Aberdeen Global II - Self Bank

Aberdeen Global II - Self Bank

Aberdeen Global II - Self Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

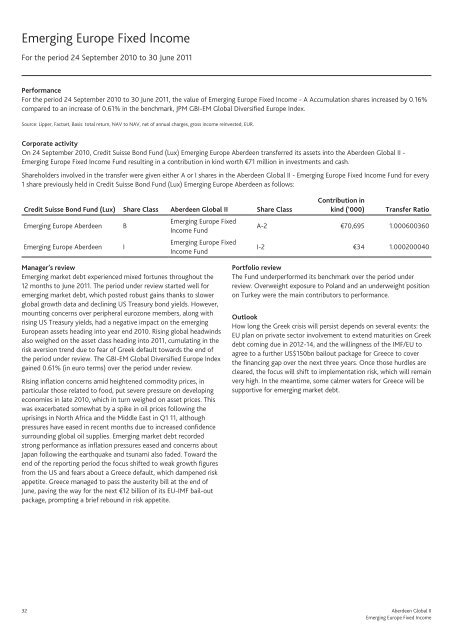

Emerging Europe Fixed IncomeFor the period 24 September 2010 to 30 June 2011PerformanceFor the period 24 September 2010 to 30 June 2011, the value of Emerging Europe Fixed Income - A Accumulation shares increased by 0.16%compared to an increase of 0.61% in the benchmark, JPM GBI-EM <strong>Global</strong> Diversified Europe Index.Source: Lipper, Factset, Basis: total return, NAV to NAV, net of annual charges, gross income reinvested, EUR.Corporate activityOn 24 September 2010, Credit Suisse Bond Fund (Lux) Emerging Europe <strong>Aberdeen</strong> transferred its assets into the <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong> -Emerging Europe Fixed Income Fund resulting in a contribution in kind worth €71 million in investments and cash.Shareholders involved in the transfer were given either A or I shares in the <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong> - Emerging Europe Fixed Income Fund for every1 share previously held in Credit Suisse Bond Fund (Lux) Emerging Europe <strong>Aberdeen</strong> as follows:Credit Suisse Bond Fund (Lux) Share Class <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong> Share ClassContribution inkind (‘000) Transfer RatioEmerging Europe <strong>Aberdeen</strong> BEmerging Europe FixedIncome FundA-2 €70,695 1.000600360Emerging Europe <strong>Aberdeen</strong> IEmerging Europe FixedIncome FundI-2 €34 1.000200040Manager’s reviewEmerging market debt experienced mixed fortunes throughout the12 months to June 2011. The period under review started well foremerging market debt, which posted robust gains thanks to slowerglobal growth data and declining US Treasury bond yields. However,mounting concerns over peripheral eurozone members, along withrising US Treasury yields, had a negative impact on the emergingEuropean assets heading into year end 2010. Rising global headwindsalso weighed on the asset class heading into 2011, cumulating in therisk aversion trend due to fear of Greek default towards the end ofthe period under review. The GBI-EM <strong>Global</strong> Diversified Europe Indexgained 0.61% (in euro terms) over the period under review.Rising inflation concerns amid heightened commodity prices, inparticular those related to food, put severe pressure on developingeconomies in late 2010, which in turn weighed on asset prices. Thiswas exacerbated somewhat by a spike in oil prices following theuprisings in North Africa and the Middle East in Q1 11, althoughpressures have eased in recent months due to increased confidencesurrounding global oil supplies. Emerging market debt recordedstrong performance as inflation pressures eased and concerns aboutJapan following the earthquake and tsunami also faded. Toward theend of the reporting period the focus shifted to weak growth figuresfrom the US and fears about a Greece default, which dampened riskappetite. Greece managed to pass the austerity bill at the end ofJune, paving the way for the next €12 billion of its EU-IMF bail-outpackage, prompting a brief rebound in risk appetite.Portfolio reviewThe Fund underperformed its benchmark over the period underreview. Overweight exposure to Poland and an underweight positionon Turkey were the main contributors to performance.OutlookHow long the Greek crisis will persist depends on several events: theEU plan on private sector involvement to extend maturities on Greekdebt coming due in 2012-14, and the willingness of the IMF/EU toagree to a further US$150bn bailout package for Greece to coverthe financing gap over the next three years. Once those hurdles arecleared, the focus will shift to implementation risk, which will remainvery high. In the meantime, some calmer waters for Greece will besupportive for emerging market debt.32 <strong>Aberdeen</strong> <strong>Global</strong> <strong>II</strong>Emerging Europe Fixed Income