Executive summary - Udo Bullmann

Executive summary - Udo Bullmann

Executive summary - Udo Bullmann

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

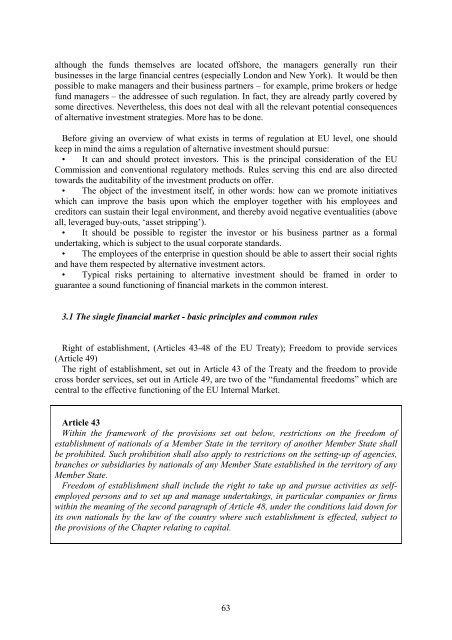

although the funds themselves are located offshore, the managers generally run theirbusinesses in the large financial centres (especially London and New York). It would be thenpossible to make managers and their business partners – for example, prime brokers or hedgefund managers – the addressee of such regulation. In fact, they are already partly covered bysome directives. Nevertheless, this does not deal with all the relevant potential consequencesof alternative investment strategies. More has to be done.Before giving an overview of what exists in terms of regulation at EU level, one shouldkeep in mind the aims a regulation of alternative investment should pursue:• It can and should protect investors. This is the principal consideration of the EUCommission and conventional regulatory methods. Rules serving this end are also directedtowards the auditability of the investment products on offer.• The object of the investment itself, in other words: how can we promote initiativeswhich can improve the basis upon which the employer together with his employees andcreditors can sustain their legal environment, and thereby avoid negative eventualities (aboveall, leveraged buy-outs, ‘asset stripping’).• It should be possible to register the investor or his business partner as a formalundertaking, which is subject to the usual corporate standards.• The employees of the enterprise in question should be able to assert their social rightsand have them respected by alternative investment actors.• Typical risks pertaining to alternative investment should be framed in order toguarantee a sound functioning of financial markets in the common interest.3.1 The single financial market - basic principles and common rulesRight of establishment, (Articles 43-48 of the EU Treaty); Freedom to provide services(Article 49)The right of establishment, set out in Article 43 of the Treaty and the freedom to providecross border services, set out in Article 49, are two of the “fundamental freedoms” which arecentral to the effective functioning of the EU Internal Market.Article 43Within the framework of the provisions set out below, restrictions on the freedom ofestablishment of nationals of a Member State in the territory of another Member State shallbe prohibited. Such prohibition shall also apply to restrictions on the setting-up of agencies,branches or subsidiaries by nationals of any Member State established in the territory of anyMember State.Freedom of establishment shall include the right to take up and pursue activities as selfemployedpersons and to set up and manage undertakings, in particular companies or firmswithin the meaning of the second paragraph of Article 48, under the conditions laid down forits own nationals by the law of the country where such establishment is effected, subject tothe provisions of the Chapter relating to capital.63