Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

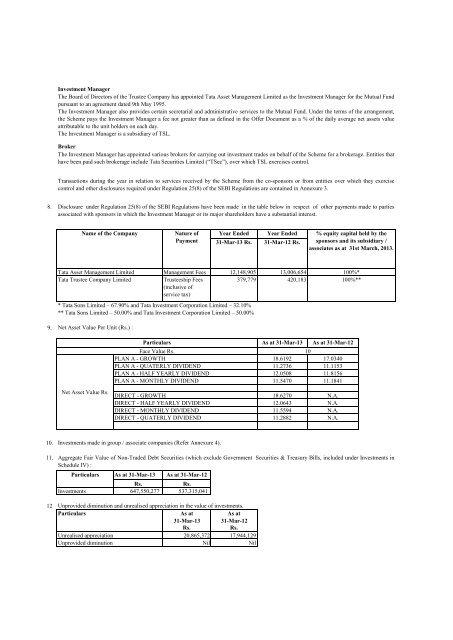

Investment ManagerThe Board of Directors of the Trustee Company has appointed <strong>Tata</strong> Asset Management Limited as the Investment Manager <strong>for</strong> the <strong>Mutual</strong> <strong>Fund</strong>pursuant to an agreement dated 9th May 1995.The Investment Manager also provides certain secretarial and administrative services to the <strong>Mutual</strong> <strong>Fund</strong>. Under the terms of the arrangement,the Scheme pays the Investment Manager a fee not greater than as defined in the Offer Document as a % of the daily average net assets valueattributable to the unit holders on each day.The Investment Manager is a subsidiary of TSL.BrokerThe Investment Manager has appointed various brokers <strong>for</strong> carrying out investment trades on behalf of the Scheme <strong>for</strong> a brokerage. Entities thathave been paid such brokerage include <strong>Tata</strong> Securities Limited (“TSec”), over which TSL exercises control.Transactions during the year in relation to services received by the Scheme from the co-sponsors or from entities over which they exercisecontrol and other disclosures required under Regulation 25(8) of the SEBI Regulations are contained in Annexure 3.8.Disclosure under Regulation 25(8) of the SEBI Regulations have been made in the table below in respect of other payments made to partiesassociated with sponsors in which the Investment Manager or its major shareholders have a substantial interest.Name of the CompanyNature ofPaymentYear Ended31-Mar-13 Rs.Year Ended31-Mar-12 Rs.% equity capital held by thesponsors and its subsidiary /associates as at 31st March, 2013.<strong>Tata</strong> Asset Management Limited<strong>Tata</strong> Trustee Company LimitedManagement Fees 12,148,905 13,006,654Trusteeship Fees(inclusive ofservice tax)379,779 420,183* <strong>Tata</strong> Sons Limited – 67.90% and <strong>Tata</strong> Investment Corporation Limited – 32.10%** <strong>Tata</strong> Sons Limited – 50.00% and <strong>Tata</strong> Investment Corporation Limited – 50.00%100%*100%**9. Net Asset Value Per Unit (Rs.) :Net Asset Value Rs.ParticularsFace Value Rs.PLAN A - GROWTHPLAN A - QUATERLY DIVIDENDPLAN A - HALF YEARLY DIVIDENDPLAN A - MONTHLY DIVIDENDDIRECT - GROWTHDIRECT - HALF YEARLY DIVIDENDDIRECT - MONTHLY DIVIDENDDIRECT - QUATERLY DIVIDENDAs at 31-Mar-13As at 31-Mar-121018.6192 17.034011.2736 11.115312.0508 11.815611.5470 11.1841blankblank18.6270 N.A. 31/03/201312.0643 N.A.11.5594 N.A.11.2882 N.A.blankblank10. Investments made in group / associate companies (Refer Annexure 4).11.Aggregate Fair Value of Non-Traded Debt Securities (which exclude Government Securities & Treasury Bills, included under Investments inSchedule IV) :ParticularsAs at 31-Mar-13As at 31-Mar-12Rs.Rs.Investments 647,550,277 537,315,04112 Unprovided diminution and unrealised appreciation in the value of investments.Particulars As at As at31-Mar-13 31-Mar-12Rs.Rs.Unrealised appreciation20,865,372 17,944,129Unprovided diminutionNilNil