Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

Annual Report for Monthly Income Schemes - Tata Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

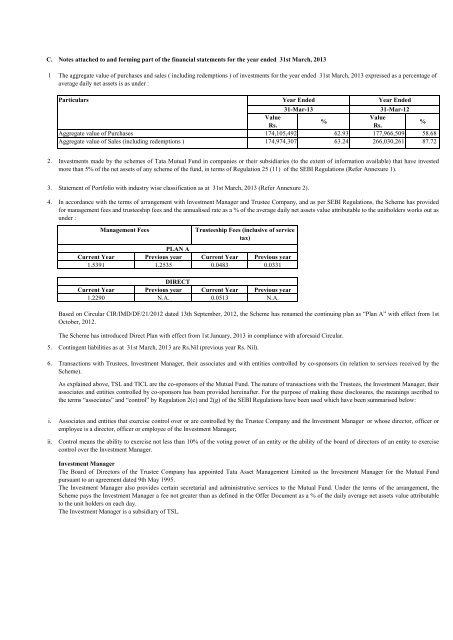

C. Notes attached to and <strong>for</strong>ming part of the financial statements <strong>for</strong> the year ended 31st March, 20131The aggregate value of purchases and sales ( including redemptions ) of investments <strong>for</strong> the year ended 31st March, 2013 expressed as a percentage ofaverage daily net assets is as under :ParticularsAggregate value of PurchasesAggregate value of Sales (including redemptions )Year EndedYear Ended31-Mar-1331-Mar-12ValueValue%Rs.Rs.%174,105,492 62.93 177,966,509 58.68174,974,307 63.24 266,030,261 87.722.Investments made by the schemes of <strong>Tata</strong> <strong>Mutual</strong> <strong>Fund</strong> in companies or their subsidiaries (to the extent of in<strong>for</strong>mation available) that have investedmore than 5% of the net assets of any scheme of the fund, in terms of Regulation 25 (11) of the SEBI Regulations (Refer Annexure 1).3.4.Statement of Portfolio with industry wise classification as at 31st March, 2013 (Refer Annexure 2).In accordance with the terms of arrangement with Investment Manager and Trustee Company, and as per SEBI Regulations, the Scheme has provided<strong>for</strong> management fees and trusteeship fees and the annualised rate as a % of the average daily net assets value attributable to the unitholders works out asunder :Management FeesTrusteeship Fees (inclusive of servicetax)PLAN ACurrent Year Previous year Current Year Previous year1.5391 1.2535 0.0483 0.0331DIRECTCurrent Year Previous year Current Year Previous year1.2290 N.A. 0.0513 N.A.Based on Circular CIR/IMD/DF/21/2012 dated 13th September, 2012, the Scheme has renamed the continuing plan as “Plan A” with effect from 1stOctober, 2012.The Scheme has introduced Direct Plan with effect from 1st January, 2013 in compliance with a<strong>for</strong>esaid Circular.5.6.Contingent liabilities as at 31st March, 2013 are Rs.Nil (previous year Rs. Nil).Transactions with Trustees, Investment Manager, their associates and with entities controlled by co-sponsors (in relation to services received by theScheme).As explained above, TSL and TICL are the co-sponsors of the <strong>Mutual</strong> <strong>Fund</strong>. The nature of transactions with the Trustees, the Investment Manager, theirassociates and entities controlled by co-sponsors has been provided hereinafter. For the purpose of making these disclosures, the meanings ascribed tothe terms “associates” and “control” by Regulation 2(c) and 2(g) of the SEBI Regulations have been used which have been summarised below:i.ii.Associates and entities that exercise control over or are controlled by the Trustee Company and the Investment Manager or whose director, officer oremployee is a director, officer or employee of the Investment Manager;Control means the ability to exercise not less than 10% of the voting power of an entity or the ability of the board of directors of an entity to exercisecontrol over the Investment Manager.Investment ManagerThe Board of Directors of the Trustee Company has appointed <strong>Tata</strong> Asset Management Limited as the Investment Manager <strong>for</strong> the <strong>Mutual</strong> <strong>Fund</strong>pursuant to an agreement dated 9th May 1995.The Investment Manager also provides certain secretarial and administrative services to the <strong>Mutual</strong> <strong>Fund</strong>. Under the terms of the arrangement, theScheme pays the Investment Manager a fee not greater than as defined in the Offer Document as a % of the daily average net assets value attributableto the unit holders on each day.The Investment Manager is a subsidiary of TSL.