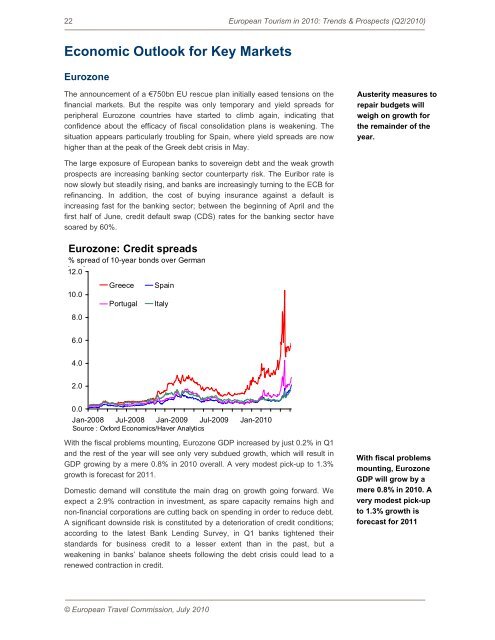

22 European Tourism in <strong>2010</strong>: <strong>Trends</strong> & <strong>Prospects</strong> (Q2/<strong>2010</strong>)Economic Outlook for Key MarketsEurozoneThe announcement of a €750bn EU rescue plan initially eased tensions on thefinancial markets. But the respite was only temporary and yield spreads forperipheral Eurozone countries have started to climb again, indicating thatconfidence about the efficacy of fiscal consolidation plans is weakening. Thesituation appears particularly troubling for Spain, where yield spreads are nowhigher than at the peak of the Greek debt crisis in May.Austerity measures torepair budgets willweigh on growth forthe remainder of theyear.The large exposure of European banks to sovereign debt and the weak growthprospects are increasing banking sector counterparty risk. The Euribor rate isnow slowly but steadily rising, and banks are increasingly turning to the ECB forrefinancing. In addition, the cost of buying insurance against a default isincreasing fast for the banking sector; between the beginning of April and thefirst half of June, credit default swap (CDS) rates for the banking sector havesoared by 60%.Eurozone: Credit spreads% spread of 10-year bonds over German12.0 b d10.08.0GreecePortugalSpainItaly6.04.02.00.0Jan-2008 Jul-2008 Jan-2009 Jul-2009 Jan-<strong>2010</strong>Source : Oxford Economics/Haver AnalyticsWith the fiscal problems mounting, Eurozone GDP increased by just 0.2% in Q1and the rest of the year will see only very subdued growth, which will result inGDP growing by a mere 0.8% in <strong>2010</strong> overall. A very modest pick-up to 1.3%growth is forecast for 2011.Domestic demand will constitute the main drag on growth going forward. Weexpect a 2.9% contraction in investment, as spare capacity remains high andnon-financial corporations are cutting back on spending in order to reduce debt.A significant downside risk is constituted by a deterioration of credit conditions;according to the latest Bank Lending Survey, in Q1 banks tightened theirstandards for business credit to a lesser extent than in the past, but aweakening in banks’ balance sheets following the debt crisis could lead to arenewed contraction in credit.With fiscal problemsmounting, EurozoneGDP will grow by amere 0.8% in <strong>2010</strong>. Avery modest pick-upto 1.3% growth isforecast for 2011© European Travel Commission, July <strong>2010</strong>

European Tourism in <strong>2010</strong>: <strong>Trends</strong> & <strong>Prospects</strong> (Q2/<strong>2010</strong>) 23Consumption will be flat this year as government incentives such as the carscrapping schemes give way to fiscal retrenchment. Moreover, despite someimprovement in countries like Germany, the overall labour market situationcontinues to worsen; in April, the harmonised unemployment rate edged upagain to 10.1% and we a expect a further rise to a peak of 10.6% by mid 2011.Worries about unemployment are also depressing consumer confidence, withthe European Commission index dipping again in May after a tentative rise inApril.The prospects for domestic demand growth will be further damaged by theseries of fiscal tightening packages being implemented across Europe.Following the fiscal austerity measures in Greece and Portugal, Spain isenacting a further ambitious consolidation package aimed at reducing its fiscaldeficit to 6% of GDP in 2012 from 11.3% posted in 2009. The plan encounteredfierce opposition in parliament and is leading to social unrest, raising somedoubts about full implementation of the plan, which is essential in order toreduce the risk of a debt crisis in the Eurozone’s fourth largest economy. TheItalian government has presented a smaller fiscal adjustment plan and someausterity measures have also been announced by Germany and France.The overall labourmarket situationcontinues to worsenalong with consumerconfidence.Not surprisingly given the sluggish growth, inflation at just 1.5% in April and theheightened financial market tensions, the ECB kept its refi rate unchanged atthe historical low of 1% at its 10 June meeting. The ECB also stated that thepurchase of government and private securities would continue. The extremeweakness of the economy and the high level of unemployment make anydomestic inflationary pressures very unlikely. As a result, we do not expectinterest rates to rise before H2 2011.UK EconomyRecent data continues to point to a steady – but unspectacular – pace ofrecovery. GDP growth for Q1 was revised up from 0.2% to 0.3%, slightly slowerthan the outturn for 2009Q4. The PMI surveys point to a stronger outturn forGDP growth in Q2, with manufacturing likely to provide the main impetus.Outlook for the UKremains muted basedon recent surveys andrising unemployment.However, the PMI services survey reports more worrying trends, with growth innew business at its slowest for nine months in May. The main source ofweakness has been consumer services, which chimes with a range of otherindicators. Retail sales have been broadly flat since early autumn, while the CBIdistributive trades survey reported a surprise drop in sales in the year to May. Inaddition, net unsecured lending has turned negative again, while consumerconfidence has edged down for the last three months.The consumer outlook remains bleak. Though the claimant count measure ofunemployment has fallen in recent months, the picture is more downbeat acrossalmost all other labour market indicators, with inactivity and ILO unemploymentrising and further declines in hours worked. We expect the impending publicsector cuts to keep ILO unemployment above 8% for the next couple of years.Furthermore, the combination of persistently weak earnings growth and abovetarget inflation also means there is likely to be no real wage growth this year, onthe back of declines in each of the two previous years.With little support from the labour market, a higher tax bill for top earners and norepeat of last year’s drop in interest rates, real incomes are forecast to fall© European Travel Commission, July <strong>2010</strong>