Executive summary - Udo Bullmann

Executive summary - Udo Bullmann

Executive summary - Udo Bullmann

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

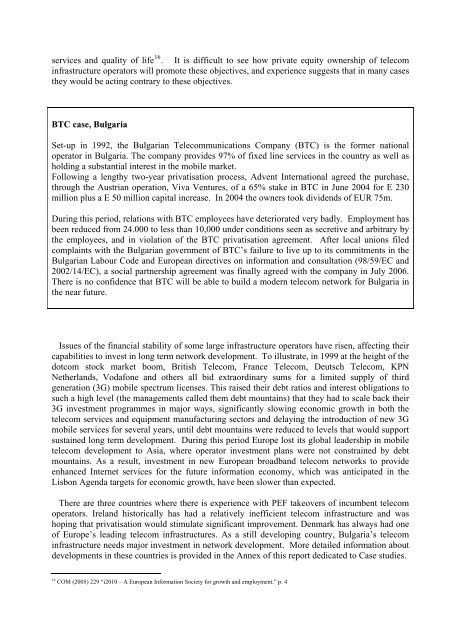

services and quality of life 16 . It is difficult to see how private equity ownership of telecominfrastructure operators will promote these objectives, and experience suggests that in many casesthey would be acting contrary to these objectives.BTC case, BulgariaSet-up in 1992, the Bulgarian Telecommunications Company (BTC) is the former nationaloperator in Bulgaria. The company provides 97% of fixed line services in the country as well asholding a substantial interest in the mobile market.Following a lengthy two-year privatisation process, Advent International agreed the purchase,through the Austrian operation, Viva Ventures, of a 65% stake in BTC in June 2004 for E 230million plus a E 50 million capital increase. In 2004 the owners took dividends of EUR 75m.During this period, relations with BTC employees have deteriorated very badly. Employment hasbeen reduced from 24.000 to less than 10,000 under conditions seen as secretive and arbitrary bythe employees, and in violation of the BTC privatisation agreement. After local unions filedcomplaints with the Bulgarian government of BTC’s failure to live up to its commitments in theBulgarian Labour Code and European directives on information and consultation (98/59/EC and2002/14/EC), a social partnership agreement was finally agreed with the company in July 2006.There is no confidence that BTC will be able to build a modern telecom network for Bulgaria inthe near future.Issues of the financial stability of some large infrastructure operators have risen, affecting theircapabilities to invest in long term network development. To illustrate, in 1999 at the height of thedotcom stock market boom, British Telecom, France Telecom, Deutsch Telecom, KPNNetherlands, Vodafone and others all bid extraordinary sums for a limited supply of thirdgeneration (3G) mobile spectrum licenses. This raised their debt ratios and interest obligations tosuch a high level (the managements called them debt mountains) that they had to scale back their3G investment programmes in major ways, significantly slowing economic growth in both thetelecom services and equipment manufacturing sectors and delaying the introduction of new 3Gmobile services for several years, until debt mountains were reduced to levels that would supportsustained long term development. During this period Europe lost its global leadership in mobiletelecom development to Asia, where operator investment plans were not constrained by debtmountains. As a result, investment in new European broadband telecom networks to provideenhanced Internet services for the future information economy, which was anticipated in theLisbon Agenda targets for economic growth, have been slower than expected.There are three countries where there is experience with PEF takeovers of incumbent telecomoperators. Ireland historically has had a relatively inefficient telecom infrastructure and washoping that privatisation would stimulate significant improvement. Denmark has always had oneof Europe’s leading telecom infrastructures. As a still developing country, Bulgaria’s telecominfrastructure needs major investment in network development. More detailed information aboutdevelopments in these countries is provided in the Annex of this report dedicated to Case studies.16 COM (2005) 229 “i2010 – A European Information Society for growth and employment.” p. 4