Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

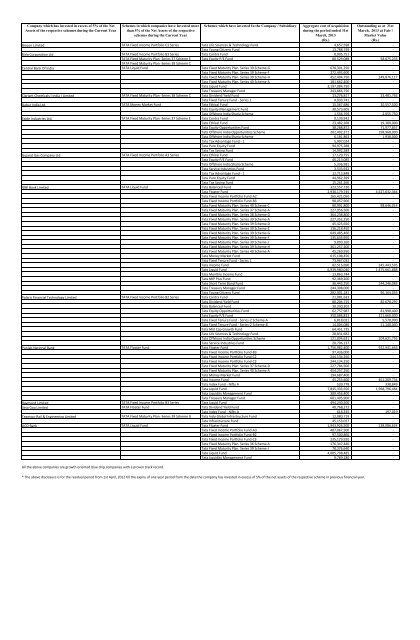

Company which has invested in excess of 5% of the NetAssets of the respective schemes during the Current Year<strong>Schemes</strong> in which companies have Invested morethan 5% of the Net Assets of the respectiveschemes during the Current Year<strong>Schemes</strong> which have invested In the Company / SubsidiaryAggregate cost of acquisitionduring the period ended 31stMarch, 2013(Rs.)Outstanding as at 31stMarch, 2013 at Fair /Market Value(Rs.)Biocon Limited TATA Fixed <strong>Income</strong> Portfolio C3 Series <strong>Tata</strong> Life Sciences & Technology <strong>Fund</strong>. 4,657,598 -<strong>Tata</strong> Young Citizens <strong>Fund</strong> 13,788,749 -Birla Corporation Ltd TATA Fixed <strong>Income</strong> Portfolio B3 Series <strong>Tata</strong> Contra <strong>Fund</strong> 8,905,751 -TATA Fixed Maturity Plan -Series 37 Scheme E <strong>Tata</strong> Equity P/E <strong>Fund</strong> 80,529,088 58,675,233TATA Fixed Maturity Plan -Series 38 Scheme C - -Central Bank Of India TATA Liquid <strong>Fund</strong> <strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-G 678,301,250 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-F 272,493,600 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-H 452,404,750 249,876,117<strong>Tata</strong> Fixed Maturity Plan. Series 40 Scheme-A 181,662,400 -<strong>Tata</strong> Liquid <strong>Fund</strong> 2,197,084,750 -<strong>Tata</strong> Treasury Manager <strong>Fund</strong> 243,866,750 -Clariant Chemicals ( India ) Limited TATA Fixed Maturity Plan -Series 38 Scheme C <strong>Tata</strong> Dividend Yield <strong>Fund</strong> 13,276,817 23,481,763<strong>Tata</strong> Fixed Tenure <strong>Fund</strong> - Series 1 4,933,741 -Dabur India Ltd. TATA Money Market <strong>Fund</strong> <strong>Tata</strong> Ethical <strong>Fund</strong> 15,567,686 20,557,500<strong>Tata</strong> Equity Management <strong>Fund</strong> 30,573,605 -<strong>Tata</strong> Offshore India Sharia Scheme 1,556,769 2,055,750Exide Industries Ltd. TATA Fixed Maturity Plan -Series 37 Scheme E <strong>Tata</strong> Contra <strong>Fund</strong> 9,139,942 -<strong>Tata</strong> Ethical <strong>Fund</strong> 23,482,268 19,380,000<strong>Tata</strong> Equity Opportunities <strong>Fund</strong> 38,288,872 71,977,837<strong>Tata</strong> Offshore India Opportunities Scheme 202,492,371 198,968,000<strong>Tata</strong> Offshore India Sharia Scheme 6,181,863 1,938,000<strong>Tata</strong> Tax Advantage <strong>Fund</strong> - 1 5,997,024 -<strong>Tata</strong> Pure Equity <strong>Fund</strong> 94,975,288 -<strong>Tata</strong> Tax Saving <strong>Fund</strong> 14,992,584 -Gujarat Gas Company Ltd TATA Fixed <strong>Income</strong> Portfolio A3 Series <strong>Tata</strong> Ethical <strong>Fund</strong> 17,129,755 -<strong>Tata</strong> Equity P/E <strong>Fund</strong> 46,213,085 -<strong>Tata</strong> Offshore India Sharia Scheme 5,336,981 -<strong>Tata</strong> Service Industries <strong>Fund</strong> 3,533,922 -<strong>Tata</strong> Tax Advantage <strong>Fund</strong> - 1 12,713,848 -<strong>Tata</strong> Pure Equity <strong>Fund</strong> 44,962,399 -<strong>Tata</strong> Tax Saving <strong>Fund</strong> 15,261,266 -IDBI Bank Limited TATA Liquid <strong>Fund</strong> <strong>Tata</strong> Balanced <strong>Fund</strong> 323,557,720 -<strong>Tata</strong> Floater <strong>Fund</strong> 2,930,179,745 4,527,632,364<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-A2 165,421,050 -<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-B3 98,057,900 -<strong>Tata</strong> Fixed Maturity Plan. Series 40 Scheme-C 90,991,800 98,646,014<strong>Tata</strong> Fixed Maturity Plan. Series 37 Scheme-A 227,956,500 -<strong>Tata</strong> Fixed Maturity Plan. Series 38 Scheme-D 364,238,800 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-A 227,352,250 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-D 45,425,650 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-E 136,218,450 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-G 649,485,460 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-F 135,634,950 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-J 9,093,160 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-H 361,257,200 -<strong>Tata</strong> Fixed Maturity Plan. Series 40 Scheme-A 45,269,950 -<strong>Tata</strong> Money Market <strong>Fund</strong> 615,108,450 -<strong>Tata</strong> Fixed Tenure <strong>Fund</strong> - Series 1 73,967,032 -<strong>Tata</strong> <strong>Income</strong> <strong>Fund</strong> 82,515,690 245,443,595<strong>Tata</strong> Liquid <strong>Fund</strong> 6,939,980,040 1,475,661,888<strong>Tata</strong> <strong>Monthly</strong> <strong>Income</strong> <strong>Fund</strong> 13,863,744 -<strong>Tata</strong> MIP Plus <strong>Fund</strong> 92,369,200 -<strong>Tata</strong> Short Term Bond <strong>Fund</strong> 36,443,250 144,246,083<strong>Tata</strong> Treasury Manager <strong>Fund</strong> 244,308,000 -<strong>Tata</strong> Young Citizens <strong>Fund</strong> 282,001,181 96,164,055Polaris Financial Technology Limited TATA Fixed <strong>Income</strong> Portfolio B2 Series <strong>Tata</strong> Contra <strong>Fund</strong> 21,081,633 -<strong>Tata</strong> Dividend Yield <strong>Fund</strong> 80,204,715 85,678,297<strong>Tata</strong> Balanced <strong>Fund</strong> 30,330,302 -<strong>Tata</strong> Equity Opportunities <strong>Fund</strong> 62,757,987 81,990,400<strong>Tata</strong> Equity P/E <strong>Fund</strong> 350,086,833 211,660,000<strong>Tata</strong> Fixed Tenure <strong>Fund</strong> - Series-2 Scheme-A 6,818,021 5,570,000<strong>Tata</strong> Fixed Tenure <strong>Fund</strong> - Series-2 Scheme-B 14,004,086 11,140,000<strong>Tata</strong> Mid Cap Growth <strong>Fund</strong> 64,451,735 -<strong>Tata</strong> Life Sciences & Technology <strong>Fund</strong>. 28,831,682 -<strong>Tata</strong> Offshore India Opportunities Scheme 121,004,631 104,621,756<strong>Tata</strong> Service Industries <strong>Fund</strong> 20,706,137 -Punjab National Bank TATA Floater <strong>Fund</strong> <strong>Tata</strong> Floater <strong>Fund</strong> 1,756,982,400 922,941,646<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-B3 97,436,000 -<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-C2 244,134,250 -<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-C3 244,134,250 -<strong>Tata</strong> Fixed Maturity Plan. Series 37 Scheme-D 227,784,500 -<strong>Tata</strong> Fixed Maturity Plan. Series 40 Scheme-A 454,257,250 -<strong>Tata</strong> Money Market <strong>Fund</strong> 194,687,400 -<strong>Tata</strong> <strong>Income</strong> <strong>Fund</strong> 45,253,600 461,209,734<strong>Tata</strong> Index <strong>Fund</strong> - Nifty A 539,778 338,849<strong>Tata</strong> Liquid <strong>Fund</strong> 7,845,333,550 1,968,796,464<strong>Tata</strong> Liquidity Management <strong>Fund</strong> 389,456,400 -<strong>Tata</strong> Treasury Manager <strong>Fund</strong> 681,405,900 -Raymond Limited TATA Fixed <strong>Income</strong> Portfolio B3 Series <strong>Tata</strong> Liquid <strong>Fund</strong> 494,240,500 -Sesa Goa Limited TATA Floater <strong>Fund</strong> <strong>Tata</strong> Dividend Yield <strong>Fund</strong> 40,768,272 -<strong>Tata</strong> Index <strong>Fund</strong> - Nifty A 618,335 197,019Texmaco Rail & Engineering Limited TATA Fixed Maturity Plan -Series 39 Scheme G <strong>Tata</strong> Indo Global Infrastructure <strong>Fund</strong> 12,080,719 -<strong>Tata</strong> Infrastructure <strong>Fund</strong> 45,153,017 -UCO Bank TATA Liquid <strong>Fund</strong> <strong>Tata</strong> Floater <strong>Fund</strong> 1,943,926,500 138,086,624<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-A3 487,067,500 -<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-B2 97,500,860 -<strong>Tata</strong> Fixed <strong>Income</strong> Portfolio <strong>Fund</strong>-C3 235,129,920 -<strong>Tata</strong> Fixed Maturity Plan. Series 36 Scheme-A 176,347,440 -<strong>Tata</strong> Fixed Maturity Plan. Series 39 Scheme-J 78,376,640 -<strong>Tata</strong> Liquid <strong>Fund</strong> 4,085,708,485 -<strong>Tata</strong> Liquidity Management <strong>Fund</strong> 9,769,180 -All the above companies are growth oriented blue chip companies with a proven track record.* The above disclosure is <strong>for</strong> the residual period from 1st April, 2012 till the expiry of one year period from the date the company has invested in excess of 5% of the net assets of the respective scheme in previous financial year.