Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

Accounting for India's Forest Wealth - Madras School of Economics

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

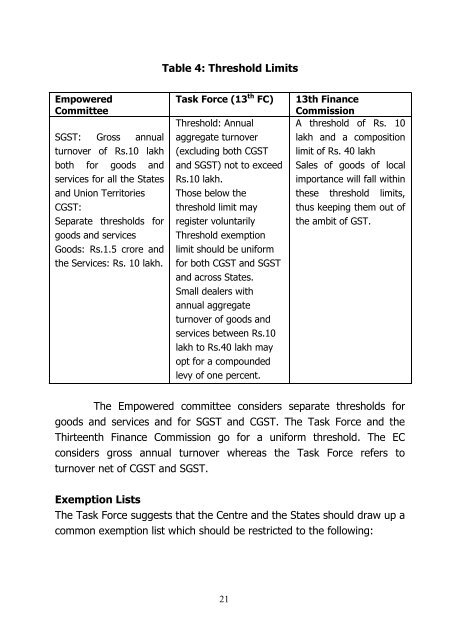

Table 4: Threshold LimitsEmpoweredCommitteeSGST: Gross annualturnover <strong>of</strong> Rs.10 lakhboth <strong>for</strong> goods andservices <strong>for</strong> all the Statesand Union TerritoriesCGST:Separate thresholds <strong>for</strong>goods and servicesGoods: Rs.1.5 crore andthe Services: Rs. 10 lakh.Task Force (13 th FC)Threshold: Annualaggregate turnover(excluding both CGSTand SGST) not to exceedRs.10 lakh.Those below thethreshold limit mayregister voluntarilyThreshold exemptionlimit should be uni<strong>for</strong>m<strong>for</strong> both CGST and SGSTand across States.Small dealers withannual aggregateturnover <strong>of</strong> goods andservices between Rs.10lakh to Rs.40 lakh mayopt <strong>for</strong> a compoundedlevy <strong>of</strong> one percent.13th FinanceCommissionA threshold <strong>of</strong> Rs. 10lakh and a compositionlimit <strong>of</strong> Rs. 40 lakhSales <strong>of</strong> goods <strong>of</strong> localimportance will fall withinthese threshold limits,thus keeping them out <strong>of</strong>the ambit <strong>of</strong> GST.The Empowered committee considers separate thresholds <strong>for</strong>goods and services and <strong>for</strong> SGST and CGST. The Task Force and theThirteenth Finance Commission go <strong>for</strong> a uni<strong>for</strong>m threshold. The ECconsiders gross annual turnover whereas the Task Force refers toturnover net <strong>of</strong> CGST and SGST.Exemption ListsThe Task Force suggests that the Centre and the States should draw up acommon exemption list which should be restricted to the following:21

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/49878970/1/190x245/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)

![Curriculum Vitae [pdf] - Madras School of Economics](https://img.yumpu.com/48715201/1/184x260/curriculum-vitae-pdf-madras-school-of-economics.jpg?quality=85)