Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

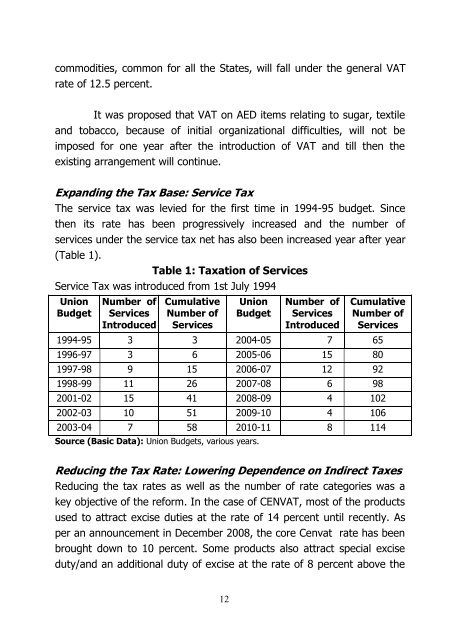

commodities, common <strong>for</strong> all the States, will fall under the general VATrate <strong>of</strong> 12.5 percent.It was proposed that VAT on AED items relating to sugar, textileand tobacco, because <strong>of</strong> initial organizational difficulties, will not beimposed <strong>for</strong> one year after the introduction <strong>of</strong> VAT and till then theexisting arrangement will continue.Expanding the Tax Base: Service TaxThe service tax was levied <strong>for</strong> the first time in 1994-95 budget. Sincethen its rate has been progressively increased and the number <strong>of</strong>services under the service tax net has also been increased year after year(Table 1).Table 1: Taxation <strong>of</strong> ServicesService Tax was introduced from 1st July 1994UnionBudgetNumber <strong>of</strong>ServicesIntroducedCumulativeNumber <strong>of</strong>ServicesUnionBudgetNumber <strong>of</strong>ServicesIntroducedCumulativeNumber <strong>of</strong>Services1994-95 3 3 2004-05 7 651996-97 3 6 2005-06 15 801997-98 9 15 2006-07 12 921998-99 11 26 2007-08 6 982001-02 15 41 2008-09 4 1022002-03 10 51 2009-10 4 1062003-04 7 58 2010-11 8 114Source (Basic Data): Union Budgets, various years.Reducing the Tax Rate: Lowering Dependence on Indirect TaxesReducing the tax rates as well as the number <strong>of</strong> rate categories was akey objective <strong>of</strong> the re<strong>for</strong>m. In the case <strong>of</strong> CENVAT, most <strong>of</strong> the productsused to attract excise duties at the rate <strong>of</strong> 14 percent until recently. Asper an announcement in December 2008, the core Cenvat rate has beenbrought down to 10 percent. Some products also attract special exciseduty/and an additional duty <strong>of</strong> excise at the rate <strong>of</strong> 8 percent above the12

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/49878970/1/190x245/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/48715201/1/184x260/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)