1. OrganizationNOTES TO FINANCIAL STATEMENTSDECEMBER 31, <strong>2002</strong> AND 2001The <strong>Bermuda</strong> Biological Station for Research, Inc. (“Station”) was founded in 1903 and was incorporated in the State <strong>of</strong> New York in 1926 as a U.S.not-for-pr<strong>of</strong>it organization. The Station is exempt from U.S. income taxes pursuant to Sections 501(c)(3) and 509(a) <strong>of</strong> the Internal Revenue Code.The Station’s mission is to conduct science research and education <strong>of</strong> the highest quality from the special perspective <strong>of</strong> a mid-ocean island. Itprovides well-equipped facilities and responsive staff support for visiting scientists, faculty and students from around the world. The Stationaccomplishes its educational mission by conducting undergraduate and graduate level courses, and elementary and secondary school programs.The Station is supported by gifts, grants and contracts received from the U.S. and <strong>Bermuda</strong> governments as well as various individual, corporateand foundation donors. Additionally, the Station charges fees for the use <strong>of</strong> its various scientific, marine and housing facilities. The Station operatesin <strong>Bermuda</strong> where its assets, except for its investments and certain cash balances, are held.2. Summary <strong>of</strong> Significant Accounting PoliciesBasis <strong>of</strong> AccountingThe accompanying financial statements have been prepared on the accrual basis.Use <strong>of</strong> EstimatesThe preparation <strong>of</strong> financial statements, in conformity with accounting principles generally accepted in the United States <strong>of</strong> America, requiresmanagement to make estimates and judgments that affect the reported amounts <strong>of</strong> assets and liabilities and disclosures <strong>of</strong> contingencies at thedate <strong>of</strong> the financial statements and revenues and expenses recognized during the reporting period. Actual results could differ from thoseestimates.Financial Statement PresentationThe Station is required to report information regarding its financial position and activities according to three classes <strong>of</strong> net assets: permanentlyrestricted, temporarily restricted, and unrestricted. Gifts and bequests that create endowment funds to provide a permanent source <strong>of</strong> income areclassified as permanently restricted net assets. Gifts <strong>of</strong> cash and other assets with stipulations that they be used for a particular purpose or for aspecified time period are classified as temporarily restricted assets until the purpose or stipulated time restriction is met. All other net assets areclassified as unrestricted.ContributionsContributions, including unconditional promises to give, are recognized as revenue in the period received or pledged. Contributions <strong>of</strong> assetsother than cash are recorded at their estimated fair value and are recorded as increases in unrestricted net assets unless the donor places restrictionson their use. Contributions due after one year are discounted at a risk-free rate. Amortization <strong>of</strong> the discount is recorded annually asadditional contribution revenue in accordance with the donor-imposed restrictions, if any.Cash EquivalentsFor the statements <strong>of</strong> cash flows, the Station considers all highly liquid investments, with a maturity <strong>of</strong> three months or less, to be cashequivalents.InventoryThe Station’s inventory is reported at the lower <strong>of</strong> cost or market (first in, first out) and consists <strong>of</strong> gift shop merchandise, cafeteria, laboratory andscuba supplies held for resale.Charitable Gift AnnuityThe charitable gift annuity is subject to the restrictions <strong>of</strong> the gift instrument requiring the Station to pay a stipulated amount to designated beneficiaries.Such payments terminate at the time specified by the donor. Contribution revenues are recognized at the date <strong>of</strong> receipt after recordingliabilities for the present value <strong>of</strong> the estimated future payments to be made to the donors and/or other beneficiaries. The liability is adjusted forthe change in the value <strong>of</strong> the asset, accretion <strong>of</strong> the discount and other changes in the estimate <strong>of</strong> future benefits.Foreign CurrencyThe Station’s functional currency is U.S. dollars. There are no foreign currency transaction gains or losses from transaction in the <strong>Bermuda</strong> dollarbecause it is equivalent to the U.S. dollar.3. Concentrations <strong>of</strong> Credit RiskThe Station’s financial instruments that are exposed to concentrations <strong>of</strong> credit risk consist primarily <strong>of</strong> cash, investments and contributionsreceivable. The Station places its cash with high credit quality financial institutions. The Station believes no significant concentrations <strong>of</strong> creditrisk exist with respect to its cash and cash equivalents. Due to the diversification and quality <strong>of</strong> investments held, the Station believes that it hasminimized risk concentration regarding its investments. At December 31, <strong>2002</strong>, the Station had outstanding contributions receivable from eightdonors totaling $1,920,000. At December 31, 2001, the Station had outstanding contributions receivable from six donors totaling $1,095,000.28

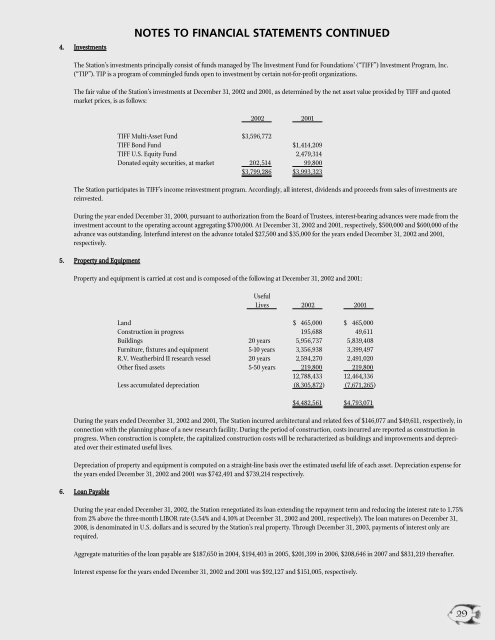

4. InvestmentsNOTES TO FINANCIAL STATEMENTS CONTINUEDThe Station’s investments principally consist <strong>of</strong> funds managed by The Investment Fund for Foundations’ (“TIFF”) Investment Program, Inc.(“TIP”). TIP is a program <strong>of</strong> commingled funds open to investment by certain not-for-pr<strong>of</strong>it organizations.The fair value <strong>of</strong> the Station’s investments at December 31, <strong>2002</strong> and 2001, as determined by the net asset value provided by TIFF and quotedmarket prices, is as follows:<strong>2002</strong> 2001TIFF Multi-Asset Fund $3,596,772TIFF Bond Fund $1,414,209TIFF U.S. Equity Fund 2,479,314Donated equity securities, at market ,202,514 ,099,800$3,799,286 $3,993,323The Station participates in TIFF’s income reinvestment program. Accordingly, all interest, dividends and proceeds from sales <strong>of</strong> investments arereinvested.During the year ended December 31, 2000, pursuant to authorization from the Board <strong>of</strong> Trustees, interest-bearing advances were made from theinvestment account to the operating account aggregating $700,000. At December 31, <strong>2002</strong> and 2001, respectively, $500,000 and $600,000 <strong>of</strong> theadvance was outstanding. Interfund interest on the advance totaled $27,500 and $35,000 for the years ended December 31, <strong>2002</strong> and 2001,respectively.5. Property and EquipmentProperty and equipment is carried at cost and is composed <strong>of</strong> the following at December 31, <strong>2002</strong> and 2001:UsefulLives <strong>2002</strong> 2001Land $ ,465,000 $ ,465,000Construction in progress ,195,688 ,049,611Buildings 20 years 5,956,737 5,839,408Furniture, fixtures and equipment 5-10 years 3,356,938 3,399,497R.V. Weatherbird II research vessel 20 years 2,594,270 2,491,020Other fixed assets 5-50 years ,219,800 ,219,80012,788,433 12,464,336Less accumulated depreciation (8,305,872) (7,671,265)$4,482,561 $4,793,071During the years ended December 31, <strong>2002</strong> and 2001, The Station incurred architectural and related fees <strong>of</strong> $146,077 and $49,611, respectively, inconnection with the planning phase <strong>of</strong> a new research facility. During the period <strong>of</strong> construction, costs incurred are reported as construction inprogress. When construction is complete, the capitalized construction costs will be recharacterized as buildings and improvements and depreciatedover their estimated useful lives.Depreciation <strong>of</strong> property and equipment is computed on a straight-line basis over the estimated useful life <strong>of</strong> each asset. Depreciation expense forthe years ended December 31, <strong>2002</strong> and 2001 was $742,491 and $739,214 respectively.6. Loan PayableDuring the year ended December 31, <strong>2002</strong>, the Station renegotiated its loan extending the repayment term and reducing the interest rate to 1.75%from 2% above the three-month LIBOR rate (3.54% and 4.10% at December 31, <strong>2002</strong> and 2001, respectively). The loan matures on December 31,2008, is denominated in U.S. dollars and is secured by the Station’s real property. Through December 31, 2003, payments <strong>of</strong> interest only arerequired.Aggregate maturities <strong>of</strong> the loan payable are $187,650 in 2004, $194,403 in 2005, $201,399 in 2006, $208,646 in 2007 and $831,219 thereafter.Interest expense for the years ended December 31, <strong>2002</strong> and 2001 was $92,127 and $151,005, respectively.29