Calvo vs. Rotemberg in a Trend Inflation World - Wiwi Uni-Frankfurt

Calvo vs. Rotemberg in a Trend Inflation World - Wiwi Uni-Frankfurt

Calvo vs. Rotemberg in a Trend Inflation World - Wiwi Uni-Frankfurt

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

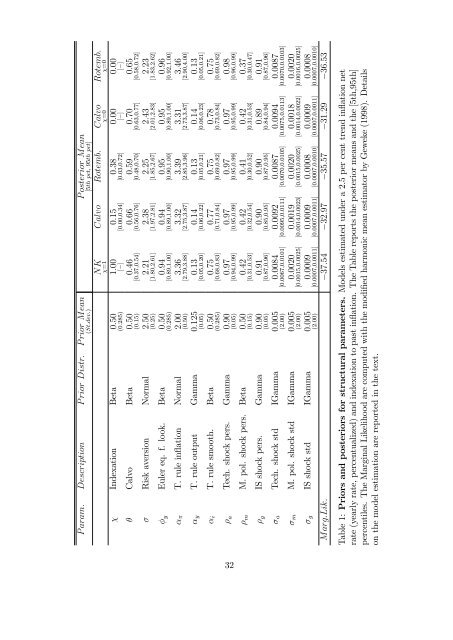

P osterior Mean<br />

[5th pct; 95th pct]<br />

P aram: Description P rior Distr: P rior Mean<br />

(St:dev:)<br />

Rotemb:<br />

=0<br />

<strong>Calvo</strong> Rotemb: <strong>Calvo</strong><br />

=0<br />

NK =1<br />

0:00<br />

[ ]<br />

0:00<br />

[ ]<br />

0:38<br />

0:15<br />

1:00<br />

[ ]<br />

Indexation Beta 0:50<br />

[0:03;0:72]<br />

[0:00;0:34]<br />

(0:285)<br />

0:65<br />

0:70<br />

0:59<br />

0:66<br />

0:46<br />

<strong>Calvo</strong> Beta 0:50<br />

[0:58;0:72]<br />

[0:63;0:77]<br />

[0:48;0:70]<br />

[0:56;0:76]<br />

[0:37;0:54]<br />

(0:15)<br />

2:23<br />

2:43<br />

2:25<br />

2:38<br />

2:21<br />

Risk aversion Normal 2:50<br />

[1:83;2:62]<br />

[2:01;2:83]<br />

[1:85;2:67]<br />

[1:97;2:81]<br />

[1:80;2:61]<br />

(0:25)<br />

0:96<br />

0:95<br />

0:95<br />

0:94<br />

0:94<br />

[0:92;1:00]<br />

[0:89;1:00]<br />

[0:90;1:00]<br />

[0:89;1:00]<br />

[0:89;1:00]<br />

(0:285)<br />

y Euler eq. f. look. Beta 0:50<br />

3:46<br />

3:31<br />

3:39<br />

3:32<br />

3:36<br />

T. rule <strong>in</strong>‡ation Normal 2:00<br />

[2:90;4:00]<br />

[2:73;3:87]<br />

[2:85;3:96]<br />

[2:75;3:87]<br />

[2:79;3:88]<br />

(0:50)<br />

0:13<br />

0:14<br />

0:13<br />

0:14<br />

0:13<br />

y T. rule output Gamma 0:125<br />

[0:05;0:21]<br />

[0:06;0:23]<br />

[0:05;0:21]<br />

[0:06;0:22]<br />

[0:05;0:20]<br />

(0:05)<br />

0:75<br />

0:78<br />

0:75<br />

0:77<br />

0:75<br />

i T. rule smooth. Beta 0:50<br />

[0:69;0:82]<br />

[0:73;0:84]<br />

[0:69;0:82]<br />

[0:71;0:84]<br />

[0:68;0:83]<br />

(0:285)<br />

0:98<br />

0:97<br />

0:97<br />

0:97<br />

0:97<br />

[0:96;0:99]<br />

[0:95;0:99]<br />

[0:95;0:99]<br />

[0:95;0:99]<br />

[0:94;0:99]<br />

(0:05)<br />

a Tech. shock pers. Gamma 0:90<br />

32<br />

0:37<br />

0:42<br />

0:41<br />

0:42<br />

0:42<br />

[0:30;0:47]<br />

[0:31;0:53]<br />

[0:30;0:52]<br />

[0:32;0:54]<br />

[0:31;0:53]<br />

(0:15)<br />

m M. pol. shock pers. Beta 0:50<br />

0:91<br />

0:89<br />

0:90<br />

0:90<br />

0:91<br />

[0:87;0:96]<br />

[0:84;0:94]<br />

[0:87;0:95]<br />

[0:85;0:95]<br />

[0:87;0:96]<br />

(0:05)<br />

g IS shock pers. Gamma 0:90<br />

0:0087<br />

0:0094<br />

0:0087<br />

0:0092<br />

0:0084<br />

a Tech. shock std IGamma 0:005<br />

[0:0070;0:0103]<br />

[0:0075;0:0113]<br />

[0:0070;0:0105]<br />

[0:0095;0:0111]<br />

[0:0067;0:0101]<br />

(2:00)<br />

0:0020<br />

0:0018<br />

0:0020<br />

0:0019<br />

0:0020<br />

m M. pol. shock std IGamma 0:005<br />

[0:0016;0:0025]<br />

[0:0014;0:0022]<br />

[0:0015;0:0025]<br />

[0:0014;0:0023]<br />

[0:0015;0:0025]<br />

(2:00)<br />

0:0008<br />

0:0009<br />

0:0008<br />

0:0009<br />

0:0009<br />

g IS shock std IGamma 0:005<br />

[0:0007;0:0010]<br />

[0:0007;0:0011]<br />

[0:0007;0:0010]<br />

[0:0007;0:0011]<br />

[0:0007;0:0011]<br />

(2:00)<br />

Marg:Lik: 37:54 32:97 35:57 31:29 36:53<br />

Table 1: Priors and posteriors for structural parameters. Models estimated under a 2.5 per cent trend <strong>in</strong>‡ation net<br />

rate (yearly rate, percentualized) and <strong>in</strong>dexation to past <strong>in</strong>‡ation. The Table reports the posterior means and the [5th,95th]<br />

percentiles. The Marg<strong>in</strong>al Likelihood are computed with the modi…ed harmonic mean estimator by Geweke (1998). Details<br />

on the model estimation are reported <strong>in</strong> the text.