Vodafone Qatar

Vodafone Qatar

Vodafone Qatar

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

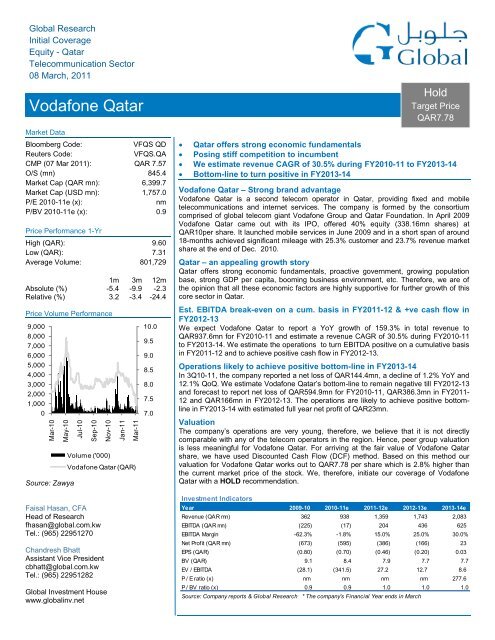

WACCGlobal Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>Valuation & RecommendationDiscounted Cash Flow (DCF) MethodFor arriving at the fair value of <strong>Vodafone</strong> <strong>Qatar</strong> share, we have used Discounted Cash Flow (DCF) method. In order to computethe cost of equity for the DCF method, we have used the Capital Asset Pricing Model (CAPM). The following assumptions havebeen taken in order to arrive at the DCF value of <strong>Vodafone</strong> <strong>Qatar</strong>: A risk-free rate of 5.6% has been assumed which is the yield on <strong>Qatar</strong> International Bond maturing in 2030.A market risk premium of 7% has been assumed.Beta assumed at 1 as stock does not have sufficient price history. The cost of equity derived from the above assumptions using the Capital Asset Pricing Model is 12.6%. The cost of debt has been assumed at 6%. On the basis of above assumptions we have derived a WACC of 11.9%.Being a start-up operation the initial years cash flow is coming negative therefore we have forecasted the cash flow tillFY2019-20. Long term growth rate has been assumed at 3.5% as the company’s operations are very young and thereforehave good growth potential.Based on our future earnings projections and the above assumptions, the DCF value of <strong>Vodafone</strong> <strong>Qatar</strong> comes out toQAR7.78 per share.<strong>Vodafone</strong> <strong>Qatar</strong> - Equity Valuation by DCF(QAR mn) 2010-11e 2011-12e 2012-13e 2013-14eFree Cash Flow (FCF) (280.5) (87.5) 54.4 427.6NPV of FCF 2,487.5NPV of Terminal Value 4,522.7Add: Cash (at the end of Q3-2011) 77.2Less: Debt (at the end of Q3-2011) 506.4Equity Value 6,581.0Shares Outstanding (mn) 845.4Per Share Value (QAR) 7.78Source: Global ResearchSensitivity AnalysisA sensitivity analysis for different estimated terminal growth rate and weighted cost of capital is shown in the table below. Thetable provides estimated fair values for <strong>Vodafone</strong> <strong>Qatar</strong>’s shares based on a range of varying inputs.Terminal Growth Rate7.78 2.5% 3.0% 3.5% 4.0% 4.5%9.9% 9.9 10.4 11.1 11.8 12.710.9% 8.4 8.8 9.2 9.7 10.311.9% 7.2 7.5 7.8 8.1 8.612.9% 6.2 6.4 6.7 6.9 7.213.9% 5.4 5.6 5.8 6.0 6.2Source: Global ResearchMarch - 2011 2

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>RecommendationThe company’s operations are very young therefore we believe that it is not directly comparable with any of the operators in theregion. Hence, peer group valuation is less meaningful for <strong>Vodafone</strong> <strong>Qatar</strong>. Our DCF value for <strong>Vodafone</strong> <strong>Qatar</strong> works out toQAR7.78 per share which is 2.8% higher than the current market price of the stock. We, therefore, initiate our coverage of<strong>Vodafone</strong> <strong>Qatar</strong> with a HOLD recommendation.Key Risks to Valuation Assumed reasonable economic growthLooking at <strong>Qatar</strong>’s rapid economic growth, we have already taken into account the overall reasonable amount of economicgrowth, however, any economic slowdown going forward or faster-than expected economic growth is likely to have an impacton our financial forecasts. Modeled as a single country operatorWe have modeled <strong>Vodafone</strong> <strong>Qatar</strong> as a single country telecom operator. Any future diversification into other country will impactour financial forecast and therefore valuation. Implementation of Mobile Number Portability (MNP)The next big thing to happen in the telecom sector of <strong>Qatar</strong> is implementation of mobile number portability (MNP). Althoughdetails of MNP have not yet been confirmed but it will strengthen competition. We believe that high-end post paid customersmay opt to migrate to <strong>Vodafone</strong>’s network as till now the incumbent operator, Qtel was the only choice for them. Assumed reasonable levels of competitionWe have assumed reasonable levels of competition among two players, however, less or unreasonable competition couldimpact our financial forecasts. Change in operational dynamicsGoing forward any change in operational dynamics, especially from the regulator, could impact the company’s financials.March - 2011 3

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong> is the second telecom operator in <strong>Qatar</strong>, providing fixed and mobile telecommunications and internet services.The company is formed by the consortium comprised of global telecom giant <strong>Vodafone</strong> Group (51% pre IPO) and <strong>Qatar</strong>Foundation (49% pre IPO). <strong>Vodafone</strong> <strong>Qatar</strong> was granted the mobile license on June 29, 2008, by ictQATAR. The license term is20 years with a right to apply to ictQATAR for a renewal. The company paid QAR7.72bn as license fees for providing mobileservices in <strong>Qatar</strong>. It paid 60% of the license fees (QAR4.63bn) on winning the license and the remaining amount QAR3.08bn waspaid after raising funds through an IPO. In April 2009 <strong>Vodafone</strong> <strong>Qatar</strong> came out with its IPO, offered 40% equity (representing338.16mn shares) at QAR10per share. The company raised QAR3.38bn through IPO. It used the IPO proceeds to pay thebalance of the license fee amounting to QAR3.08bn and the remaining QAR295.2mn for general business and operationalpurposes.<strong>Vodafone</strong> <strong>Qatar</strong> Shareholding Pattern:Pre IPOPost IPO22.95%40%49%51%22.05%15%<strong>Vodafone</strong> Group<strong>Qatar</strong> Foundation<strong>Vodafone</strong> Group<strong>Qatar</strong>i Govt. Inst. Investors<strong>Qatar</strong> FoundationPublicSource: IPO prospectus, Global ResearchPost-IPO the stake of <strong>Vodafone</strong> Group and <strong>Qatar</strong> Foundation reduced to 22.95% and 22.05% respectively. <strong>Qatar</strong>i Govt.Institutional Investors comprised of <strong>Qatar</strong> Foundation (5%), Military Staff Loans Fund (3.4%), Healthcare and EducationEndowment (3.3%) and Military Pension Fund (3.3%). As of June 30, 2010, Public holding comprised of institutional investors46% and individual investors 54%.License terms and network roll-outAs per the terms of the mobile license, the company is required to pay annual fees which comprised of License fees of 1% of netrevenue and Industry fees of 12.5% of net profit. In terms of network updates, <strong>Vodafone</strong> has 100% geographic coverage of 2G byDecember 28, 2009 and more than 98% population coverage of 3G. It recently increased the network capacity to meet growingdemand.Awarded Fixed line licenseIn March 2010, the company was also awarded the country’s second fixed line license for QAR10mn. The terms of <strong>Vodafone</strong><strong>Qatar</strong>'s fixed line license initially included 100% coverage of the Pearl development; broadband internet services must beprovided within three months and fixed line voice services must be provided within twelve months from the effective date of thelicense i.e. April 29, 2010. The fixed line license contains further obligations to cover West Bay CBD with fixed line voice serviceswithin 30 months and to provide 100% coverage in the rest of <strong>Qatar</strong> within 48 months. <strong>Vodafone</strong> launched its commercialbroadband service at the Pearl on 14th July 2010 while fixed voice services are to be extended to the Pearl by Q3-2011.<strong>Vodafone</strong>’s entry in <strong>Qatar</strong> has changed landscape of <strong>Qatar</strong>’s telecom market as it was served by the only operator “<strong>Qatar</strong>Telecom (Qtel)”. <strong>Vodafone</strong> has provided one more option to customers in terms of offer, pricing and customer service. To someextent it was also benefited from dual SIM effect as till now customers were not having second choice. <strong>Vodafone</strong> <strong>Qatar</strong> will beable to capitalize on several levels from its strong affiliation with <strong>Vodafone</strong> Group, including international roaming agreements,network purchasing, billing platforms and handset purchasing, to mention a few.March - 2011 4

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong><strong>Qatar</strong> Telecom Sector<strong>Qatar</strong> – an appealing growth story<strong>Qatar</strong>’s economic growth model is based on liberal economic and financial policies and is well integrated into the globaleconomy. <strong>Qatar</strong>, the world largest exporter of natural gas and the third largest natural gas producer is one of the fastest growingeconomies in the world. A robust growth in oil prices in the past five years, coupled with a tight fiscal regime, led to a substantialwindfall gains for the government revenues. <strong>Qatar</strong>’s nominal GDP grew at an astounding CAGR of 17.6% during 2006-09, whilereal GDP grew at a CAGR of 20% during the same period. The country maintained its growth momentum despite the financialcrisis and posted an impressive real GDP growth of 25.4% in 2008 and 8.6% in 2009 as compared to a negative or pausedgrowth in neighboring countries. As per latest available data, <strong>Qatar</strong> registered a nominal GDP of QAR312.1bn in the first 9-months of 2010. In 3Q10 GDP grew 21.1% YoY and 13.1% QoQ, reaching QAR111.3bn. <strong>Qatar</strong> also enjoys high GDP per capitaof around USD70,000.<strong>Qatar</strong> Real GDP growth3953653353052752452151851551252006 2007 2008 2009 2010e 2011e30.0%25.0%20.0%15.0%10.0%5.0%Real GDP (QAR bn) - LHSReal GDP growth - RHSSource: <strong>Qatar</strong> Central Bank & IMF<strong>Qatar</strong>'s sound and balanced economic policy aims at achievement of sustainable economic development; diversifying nationalincome resources; increasing private sector contribution in economic development; encouraging inflows of direct foreigninvestments. Over the years the Government has taken many proactive steps to facilitate private as well as foreign participation inmany business ventures. All round economic developments are underway in <strong>Qatar</strong> right from core projects of hydrocarbon sectorto infrastructure, real estate and financial sectors. <strong>Qatar</strong>’s biggest strength is continuous expansion in its liquefied natural gas(LNG) capacity. The country has significant expansion plans to increase the production of LNG over the coming years. Apart fromthis, the main successes are increasing infrastructure support in terms of airport expansion and upcoming new internationalairport, increasing power capacity, setting up of Energy City <strong>Qatar</strong>, health and education projects, setting up of <strong>Qatar</strong> FinancialCentre, etc.<strong>Qatar</strong> won the bid to host FIFA World CupIn December 2010, <strong>Qatar</strong> won the bid to host FIFA World Cup 2022 and will be the first country in the Middle East to ever host it.<strong>Qatar</strong> has promised to spend USD50bn on infrastructure and USD4bn on new stadiums for the event. The <strong>Qatar</strong>i economy willbenefit through various avenues. Construction activity will witness a significant increase as projects activity witness an increasedactivity, hospitality and real estate sector will boom as <strong>Qatar</strong> plans to increase hotel and apartment capacity to 84,000 roomsmore than 60,000 minimum requirement of the FIFA.<strong>Qatar</strong> Telecom Profile000s 2006 2007 2008 2009 2010*Cellular Subscribers (000) 920 1,264 1,683 2,472 2,811Cellular Penetration 88% 103% 116% 152% 166%Prepaid subscribers % 80% 83% 80% 87% 88%Postpaid subscribers % 20% 17% 20% 13% 12%Fixed Line Subscribers (000) 228 237 263 285 292Fixed Line Penetration % 22% 19% 18% 18% 17%Internet Users (000) 290 421 500 564 725User Penetration % 28% 34% 34% 35% 43%* Prepaid & postpaid mobile data and Internet users for 2010 are our estimatesSource: ITU, Industry sources and Global ResearchMarch - 2011 5

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>With prudent government policies, <strong>Qatar</strong> has weathered the credit crisis well enough. As per IMF estimates, <strong>Qatar</strong> real GDP isexpected to increase 16.0% in 2010 and 20.0% in 2011, which is among the highest in the world, backed by higher hydrocarbonprices, huge expansion in natural gas production and public investment expenditure.The telecom sector in any country always have strong correlation with the economic environment under which it operates. <strong>Qatar</strong>offers strong economic fundamentals, proactive government, growing population base, strong GDP per capita, booming businessenvironment, etc. Therefore, we are of the opinion that all these economic factors are highly supportive for further growth of thiscore sector in <strong>Qatar</strong>.GSM Subscribers and Penetration Forecasts4.504.003.503.002.502.001.501.000.500.002010-11e 2011-12e 2012-13e 2013-14e195.0%190.0%185.0%180.0%175.0%170.0%165.0%160.0%Subscribers (mn)Penetration Rate*Year end in the chart is corresponding to <strong>Vodafone</strong> <strong>Qatar</strong>’s financial year end (April-March)Source: Global ResearchLast in GCC to open its doorsMobile subscribers in <strong>Qatar</strong> have grown at a 2006-10 CAGR of 25% to 2.81mn. However, Qtel was the only player in the marketto take advantage of the rapid growth in cellular subscribers till <strong>Vodafone</strong> entered the market in 2H09. We believe <strong>Qatar</strong> iscurrently at a stage where the incumbent operator is likely to lose its mobile market share to the new operator. The trend hasalready set in with <strong>Vodafone</strong> captured 25.3% of the market subscribers at of the end of 4Q10.<strong>Vodafone</strong> to extend its reach in the fixed line segmentThe incumbent is also likely to face competition in the fixed line sector as <strong>Vodafone</strong> has already rolled out its fixed line operationsin 2H10. The launch will give the incumbent the first taste of competition in this segment which is likely to boost the fixed linepenetration rate. Fixed line subscribers have grown at a 2006-10 CAGR of 5.1%.Internet usage yet to take offInternet users have grown at a 2006-10 CAGR of 20.1%. In <strong>Qatar</strong>, the internet user penetration rate reached around 43% at theend of 2010 which leaves room for significant growth ahead. The growth has lagged its peers in GCC as Qtel was the onlyprovider. However, the entry of <strong>Vodafone</strong> is likely to accelerate the growth in this segment. We expect around 38% YoY growth ininternet user base for the year 2011.Revenue market share<strong>Vodafone</strong> <strong>Qatar</strong> launched its mobile services in June 2009 and in a short span of around 18-months it achieved significantmileage in revenue market share which was at 15.9% at the end of June 2010 and increased to 23.7% at the end of Dec. 2010. Itachieved this by posing stiff competition to the incumbent operator, Qtel, as during these six quarters Qtel’s mobile revenuedeclined from QAR1,015.2mn in Q2 ended June 2009 to QAR857.7mn at the end of Q4 ended Dec. 2010. Sector’s mobilerevenue grew from QAR1,018.2mn in June 2009 to QAR1,124.2mn in Dec. 2010, witnessing a marginal CAGR of 1.7%.March - 2011 6

Dec-08Mar-09Jun-09Sep-09Dec-09Mar-10Jun-10Sep-10Dec-10Dec-08Mar-09Jun-09Sep-09Dec-09Mar-10Jun-10Sep-10Dec-10(in '000)Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>Revenue Market Share120.0%100.0%80.0%99.7%96.4%83.9% 86.2% 84.1%80.5%76.3%60.0%40.0%20.0%0.0%16.1%23.7%19.5%13.8% 15.9%0.3%3.6%Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10<strong>Vodafone</strong>QtelSource: Company reports & Global ResearchCustomer market share<strong>Vodafone</strong> <strong>Qatar</strong>’s current subscriber base of 711.2k gives it a 43% mobile population share and customer market share of 25.3%.At the end of FY2009-10, the subscriber base was at 464.9k, which was 121% ahead of the company’s own projections.<strong>Vodafone</strong> <strong>Qatar</strong> rapidly gaining the subscribers market share which increased from 0.8% at the end of June 2009 to 25.3% at theend of Dec. 2010. In the last six quarters (Sep.09 to Dec.10), <strong>Vodafone</strong> <strong>Qatar</strong>’s net adds were 135.8k, 202.8k, 111.4k, 69.5k,66.4k and 110.3k while Qtel’s customer net adds were 214.4k, -17.6k, 31.2k, 4.5k, -20.3k and -33.7k respectively.Customer Market ShareCustomer Additions (in '000)110.0%100.0% 99.9% 99.2%100.0%93.4%90.0%85.7% 82.2% 80.1% 78.0%80.0%74.7%70.0%60.0%50.0%40.0%30.0%25.3%17.8% 19.9% 22.0%20.0%14.3%6.6%10.0%0.1% 0.8%0.0%250.0202.7200.0150.0100.050.00.0146.51.092.214.0214.4135.8202.8111.431.269.5 66.44.5110.3-50.0(17.6)(20.3) (33.7)<strong>Vodafone</strong>Qtel<strong>Vodafone</strong>QtelSource: Company reports & Global ResearchAt the quarter ended Dec. 2010, <strong>Vodafone</strong> <strong>Qatar</strong>’s customer market share grew by 332bps QoQ to 25.3% while revenue marketshare witnessed a QoQ growth of 420bps to 23.7%. The company’s customer base increased by 18.4% QoQ and 101.1% YoY.We expect <strong>Vodafone</strong> <strong>Qatar</strong>’s mobile subscribers to increase at a CAGR of 28.1% during FY2011 to FY2014. We forecast<strong>Vodafone</strong>’s customer market share will increase to about 41% by FY2014 from the current 25.3%.March - 2011 7

Q2-2008Q3-2008Q4-2008Q1-2009Q2-2009Q3-2009Q4-2009Q1-2010Q2-2010Q3-2010Q4-2010ARPU (USD)ARPU (USD)Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>1.81.61.41.21.00.80.60.40.2-<strong>Vodafone</strong> <strong>Qatar</strong> - Subscribers & Market Share Forecasts2010-11e 2011-12e 2012-13e 2013-14e45%40%35%30%25%20%Subscribers (in mn) - LHSMarket shareYear end in the chart is corresponding to <strong>Vodafone</strong> <strong>Qatar</strong>’s financial year end ( April-March)Source: Global ResearchARPUHistorically <strong>Qatar</strong> enjoyed relatively high mobile ARPU in the region. However, since the entry of <strong>Vodafone</strong> <strong>Qatar</strong> ARPU havecome down significantly mainly due to pricing pressure. Before the entry of <strong>Vodafone</strong>, Qtel’s mobile ARPU was as high asUSD55.2 (2Q08) which now declined to USD30.8 (4Q10).Qtel mobile ARPU<strong>Vodafone</strong> & Qtel ARPU Trend50.045.040.035.030.025.047.536.4 33.747.032.427.733.9 31.330.828.633.030.860.050.040.030.020.010.055.252.9 52.844.2 43.036.433.7 32.433.931.3 30.820.0Sept-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-100.0<strong>Vodafone</strong>QtelSource: Company reports & Global Research<strong>Vodafone</strong>’s mobile ARPU are much more comparable to other second operators in GCC. In case of <strong>Vodafone</strong>, ARPU hasincreased in the last three quarters, we expect it to increase further as from now onwards it will focus on postpaid segment. Thecompany was primarily focusing on prepaid segment as its base comprises mostly blue-collar workers.March - 2011 8

ARPU (USD)Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>50.0Mobile ARPU of second operators in GCC45.040.035.030.025.020.015.010.0Sept-09 Dec-09 Mar-10 Jun-10 Sep-10Emirates Integrated Telecom Co. (du) - UAE<strong>Vodafone</strong> <strong>Qatar</strong>Source: Company reports & Global ResearchNawras Telecom - OmanZain - BahrainExpatriates - main focus of <strong>Vodafone</strong> <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>’s customer base is predominantly made up of workers and short-term expats. It has now started targeting<strong>Qatar</strong>is, Gulf Arabs, other Arabs from the MENA region, long-term residents and businesses. Part of that process will involvetargeting those communities with aggressive marketing and special offers.Posing stiff competitionThe advent of the second operator in the <strong>Qatar</strong>i market had spurred incumbent Qtel to improve its services as well. The morecompetitive environment in <strong>Qatar</strong> has already paid dividends to the country’s consumer base. According to management, the costper average international call minute had dropped from between QAR2.50-QAR3.00 at the time of the <strong>Vodafone</strong> <strong>Qatar</strong> launch toaround QAR1.00 now. <strong>Vodafone</strong> <strong>Qatar</strong>'s network now supports customers making a combined average of about three millionlocal call minutes every day, and more than two million international call minutes a day.<strong>Vodafone</strong> <strong>Qatar</strong> launched its mobile broadband services in the country with a range of flexible tariffs designed to lure priceconscious customers, and in August 2010, it introduced three new ranges of mobile numbers in line with its increasing subscriberbase. It also offers an exclusive sequential number range for its Business World customers. These are the few ways to stayahead in a highly competitive environment. <strong>Vodafone</strong> <strong>Qatar</strong> has plans for several product and service launches. In November2010, it launched <strong>Vodafone</strong> Money Transfer (VMT), an international mobile money transfer. In partnership with Doha Bank,<strong>Vodafone</strong>'s financial services provider for <strong>Vodafone</strong> Money Transfer, and Globe Telecom, <strong>Vodafone</strong> Money Transfer will enablecustomers to instantly make mobile-to-mobile money transfer from <strong>Qatar</strong> to the Philippines. In future, <strong>Vodafone</strong> Money Transferwill be expanding remittance options beyond the Philippines to countries across Asia, Africa and the Middle East.March - 2011 9

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>Peer ComparisonThe company’s operations are very young therefore we believe that it is not directly comparable with any of the operators in theregion. As <strong>Vodafone</strong> <strong>Qatar</strong> is a second operator in <strong>Qatar</strong> we have made comparative analysis of second operators in GCC withtheir initial years performance.Initial years performance of GCC based Second Operators<strong>Vodafone</strong> * Nawras Du Mobily<strong>Qatar</strong> Oman UAE KSAMobile Subscribers Yr - 1 0.46mn 0.24mn 1.22mn 2.30mnYr - 2 0.76mn 0.57mn 2.47mn 6.07mnYr - 3 1.06mn 1.02mn 3.48mn 11.10mnMobile customer marketshare Yr - 1 18% 18% 16% 16%Yr - 2 25% 31% 26% 31%Yr - 3 32% 41% 31% 39%Revenue (USD mn) Yr - 1 99 38 419 443Yr - 2 258 129 1,077 1,558Yr - 3 373 245 1,455 2,251EBITDA (USD mn) Yr - 1 (62) (54) (192) (30)Yr - 2 (5) 10 101 533Yr - 3 56 66 290 786EBITDA Margin Yr - 1 -62% -143% -46% -7%Yr - 2 -2% 8% 9% 34%Yr - 3 15% 27% 20% 35%Net Profit (USD mn) Yr - 1 (185) (73) (241) (311)Yr - 2 (163) (31) 1 187Yr - 3 (106) 21 72 368* Numbers for <strong>Vodafone</strong> <strong>Qatar</strong> for the year 2 & 3 are Global Research's estimatesSource: Company reports & Global ResearchMarch - 2011 10

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong> - Financial Overview & Forecasts<strong>Vodafone</strong> <strong>Qatar</strong> follows April-March as its financial year. As the company launched its commercial operation in July 2009, thefinancial year 2009-10 was the company’s first year of operation in which it reported a revenue of QAR361.5mn. Out of this,revenue of QAR305.1mn was generated for the financial year before the inclusion of Star Number and handset revenue, with alarge proportion of total revenue being derived from international calling. During last financial year, the company raised QAR85mnfrom Star Number reservation fees. In FY2009-10, the company recognized QAR14.3mn of Star Number revenue in the totalrevenue, with the remaining Star Number revenue reported as deferred revenue in the Balance Sheet to be recognized in futureyears. The company’s policy is to recognize it as revenue over four years period. Among the major cost component areDepreciation and amortization of license cost. The license fee is being amortized over 19.16 years, resulting in an annual chargeof QAR402.8mn. The company reported negative EBITDA of QAR225.3mn for FY2009-10. It reported a net loss of QAR673.4mnin FY2009-10 which was at QAR132.9mn in FY2008-09.<strong>Vodafone</strong> <strong>Qatar</strong> KPIs3Q10-11 2Q10-11 1Q10-11 4Q09-10Mobile subs ('000) 711.2 600.9 534.5 465.0Net adds ('000) 110.3 66.4 69.5 111.4Mobile customer marketshare (%) 25% 22.0% 19.9% 17.8%ARPU (QAR) 120.0 112.0 104.0 101.0Revenue (QAR mn) 266.5 209.7 175.8 144.7EBITDA (QAR mn) 1.0 (23.1) (8.8) (28.7)The company follows April-March as its financial year.Source: Company reportsIn 3Q10-11, <strong>Vodafone</strong>’s revenue grew by 50% YoY and 27.1% QoQ to QAR266.5mn. Total revenue for 9M10-11 wasQAR652mn. Fixed-line broadband services are now being offered on the Pearl while fixed voice services are to be extended tothe Pearl by 4Q11. We expect the company to report a YoY growth of 159.3% in total revenue to QAR937.6mn for FY2010-11and estimate a revenue CAGR of 30.5% during FY2010-11 to FY2013-14.Revenue and EBITDA Forecasts(QAR mn)2,250.02,000.01,750.01,500.01,250.01,000.0750.0500.0250.0-(250.0)likely to achieve +ve EBITDA2010-11e 2011-12e 2012-13e 2013-14eRevenueEBITDASource: Global ResearchMarch - 2011 11

(QAR mn)(QAR mn)Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>EBITDA BreakevenWith positive EBITDA of QAR1mn in 3Q10-11, the company's EBITDA loss declined to QAR30.9mn in 9M10-11 fromQAR185.8mn reported in 9M09-10. The company’s operations turned EBITDA positive one quarter ahead of management’sexpectations. Management forecasts operations to report positive EBITDA on a cumulative basis by mid-2012 (calendar year).We expect <strong>Vodafone</strong> <strong>Qatar</strong> to turn EBITDA positive on a cumulative basis in FY2011-12. We expect EBITDA to increase atFY2011-12 to FY2013-14 CAGR of 45.3%.Capex and Cash Flow ForecastBased on our financial model we estimate <strong>Vodafone</strong> <strong>Qatar</strong> to achieve positive cash flow in FY2012-13. The company’s capexwas QAR235mn for 9M10-11 and management stated that capex for 4Q10-11 is estimated at QAR57mn. Capex relating tonationwide fixed-line deployment (under the National Broadband Network) are yet to be determined. However, managementexpects long-term capital expenditure expected to stabilize at 8% of revenue from 2013 onwards. We estimate <strong>Vodafone</strong> <strong>Qatar</strong> toachieve positive FCF in FY2012-13.500400Free Cash Flow Forecasts300200100-(100)(200)(300)(400)likely to achieve +ve cash flow2010-11e 2011-12e 2012-13e 2013-14eSource: Global ResearchOperations likely to achieve positive bottom-line in FY2013-14In 3Q10-11, the company reported a net loss of QAR144.4mn which declined by 1.2% YoY and 12.1% QoQ. We estimate<strong>Vodafone</strong> <strong>Qatar</strong>’s bottom-line to remain negative till FY2012-13. We forecast the company to report net loss of QAR594.9mn inFY2010-11, QAR386.3mn in FY2011-12 and QAR166mn in FY2012-13. The operations are likely to achieve positive bottom-linein FY2013-14 with estimated full year net profit of QAR23mn.Net Profit Forecasts100.02010-11e 2011-12e 2012-13e 2013-14e-(100.0)(200.0)bottom-line likely to turn +ve(300.0)(400.0)(500.0)(600.0)(700.0)Source: Global ResearchMarch - 2011 12

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>Financial StatementsBalance Sheet<strong>Vodafone</strong> <strong>Qatar</strong>QAR mn 2008-09 2009-10 2010-11e 2011-12e 2012-13e 2013-14eCash & cash equivalents 1 85 63 65 78 350Trade & other receivables 26 118 225 258 314 344Inventories 5 22 21 31 44 52Current assets 31 225 309 353 435 746Prepayments 5 4 7 8 9 11License cost - 7,716 7,726 7,726 7,726 7,726Amortization - (369) (772) (1,175) (1,578) (1,981)License cost (net) 7,716 7,347 6,954 6,551 6,148 5,745Property, plant and equipment 389 913 1,260 1,531 1,695 1,857Accumulated depreciation (1) (81) (225) (375) (534) (699)Net property, plant andequipment389 832 1,035 1,155 1,161 1,158Non-Current Assets 8,110 8,183 7,995 7,714 7,318 6,913Total Assets 8,141 8,409 8,304 8,068 7,753 7,659Short-term Borrowings 35 - - - - -Trade & other payables 3,166 364 563 584 436 438Current Liabilities 3,201 364 563 584 436 438Long term debt - 379 670 798 798 678End of employee benefits 0 2 2 2 2 3Provisions 0 5 5 5 6 6Total Liabilities 3,201 750 1,240 1,390 1,241 1,124Share capital 5,072 8,454 8,454 8,454 8,454 8,454Reserves (133) (795) (1,390) (1,776) (1,942) (1,919)Total Shareholders' Equity 4,939 7,659 7,064 6,678 6,512 6,535Total Liabilities &Shareholders' Equity8,141 8,409 8,304 8,068 7,753 7,659Source: Company Reports & Global ResearchThe company's Financial Year ends in MarchMarch - 2011 13

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>INCOME STATEMENT<strong>Vodafone</strong> <strong>Qatar</strong>QAR mn 2008-09 2009-10 2010-11e 2011-12e 2012-13e 2013-14eRevenue 0 362 938 1,359 1,743 2,083Revenue Growth 159% 45% 28% 20%EBITDA (124) (225) (17) 204 436 625Depreciation (1) (80) (145) (150) (159) (164)Amortization of license - (369) (403) (403) (403) (403)EBIT (125) (675) (564) (349) (126) 58Finance costs (20) (25) (35) (40) (44) (41)Interest income 12 27 4 3 4 6Profit before tax (133) (673) (595) (386) (166) 23Income Tax - - - - - -Profit after tax (133) (673) (595) (386) (166) 23Source: Company Reports & Global ResearchThe company's Financial Year ends in MarchMarch - 2011 14

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>CASH FLOW STATEMENT<strong>Vodafone</strong> <strong>Qatar</strong>QAR mn 2008-09 2009-10 2010-11e 2011-12e 2012-13e 2013-14eOperating ActivitiesProfit for the year (133) (673) (595) (386) (166) 23Depreciation 1 80 145 150 159 164Amortization of licenses - 369 403 403 403 403Interest income (12) (27) (4) (3) (4) (6)Interest expense 20 25 35 40 44 41Working capital changes:Inventories (5) (17) 1 (9) (13) (9)Trade and other receivables (31) (92) (107) (33) (56) (30)Financing costs (20) (5) - - - -Trade and other payables 79 185 199 22 (149) 2Increase in end of employee benefits 0 2 - - - -Increase in provisions 0 5 0 0 0 0Cash Flow from Operations (100) (148) 76 183 219 589Investing ActivitiesPurchase of property, plant andequipment (389) (424) (347) (271) (165) (161)Licence fees (4,630) (3,086) (10) - - -Prepayments - - (2) (1) (1) (1)Interest received 12 27 4 3 4 6Cash Flow from Investing Activities (5,007) (3,484) (355) (269) (162) (156)Financing ActivitiesIssue of ordinary share capital 5,072 3,393 - - - -Proceeds ( Repayment) fromborrowings - 379 291 127 - (120)Net movement in short termborrowings 35 (35) - - - -Interest paid (0) (21) (35) (40) (44) (41)Cash Flow from Financing Activities 5,107 3,716 256 87 (44) (160)Cash and cash equivalents - Beginning - 1 85 63 65 78Increase / Decrease in Cash 1 85 (22) 2 13 272Cash and cash equivalents - Ending 1 85 63 65 78 350Source: Company Reports & Global ResearchThe company's Financial Year ends in MarchMarch - 2011 15

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>Ratio Analysis<strong>Vodafone</strong> <strong>Qatar</strong>2009-10 2010-11e 2011-12e 2012-13e 2013-14eLiquidity RatiosCurrent ratio (x) 0.6 0.5 0.6 1.0 1.7Quick ratio (x) 0.6 0.5 0.6 0.9 1.6Cash ratio (x) 0.2 0.1 0.1 0.2 0.8Profitability RatiosEBITDA Margin -62.3% -1.8% 15.0% 25.0% 30.0%EBIT Margin -186.6% -60.2% -25.7% -7.2% 2.8%Net Profit Margin -186.3% -63.5% -28.4% -9.5% 1.1%Return on Average Equity -10.7% -8.1% -5.6% -2.5% 0.4%Return on Average Assets -8.1% -7.1% -4.7% -2.1% 0.3%Efficiency RatiosDebtors Turnover (x) 5.0 5.5 5.6 6.1 6.3Inventory Turnover (x) 27.3 43.8 52.6 47.0 43.6Creditors Turnover (x) 0.1 0.7 0.8 1.2 1.6Total Assets Turnover (x) 0.0 0.1 0.2 0.2 0.3Total Net Fixed Assets Turnover (x) 0.6 1.0 1.2 1.5 1.8Equity Turnover (x) 0.1 0.1 0.2 0.3 0.3COS / Sales 68.5% 0.9% 1.0% 1.1% 1.3%SG&A / Sales 93.8% 17.2% 14.8% 13.5% 12.9%Leverage RatiosDebt / Equity (x) 0.0 0.1 0.1 0.1 0.1Net Debt / EBITDA (x) (1.30) (36.59) 3.60 1.65 0.52Interest Coverage (x) (8.8) (0.5) 5.0 9.9 15.4Ratios Used for ValuationNumber of shares (in mn) 845.4 845.4 845.4 845.4 845.4EPS (QAR) (0.80) (0.70) (0.46) (0.20) 0.03BV per share (QAR) 9.1 8.4 7.9 7.7 7.7EV / Revenue (x) 17.5 6.0 4.1 3.2 2.6EV / EBITDA (x) (28.1) (341.5) 27.2 12.7 8.6Market price share (QAR) 8.05 7.57 7.57 7.57 7.57Market capitalization (QAR mn) 6,805 6,400 6,400 6,400 6,400P/E ratio (x) nm nm nm nm 277.6P/BV ratio (x) 0.9 0.9 1.0 1.0 1.0Source: Company Reports & Global ResearchThe company's Financial Year ends in MarchHistorical P/E & P/BV multiples pertain to respective year-end prices, while those for future years are based on closing prices on the <strong>Qatar</strong>Exchange as of March 7th 2011.March - 2011 16

Global Research - <strong>Qatar</strong><strong>Vodafone</strong> <strong>Qatar</strong>DisclosureThe following is a comprehensive list of disclosures which may or may not apply to all our researches. Only the relevantdisclosures which apply to this particular research has been mentioned in the table below under the heading of disclosure.Disclosure ChecklistCompanyRecommendationBloombergTickerReutersTicker Price Disclosure<strong>Vodafone</strong> <strong>Qatar</strong> Hold VFQS QD VFQS.QA QAR7.57 1,101. Global Investment House did not receive and will not receive any compensation from the company or anyone else for thepreparation of this report.2. The company being researched holds more than 5% stake in Global Investment House.3. Global Investment House makes a market in securities issued by this company.4. Global Investment House acts as a corporate broker or sponsor to this company.5. The author of or an individual who assisted in the preparation of this report (or a member of his/her household) has a directownership position in securities issued by this company.6. An employee of Global Investment House serves on the board of directors of this company.7. Within the past year, Global Investment House has managed or co-managed a public offering for this company, for which itreceived fees.8. Global Investment House has received compensation from this company for the provision of investment banking or financialadvisory services within the past year.9. Global Investment House expects to receive or intends to seek compensation for investment banking services from thiscompany in the next three month.10. Please see special footnote below for other relevant disclosures.Global Research: Equity Ratings DefinitionsGlobal RatingDefinitionSTRONG BUYBUYHOLDSELLFair value of the stock is >20% from the current market priceFair value of the stock is between +10% and +20% from the current market priceFair value of the stock is between +10% and -10% from the current market priceFair value of the stock is < -10% from the current market priceDisclaimerThis material was produced by Global Investment House KSCC (‘Global’),a firm regulated by the Central Bank of Kuwait. This document is notto be used or considered as an offer to sell or a solicitation of an offer to buy any securities. Global may, from time to time to the extent permittedby law, participate or invest in other financing transactions with the issuers of the securities (‘securities’), perform services for or solicit businessfrom such issuer, and/or have a position or effect transactions in the securities or options thereof. Global may, to the extent permitted byapplicable Kuwaiti law or other applicable laws or regulations, effect transactions in the securities before this material is published to recipients.Information and opinions contained herein have been compiled or arrived by Global from sources believed to be reliable, but Global has notindependently verified the contents of this document. Accordingly, no representation or warranty, express or implied, is made as to and noreliance should be placed on the fairness, accuracy, completeness or correctness of the information and opinions contained in this document.Global accepts no liability for any loss arising from the use of this document or its contents or otherwise arising in connection therewith. Thisdocument is not to be relied upon or used in substitution for the exercise of independent judgment. Global shall have no responsibility or liabilitywhatsoever in respect of any inaccuracy in or omission from this or any other document prepared by Global for, or sent by Global to any personand any such person shall be responsible for conducting his own investigation and analysis of the information contained or referred to in thisdocument and of evaluating the merits and risks involved in the securities forming the subject matter of this or other such document. Opinionsand estimates constitute our judgment and are subject to change without prior notice. Past performance is not indicative of future results. Thisdocument does not constitute an offer or invitation to subscribe for or purchase any securities, and neither this document nor anything containedherein shall form the basis of any contract or commitment whatsoever. It is being furnished to you solely for your information and may not bereproduced or redistributed to any other person. Neither this report nor any copy hereof may be distributed in any jurisdiction outside Kuwaitwhere its distribution may be restricted by law. Persons who receive this report should make themselves aware of and adhere to any suchrestrictions. By accepting this report you agree to be bound by the foregoing limitations.March - 2011 17

Global Investment HouseWebsite: www.globalinv.netGlobal TowerSharq, Al-Shuhada Str.Tel. + (965) 2 295 1000Fax. + (965) 2 295 1005P.O. Box: 28807 Safat, 13149 KuwaitResearchFaisal Hasan, CFA(965) 2295-1270fhasan@global.com.kwIndexRasha Al-Huneidi(965) 2295-1285huneidi@global.com.kwBrokerageFouad Fahmi Darwish(965) 2295-1700fdarwish@global.com.kwWealth Management -KuwaitRasha Al-Qenaei(965) 2295-1380alqenaei@global.com.kwWealth Management -InternationalFahad Al-Ibrahim(965) 2295-1400fahad@global.com.kwGlobal KuwaitTel: (965) 2 295 1000Fax: (965) 2 295 1005P.O.Box 28807 Safat, 13149KuwaitGlobal Abu DhabiTel: (971) 2 6744446Fax: (971) 2 6725263/4P.O.Box 127373 Abu Dhabi,UAEGlobal EgyptTel: (202) 24189705/06Fax: (202) 2290597224 Cleopatra St., Heliopolis,CairoGlobal BahrainTel: (973) 17 210011Fax: (973) 17 210222P.O.Box 855 Manama,BahrainGlobal Saudi ArabiaTel: (966) 1 2994100Fax: (966) 1 2994199P.O. Box 66930 Riyadh11586,Kingdom of Saudi ArabiaGlobal JordanTel: (962) 6 5005060Fax: (962) 6 5005066P.O.Box 3268 Amman 11180,JordanGlobal DubaiTel: (971) 4 4477066Fax: (971) 4 4477067P.O.Box 121227 Dubai,UAEGlobal <strong>Qatar</strong>Tel: (974) 4967305Fax: (974) 4967307P.O.Box 18126 Doha,<strong>Qatar</strong>Global Wealth ManagerE-mail: contactus@global.com.kwTel: (965) 1-804-242