Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

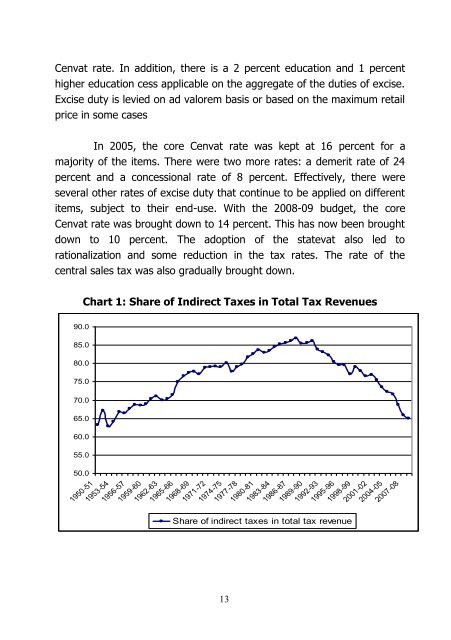

Cenvat rate. In addition, there is a 2 percent education and 1 percenthigher education cess applicable on the aggregate <strong>of</strong> the duties <strong>of</strong> excise.Excise duty is levied on ad valorem basis or based on the maximum retailprice in some casesIn 2005, the core Cenvat rate was kept at 16 percent <strong>for</strong> amajority <strong>of</strong> the items. There were two more rates: a demerit rate <strong>of</strong> 24percent and a concessional rate <strong>of</strong> 8 percent. Effectively, there wereseveral other rates <strong>of</strong> excise duty that continue to be applied on differentitems, subject to their end-use. With the 2008-09 budget, the coreCenvat rate was brought down to 14 percent. This has now been broughtdown to 10 percent. The adoption <strong>of</strong> the statevat also led torationalization and some reduction in the tax rates. The rate <strong>of</strong> thecentral sales tax was also gradually brought down.Chart 1: Share <strong>of</strong> Indirect Taxes in Total Tax Revenues90.085.080.075.070.065.060.055.050.01950-511953-541956-571959-601962-631965-661968-691971-721974-751977-781980-811983-841986-871989-901992-93Share <strong>of</strong> indirect taxes in total tax revenue131995-961998-992001-022004-052007-08

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/49878970/1/190x245/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/48715201/1/184x260/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)