High Standards, Local Support

High Standards, Local Support

High Standards, Local Support

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

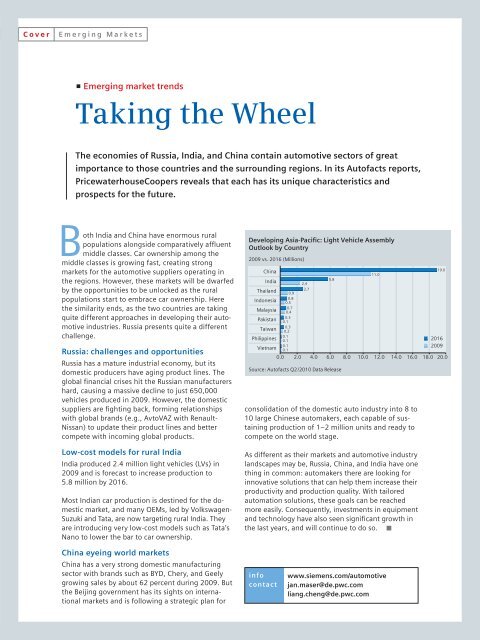

Cover Emerging Marketsp Emerging market trendsTaking the WheelThe economies of Russia, India, and China contain automotive sectors of greatimportance to those countries and the surrounding regions. In its Autofacts reports,PricewaterhouseCoopers reveals that each has its unique characteristics andprospects for the future.Both India and China have enormous ruralpopulations alongside comparatively affluentmiddle classes. Car ownership among themiddle classes is growing fast, creating strongmarkets for the automotive suppliers operating inthe regions. However, these markets will be dwarfedby the opportunities to be unlocked as the ruralpopulations start to embrace car ownership. Herethe similarity ends, as the two countries are takingquite different approaches in developing their automotiveindustries. Russia presents quite a differentchallenge.Russia: challenges and opportunitiesRussia has a mature industrial economy, but itsdomestic producers have aging product lines. Theglobal financial crises hit the Russian manufacturershard, causing a massive decline to just 650,000vehicles produced in 2009. However, the domesticsuppliers are fighting back, forming relationshipswith global brands (e.g., AvtoVAZ with Renault-Nissan) to update their product lines and bettercompete with incoming global products.Low-cost models for rural IndiaIndia produced 2.4 million light vehicles (LVs) in2009 and is forecast to increase production to5.8 million by 2016.Most Indian car production is destined for the domesticmarket, and many OEMs, led by Volks wagen-Suzuki and Tata, are now targeting rural India. Theyare introducing very low-cost models such as Tata’sNano to lower the bar to car ownership.Developing Asia-Pacific: Light Vehicle AssemblyOutlook by Country2009 vs. 2016 (Millions)China19.011.05.8India2,42.7Thailand 0.90.8Indonesia 0.50.7Malaysia 0.40.3Pakistan 0.10.3Taiwan 0.20.1Philippines 0.120160.1Vietnam 0.120090.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 20.0Source: Autofacts Q2/2010 Data Releaseconsolidation of the domestic auto industry into 8 to10 large Chinese automakers, each capable of sustainingproduction of 1–2 million units and ready tocompete on the world stage.As different as their markets and automotive industrylandscapes may be, Russia, China, and India have onething in common: automakers there are looking forinnovative solutions that can help them increase theirproductivity and production quality. With tailoredautomation solutions, these goals can be reachedmore easily. Consequently, investments in equipmentand technology have also seen significant growth inthe last years, and will continue to do so. pChina eyeing world marketsChina has a very strong domestic manufacturingsector with brands such as BYD, Chery, and Geelygrowing sales by about 62 percent during 2009. Butthe Beijing government has its sights on internationalmarkets and is following a strategic plan forinfocontactwww.siemens.com/automotivejan.maser@de.pwc.comliang.cheng@de.pwc.commove up | 1-2010 13