Aberdeen Global II - Self Bank

Aberdeen Global II - Self Bank

Aberdeen Global II - Self Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

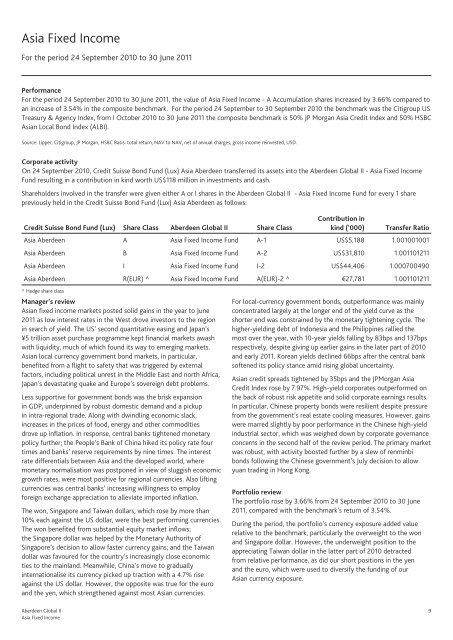

Asia Fixed IncomeFor the period 24 September 2010 to 30 June 2011PerformanceFor the period 24 September 2010 to 30 June 2011, the value of Asia Fixed Income - A Accumulation shares increased by 3.66% compared toan increase of 3.54% in the composite benchmark. For the period 24 September to 30 September 2010 the benchmark was the Citigroup USTreasury & Agency Index, from I October 2010 to 30 June 2011 the composite benchmark is 50% JP Morgan Asia Credit Index and 50% HSBCAsian Local Bond Index (ALBI).Source: Lipper, Citigroup, JP Morgan, HSBC Basis: total return, NAV to NAV, net of annual charges, gross income reinvested, USD.Corporate activityOn 24 September 2010, Credit Suisse Bond Fund (Lux) Asia <strong>Aberdeen</strong> transferred its assets into the <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong> - Asia Fixed IncomeFund resulting in a contribution in kind worth US$118 million in investments and cash.Shareholders involved in the transfer were given either A or I shares in the <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong> - Asia Fixed Income Fund for every 1 sharepreviously held in the Credit Suisse Bond Fund (Lux) Asia <strong>Aberdeen</strong> as follows:Contribution inCredit Suisse Bond Fund (Lux) Share Class <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong> Share Classkind (‘000) Transfer RatioAsia <strong>Aberdeen</strong> A Asia Fixed Income Fund A-1 US$5,188 1.001001001Asia <strong>Aberdeen</strong> B Asia Fixed Income Fund A-2 US$31,810 1.001101211Asia <strong>Aberdeen</strong> I Asia Fixed Income Fund I-2 US$44,406 1.000700490Asia <strong>Aberdeen</strong> R(EUR) ^ Asia Fixed Income Fund A(EUR)-2 ^ €27,781 1.001101211^ Hedge share classManager’s reviewAsian fixed income markets posted solid gains in the year to June2011 as low interest rates in the West drove investors to the regionin search of yield. The US’ second quantitative easing and Japan’s¥5 trillion asset purchase programme kept financial markets awashwith liquidity, much of which found its way to emerging markets.Asian local currency government bond markets, in particular,benefited from a flight to safety that was triggered by externalfactors, including political unrest in the Middle East and north Africa,Japan’s devastating quake and Europe’s sovereign debt problems.Less supportive for government bonds was the brisk expansionin GDP, underpinned by robust domestic demand and a pickupin intra-regional trade. Along with dwindling economic slack,increases in the prices of food, energy and other commoditiesdrove up inflation. In response, central banks tightened monetarypolicy further; the People’s <strong>Bank</strong> of China hiked its policy rate fourtimes and banks’ reserve requirements by nine times. The interestrate differentials between Asia and the developed world, wheremonetary normalisation was postponed in view of sluggish economicgrowth rates, were most positive for regional currencies. Also liftingcurrencies was central banks’ increasing willingness to employforeign exchange appreciation to alleviate imported inflation.The won, Singapore and Taiwan dollars, which rose by more than10% each against the US dollar, were the best performing currencies.The won benefited from substantial equity market inflows;the Singapore dollar was helped by the Monetary Authority ofSingapore’s decision to allow faster currency gains; and the Taiwandollar was favoured for the country’s increasingly close economicties to the mainland. Meanwhile, China’s move to graduallyinternationalise its currency picked up traction with a 4.7% riseagainst the US dollar. However, the opposite was true for the euroand the yen, which strengthened against most Asian currencies.For local-currency government bonds, outperformance was mainlyconcentrated largely at the longer end of the yield curve as theshorter end was constrained by the monetary tightening cycle. Thehigher-yielding debt of Indonesia and the Philippines rallied themost over the year, with 10-year yields falling by 83bps and 137bpsrespectively, despite giving up earlier gains in the later part of 2010and early 2011. Korean yields declined 66bps after the central banksoftened its policy stance amid rising global uncertainty.Asian credit spreads tightened by 35bps and the JPMorgan AsiaCredit Index rose by 7.97%. High-yield corporates outperformed onthe back of robust risk appetite and solid corporate earnings results.In particular, Chinese property bonds were resilient despite pressurefrom the government’s real estate cooling measures. However, gainswere marred slightly by poor performance in the Chinese high-yieldindustrial sector, which was weighed down by corporate governanceconcerns in the second half of the review period. The primary marketwas robust, with activity boosted further by a slew of renminbibonds following the Chinese government’s July decision to allowyuan trading in Hong Kong.Portfolio reviewThe portfolio rose by 3.66% from 24 September 2010 to 30 June2011, compared with the benchmark’s return of 3.54%.During the period, the portfolio’s currency exposure added valuerelative to the benchmark, particularly the overweight to the wonand Singapore dollar. However, the underweight position to theappreciating Taiwan dollar in the latter part of 2010 detractedfrom relative performance, as did our short positions in the yenand the euro, which were used to diversify the funding of ourAsian currency exposure.<strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong> 9Asia Fixed Income