Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

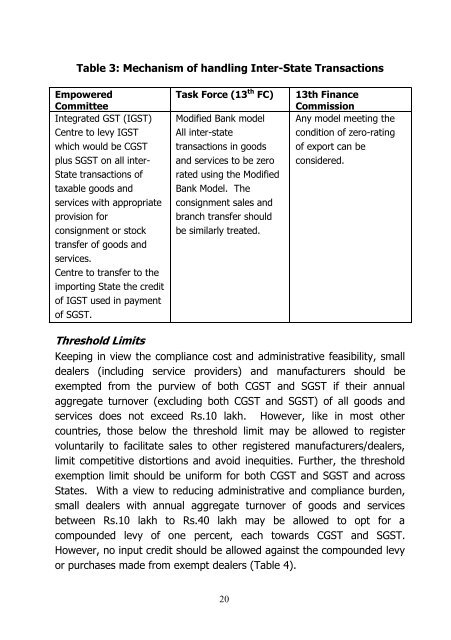

Table 3: Mechanism <strong>of</strong> handling Inter-State TransactionsEmpoweredCommitteeIntegrated GST (IGST)Centre to levy IGSTwhich would be CGSTplus SGST on all inter-State transactions <strong>of</strong>taxable goods andservices with appropriateprovision <strong>for</strong>consignment or stocktransfer <strong>of</strong> goods andservices.Centre to transfer to theimporting State the credit<strong>of</strong> IGST used in payment<strong>of</strong> SGST.Task Force (13 th FC)Modified Bank modelAll inter-statetransactions in goodsand services to be zerorated using the ModifiedBank Model. Theconsignment sales andbranch transfer shouldbe similarly treated.13th FinanceCommissionAny model meeting thecondition <strong>of</strong> zero-rating<strong>of</strong> export can beconsidered.Threshold LimitsKeeping in view the compliance cost and administrative feasibility, smalldealers (including service providers) and manufacturers should beexempted from the purview <strong>of</strong> both CGST and SGST if their annualaggregate turnover (excluding both CGST and SGST) <strong>of</strong> all goods andservices does not exceed Rs.10 lakh. However, like in most othercountries, those below the threshold limit may be allowed to registervoluntarily to facilitate sales to other registered manufacturers/dealers,limit competitive distortions and avoid inequities. Further, the thresholdexemption limit should be uni<strong>for</strong>m <strong>for</strong> both CGST and SGST and acrossStates. With a view to reducing administrative and compliance burden,small dealers with annual aggregate turnover <strong>of</strong> goods and servicesbetween Rs.10 lakh to Rs.40 lakh may be allowed to opt <strong>for</strong> acompounded levy <strong>of</strong> one percent, each towards CGST and SGST.However, no input credit should be allowed against the compounded levyor purchases made from exempt dealers (Table 4).20

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/49878970/1/190x245/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/48715201/1/184x260/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)