Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

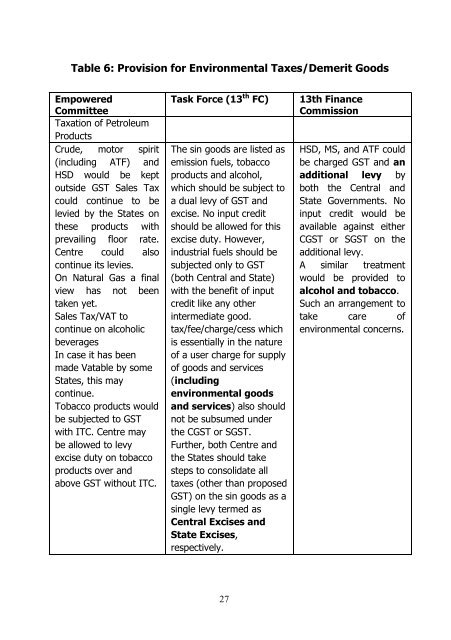

Table 6: Provision <strong>for</strong> Environmental Taxes/Demerit GoodsEmpoweredCommitteeTaxation <strong>of</strong> PetroleumProductsCrude, motor spirit(including ATF) andHSD would be keptoutside GST Sales Taxcould continue to belevied by the States onthese products withprevailing floor rate.Centre could alsocontinue its levies.On Natural Gas a finalview has not beentaken yet.Sales Tax/VAT tocontinue on alcoholicbeveragesIn case it has beenmade Vatable by someStates, this maycontinue.Tobacco products wouldbe subjected to GSTwith ITC. Centre maybe allowed to levyexcise duty on tobaccoproducts over andabove GST without ITC.Task Force (13 th FC)The sin goods are listed asemission fuels, tobaccoproducts and alcohol,which should be subject toa dual levy <strong>of</strong> GST andexcise. No input creditshould be allowed <strong>for</strong> thisexcise duty. However,industrial fuels should besubjected only to GST(both Central and State)with the benefit <strong>of</strong> inputcredit like any otherintermediate good.tax/fee/charge/cess whichis essentially in the nature<strong>of</strong> a user charge <strong>for</strong> supply<strong>of</strong> goods and services(includingenvironmental goodsand services) also shouldnot be subsumed underthe CGST or SGST.Further, both Centre andthe States should takesteps to consolidate alltaxes (other than proposedGST) on the sin goods as asingle levy termed asCentral Excises andState Excises,respectively.13th FinanceCommissionHSD, MS, and ATF couldbe charged GST and anadditional levy byboth the Central andState Governments. Noinput credit would beavailable against eitherCGST or SGST on theadditional levy.A similar treatmentwould be provided toalcohol and tobacco.Such an arrangement totake care <strong>of</strong>environmental concerns.27

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/49878970/1/190x245/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/48715201/1/184x260/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)