Sixteen Mile Sports Complex | Officially opened ... - Oakville

Sixteen Mile Sports Complex | Officially opened ... - Oakville

Sixteen Mile Sports Complex | Officially opened ... - Oakville

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

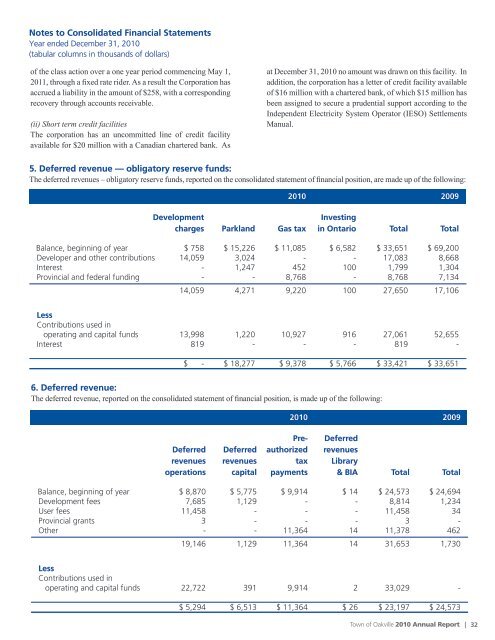

Notes to Consolidated Financial StatementsYear ended December 31, 2010(tabular columns in thousands of dollars)of the class action over a one year period commencing May 1,2011, through a fixed rate rider. As a result the Corporation hasaccrued a liability in the amount of $258, with a correspondingrecovery through accounts receivable.(ii) Short term credit facilitiesThe corporation has an uncommitted line of credit facilityavailable for $20 million with a Canadian chartered bank. Asat December 31, 2010 no amount was drawn on this facility. Inaddition, the corporation has a letter of credit facility availableof $16 million with a chartered bank, of which $15 million hasbeen assigned to secure a prudential support according to theIndependent Electricity System Operator (IESO) SettlementsManual.5. Deferred revenue — obligatory reserve funds:The deferred revenues – obligatory reserve funds, reported on the consolidated statement of financial position, are made up of the following:2010 2009DevelopmentInvestingcharges Parkland Gas tax in Ontario Total TotalBalance, beginning of year $ 758 $ 15,226 $ 11,085 $ 6,582 $ 33,651 $ 69,200Developer and other contributions 14,059 3,024 - - 17,083 8,668Interest - 1,247 452 100 1,799 1,304Provincial and federal funding - - 8,768 - 8,768 7,13414,059 4,271 9,220 100 27,650 17,106LessContributions used inoperating and capital funds 13,998 1,220 10,927 916 27,061 52,655Interest 819 - - - 819 -$ - $ 18,277 $ 9,378 $ 5,766 $ 33,421 $ 33,6516. Deferred revenue:The deferred revenue, reported on the consolidated statement of financial position, is made up of the following:2010 2009Pre- DeferredDeferred Deferred authorized revenuesrevenues revenues tax Libraryoperations capital payments & BIA Total TotalBalance, beginning of year $ 8,870 $ 5,775 $ 9,914 $ 14 $ 24,573 $ 24,694Development fees 7,685 1,129 - - 8,814 1,234User fees 11,458 - - - 11,458 34Provincial grants 3 - - - 3 -Other - - 11,364 14 11,378 46219,146 1,129 11,364 14 31,653 1,730LessContributions used inoperating and capital funds 22,722 391 9,914 2 33,029 -$ 5,294 $ 6,513 $ 11,364 $ 26 $ 23,197 $ 24,573Town of <strong>Oakville</strong> 2010 Annual Report | 32