Decision Making using Game Theory: An introduction for managers

Decision Making using Game Theory: An introduction for managers

Decision Making using Game Theory: An introduction for managers

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

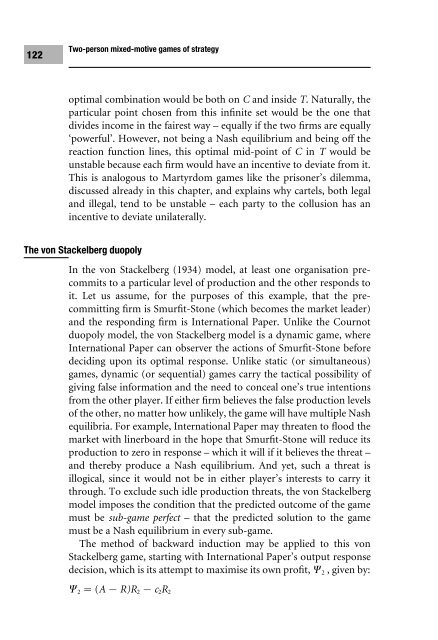

122Two-person mixed-motive games of strategyoptimal combination would be both on C and inside T. Naturally, theparticular point chosen from this inWnite set would be the one thatdivides income in the fairest way – equally if the two Wrms are equally‘powerful’. However, not being a Nash equilibrium and being oV thereaction function lines, this optimal mid-point of C in T would beunstable because each Wrm would have an incentive to deviate from it.This is analogous to Martyrdom games like the prisoner’s dilemma,discussed already in this chapter, and explains why cartels, both legaland illegal, tend to be unstable – each party to the collusion has anincentive to deviate unilaterally.The von Stackelberg duopolyIn the von Stackelberg (1934) model, at least one organisation precommitsto a particular level of production and the other responds toit. Let us assume, <strong>for</strong> the purposes of this example, that the precommittingWrm is SmurWt-Stone (which becomes the market leader)and the responding Wrm is International Paper. Unlike the Cournotduopoly model, the von Stackelberg model is a dynamic game, whereInternational Paper can observer the actions of SmurWt-Stone be<strong>for</strong>edeciding upon its optimal response. Unlike static (or simultaneous)games, dynamic (or sequential) games carry the tactical possibility ofgiving false in<strong>for</strong>mation and the need to conceal one’s true intentionsfrom the other player. If either Wrm believes the false production levelsof the other, no matter how unlikely, the game will have multiple Nashequilibria. For example, International Paper may threaten to Xood themarket with linerboard in the hope that SmurWt-Stone will reduce itsproduction to zero in response – which it will if it believes the threat –and thereby produce a Nash equilibrium. <strong>An</strong>d yet, such a threat isillogical, since it would not be in either player’s interests to carry itthrough. To exclude such idle production threats, the von Stackelbergmodel imposes the condition that the predicted outcome of the gamemust be sub-game perfect – that the predicted solution to the gamemust be a Nash equilibrium in every sub-game.The method of backward induction may be applied to this vonStackelberg game, starting with International Paper’s output responsedecision, which is its attempt to maximise its own proWt, Ψ 2 , given by:Ψ 2 (A R)R 2 c 2 R 2