 9.5%EBITDA NA -15.7% NA 0.4% 5.6% 8.2% 10.8%Interest and other income NA 0.7% NA 0.1% 0.1% 0.1% 0.1%Foreign currency loss NA 0.0% NA 0.0% 0.0% 0.0% 0.0%Net profit/ (loss) for the year NA -19.2% NA -2.2% 4.1% 6.9% 9.7%

Financial Ratios2007A 2008A 1H08A 1H09A 2009E 2010E 2011ELiquidity Ratios:Current Ratio (x) 0.45 0.70 0.58 0.80 0.84 0.96 1.11Quick Ratio (x) 0.45 0.57 0.58 0.48 0.52 0.60 0.71Inventory <strong>Co</strong>nversion Period (Days) NA NA NA 30 27 34 34Average <strong>Co</strong>llection Period (Days) NA NA NA 43 41 43 46Average Advances to Suppliers Period(Days) NA 14 NA 1 1 1 0Average Prepayment Period (Days) NA 6 NA 2 2 2 2Length of Operating Cycle (Days) NA 20 NA 76 71 80 83Average Payment Period (Days) NA 206 NA 113 108 95 90Length of Cash Cycle (Days) NA -186 NA -37 -37 -15 -7Activity Ratios:Debtors Turnover Ratio (x) NA NA NA 8.53 8.87 8.41 7.92Creditors' Turnover Ratio (x) NA 1.77 NA 3.24 3.38 3.84 4.07Net Fixed Assets Turnover Ratio (x) NA 0.21 NA 0.59 0.65 0.84 0.97Total Assets Turnover Ratio (x) NA 0.17 NA 0.48 0.53 0.65 0.72Equity Turnover Ratio (x) NA 0.86 NA 2.58 2.70 3.12 2.92Profitability Ratios:EBITDA Margin (%) NA -15.7 NA 0.4 5.6 8.2 10.8Operating Profit Margin (OPM) (%) NA -19.9 NA -2.4 4.0 6.8 9.5Net Profit Margin (NPM) (%) NA -19.2 NA -2.2 4.1 6.9 9.7Return on Average Equity (RoAE) (%) NA -16.5 -4.9* -5.8* 11.1 21.7 28.2Return on Average Assets (RoAA) (%) NA -3.4 -1.3* -1.1* 2.2 4.5 7.0Leverage Ratios:Debt to Equity (D/E) Ratio (x) 3.27 3.41 2.07 3.75 3.30 2.73 2.09Shareholders' Equity to Total AssetsRatio (x) 0.22 0.19 0.31 0.18 0.20 0.22 0.27Total Liabilities to Total Assets Ratio(x) 0.78 0.81 0.69 0.82 0.80 0.78 0.73Current Liabilities to Equity Ratio (x) 0.26 0.78 0.12 0.98 0.89 0.82 0.65Growth Rates:% YoY Growth in Total Revenues NA NA NA NA 302.6 34.9 19.4% YoY Growth in Operating Profit NA 207.8 -244.6 18.0 -180.9 131.2 66.2% YoY Growth in EBITDA NA 143.2 -244.4 -120.9 -243.5 97.9 56.8% YoY Growth in Net Profit NA 183.9 -227.2 34.0 -186.3 127.8 66.1% YoY Growth in Total Assets NA 77.7 68.8 54.6 9.4 7.5 8.2% YoY Growth in Shareholders' Equity NA 55.6 65.4 -12.8 10.5 22.8 31.3Ratios used for Valuation:Adj. EPS (SAR) -0.51 -1.43 -0.45* -0.60* 1.24 2.82 4.68Adj. BVPS (SAR) 6.80 10.58 11.78 10.27 11.69 14.35 18.85P/E Ratio (x) -65.32 -23.01 -73.16 -54.62 26.67 11.71 7.05P/BV Ratio (x) 4.86 3.12 2.80 3.21 2.82 2.30 1.75Current Market Price (SAR)** 33.00 33.00 33.00 33.00 33.00 33.00 33.00* Annualized** Current Market Price as on September 14, 2009

Call us on +973 17549499 or email us at research@taib.comDISCLAIMER:All reasonable care has been taken to ensure that the information contained herein is not misleading or untrue at the time of publication, but we make norepresentation as to its accuracy or completeness. All information is for the private use of the person to whom it is provided without any liability whatsoeveron the part of TAIB Securities WLL, any associated company or the employees thereof. Nothing contained herein should be construed as an offer to buy orsell or a solicitation of an offer to buy or sell. The value of any investment may fall as well as rise. Past performance is no guide to the future. The rate ofexchange between currencies may cause the value of the investment to increase or diminish. <strong>Co</strong>nsequently, investors may not get back the full value oftheir original investment