Aberdeen Global II - Self Bank

Aberdeen Global II - Self Bank

Aberdeen Global II - Self Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

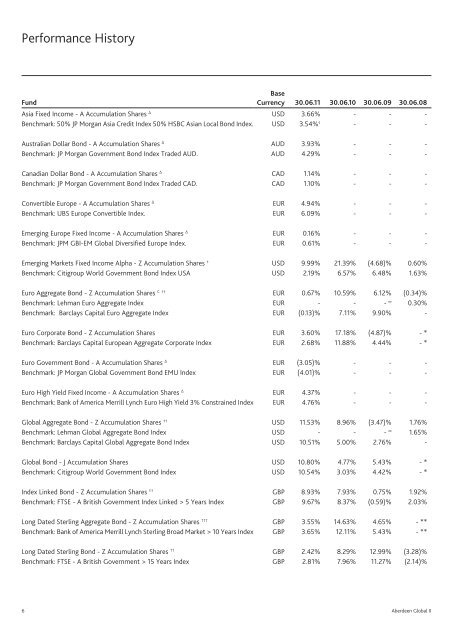

Performance HistoryFundBaseCurrency 30.06.11 30.06.10 30.06.09 30.06.08Asia Fixed Income - A Accumulation Shares ∆ USD 3.66% - - -Benchmark: 50% JP Morgan Asia Credit Index 50% HSBC Asian Local Bond Index. USD 3.54% ◊ - - -Australian Dollar Bond - A Accumulation Shares ∆ AUD 3.93% - - -Benchmark: JP Morgan Government Bond Index Traded AUD. AUD 4.29% - - -Canadian Dollar Bond - A Accumulation Shares ∆ CAD 1.14% - - -Benchmark: JP Morgan Government Bond Index Traded CAD. CAD 1.10% - - -Convertible Europe - A Accumulation Shares ∆ EUR 4.94% - - -Benchmark: UBS Europe Convertible Index. EUR 6.09% - - -Emerging Europe Fixed Income - A Accumulation Shares ∆ EUR 0.16% - - -Benchmark: JPM GBI-EM <strong>Global</strong> Diversified Europe Index. EUR 0.61% - - -Emerging Markets Fixed Income Alpha - Z Accumulation Shares † USD 9.99% 21.39% (4.68)% 0.60%Benchmark: Citigroup World Government Bond Index USA USD 2.19% 6.57% 6.48% 1.63%Euro Aggregate Bond - Z Accumulation Shares C †† EUR 0.67% 10.59% 6.12% (0.34)%Benchmark: Lehman Euro Aggregate Index EUR - - - ∞ 0.30%Benchmark: Barclays Capital Euro Aggregate Index EUR (0.13)% 7.11% 9.90% -Euro Corporate Bond - Z Accumulation Shares EUR 3.60% 17.18% (4.87)% - *Benchmark: Barclays Capital European Aggregate Corporate Index EUR 2.68% 11.88% 4.44% - *Euro Government Bond - A Accumulation Shares ∆ EUR (3.05)% - - -Benchmark: JP Morgan <strong>Global</strong> Government Bond EMU Index EUR (4.01)% - - -Euro High Yield Fixed Income - A Accumulation Shares ∆ EUR 4.37% - - -Benchmark: <strong>Bank</strong> of America Merrill Lynch Euro High Yield 3% Constrained Index EUR 4.76% - - -<strong>Global</strong> Aggregate Bond - Z Accumulation Shares †† USD 11.53% 8.96% (3.47)% 1.76%Benchmark: Lehman <strong>Global</strong> Aggregate Bond Index USD - - - ∞ 1.65%Benchmark: Barclays Capital <strong>Global</strong> Aggregate Bond Index USD 10.51% 5.00% 2.76% -<strong>Global</strong> Bond - J Accumulation Shares USD 10.80% 4.77% 5.43% - *Benchmark: Citigroup World Government Bond Index USD 10.54% 3.03% 4.42% - *Index Linked Bond - Z Accumulation Shares †† GBP 8.93% 7.93% 0.75% 1.92%Benchmark: FTSE - A British Government Index Linked > 5 Years Index GBP 9.67% 8.37% (0.59)% 2.03%Long Dated Sterling Aggregate Bond - Z Accumulation Shares ††† GBP 3.55% 14.63% 4.65% - **Benchmark: <strong>Bank</strong> of America Merrill Lynch Sterling Broad Market > 10 Years Index GBP 3.65% 12.11% 5.43% - **Long Dated Sterling Bond - Z Accumulation Shares †† GBP 2.42% 8.29% 12.99% (3.28)%Benchmark: FTSE - A British Government > 15 Years Index GBP 2.81% 7.96% 11.27% (2.14)%6 <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong>