Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

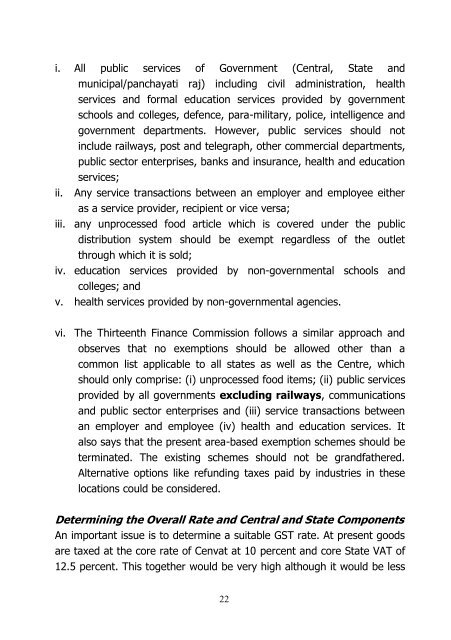

i. All public services <strong>of</strong> Government (Central, State andii.municipal/panchayati raj) including civil administration, healthservices and <strong>for</strong>mal education services provided by governmentschools and colleges, defence, para-military, police, intelligence andgovernment departments. However, public services should notinclude railways, post and telegraph, other commercial departments,public sector enterprises, banks and insurance, health and educationservices;Any service transactions between an employer and employee eitheras a service provider, recipient or vice versa;iii. any unprocessed food article which is covered under the publicdistribution system should be exempt regardless <strong>of</strong> the outletthrough which it is sold;iv. education services provided by non-governmental schools andcolleges; andv. health services provided by non-governmental agencies.vi. The Thirteenth Finance Commission follows a similar approach andobserves that no exemptions should be allowed other than acommon list applicable to all states as well as the Centre, whichshould only comprise: (i) unprocessed food items; (ii) public servicesprovided by all governments excluding railways, communicationsand public sector enterprises and (iii) service transactions betweenan employer and employee (iv) health and education services. Italso says that the present area-based exemption schemes should beterminated. The existing schemes should not be grandfathered.Alternative options like refunding taxes paid by industries in theselocations could be considered.Determining the Overall Rate and Central and State ComponentsAn important issue is to determine a suitable GST rate. At present goodsare taxed at the core rate <strong>of</strong> Cenvat at 10 percent and core State VAT <strong>of</strong>12.5 percent. This together would be very high although it would be less22

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/49878970/1/190x245/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/48715201/1/184x260/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)