Prompt Payment Act Compliance - Virginia Department of Accounts

Prompt Payment Act Compliance - Virginia Department of Accounts

Prompt Payment Act Compliance - Virginia Department of Accounts

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Complying with<strong>Virginia</strong>’s <strong>Prompt</strong><strong>Payment</strong> RequirementsFiscal FundamentalsPhoto by Karl Steinbrenner

“<strong>Prompt</strong> <strong>Payment</strong> <strong>Act</strong>” HistoryEnacted in the 1980s, the “<strong>Prompt</strong> <strong>Payment</strong><strong>Act</strong>” no longer exists as a separate statute. In2001, <strong>Virginia</strong>’s codification process embeddedprompt payment requirements into the <strong>Virginia</strong>Public Procurement <strong>Act</strong> (§ 2.2-4347 through §2.2-4356).The term “<strong>Prompt</strong> <strong>Payment</strong> <strong>Act</strong>” remains inpopular use for referring to related portions <strong>of</strong>the <strong>Virginia</strong> Public Procurement <strong>Act</strong>.9/10/2008 Financial Reporting 2

<strong>Prompt</strong> <strong>Payment</strong> RequirementsThe law requires agencies to pay for deliveredgoods and services by the “required” duedate.The “required” due date is established by theterms <strong>of</strong> the contract.If the contract includes no payment terms,then 30 calendar days after receipt <strong>of</strong> aproper invoice, or 30 days after receipt <strong>of</strong> thegoods or services, whichever is later.9/10/2008 Financial Reporting 3

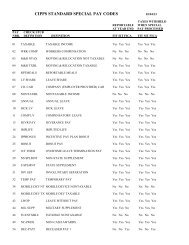

<strong>Prompt</strong> <strong>Payment</strong> Requirements<strong>Virginia</strong> law requires 100% prompt paymentcompliance.DOA calculates agency compliance rates eachmonth. <strong>Compliance</strong> rate = (number <strong>of</strong> latepayments made) divided by (total number <strong>of</strong>payments made).<strong>Payment</strong>s without due dates and interagencytransfers are not considered.Agencies or institutions with compliance < 95%appear in DOA’s quarterly Report on StatewideFinancial Management and <strong>Compliance</strong>.9/10/2008 Financial Reporting 4

Agency Role in <strong>Compliance</strong>Agencies should have appropriate writtenpolicies and procedures.Agencies should review CARS reportsroutinely.A “no exceptions” policy applies to <strong>Prompt</strong><strong>Payment</strong> <strong>Act</strong> compliance.9/10/2008 Financial Reporting 5

DOA’s Role in <strong>Compliance</strong>Monitor prompt payment monthlyPrepare Quarterly Report performancestatisticsSend statistics to agencies and institutionsquarterlyAssist agencies9/10/2008 Financial Reporting 6

Allowing enough processing timeCommon Problems (1 <strong>of</strong> 3)– 7 work days for non-decentralized agencies(allows for pre-audit reviews, CDS, checkwriting, and payment by mail or EDI)– 4 work days for decentralized agencies(allows for all <strong>of</strong> the above, except pre-auditreviews)9/10/2008 Financial Reporting 7

Common Problems (2 <strong>of</strong> 3)Keying correct calendar year on paymentsThoroughly reviewing payments beforereleaseClearing the CARS error file quickly9/10/2008 Financial Reporting 8

Common Problems (3 <strong>of</strong> 3)Anticipating payments with weekend orholiday due dates, which are paid on thelast business day prior to weekend orholidayProcessing payments up to CARS closingdate (for example, if CARS February closeis on March 8, payments processed up toMarch 8 are included in February)9/10/2008 Financial Reporting 9

Internal ControlsEnsure receiving report and purchase ordermatch vendor invoice before approvalCalculate the required payment due dateDocument unacceptable materials andincomplete services on receiving report andtake corrective actionFile original payment processing documentsfor auditReview CARS reports for prompt paycompliance9/10/2008 Financial Reporting 10

ReferencesCAPP Manual Topics– 20315, <strong>Prompt</strong> <strong>Payment</strong>– 20310, ExpendituresCode <strong>of</strong> <strong>Virginia</strong>– <strong>Virginia</strong> Public Procurement <strong>Act</strong>, § 2.2-4347through § 2.2-4356.9/10/2008 Financial Reporting 11

Contactspromptpay@doa.virginia.gov804-225-3804 – voice804-225-2430 – facsimileU. S. Mail:Financial Reporting – <strong>Prompt</strong> <strong>Payment</strong><strong>Virginia</strong> <strong>Department</strong> <strong>of</strong> <strong>Accounts</strong>P. O. Box 1971Richmond, VA 23218-19719/10/2008 Financial Reporting 12