Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

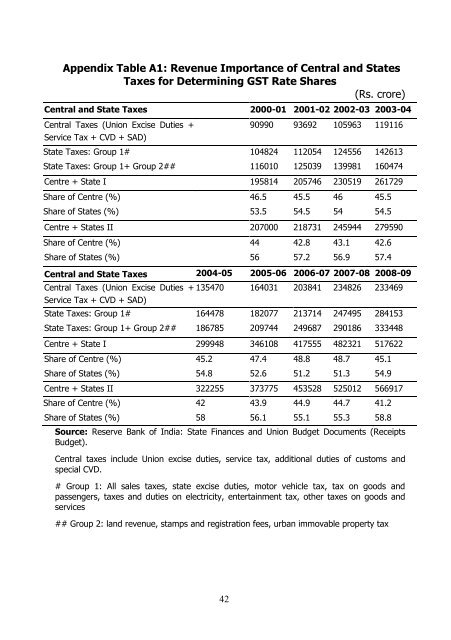

Appendix Table A1: Revenue Importance <strong>of</strong> Central and StatesTaxes <strong>for</strong> Determining GST Rate Shares(Rs. crore)Central and State Taxes 2000-01 2001-02 2002-03 2003-04Central Taxes (Union Excise Duties +Service Tax + CVD + SAD)90990 93692 105963 119116State Taxes: Group 1# 104824 112054 124556 142613State Taxes: Group 1+ Group 2## 116010 125039 139981 160474Centre + State I 195814 205746 230519 261729Share <strong>of</strong> Centre (%) 46.5 45.5 46 45.5Share <strong>of</strong> States (%) 53.5 54.5 54 54.5Centre + States II 207000 218731 245944 279590Share <strong>of</strong> Centre (%) 44 42.8 43.1 42.6Share <strong>of</strong> States (%) 56 57.2 56.9 57.4Central and State Taxes 2004-05 2005-06 2006-07 2007-08 2008-09Central Taxes (Union Excise Duties + 135470 164031 203841 234826 233469Service Tax + CVD + SAD)State Taxes: Group 1# 164478 182077 213714 247495 284153State Taxes: Group 1+ Group 2## 186785 209744 249687 290186 333448Centre + State I 299948 346108 417555 482321 517622Share <strong>of</strong> Centre (%) 45.2 47.4 48.8 48.7 45.1Share <strong>of</strong> States (%) 54.8 52.6 51.2 51.3 54.9Centre + States II 322255 373775 453528 525012 566917Share <strong>of</strong> Centre (%) 42 43.9 44.9 44.7 41.2Share <strong>of</strong> States (%) 58 56.1 55.1 55.3 58.8Source: Reserve Bank <strong>of</strong> India: State Finances and Union Budget Documents (ReceiptsBudget).Central taxes include Union excise duties, service tax, additional duties <strong>of</strong> customs andspecial CVD.# Group 1: All sales taxes, state excise duties, motor vehicle tax, tax on goods andpassengers, taxes and duties on electricity, entertainment tax, other taxes on goods andservices## Group 2: land revenue, stamps and registration fees, urban immovable property tax42

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/49878970/1/190x245/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/48715201/1/184x260/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)