07 CAFR cover FINAL.p65 - WMATA.com

07 CAFR cover FINAL.p65 - WMATA.com

07 CAFR cover FINAL.p65 - WMATA.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

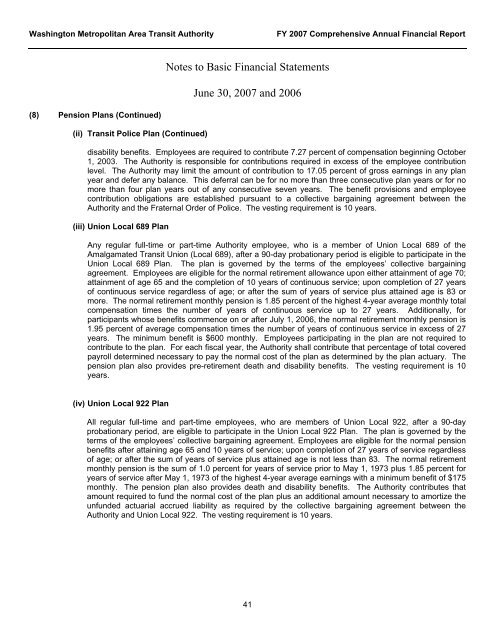

Washington Metropolitan Area Transit AuthorityFY 20<strong>07</strong> Comprehensive Annual Financial ReportNotes to Basic Financial StatementsJune 30, 20<strong>07</strong> and 2006(8) Pension Plans (Continued)(ii) Transit Police Plan (Continued)disability benefits. Employees are required to contribute 7.27 percent of <strong>com</strong>pensation beginning October1, 2003. The Authority is responsible for contributions required in excess of the employee contributionlevel. The Authority may limit the amount of contribution to 17.05 percent of gross earnings in any planyear and defer any balance. This deferral can be for no more than three consecutive plan years or for nomore than four plan years out of any consecutive seven years. The benefit provisions and employeecontribution obligations are established pursuant to a collective bargaining agreement between theAuthority and the Fraternal Order of Police. The vesting requirement is 10 years.(iii) Union Local 689 PlanAny regular full-time or part-time Authority employee, who is a member of Union Local 689 of theAmalgamated Transit Union (Local 689), after a 90-day probationary period is eligible to participate in theUnion Local 689 Plan. The plan is governed by the terms of the employees’ collective bargainingagreement. Employees are eligible for the normal retirement allowance upon either attainment of age 70;attainment of age 65 and the <strong>com</strong>pletion of 10 years of continuous service; upon <strong>com</strong>pletion of 27 yearsof continuous service regardless of age; or after the sum of years of service plus attained age is 83 ormore. The normal retirement monthly pension is 1.85 percent of the highest 4-year average monthly total<strong>com</strong>pensation times the number of years of continuous service up to 27 years. Additionally, forparticipants whose benefits <strong>com</strong>mence on or after July 1, 2006, the normal retirement monthly pension is1.95 percent of average <strong>com</strong>pensation times the number of years of continuous service in excess of 27years. The minimum benefit is $600 monthly. Employees participating in the plan are not required tocontribute to the plan. For each fiscal year, the Authority shall contribute that percentage of total <strong>cover</strong>edpayroll determined necessary to pay the normal cost of the plan as determined by the plan actuary. Thepension plan also provides pre-retirement death and disability benefits. The vesting requirement is 10years.(iv) Union Local 922 PlanAll regular full-time and part-time employees, who are members of Union Local 922, after a 90-dayprobationary period, are eligible to participate in the Union Local 922 Plan. The plan is governed by theterms of the employees’ collective bargaining agreement. Employees are eligible for the normal pensionbenefits after attaining age 65 and 10 years of service; upon <strong>com</strong>pletion of 27 years of service regardlessof age; or after the sum of years of service plus attained age is not less than 83. The normal retirementmonthly pension is the sum of 1.0 percent for years of service prior to May 1, 1973 plus 1.85 percent foryears of service after May 1, 1973 of the highest 4-year average earnings with a minimum benefit of $175monthly. The pension plan also provides death and disability benefits. The Authority contributes thatamount required to fund the normal cost of the plan plus an additional amount necessary to amortize theunfunded actuarial accrued liability as required by the collective bargaining agreement between theAuthority and Union Local 922. The vesting requirement is 10 years.41