Payroll Bulletin 2012-01 - Virginia Department of Accounts

Payroll Bulletin 2012-01 - Virginia Department of Accounts

Payroll Bulletin 2012-01 - Virginia Department of Accounts

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

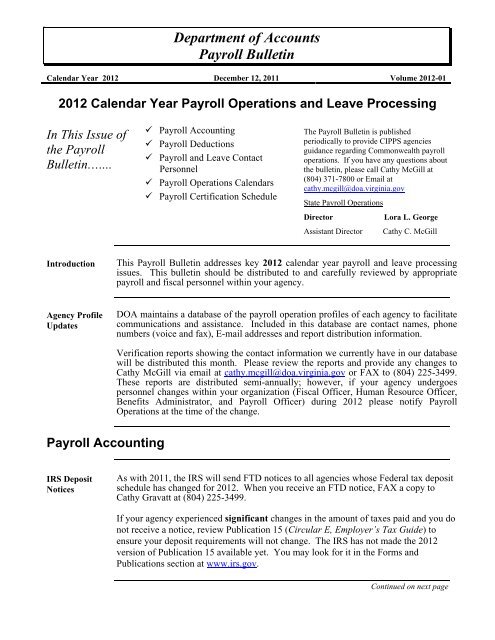

<strong>Department</strong> <strong>of</strong> <strong>Accounts</strong><strong>Payroll</strong> <strong>Bulletin</strong>Calendar Year <strong>2<strong>01</strong>2</strong> December 12, 2<strong>01</strong>1 Volume <strong>2<strong>01</strong>2</strong>-<strong>01</strong><strong>2<strong>01</strong>2</strong> Calendar Year <strong>Payroll</strong> Operations and Leave ProcessingIn This Issue <strong>of</strong>the <strong>Payroll</strong><strong>Bulletin</strong>….... <strong>Payroll</strong> Accounting <strong>Payroll</strong> Deductions <strong>Payroll</strong> and Leave ContactPersonnel <strong>Payroll</strong> Operations Calendars <strong>Payroll</strong> Certification ScheduleThe <strong>Payroll</strong> <strong>Bulletin</strong> is publishedperiodically to provide CIPPS agenciesguidance regarding Commonwealth payrolloperations. If you have any questions aboutthe bulletin, please call Cathy McGill at(804) 371-7800 or Email atcathy.mcgill@doa.virginia.govState <strong>Payroll</strong> OperationsDirectorAssistant DirectorLora L. GeorgeCathy C. McGillIntroductionThis <strong>Payroll</strong> <strong>Bulletin</strong> addresses key <strong>2<strong>01</strong>2</strong> calendar year payroll and leave processingissues. This bulletin should be distributed to and carefully reviewed by appropriatepayroll and fiscal personnel within your agency.Agency Pr<strong>of</strong>ileUpdatesDOA maintains a database <strong>of</strong> the payroll operation pr<strong>of</strong>iles <strong>of</strong> each agency to facilitatecommunications and assistance. Included in this database are contact names, phonenumbers (voice and fax), E-mail addresses and report distribution information.Verification reports showing the contact information we currently have in our databasewill be distributed this month. Please review the reports and provide any changes toCathy McGill via email at cathy.mcgill@doa.virginia.gov or FAX to (804) 225-3499.These reports are distributed semi-annually; however, if your agency undergoespersonnel changes within your organization (Fiscal Officer, Human Resource Officer,Benefits Administrator, and <strong>Payroll</strong> Officer) during <strong>2<strong>01</strong>2</strong> please notify <strong>Payroll</strong>Operations at the time <strong>of</strong> the change.<strong>Payroll</strong> AccountingIRS DepositNoticesAs with 2<strong>01</strong>1, the IRS will send FTD notices to all agencies whose Federal tax depositschedule has changed for <strong>2<strong>01</strong>2</strong>. When you receive an FTD notice, FAX a copy toCathy Gravatt at (804) 225-3499.If your agency experienced significant changes in the amount <strong>of</strong> taxes paid and you donot receive a notice, review Publication 15 (Circular E, Employer’s Tax Guide) toensure your deposit requirements will not change. The IRS has not made the <strong>2<strong>01</strong>2</strong>version <strong>of</strong> Publication 15 available yet. You may look for it in the Forms andPublications section at www.irs.gov.Continued on next page

Calendar Year <strong>2<strong>01</strong>2</strong> December 12, 2<strong>01</strong>1 Volume <strong>2<strong>01</strong>2</strong>-<strong>01</strong><strong>Payroll</strong> Accounting, ContinuedW-4 Form Employees who claim exempt from withholding during the prior year on their W-4must complete a new W-4 Form by February 15 th to maintain their exempt status. Ifsuch employees do not provide a newly completed W-4 Form by February 15th,immediately begin to withhold Federal income tax as if they are single, with zerowithholding allowances. Agencies can request CIPPS report #823, Employees WithFIT Status Not Equal to 4, 5, or 6, to identify employees with current exempt W-4s(FIT status "A").IRS regulations stipulate which employees are eligible to file a W-4 Form with exemptstatus. Refer to Section 9 <strong>of</strong> Publication 15 (Circular E) for more information.Remember that employers are no longer required to submit copies <strong>of</strong> W-4s to the IRSfor employees who claim more than 10 exemptions. In cases where problems areidentified, the employer will receive a written notice (called a lock-in letter) from theIRS with specific instructions for withholding on the affected employee.The <strong>2<strong>01</strong>2</strong> version <strong>of</strong> the W-4 is available from the IRS website at:http://www.irs.gov/pub/irs-pdf/fw4.pdf?portlet=103Social SecurityTaxWithholdingThe maximum wage base for <strong>2<strong>01</strong>2</strong> withholding will increase to $110,100 for OASDI(Old Age, Survivors, and Disability Insurance). The wage base for HI (HospitalInsurance) remains unlimited (i.e., all wages are HI taxable).Unless Congress approves legislation currently under consideration, the OASDI taxrate will return to 6.2% each for employees and employers. For HI, the rate is 1.45%each for employees and employers.When the maximum has been reached for an individual Employee Id Number within anagency, OASDI taxes will cease to be calculated and withheld. No agency action isrequired since CIPPS recognizes the OASDI maximum.DOA monitors totals for employees with records at more than one CIPPS agency andwill change the FICA status to “6” once the OASDI max has been reached. Don’tforget to change the FICA status from “6” back to a “4” for the new calendaryear. Report #825, FICA Status not Equal to 4 and Employee Status Equal 1 or 2, maybe requested on HSRUT for review.IRS PUBS &FORMSThe IRS web site address is http://www.irs.gov/If you do not have internet access, IRS publications and forms can be ordered bycalling 1-800-TAX-FORM (1-800-829-3676).Continued on next pagePage 2 <strong>of</strong> 13http://www.doa.virginia.gov/procedures/<strong>Payroll</strong>/<strong>Payroll</strong><strong>Bulletin</strong>s/payroll.htm

Calendar Year <strong>2<strong>01</strong>2</strong> December 12, 2<strong>01</strong>1 Volume <strong>2<strong>01</strong>2</strong>-<strong>01</strong><strong>Payroll</strong> Accounting, ContinuedName ChangesEmployees requesting name changes in CIPPS should be reminded to notify the SocialSecurity Administration (SSA) <strong>of</strong> the change immediately. Name changes for existingemployees are part <strong>of</strong> the PMIS/CIPPS interface and changes to employee namesshould not be entered in PMIS until the employee provides a new SS card showing thechanged name or documentation proving SSA notification. If the employee’s name ischanged in CIPPS but not with the SSA, the name will not match SSA records whenDOA remits the W-2 tape, possibly resulting in agency penalties. Refer to section 4 <strong>of</strong>Publication 15 (Circular E) for more information. You can verify up to 10names/SSNs online and find out immediately if there is a mismatch. Go towww.ssa.gov/bso/bsowelcome.htm and register for a PIN and password. Youractivation code will be sent to your supervisor. Input the activation code to turn onSSNVS. Log into Business Services Online with your PIN and password and enter theSSNs for verification.http://www.socialsecurity.gov/employer/critical.htmHelpfulRemindersSome items that should be considered when beginning a new calendar year: Ensure all garnishments that have been satisfied due to a goal being reachedare deactivated (frequency changed to 00). Review the pending file reports and delete transactions no longer required. When entering a certification or edit request in <strong>2<strong>01</strong>2</strong> with a pay period begin datewith a 2<strong>01</strong>1 value, you will receive a Warning message stating "YEAR NOTSAME AS CURRENT YEAR." This is an informational message. However, youmust hit the enter button again for the data on PYCTF/PYEDT to be accepted in thesystem.<strong>Payroll</strong> DeductionsFlexReimbursement<strong>Accounts</strong>Flex accounts set up through the interface with BES now use an end-date instead <strong>of</strong> agoal as the means <strong>of</strong> turning <strong>of</strong>f the deduction. DOA will NOT process any masstransactions at calendar year-end to change any fields related to the flex accounts onH0ZDC. If you manually set up accounts using a goal, you must review the deductionto ensure that the correct amount will be withheld for the remainder <strong>of</strong> the plan year(January through June deductions).Continued on next pagePage 3 <strong>of</strong> 13http://www.doa.virginia.gov/procedures/<strong>Payroll</strong>/<strong>Payroll</strong><strong>Bulletin</strong>s/payroll.htm

Calendar Year <strong>2<strong>01</strong>2</strong> December 12, 2<strong>01</strong>1 Volume <strong>2<strong>01</strong>2</strong>-<strong>01</strong><strong>Payroll</strong> Deductions, ContinuedMisc. DeductionTPA ProcessingScheduleThe calendar year <strong>2<strong>01</strong>2</strong> cut-<strong>of</strong>f date schedule governing new enrollment and changeprocessing for the miscellaneous insurance and annuity third party administrator(FBMC) follows:Pay periodFBMC Cut-OffCHANGE LISTTO AgencyDOA CertifyDeadlinePAYDAY12/25/11-<strong>01</strong>/09/12 12/21/2<strong>01</strong>1 1/3/2<strong>01</strong>1 1/6/12 1/12/12<strong>01</strong>/10/12-<strong>01</strong>/24/12 1/10/<strong>2<strong>01</strong>2</strong> 1/19/<strong>2<strong>01</strong>2</strong> 1/26/12 2/1/12<strong>01</strong>/25/12-02/09/12 1/27/<strong>2<strong>01</strong>2</strong> 2/03/<strong>2<strong>01</strong>2</strong> 2/10/12 2/16/1202/10/12-02/24/12 2/9/<strong>2<strong>01</strong>2</strong> 2/16/<strong>2<strong>01</strong>2</strong> 2/24/12 3/1/1202/25/12-03/09/12 2/27/<strong>2<strong>01</strong>2</strong> 3/5/<strong>2<strong>01</strong>2</strong> 3/12/12 3/16/1203/10/12-03/24/12 3/12/<strong>2<strong>01</strong>2</strong> 3/19/<strong>2<strong>01</strong>2</strong> 3/26/12 3/30/1203/25/12-04/09/12 3/27/<strong>2<strong>01</strong>2</strong> 4/3/<strong>2<strong>01</strong>2</strong> 4/10/12 4/16/1204/10/12-04/24/12 4/11/<strong>2<strong>01</strong>2</strong> 4/18/<strong>2<strong>01</strong>2</strong> 4/25/12 5/1/1204/25/12-05/09/12 4/26/<strong>2<strong>01</strong>2</strong> 5/3/<strong>2<strong>01</strong>2</strong> 5/10/12 5/16/1205/10/12-05/24/12 5/11/<strong>2<strong>01</strong>2</strong> 5/18/<strong>2<strong>01</strong>2</strong> 5/25/12 6/1/1205/25/12-06/09/12 5/25/<strong>2<strong>01</strong>2</strong> 6/4/<strong>2<strong>01</strong>2</strong> 6/11/12 6/15/1206/10/12-06/24/12 6/12/<strong>2<strong>01</strong>2</strong> 6/19/<strong>2<strong>01</strong>2</strong> 6/26/12 7/2/1206/25/12-07/09/12 6/25/<strong>2<strong>01</strong>2</strong> 7/2/<strong>2<strong>01</strong>2</strong> 7/10/12 7/16/1207/10/12-07/24/12 7/12/<strong>2<strong>01</strong>2</strong> 7/19/<strong>2<strong>01</strong>2</strong> 7/26/12 8/1/1207/25/12-08/09/12 7/27/<strong>2<strong>01</strong>2</strong> 8/3/<strong>2<strong>01</strong>2</strong> 8/10/12 8/16/1208/10/12-08/24/12 8/13/<strong>2<strong>01</strong>2</strong> 8/20/<strong>2<strong>01</strong>2</strong> 8/27/12 8/31/1208/25/12-09/09/12 8/24/<strong>2<strong>01</strong>2</strong> 8/31/<strong>2<strong>01</strong>2</strong> 9/10/12 9/14/1209/10/12-09/24/12 9/10/<strong>2<strong>01</strong>2</strong> 9/17/<strong>2<strong>01</strong>2</strong> 9/24/12 9/28/1209/25/12-10/09/12 9/25/<strong>2<strong>01</strong>2</strong> 10/2/<strong>2<strong>01</strong>2</strong> 10/10/12 10/16/1210/10/12-10/24/12 10/12/<strong>2<strong>01</strong>2</strong> 10/19/<strong>2<strong>01</strong>2</strong> 10/26/12 11/1/1210/25/12-11/09/12 10/26/<strong>2<strong>01</strong>2</strong> 11/2/<strong>2<strong>01</strong>2</strong> 11/9/12 11/16/1211/10/12-11/24/12 11/7/<strong>2<strong>01</strong>2</strong> 11/15/<strong>2<strong>01</strong>2</strong> 11/26/12 11/30/1211/25/12-12/09/12 11/26/<strong>2<strong>01</strong>2</strong> 12/3/<strong>2<strong>01</strong>2</strong> 12/10/12 12/14/1212/10/12-12/24/12 12/7/<strong>2<strong>01</strong>2</strong> 12/14/<strong>2<strong>01</strong>2</strong> 12/21/12 12/31/12This schedule is posted on DOA's web site at the following address:http://www.doa.virginia.gov/<strong>Payroll</strong>/TPA/TPA_Calendar_<strong>2<strong>01</strong>2</strong>.pdfContinued on next pagePage 5 <strong>of</strong> 13http://www.doa.virginia.gov/procedures/<strong>Payroll</strong>/<strong>Payroll</strong><strong>Bulletin</strong>s/payroll.htm

Calendar Year <strong>2<strong>01</strong>2</strong> December 12, 2<strong>01</strong>1 Volume <strong>2<strong>01</strong>2</strong>-<strong>01</strong><strong>Payroll</strong> and Leave Contact Personnel, Continued<strong>Payroll</strong> Operations - ProductionName Functional Area E-mail Phone(804 AreaCode)Felecia Smith Direct Deposit Stop Payments,Checkwrites; Direct Deposit; DepositCertificates; CIPPS Production Jobs &Report Distribution/Recovery; AD-HOCfelecia.smith@doa.virginia.gov 371-8385Reports/U1’s; Stop Payments-VoidEarnings Notices; Gross Pay DifferencesDiana Jones Direct Deposit Stop Payments,Checkwrites; Direct Deposit; DepositCertificates; CIPPS Production Jobs &Report Distribution/Recovery; AD-HOCReports/U1’s; Stop Payments-VoidEarnings Notices; Gross Pay Differencesdiana.jones@doa.virginia.gov 371-4883<strong>Payroll</strong> Operations - ManagementName and Title Functional Area E-mail Phone(804 AreaCode)Lora George,Director, StateGeneral Informationlora.george@doa.virginia.gov 225-2245<strong>Payroll</strong> OperationsCathy McGill,Assistant Director,State <strong>Payroll</strong>OperationsGeneral Information, Technical Support,Mass Transactions, Special Pay, Deduction,or Report Set-up; CIPPS Production Jobs &Report Distribution/Recovery; Gross PayDifferencescathy.mcgill@doa.virginia.gov 371-7800<strong>Payroll</strong>OperationsFAX Number (804) 225-3499Continued on next pagePage 7 <strong>of</strong> 13http://www.doa.virginia.gov/procedures/<strong>Payroll</strong>/<strong>Payroll</strong><strong>Bulletin</strong>s/payroll.htm

January <strong>2<strong>01</strong>2</strong>Sunday Monday Tuesday Wednesday Thursday Friday Saturday19AM - CIPPS filesopen - no edits orpayruns2StateHoliday:New Years3DeferredCompTransactionUploadTPA Upload4 5 6SemimonthlysalariedcertificationPeriod #1(12/25-<strong>01</strong>/09)79AM - CIPPS filesopen - no edits orpayruns89AM - CIPPS filesopen - no edits orpayruns9CYE CertDue10 11Leave keyingdeadline(12/25-<strong>01</strong>/09)12Payday forsemi-monthlysalariedemployeesDeferredCompTransactionUpload13StateHoliday:Lee-JacksonDay149AM - CIPPS filesopen - no edits orpayruns159AM - CIPPS filesopen - no edits orpayruns229AM – CIPPS filesopen – no edits orpayruns299AM - CIPPS filesopen - no edits orpayruns16StateHoliday: ML King, Jr.Day9AM - CIPPS filesopen - no edits orpayruns23 24DeferredCompTransactionUpload30 31Leave keyingDeadline(<strong>01</strong>/10-<strong>01</strong>/24)17 18 19TPA UploadDecemberHealthcareCert Due25 26SemimonthlysalariedcertificationdeadlinePeriod #2(<strong>01</strong>/10-<strong>01</strong>/24)9AM - CIPPS filesopen - no edits orpayruns20DeferredComp AutoEnrollTransactionUpload219AM – CIPPS filesopen – no edits orpayruns27 289AM - CIPPS filesopen - no edits orpayruns

February <strong>2<strong>01</strong>2</strong>Sunday Monday Tuesday Wednesday Thursday Friday Saturday1Payday forsemi-monthlysalariedemployees2 3TPA Upload49AM - CIPPS filesopen - no edits orpayruns59AM - CIPPS filesopen - no edits orpayruns129AM - CIPPS filesopen - no edits orpayruns6DeferredCompTransactionUploadDeferredCompTransactionUpload7 8 9 10Semi-monthlysalariedcertificationPeriod #113 14 15Leave keyingdeadline(<strong>01</strong>/25-02/09)16Payday forsemi-monthlysalariedemployees119AM - CIPPS filesopen - no edits orpayruns(<strong>01</strong>/25-02/09)17 189AM - CIPPS filesopen - no edits orpayruns199AM - CIPPS filesopen - no edits orpayruns20StateHoliday:GeorgeWashington’s Birthday21DeferredComp AutoEnrollTransactionUploadTPA Upload22 23 24Semi-monthlysalariedcertificationPeriod #2(02/10-02/24)259AM - CIPPS filesopen - no edits orpayruns269AM - CIPPS filesopen - no edits orpayruns9AM - CIPPS filesopen - no edits orpayruns27 28 29Leave keyingdeadline(02/10-02/24)JanuaryHealthcareCert Due

March <strong>2<strong>01</strong>2</strong>Sunday Monday Tuesday Wednesday Thursday Friday Saturday1Payday forsemi-monthlysalariedemployees2 39AM - CIPPS filesopen - no edits orpayruns49AM - CIPPS filesopen - no edits orpayruns119AM - CIPPS filesopen - no edits orpayruns189AM - CIPPS filesopen - no edits orpayruns5DeferredCompTransactionUploadTPA Upload12SemimonthlysalariedcertificationPeriod #1(02/25-03/09)19DeferredComp AutoEnrollTransactionUploadDeferredCompTransactionUpload6 9 109AM - CIPPS filesopen - no edits orpayruns13 14 15Leave keyingdeadline(02/25-03/09)16Payday forsemi-monthlysalariedemployees179AM - CIPPS filesopen - no edits orpayruns20 21 22 23 249AM - CIPPS filesopen - no edits orpayruns259AM - CIPPS filesopen - no edits orpayrunsTPA Upload26SemimonthlysalariedcertificationPeriod #2(03/10-03/24)27 28 29Leave keyingdeadline(03/10-03/24)30Payday forsemi-monthlysalariedemployeesFebruaryHealthcareCert Due319AM - CIPPS filesopen - no edits orpayruns

April <strong>2<strong>01</strong>2</strong>Sunday Monday Tuesday Wednesday Thursday Friday Saturday19AM - CIPPS filesopen - no edits orpayruns89AM - CIPPS filesopen - no edits orpayruns159AM - CIPPS filesopen - no edits orpayruns229AM - CIPPS filesopen - no edits orpayruns299AM - CIPPS filesopen - no edits orpayruns2DeferredCompTransactionUpload91 st QTR CertDue16Payday forsemi-monthlysalariedemployees3TPA Upload10Semi-monthlysalariedcertificationPeriod #1(03/25-04/09)17 18TPA Upload23 24 25Semi-monthlysalariedcertificationPeriod #2(04/10-04/24)30Leave keyingdeadline(04/10-04/24)MarchHealthcareCert Due4 5 6DeferredCompTransactionUpload11 12 13Leave keyingdeadline(03/25-04/09)19 20DeferredComp AutoEnrollTransactionUpload79AM - CIPPS filesopen - no edits orpayruns149AM - CIPPS filesopen - no edits orpayruns219AM - CIPPS filesopen - no edits orpayruns26 27 289AM - CIPPS filesopen - no edits orpayruns

May <strong>2<strong>01</strong>2</strong>Sunday Monday Tuesday Wednesday Thursday Friday Saturday1Payday forsemi-monthlysalariedemployees2DeferredCompTransactionUpload3TPA Upload4 59AM - CIPPS filesopen - no edits orpayruns69AM - CIPPS filesopen - no edits orpayruns139AM - CIPPS filesopen - no edits orpayruns7DeferredCompTransactionUpload14 15Leave keyingdeadline(04/25-05/09)8 9 10SemimonthlysalariedcertificationPeriod #1(04/25-05/09)16Payday forsemi-monthlysalariedemployees17 18DeferredComp AutoEnrollTransactionUpload11 129AM - CIPPS filesopen - no edits orpayruns199AM - CIPPS filesopen - no edits orpayruns209AM - CIPPS filesopen - no edits orpayruns279AM - CIPPS filesopen - no edits orpayruns21 22 23DeferredCompTransactionUpload28StateHoliday:MemorialDay9AM - CIPPS filesopen - no edits orpayruns29 30 31Leave keyingdeadline(05/10-05/24)TPA Upload24 25SemimonthlysalariedcertificationPeriod #2(05/10-05/24)AprilHealthcareCert Due269AM - CIPPS filesopen - no edits orpayruns

Certification ScheduleThe <strong>Payroll</strong> Operations Calendar for the period June through November <strong>2<strong>01</strong>2</strong> will be issued in May.The calendar for December <strong>2<strong>01</strong>2</strong> will be issued in November. For agency planning purposes, thecertification dates and paydays for this period are listed below.Month and Period Certification Date Pay DateJuneJuly1st pay period 5/25 - 6/92nd pay period 6/10 -6/241st pay period 6/25 - 7/92nd pay period 7/10 - 7/24August1st pay period 7/25 - 8/92nd pay period 8/10 - 8/24September1st pay period 8/25 -9/92nd pay period 9/10 -9/24October1st pay period 9/25 - 10/92nd pay period 10/10 - 10/24November1st pay period 10/25 -11/92nd pay period 11/10 - 11/24December1st pay period 11/25 - 12/92nd pay period 12/10 - 12/246/116/267/107/268/108/279/109/2410/1<strong>01</strong>0/2611/0911/2612/1<strong>01</strong>2/216/157/27/168/18/168/319/149/2810/1611/111/1611/3<strong>01</strong>2/1412/31