Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

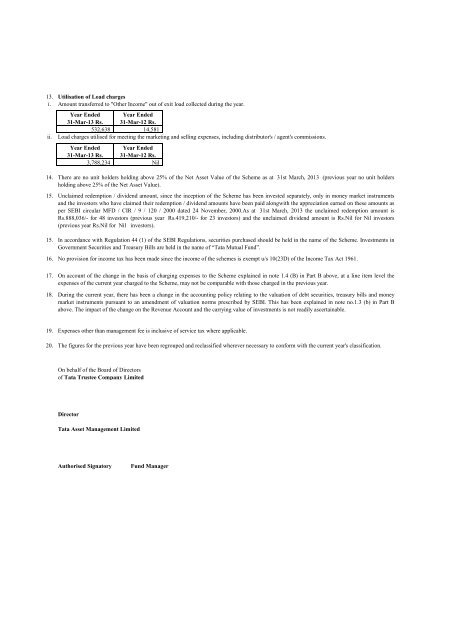

13. Utilisation of Load chargesi. Amount transferred to "Other <strong>Income</strong>" out of exit load collected during the year.Year Ended Year Ended31-Mar-13 Rs. 31-Mar-12 Rs.532,638 14,581ii. Load charges utilised <strong>for</strong> meeting the marketing and selling expenses, including distributor's / agent's commissions.Year Ended Year Ended31-Mar-13 Rs. 31-Mar-12 Rs.3,788,234 Nil14.15.15.16.17.18.There are no unit holders holding above 25% of the Net Asset Value of the Scheme as at 31st March, 2013 (previous year no unit holdersholding above 25% of the Net Asset Value).Unclaimed redemption / dividend amount, since the inception of the Scheme has been invested separately, only in money market instrumentsand the investors who have claimed their redemption / dividend amounts have been paid alongwith the appreciation earned on these amounts asper SEBI circular MFD / CIR / 9 / 120 / 2000 dated 24 November, 2000.As at 31st March, 2013 the unclaimed redemption amount isRs.888,036/- <strong>for</strong> 48 investors (previous year Rs.419,210/- <strong>for</strong> 23 investors) and the unclaimed dividend amount is Rs.Nil <strong>for</strong> Nil investors(previous year Rs.Nil <strong>for</strong> Nil investors).In accordance with Regulation 44 (1) of the SEBI Regulations, securities purchased should be held in the name of the Scheme. Investments inGovernment Securities and Treasury Bills are held in the name of “<strong>Tata</strong> <strong>Mutual</strong> <strong>Fund</strong>”.No provision <strong>for</strong> income tax has been made since the income of the schemes is exempt u/s 10(23D) of the <strong>Income</strong> Tax Act 1961.On account of the change in the basis of charging expenses to the Scheme explained in note 1.4 (B) in Part B above, at a line item level theexpenses of the current year charged to the Scheme, may not be comparable with those charged in the previous year.During the current year, there has been a change in the accounting policy relating to the valuation of debt securities, treasury bills and moneymarket instruments pursuant to an amendment of valuation norms prescribed by SEBI. This has been explained in note no.1.3 (b) in Part Babove. The impact of the change on the Revenue Account and the carrying value of investments is not readily ascertainable.19.20.Expenses other than management fee is inclusive of service tax where applicable.The figures <strong>for</strong> the previous year have been regrouped and reclassified wherever necessary to con<strong>for</strong>m with the current year's classification.On behalf of the Board of Directorsof <strong>Tata</strong> Trustee Company LimitedDirector<strong>Tata</strong> Asset Management LimitedAuthorised Signatory<strong>Fund</strong> Manager