Reformed Presbyterian Minutes of Synod 1993

Reformed Presbyterian Minutes of Synod 1993

Reformed Presbyterian Minutes of Synod 1993

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

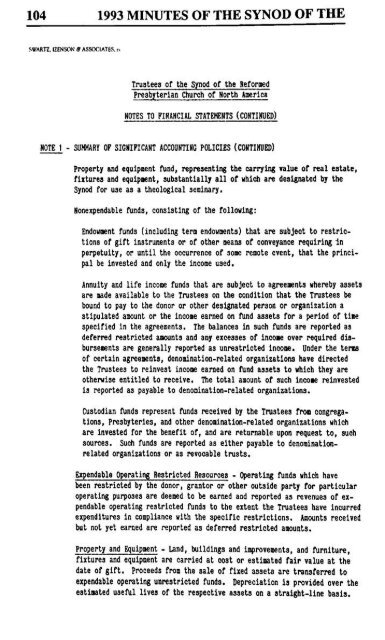

104 <strong>1993</strong> MINUTES OF THE SYNOD OF THESWARTC, IZENSON » ASSOCIATES, rTrustees <strong>of</strong> the <strong>Synod</strong> <strong>of</strong> the <strong>Reformed</strong><strong>Presbyterian</strong> Church <strong>of</strong> North AmericaNOTES TO FINANCIAL STATEMENTS (CONTINUED)NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)Property and equipment fund, representing the carrying value <strong>of</strong> real estate,fixtures and equipment, substantially all <strong>of</strong> which are designated by the<strong>Synod</strong> for use as a theological seminary.Nonexpendable funds, consisting <strong>of</strong> the following:Endowment funds (including term endowments) that are subject to restrictions<strong>of</strong> gift instruments or <strong>of</strong> other means <strong>of</strong> conveyance requiring inperpetuity, or until the occurrence <strong>of</strong> some remote event, that the principalbe invested and only the income used.Annuity and life income funds that are subject to agreements whereby assetsare made available to the Trustees on tbe condition that the Tmstees bebound to pay to the donor or other designated person or organization astipulated amount or the income earned on fund assets for a period <strong>of</strong> timespecified in the agreements. The balances in such funds are reported asdeferred restricted amounts and any excesses <strong>of</strong> income over required disbursementsare generally reported as unrestricted income. Under the terns<strong>of</strong> certain agreements, denomination-related organizations have directedthe Trustees to reinvest income earned on fund assets to which they areotherwise entitled to receive. The total amount <strong>of</strong> such income reinvestedis reported as payable to denomination-related organizations.Custodian funds represent funds received by the Trustees from congregations,Presbyteries, and other denomination-related organizations whichare Invested for the benefit <strong>of</strong>, and are returnable upon request to, suchsources. Such funds are reported as either payable to denominationrelatedorganizations or as revocable trusts.Expendable Operating Restricted Resources - Operating funds which havebeen restricted by the donor, grantor or other outside party for particularoperating purposes are deemed to be earned and reported as revenues <strong>of</strong> expendableoperating restricted funds to the extent the Trustees have incurredexpenditures in compliance with the specific restrictions. Amounts receivedbut not yet earned are reported as deferred restricted amounts.Property and Equipment - Land, buildings and improvements, and furniture,fixtures and equipment are carried at cost or estimated fair value at thedate <strong>of</strong> gift. Proceeds from the sale <strong>of</strong> fixed assets are transferred toexpendable operating unrestricted funds. Depreciation is provided over theestimated useful lives <strong>of</strong> the respective assets on a straight-line basis.